by Alessia Leibert

June 2021

During the COVID-19 pandemic, the impact of business restrictions or changes in consumer behavior in some industries created new employment opportunities elsewhere. As documented in a new report in this issue of Trends, in-person dining restrictions at restaurants created new job opportunities in grocery stores and food manufacturing, travel restrictions created additional jobs in construction for home improvement projects, and the boom of online purchases created new opportunities in packaging manufacturing, warehousing, delivery, and cloud computing services needed to manage novel commerce platforms.

The problem, however, is that some of the characteristics of emerging job opportunities do not fit the skills characteristics or the constraints faced by displaced workers. In this game of musical chairs, some displaced workers cannot find chairs that fit them, leaving some chairs unoccupied. That's one of the reasons why we are seeing a high number of job vacancies during relatively high unemployment.

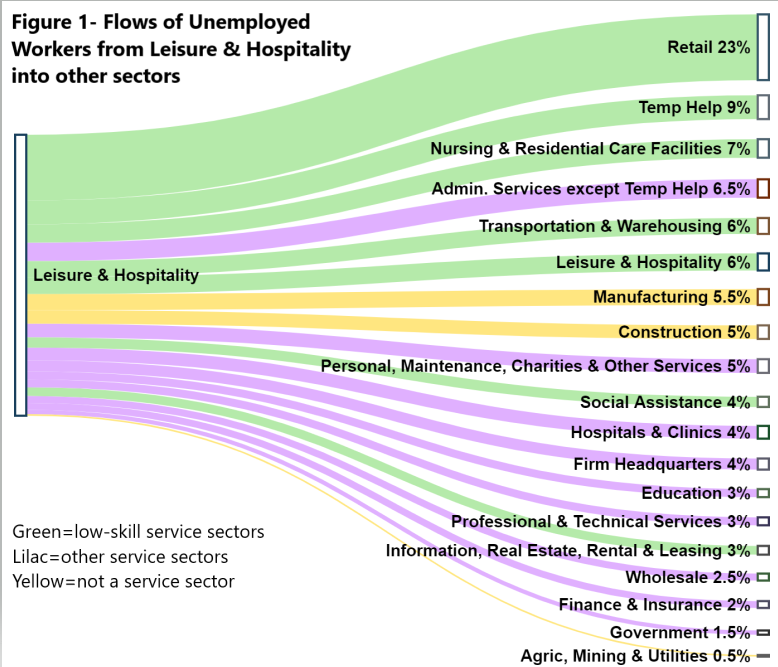

An analysis of reemployment patterns among unemployed workers in summer 2020 detailed in the report mentioned above shows that only 6% of Unemployment Insurance (UI) claimants (35,673 individuals) transitioned to a different industry in 3rd quarter 2020. And among those, very few switched to the industries that were less impacted by the pandemic. Figure 1 shows the flows of UI claimants out of the hardest-hit industry – Leisure & Hospitality, which includes the Food Services sector – into other industries in third quarter 2020.

Figure 1- Flows of unemployed workers from Leisure & Hospitality into other industry sectors in July-September 2020

The chart represents all 6,810 individuals who were laid off from jobs in Leisure & Hospitality, filed for UI from March to June 2020, were certified as eligible to receive UI benefits, and transitioned to another industry sector upon reemployment during third quarter 2020.1 The largest flows out of Leisure & Hospitality – a low-skilled service sector – entered other low-skilled service sectors such as Retail (23%), Temp Help (9%) and Nursing & Residential Care Facilities (7%). Far less common were the transitions into goods producing sectors like Manufacturing and Construction and into high-skill service sectors like Hospitals & Clinics. Despite the fact that Manufacturing posted record numbers of job vacancies between October and December2, it absorbed only 6% of laid off workers from Leisure & Hospitality, about the same number who switched to Leisure & Hospitality itself. In other words, one of the best performing sectors attracted just as many workers as the worst performing sector.

Manufacturing and Construction generally provide a pay advantage compared to the sectors that drew the most unemployed workers as shown in Figure 1. Why, then, do vacancies in these sectors remain unfilled while so many people are out of work?

The problem is nothing new and is particularly stark in the skilled trades. The explanation for this phenomenon lies with skills incompatibility and other characteristics of job openings – such as work hours and location – acting as barriers to reemployment for certain service-sector workers.

