-

Overview

The Minnesota Emerging Entrepreneur Loan Program (ELP) supports the growth of businesses owned and operated by minorities, low-income persons, women, veterans and/or persons with disabilities. DEED provides grant funds to a network of nonprofit lenders which use these funds for loans to startup and expanding businesses throughout the state.

The program has additional goals of providing jobs for minority and/or low-income persons, creating and strengthening minority business enterprises, and promoting economic development in low-income areas.

Program Requirements

DEED provides ELP funding to certified nonprofit partners to make loans to Minnesota businesses that are majority-owned and operated by minorities, low-income persons, women, veterans and/or persons with disabilities.

Businesses must apply directly with a certified lender, although DEED may be able to assist in identifying an appropriate lender. Once the lender approves the loan, they will forward the loan package to DEED for approval by the commissioner and disbursement of funds for the project.

Certified Partners

There are a number of nonprofit lending partners participating in ELP. These organizations serve different communities and areas of the state. They may have additional limitations, including loan size available and target populations served.

Partner Referrals

If you need a referral to a certified lender, fill out the Lender Referral Request and DEED staff will assist you.

Flyer

Our flyer is available for download and sharing.

For More Information

For questions or a referral to an appropriate certified partner, contact Jason Burak, 651-259-7338 or jason.burak@state.mn.us.

-

Lender Directory

Businesses must apply directly with a certified lender, although DEED may be able to assist in identifying an appropriate lender. Once the lender approves the loan, they will forward the loan package to DEED for approval by the commissioner and disbursement of funds for the project.

Certified Partners

There are a number of nonprofit lending partners participating in ELP. These organizations serve different communities and areas of the state. They may have additional limitations, including loan size available and target populations served. [Note: the directory also contains information for lenders participating in the Small Business Loan Participation Program (SBLPP) which is part of the State Small Business Credit Initiative (SSBCI).]

For More Information

For questions or a referral to an appropriate certified partner, contact Jason Burak, 651-259-7338 or jason.burak@state.mn.us.

-

Eligibility

In order to qualify for a loan under the Minnesota Emerging Entrepreneur Loan Program (ELP), businesses must be based in Minnesota and owned and operated by one or more Minnesota residents who are minorities, low-income persons, women, veterans and/or persons with disabilities.

The program will finance a variety of startup and expansion costs, including normal expenses such as machinery and equipment, inventory and receivables, working capital, new construction, renovation, and site acquisition. Financing of existing debt is not permitted.

Businesses eligible for loans include, but are not limited to, technologically innovative industries, value-added manufacturing, and information industries. The program does not make loans to liquor stores or establishments primarily selling liquor made off site, stores primarily selling tobacco or electronic smoking products, gambling operations, or adult oriented businesses.

Certain provisions, including eligibility of retail businesses, are available only to microenterprises, defined as businesses that have fewer than five employees and have generated sales revenue for two years or less.

Businesses located in low-income areas of Minnesota will be given priority for loans. For the purposes of ELP, all of Minnesota outside of the 7-county Twin Cities metropolitan area is considered low-income. Within the 7-county Twin Cities metropolitan area, the following areas are considered low-income:

- Bayport

- Belle Plaine

- Brooklyn Center

- Castle Rock township

- Columbia Heights

- Coon Rapids

- Crystal

- Fort Snelling (unincorporated)

- Fridley

- Hilltop

- Hollywood township

- Hopkins

|

- Jackson township

- Jordan

- Lake St. Croix Beach

- Landfall

- Lauderdale

- Lexington

- Loretto

- Minneapolis

- Mound

- New Germany

- Newport

|

- North St. Paul

- Northfield

- Randolph

- Richfield

- Rockford

- San Francisco township

- South St. Paul

- St. Francis

- St. Marys Point

- St. Paul

- Vermillion

|

For More Information

For questions or a referral to an appropriate certified partner, contact Jason Burak, 651-259-7338 or jason.burak@state.mn.us.

-

Terms and Interest

Each nonprofit lender has authority to determine the specific interest rate, collateral requirements and other terms of each loan made under the Minnesota Emerging Entrepreneur Loan Program (ELP). However, the interest rate may not exceed the Wall St. Journal prime rate plus 4%. A lender may deny an application that does not fit within the lender’s program guidelines even if the borrower meets the characteristics requirements of ELP.

The state’s share of an ELP loan can range from a minimum of $5,000 to a maximum of $150,000 per project with state funds matched at least 1:1 by new private financing. Beginning microenterprises, including retail businesses, may apply for $5,000 to $35,000 throughout the state and $5,000 to $50,000 in low-income areas without private matching funds.

For More Information

For questions or a referral to an appropriate certified partner, contact Jason Burak, 651-259-7338 or jason.burak@state.mn.us.

-

Apply

Businesses must apply directly with a certified Minnesota Emerging Entrepreneur Loan Program (ELP) lender. Lenders accept applications on a year-round basis, subject to funds availability. The application forms, process, and loan eligibility criteria may differ from lender to lender.

The underwriting process and credit decision is generally left to each lender's discretion. If a business’s application is approved by a certified lender, the lender will forward the application for DEED for commissioner approval.

