By Sanjukta Chaudhuri

September 2020

Much has transpired in the Minnesota labor market since the COVID-19 pandemic Executive Order of March 13 led to the mass shutdown of businesses, social distancing protocols, and resulting layoffs of thousands of Minnesotans. The unemployment rate surged from 3.6% in third quarter of 2019 (not seasonally adjusted), to 8.7% in second quarter, peaking at 9.4% in May, and settled down at 6.6% in third quarter. With the unprecedented impact of the pandemic on the labor market, much research has already gone into understanding and explaining the sharp movements in the labor market. Through these unique research challenges, the unemployment insurance claims data have been a major guiding light for all labor market economists. Minnesota DEED's LMI office has published several important articles on a wide range of time sensitive topics on the pandemic the Minnesota labor market.

The one yet unexplored area of research data relates to the BLS Program for Measuring Insured Unemployed Statistics (PROMIS), a standalone software of UI claims and claimants which is the logical outcome of Section 309 of the Workforce Investment Act (WIA) of 1998. The PROMIS system stores claimants' data in one database, for use as inputs to the Local Area Unemployment Statistics (LAUS), LAUS being the BLS program that utilizes the Current Population Survey, census data, and state level inputs delivered through the PROMIS software on claimants' information to use complex econometric methods to produce the estimated labor force numbers on a monthly basis for national and state level. The official/headline unemployment rates released in the national and state level monthly employment situation are an outcome of LAUS, with PROMIS providing the important state level input on UI claimants.

To be clear, the PROMIS database is a very specific database, whose objective is to store only the data that are relevant inputs for the LAUS estimation process. With the importance of the survey reference week for the Current Population Survey, PROMIS database stores only claims whose week ending date is the same as the week ending date of the CPS survey, always the second Saturday of any given month. Hence, the numbers produced by PROMIS are a subset of Unemployment Insurance claim numbers. Nonetheless, PROMIS offers valuable data. Specifically, the production of county level UI statistics by socioeconomic characteristics supports the development of total unemployment estimates by demographics, occupation, industry, race, and place of residence in PROMIS.

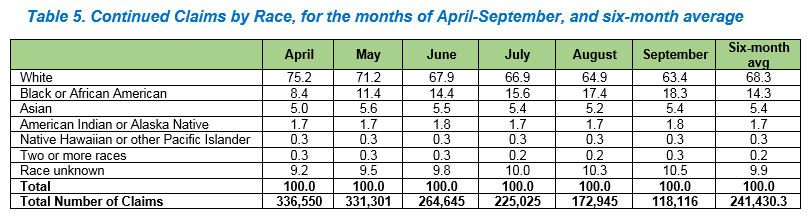

One of the recurring data requests for the LMI office has asked for the demographic and race/ethnicity make-up of UI claimants through the pandemic months. This article aims at providing a brief overview of the trends in claimants, while also demonstrating the valuable data that are produced by the PROMIS system. Tables 1 through 5 show the breakdown of continued claims by county, race, education, industry and occupation. Some interesting patterns are revealed.

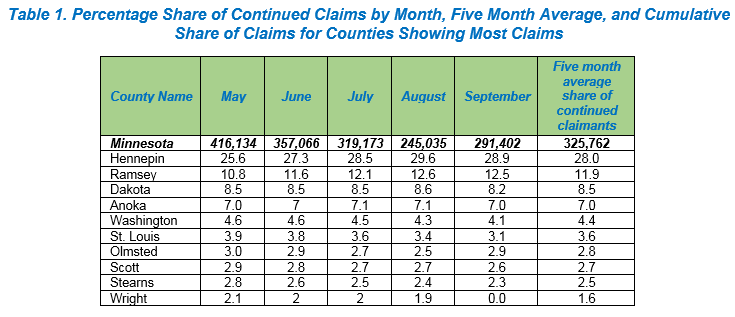

In the six-month period from May through September, statewide data show that May was the peak month of unemployment insurance claims, with continued claims totaling 416,134 that month. Continued claims have been lower in subsequent months, with September recording 291,402 claims. The five month average stood at 325,762 claims. As already mentioned in the introduction, note that the number of claims shown here are only from what is available in the PROMIS database, and since the focus of PROMIS is on the reference week of the CPS survey, the number of continued claims shown here is smaller than what is reported by the Unemployment Insurance division. Nonetheless, the demographic and race/residence data on claims that PROMIS produces as part of its output is critical for ongoing research on the labor market impact of the pandemic.

