by Jan Saxhaug

August 2013

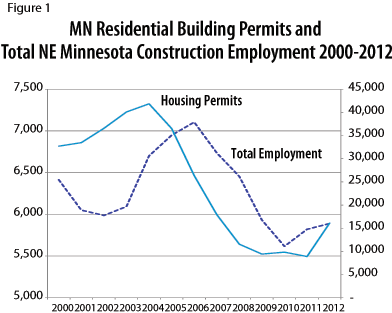

No industry was hit harder by the Great Recession than construction, with residential construction bearing the brunt of the losses. As the housing bubble burst, residential developments and condo buildings were left unfinished, many becoming ghost towns of steel and timber framing. The decline of the Residential Construction industry is effectively illustrated by U.S. Census data on building permit authorizations. In 2004 there were 41,843 residential building permits authorized in Minnesota. By the low point of the recession in 2009, statewide permit authorizations had fallen to 9,425 - a drop of 77.4 percent. As the number of building projects plummeted, so did employment. From 2005 to 2010 the Minnesota construction industry shed 41,189 jobs - or 30.2 percent of its total employment, by far the largest drop of the 11 industry super-sectors.

Not surprisingly, the drop in construction activity in the state led to a drastic decrease in construction-related employment in Northeast Minnesota. According to Quarterly Census of Employment and Wages (QCEW) data, construction employment in Northeast Minnesota reached a peak of 7,104 jobs in 2006 and made up 5 percent of the employment share in the region. At the recession's low point in 2009, industry employment had dropped by 20 percent to 5,932 jobs. By 2010 the total share of employment fell to 4 percent and employment numbers bottomed out at 5,616 jobs, 26 percent below 2007 levels.

Not surprisingly, in Northeast Minnesota, of the three industry sub-sectors - Construction of Buildings, Heavy and Civil Engineering Construction, and Specialty Trade Contractors - the biggest losses were sustained in Construction of Buildings, or more specifically, Residential Buildings and Single Family Homes Construction. Residential Building actually peaked in 2004 - three years before the industry as a whole peaked - at 1,060 jobs before beginning its precipitous decline, bottoming out in 2011 at 584 jobs. From 2009 to 2012, continued declines in new single-family home construction led to a further drop of 19 percent in Residential Building Construction employment. Viewed in the light of the U.S. census data on declining permit authorizations, these numbers are not surprising.

As bad as things got during the recession, the construction industry is poised for a strong recovery. In May 2013 residential building permits in Minnesota grew by 62.7 percent over the previous May to 1,719. This is still far below pre-recession numbers, but if Northeast Minnesota is any indicator it will actually be Non-Residential Building Construction and Heavy and Civil Engineering Construction that drive future growth.

The Northeast Minnesota construction industry has once again begun to add jobs, albeit slowly, climbing by 1 percent back to 5,889 in 2012 while construction's share of total employment ticked back up to 4.2 percent. With Residential Building Construction and the Specialty Trade Contractor employment still in decline over the same period throughout the region, it has been the other sectors, namely Non-Residential Building Construction and Heavy Civil Engineering Construction, that have been driving regional growth. Between 2009 and 2012 nonresidential building construction grew by 37 percent, adding 186 jobs, and heavy and civil engineering construction grew by 12 percent and added 130 jobs. So while Residential Construction is experiencing a slow recovery along with the housing market, the Construction industry as a whole has been buoyed by growth in the Non-Residential and Heavy and Civil Engineering Construction sub-sectors.

Duluth has numerous large-scale commercial construction projects on the horizon totaling more than $200 million. These include a new downtown office tower that will be the corporate home for Maurice's, a multi-modal transportation hub, Pier B redevelopment, and the restoration of the NorShor Theatre among many others. Additionally, growth in the Manufacturing and Mining sectors throughout the region should create increased demand for Commercial and Industrial Building Construction. In fact, according to DEED's long term projections, between 2010 and 2020 construction employment is projected to grow by 33.4 percent throughout Northeast Minnesota. The projected growth is spread across all sectors but is concentrated in Utility System Construction with 40.7 percent growth, Specialty Trade Contractors at 36 percent, and Construction of Buildings at 27.9 percent. Five of the 16 industries classified as high-growth/high-wage are in the Construction sector (Table 1).