DEED reviews each project application to ensure that it meets program parameters, but generally does not conduct a second credit review. If approved, ELP funds are released to the lender for disbursement to the borrower. Each lender will provide and have the business execute the appropriate loan documents.

All borrowers are required to provide periodic reports to the lender, which will be used in the lender’s reporting to DEED.

Certified Partners

There are a number of nonprofit lending partners participating in ELP. These organizations serve different communities and areas of the state. They may have additional limitations, including loan size available and target populations served.

For More Information

For questions or a referral to an appropriate certified partner, contact Jason Burak, 651-259-7338 or jason.burak@state.mn.us.

-

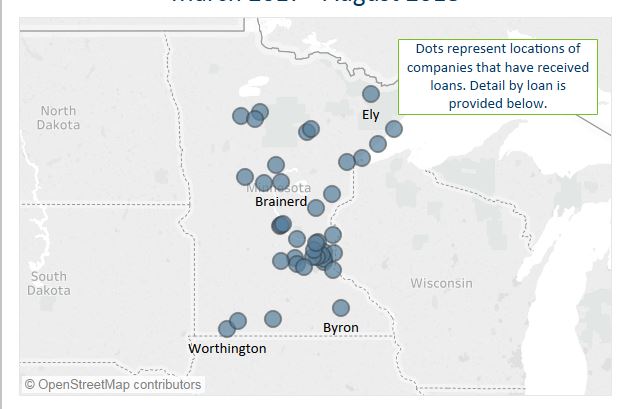

Funding Map

Use this interactive map to see where ELP projects are located throughout Minnesota.

Use this interactive map to see where ELP projects are located throughout Minnesota.

You can see the amount of the awards, lending partner, qualifying group characteristic and more for each project and download the data.

The map will open in a new window.

-

FAQs

What qualifies a company to receive a loan from the program?

The program requires the company to be a Minnesota-based small business that is majority owned and operated by one or more Minnesota residents who can be characterized as a minority, woman, veteran, low-income person, or person with disabilities.

Must the business owner(s) be a resident of Minnesota?

The majority owner(s)/operator(s) with the program qualifying characteristics must be Minnesota resident(s).

What are the minimum and maximum loan amounts?

The minimum amount provided by DEED for a loan is $5,000 and the maximum is $150,000. Approved lenders may use other funding sources or partner with other institutions to complete larger projects.

What is the interest rate of loans under the program?

The approved lender will set the terms of the loan, including the interest rate. The rate for loans under the program may not exceed the Wall Street prime rate plus 4%.

Are revolving lines of credit allowed under the program?

No, only term loans are permitted.

Can real estate be financed through the program?

Yes, but the real estate must be majority owned by individual(s) qualified under the program and must be occupied by a business that is majority owned and operated by individual(s) qualified under the program. Passive real estate investments where the owner is not running a business housed within the real estate will not be approved under the program.

Are retail businesses eligible for the program?

A retail business is only eligible if it is a beginning microenterprises that has fewer than five employees and has generated revenue for two years or less.

Are there types of loans or industries that will not be approved under the program?

Retail businesses, meaning those businesses such as stores selling directly to consumers (NAICS 44-45), must be eligible beginning microenterprises to qualify under the program. No liquor stores or establishments primarily selling liquor made off site, stores primarily selling tobacco or electronic smoking products, gambling operations, or adult oriented businesses will be considered under the program. Projects for financial or insurance businesses (NAICS 52-53) will not generally be approved.

Does each lender have unique criteria for deciding whether to make a loan through the program?

Yes. Each approved lender will have its own criteria and guidelines for considering and approving a loan that is funded by the program. Each lender retains discretion over whether to make a loan to an applicant.

Are matching funds required?

Yes, unless the business is a beginning microenterprise, meaning it has fewer than five employees and has generated revenue for two years or less, and the loan does not exceed $35,000 outside of a low-income area or $50,000 in a low-income area.

Who counts as an employee?

All employees who receive a W-2, including the business owner, are considered employees. Each employee is counted regardless of full-time/part-time status.

Can other government funds be used to match DEED funds?

DEED funds must be matched with new private investment. There are several circumstances under which certain government-related funds would qualify:

- If the certified partner has borrowed recourse funds from a government entity, those funds may be used for the match.

- If the lender is using non-recourse grant funding that was granted by a government entity, those funds may be used for the match once they have been used for the grant purpose, released from the grant restrictions and added to the lender's net assets.

- Funds that are guaranteed, not directly funded, such as SBA 7(a) loans, may be used for the match.

Are there fees associated with the program?

Each approved lender may charge up to 1% of the total loan amount as an origination fee. Any application fee initially charged by the lender must be counted toward this 1% total. The lender may recover out-of-pocket costs incurred as a result of their due diligence and underwriting process (e.g., credit reports, UCC filing fees).

Can funds be used to refinance existing debt?

No. There are few restrictions on use of funds, but the program does not allow for retirement or refinance of existing debt.

Can a business receive funds through the program from more than one lender?

Yes, but the lenders must work in cooperation with each other and there must be one lender identified as the lead for the project. The maximum amount of funds available from the program is capped at $150,000 per business regardless of how many lenders are participating.