Low compatibility between the skills available in the applicant pool and the skills required to fill available positions is commonly known as the "skills gaps problem". According to the 2019 Skills Gaps in Manufacturing report, that summarizes detailed employer interviews on hiring skilled production, repair and engineering technician occupations in Minnesota, work in the skilled trades is becoming increasingly specialized. The skills most needed are best developed through on-the-job training and include mechanical aptitude, problem solving, and STEM skills, which are not typical in the majority of jobs lost during the COVID-19 recession.

To make the skills gaps problem worse, there is often misalignment between postsecondary program offerings and the credentials required to work in high-demand occupations. For example, no programs exist in Northwest Minnesota for Computer Numerically Controlled Tool Programmers3, a high-demand, high-pay occupation that employers in the region are struggling to recruit for. Not even high wages and a stellar job outlook can draw applicants if the training paths do not exist and if high school students in the region are unaware of these career opportunities near home. If post-secondary institutions respond more to students' interests than to local market demand, employers won't be able to find the talent they need.

Entering Manufacturing from the service sector is difficult for two additional reasons besides candidates' inadequate skills: first, mismatches between the geographic location of jobs and job seekers; and second, inconvenient work hours. The following quotes from 2019 survey respondents, all from Manufacturing, offer a glimpse of the possible reasons why the sector did not attract as many unemployed workers as expected in summer 2020:

"Our current issue is that the shift we have open is on night shift. We had 2 candidates that stopped the interview once they found out it would be nights."

"We are in Eden Prairie. There is limited public transportation Monday through Friday and none on the weekends, and we are trying to hire a night shift and weekend shift."

"The work environment in our facility is not desirable because it is not air conditioned, not in a clean room, and workers need to stand. And the shift is 6 a.m. to 4:30 p.m."

"We are in a small town, and who wants to live out in the middle of nowhere? There are so many opening in the skilled labor market for maintenance so you are competing against each other for the same pool of people. Furthermore, we are seasonal labor and once you tell people that you work 60 hours a week in the summer, they are done. That is a deterrent for many."

"Maybe we aren't the best offer. Maybe others offer more perks, a location closer to where they live, maybe a different shift, maybe hours that are more flexible, maybe they don't like the start time and the end time so they can take the kids to school in the morning and then come to work."

At a time when telecommuting and flexible work schedules are becoming the norm, employers who cannot offer these perks to job seekers might find themselves at a disadvantage in the talent race. Work hours might be a particularly important factor in the decision to return to work for workers laid off from Leisure & Hospitality, because flexible and part-time schedules could be the reason for choosing to work in the sector in the first place. Parents who had to stay home while day care centers were closed or while their kids were in distance learning, college students, and the elderly might be available only for part-time or flexible work.

The pandemic has also exacerbated pre-existing problems of jobs-to-job seeker mismatch in terms of geographic location, because workers laid off from Leisure & Hospitality - primarily located in the Twin Cities - might find it difficult to reach manufacturing facilities located in the suburbs or outside the Metro. Construction has similar problems with regards to the location of jobs because workers are required to have a driver's license and a reliable vehicle to reach construction sites. Lack of transportation was a well-known barrier for accessing jobs in Construction even before the pandemic.4

Finally, an important reason why industry mobility was so rare in 2020 has to do with wages. One out of three (34%) of claimants who switched industry in 3rd quarter 2020 suffered a pay cut relative to their pre-pandemic wages. Not all workers are willing or able to afford such an earnings loss. Laid off workers who expect to be able to return to a prior employer might prefer to wait out the crisis rather than having to start from scratch in a completely different field at lower wages.

According to conversations with workforce practitioners in March 2021, job seekers that are actively applying face the following difficulties:

We asked Jinny Rietmann, Executive Director of Workforce Development Inc. In Southeast Minnesota, to summarize what she has been hearing from job seekers about their concerns and experiences during the first months of 2021. Here is her response:

"Due to Covid, there is a real concern about safety. There are also concerns about childcare and school-aged children at home. Individuals are researching new careers with more flexibility. I'm very concerned about recruiting becoming increasingly difficult in more traditional non-flexible work environments, because not all employers can offer flexible schedules or remote work. Surprisingly, career seekers are not as aware of the opportunities available to them, and/or they do not see themselves in those opportunities. While employers may be screaming for help, the message isn't always trickling down to the career seeker to see themselves in the roles available."

Evidence also shows that age is one of the biggest barriers to reemployment, and particularly to taking jobs in a different industry. Reemployed claimants over the age of 50 were four times less likely than those under age 25 to engage in industry transitions. Older workers' lower propensity to switch might be explained by fear of catching COVID-19 in certain work environments, fear of taking a pay cut, inability to adapt to the physical demands and different work schedules of some jobs currently available, lack of familiarity with new job searching methods, and employers' bias against hiring older job seekers.