County data show that the counties of the Twin Cities Metro Area have been most affected by unemployment. Hennepin has been consistently the top county for number of claims, averaging 28% of all claims since May. Hennepin is followed by Ramsey (five-month average 11.9%), Dakota (8.5%), Anoka (7.0%), and Washington (4.4%). Following these, St. Louis, Olmsted, Wright, Scott and Stearns counties had high share of claims. Together, these 10 counties accounted for almost 75% of statewide claims (see Table 1).

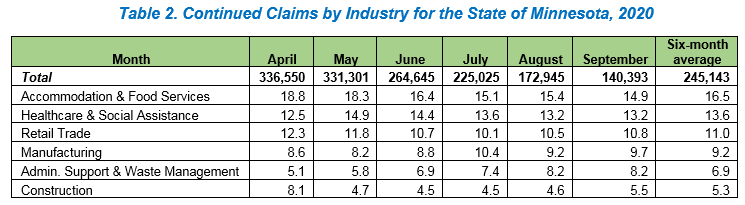

Table 2 shows the descending order of the seven industries that were most likely to file continued claims. Accommodation and Food Services accounted for the largest share (16.5%), followed by Healthcare and Social Assistance (13.6%), Retail Trade (11%), Manufacturing (9.2%), Administrative and Support and Waste Management (6.9%), and Construction (5.3%).

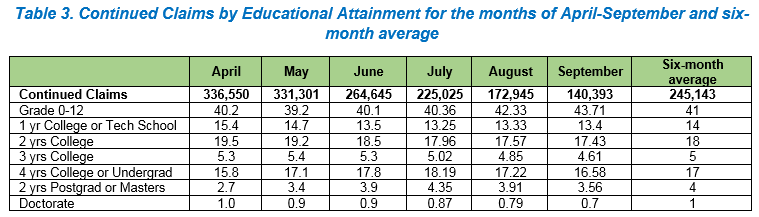

Table 3 shows that, as expected, most claims are filed by those who have not completed high school (41%). This group is followed by those with one to three years of college. Undergraduates represented 17% of claims. On the other hand, those with Postgraduate professional or Masters degrees, or with doctorate degrees were least vulnerable to being laid off and had a very small share of claims.

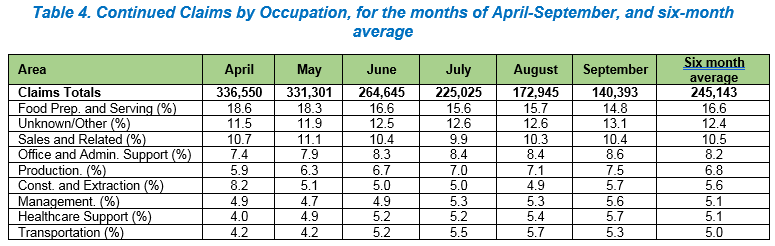

Amongst occupations Food Preparation and Serving occupations were hardest hit, comprising the largest share of claims when broken out by occupation (16.6% six month average share of claims). This was followed by Sales and Related (10.5%), Office and Administrative Support (8.2%), Production (6.8%), and Construction and Extraction (5.6%). Management (5.1%), Healthcare Support (5.1%), and Transportation (5.0%) were also relatively hard hit.

Table 5 shows that when broken out by race, whites had the largest share of claims (68.3%), followed by Blacks (14.3%) and Asians (5.4%).

This article's main objective was to present BLS PROMIS as a valuable and unexplored database with a wealth of information on unemployment insurance claims. During the tumultuous labor market situation brought upon us by COVID-19, the importance of PROMIS is even more valuable than before. PROMIS is not just a stand-alone database for providing inputs to the LAUS estimation process, but it serves the significant purpose of providing breakdown of unemployment insurance by demographic, education, industry, occupation, and race data. This article sets the stage for further in-depth research using this database. As we look ahead into ideas, we are excited to update our tables in the near future with data on age and gender breakdown of unemployment insurance claimants. We believe that these two variables in particular with help us better understand two pressing questions of the COVID-19 labor market: (1) have women been more affected by the pandemic than men? And (2) is the pandemic pushing out older workers from the labor force, and are younger workers disproportionately affected by unemployment from the pandemic?