| High-Growth/High-Wage Construction Industries | ||||

|---|---|---|---|---|

| Title | NAICS | Estimated 2010 Employment | Projected 2020 Percent Change | Median Salary |

| Other Specialty Trade Contractors | 2389 | 677 | 41.8% | $39,364 |

| Building Foundation/Exterior Contractors | 2381 | 841 | 36.7% | $52,520 |

| Highway, Street, and Bridge Construction | 2373 | 373 | 34% | $56,888 |

| Building Equipment Contractors | 2382 | 1,452 | 32.2% | $49,868 |

| Nonresidential | 2362 | 650 | 30.8% | $46,280 |

| Source: DEED Employment Outlook (Projections) | ||||

The future looks bright for construction sector occupations. Of the 22 major occupational categories, construction and extraction occupations is projected to be fourth behind health care support occupations, personal care and service occupations, and community and social service occupations in projected job growth from 2010 to 2020. Table 2 lists several occupations within the Construction and Extraction sector that have been classified as high growth/high wage.

| High-Growth/High-Wage Construction Occupations | |||||||

|---|---|---|---|---|---|---|---|

| Occupational Title | Estimated 2010 Employment | Projected 2020 Percent Change | New Hires | Replacement Openings | Total Openings | Projected Employment 2020 | Median Salary |

| Carpenters | 1,259 | 24.1% | 304 | 270 | 574 | 1,563 | $48,248.23 |

| Cement Masons and Concrete Finishers | 228 | 35.1% | 80 | 40 | 120 | 308 | $50,742.66 |

| Construction Laborers | 692 | 19.2% | 133 | 60 | 193 | 825 | $42,962.58 |

| Operating Engineers and Other Construction Equipment | 783 | 15.5% | 121 | 180 | 301 | 904 | $47,386.13 |

| Electricians | 1,020 | 17.2% | 175 | 280 | 455 | 1,195 | $67,073.06 |

| Painters, Construction and Maintenance | 310 | 24.5% | 76 | 70 | 146 | 386 | $38,265.45 |

| Plumbers, Pipefitters, and Steamfitters | 319 | 27.3% | 87 | 90 | 177 | 406 | $61,780.34 |

| Roofers | 261 | 18.8% | 49 | 50 | 99 | 310 | $58,445.01 |

| Source: DEED Employment Outlook (Projections) | |||||||

Compared to the rest of the industries in the state, the Construction Industry is developing into a strong cluster in Northeast Minnesota. One way to measure an industry's concentration in a region is by calculating location quotients. Location Quotients are the ratio of an industry's share of employment in a region compared to the industry share at the state or national level. Industries or sectors with location quotients above one indicate industry specialization and are generally considered to be drivers of regional economic growth. Because nationwide numbers are available only for the private sector, these location quotients have been calculated using private sector employment numbers for Northeast Minnesota. Table 3 provides construction industry location quotients greater than one compared to the nation and state.

When compared to the state the construction industry as a whole in Northeast Minnesota is relatively concentrated - with a location quotient of 1.19 (Table 3). The region also demonstrates a high level of specialization in several specialty trade contractor subsectors including Framing, Masonry, and Site Preparation Contractors among others.

| Private Sector Construction Employment and Location Quotients 1 | ||||

|---|---|---|---|---|

| NAICS Title | 2011 Jobs U.S. | 2011 Jobs MN | 2011 Jobs NE MN | U.S. LQ |

| Construction | 5,470,906 | 91,785 | 5,399 | 0.96 |

| Residential Building Construction | 565,436 | 9,249 | 584 | 1.01 |

| Heavy and Civil Engineering Construction | 819,707 | 12,817 | 801 | 0.95 |

| Highway, Street, and Bridge Construction | 283,765 | 5,456 | 361 | 1.24 |

| Foundation, Structure, and Building Exterior Contractors | 661,567 | 11,336 | 914 | 1.35 |

| Framing Contractors | 50,432 | 927 | 72 | 1.40 |

| Masonry Contractors | 127,972 | 2,727 | 207 | 1.58 |

| Other Building Equipment Contractors | 118,651 | 2,417 | 265 | 2.18 |

| Other Specialty Trade Contractors | 518,184 | 9,651 | 706 | 1.33 |

| Site Preparation Contractors | 263,201 | 3,875 | 500 | 1.86 |

| Total Jobs | 108,165,289 | 2,236,950 | 110,684 | |

| Source: Quarterly Census of Employment and Wages | ||||

While the construction industry took a huge hit in the recession, signs are pointing toward a comeback. Private businesses are again investing in Commercial and Industrial Construction, and the industry is adding jobs with projections for future growth looking strong. As Residential Construction takes up a smaller footprint, Non-Residential and Heavy and Civil Engineering Construction will drive future growth. With several sub-sectors becoming highly concentrated in the region, numerous in-demand occupations, and current job vacancy rates around 3.9 percent it is a great time for job seekers to think about breaking into the industry.