One of the concerns that emerge from conversations with employers5 struggling to fill job openings in 2021 is candidates not returning phone calls or not showing up at job interviews. These behaviors were also mentioned by survey respondents in 2019. Specifically, 52% of Manufacturing employers who participated in the survey agreed that their recruiting difficulties could be related to candidates' lack of work ethic or interest6.

This problem, frequently mentioned in combination with other factors, is a common feature of tight labor markets when job seekers have lots of choices. The following quotes from 2019 show how lack of work ethic or interest rarely occurs in isolation from other factors that make the job less desirable or harder for job seekers to qualify for:

"We had applicants who wanted $20 hour because that's what they earned when they were just a cook. I can't pay a machinist $20 an hour. We did work with several temporary agencies. It was like a revolving door. They show up one day and don't show up the next. Also, the second shift is a tough one for us to fill."

"When we have applicants, they don't show up to the interview, and if they do they don't always have the skills set needed to pass a weld test."

"The problem is not being able to reach applicants. They don't answer when trying to set up interviews, and when you do reach them they don't know what they applied for because they are applying for everything. And we require 1 to 3 years of experience in electrical controls."

Furthermore, 7% of 2019 survey respondents mentioned "low unemployment rate" as a factor contributing to their hiring difficulties7. Since the start of the COVID-19 pandemic, the low unemployment narrative has given way to the narrative, also not new, of unemployment benefits acting as a disincentive for individuals to return to work. Given that candidates not returning phone calls or not showing up for job interviews was an issue even before the pandemic, the phenomenon is unlikely to be related to the pandemic or to changes in UI benefits or eligibility. Rather, it is a phenomenon quite typical of tight labor markets.

When talking about the effect of the pandemic on job search activity it is important to remember that even in 2021 Minnesota ranked 5th nationwide for labor force participation rates, at 67.7%, well above the national average of 61.7%. Minnesotans are some of the hardest working people in the country and the pandemic has not changed that.

The pandemic has demonstrated once again that high unemployment does not necessarily make it easier for employers to recruit. If it did, we would have seen more unemployed workers entering rebounding industries like Manufacturing and Construction during third quarter 2020. Sadly, high employment can happen at the same time as large numbers of vacancies remain unfilled. As soon as the labor market tightens again, pre-existing and unresolved recruiting challenges inevitably reemerge.

Findings from the 2019 Skills Gaps survey showed than Manufacturing employers who implemented the following strategies saw an improvement in their ability to attract qualified candidates:

These examples show a high degree of awareness on the part of Manufacturing employers that offering training and promotion opportunities enhances their ability to hire and groom the specific skills needed. Most of these best practices are applicable to employers from all sectors.

The pandemic is highlighting long-standing workforce challenges. These include mismatches between the skills sought by employers and those of job seekers, inconvenient location or work hours of available jobs, misalignment between post-secondary program offerings and skills in highest needs, and infrastructure barriers – such as lack of childcare and transportation – that limit the ability of some laid off workers to return to work or enter the industries that are struggling the most to hire. The post-pandemic recovery offers a unique opportunity for Minnesota to tackle these well-known labor market dysfunctionalities. Employers should identify the reasons why their job offers are not competitive and try to address them. They should also offer more work-based learning opportunities to motivate displaced workers to train for a new career. The education sector – especially community colleges – should partner more closely with employers to improve the alignment between their program offerings and local workforce needs. And finally, unemployed workers – especially those without a college degree and whose jobs are not coming back – should be encouraged to take advantage of government-funded retraining programs geared towards in-demand industries that are struggling the most to find workers.

1Individuals who switched from Accommodation & Food Service to Arts, Recreation & Entertainment or vice-versa were treated as industry transitions (Leisure & Hospitality to Leisure & Hospitality in the graph).

2Manufacturing reported 10,958 vacancies in Fall 2020, up from 9,153 in Fall 2019. Source: Minnesota Job Vacancy Survey.

3The Occupations In Demand (OID) tool shows Computer Numerically Controlled Tool Programmers as a five-star occupation in Northwest Minnesota, but no programs exist in the region to prepare for it.

4See The Case for Diversifying Construction. Economic Trends magazine.

5Information collected by DEED's Regional Analysis & Outreach (RAO) Unit

6Source: Minnesota Hiring Difficulties Survey Report, page 8, 10, and 11. Findings from previous rounds of the Hiring Difficulties Survey.

7Quote from a respondent: "There are not enough unemployed applicants to fill all positions."