By Anthony Schaffhauser

April 2023

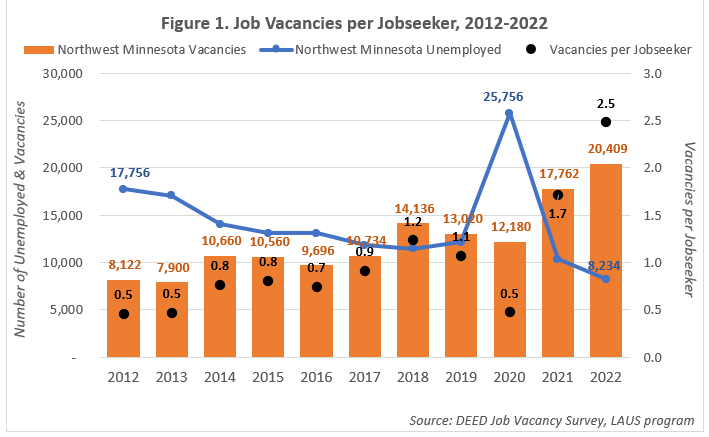

The recently released Job Vacancy Survey shows that Northwest Minnesota's labor market remains extremely tight. The estimated 20,409 job vacancies reported by employers is a new all-time record for the region, going back to 2001 when Minnesota completed the first Job Vacancy Survey. This unprecedented hiring demand, combined with record low unemployment, reveals a labor market that is tighter than at any time since these statistics have been produced.

Figure 1 combines worker supply and demand statistics to show an estimated 2.5 vacancies per jobseeker. That means that even if every unemployed worker were an immediate fit for an available job, 60% of open positions would still be unfilled. Typically, Figure 1 has displayed jobseekers per vacancy, but the inverse ratio of job vacancies per jobseeker makes more sense since 2018. It is more informative to say, "in 2022 there were 2.5 job vacancies per job seeker" rather than "there were 0.4 jobseekers per job vacancy." Conversely, in 2013 it was more descriptive to say, "there were two job seekers per job vacancy." This illustrates how much labor market conditions have tightened over the past five years.

This latest 2022 Job Vacancy Survey captures labor demand two years past the trough of the pandemic recession in second quarter 2020. It is notable that Northwest Minnesota was the only region to hit a new high in job vacancies. Statewide and in every other planning region is down from the records set in 2021. However, job vacancies remain well above pre-pandemic levels statewide and in every region.

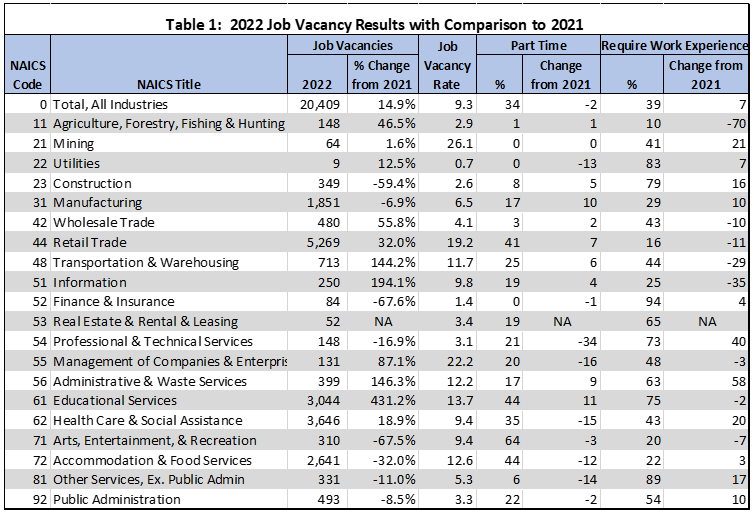

Table 1 presents job vacancies by industry in Northwest Minnesota with some characteristics of these vacancies and a comparison to 2021 results. The largest number of vacancies are in Retail Trade, growing from an already large number a year ago as the pandemic recovery continues to surge in the Northwest. In contrast, Retail job vacancies are down nearly 25% from a year ago statewide.

However, with the large number and percentage of the region's jobs in Retail, the vacancy rate is not as high as Mining and Management of Companies. Job vacancy rates are a comparison of the number of vacancies relative to the number of filled positions, and very high rates can signify an exceptional need for workers. Part-time Retail vacancies have risen to above average, and work experience is required for a very small and shrinking percentage of these positions.

Also continuing a growth trend, Health Care and Social Assistance has the second highest number of job vacancies. Statewide, this industry has the highest number of vacancies, but declined slightly from 2021. Compared to 2021, the industry has fewer part-time vacancies in the Northwest and more frequently requires work experience and postsecondary education.

Educational Services has the fastest growth in vacancies from 2021 as restaffing at schools from pandemic disruptions gets into full swing, consistent with a surge statewide. Vacancy rates have increased to above average, part-time has lessened to about average, and work experience is more often required.

Accommodation and Food Services still has the fourth largest number of vacancies, despite hiring's cooling down from the reopening demand a year ago. There is a very similar slide statewide. The related Arts, Entertainment and Recreation industry has the largest slowdown from a year ago, and the vacancy rate drops to near average. Both industries have similar changes statewide. Construction is the other industry where hiring slowed significantly both in the Northwest and statewide. Also, work experience requirements are more frequent.

The Northwest industries that increased vacancies while statewide hiring demand slowed include: Information, Administrative and Waste Services, Transportation and Warehousing, and Management of Companies. These industries make the difference in pushing job vacancies to a new record in the Northwest.

In contrast, Manufacturing vacancies have declined in the Northwest while increasing statewide. Like Construction, Northwest Manufacturing had a pandemic-related boom that was destined to cool as spending on services resumed. Note that Northwest Manufacturing includes a concentration in Building Materials and also outdoor recreational products. However, both statewide and Northwest manufacturers significantly increased the frequency of part-time openings, which could make these jobs appealing to more workers.

Overall, the latest Job Vacancy Survey results reflect the region's tightening labor market in 2022, as well as the shift from spending on goods to spending on services. However, the most useful results of this research are the vacancies and their characteristics by occupation. That is what feeds the extremely useful Occupations in Demand Tool that informs educational and workforce development decisions of consumers, businesses, and education and workforce development services providers. Informed workforce decisions are critical to achieve greatest success for individuals and Minnesota as a whole.