by Mark Schultz

August 2019

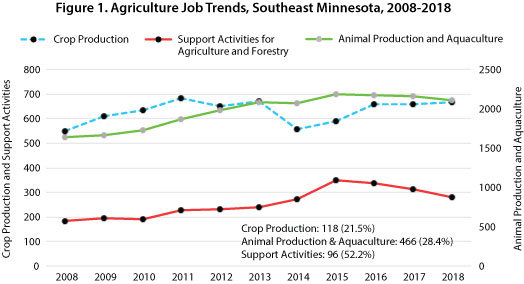

While not the largest employing industry in Southeast Minnesota, Agriculture nonetheless plays a role in the region's economy. As shown in Figure 1, there are three main sub-sectors in the Agriculture industry sector – Crop Production, Animal Production and Aquaculture, and Support Activities for Agriculture and Forestry. While all three of these sectors have seen overall job growth over the last 10 years, the highest numeric growth was seen in Animal Production and Aquaculture, which saw an increase of 466 jobs, while Support Activities for Agriculture and Forestry saw the largest percent change with a jump of 52.2 percent (see Figure 1).

Of these three industry sub-sectors, the largest portion of Agriculture jobs are in Animal Production and Aquaculture, which makes up 68.4 percent of the region's jobs in Agriculture, Forestry, Fishing, and Hunting, with 2,106 jobs in 205 firms. Crop Production makes up 21.7 percent of these jobs in 109 firms, and Support Activities for Agriculture and Forestry makes up the remaining 9.1 percent in 65 firms. Animal Production and Aquaculture also accounts for the highest percentage of the total payroll at 68.7 percent, but Crop Production has the highest average weekly wages with $674 weekly. Interestingly, Crop Production saw a general decline from 2011 to 2014 before beginning to grow again whereas Animal Production and Aquaculture and Support Activities continued to grow through 2015 before starting to decline (see Figure 1).

These three industry sub-sectors can be broken down even further with the largest portion of Crop Production being Greenhouse, Nursery, and Floriculture Production followed closely by Oilseed and Grain Farming. The greatest number of Animal Production and Aquaculture jobs are in Cattle Ranching and Farming. Support Activities for Crop Production make up the largest segment of the Support Activities jobs. Southeast Minnesota has almost 20 percent of the Animal Production and Aquaculture jobs in the state, including 28 percent of the state's Cattle Ranching jobs and 16.1 percent of the jobs in Hog and Pig Farming. The region also makes up 18.6 percent of the Fruit and Tree Nut Farming and 12 percent of the Vegetable and Melon Farming jobs in the state.

| Table 1. Agriculture Industry Employment Statistics, Southeast Minnesota, 2018 Annual Averages | |||||

|---|---|---|---|---|---|

| Industry | 2018 Jobs | 2018 Percent of Agriculture Jobs | 2018 Firms | 2018 Total Payroll | 2018 Average Annual Wage |

| Total, All Industries | 244,297 | - | 12,552 | $12,771,390,831 | $52,260 |

| Agriculture, Forestry, Fishing, and Hunting | 3,078 | 100.0% | 392 | $104,442,870 | $33,904 |

| Crop Production | 668 | 21.7% | 109 | $23,522,263 | $35,048 |

| Oilseed and Grain Farming | 217 | 7.0% | 55 | $8,161,868 | $37,388 |

| Vegetable and Melon Farming | 114 | 3.7% | 13 | $3,220,141 | $27,924 |

| Fruit and Tree Nut Farming | 55 | 1.8% | 8 | $1,245,500 | $23,972 |

| Greenhouse, Nursery, and Floriculture Production | 231 | 7.5% | 19 | $8,958,016 | $39,052 |

| Other Crop Farming | 50 | 1.6% | 14 | $1,936,738 | $39,104 |

| Animal Production and Aquaculture | 2,106 | 68.4% | 205 | $71,708,312 | $34,060 |

| Cattle Ranching and Farming | 1,328 | 43.1% | 126 | $39,052,602 | $29,380 |

| Hog and Pig Farming* | 529 | 17.2% | 52 | $22,720,060 | $42,952 |

| Poultry and Egg Production | 137 | 4.5% | 7 | $6,333,001 | $46,488 |

| Animal Aquaculture | 16 | 0.5% | 2 | $939,043 | $59,644 |

| Support Activities for Agriculture and Forestry | 280 | 9.1% | 65 | $8,415,597 | $30,004 |

| Support Activities for Crop Production | 162 | 5.3% | 31 | $5,153,038 | $31,720 |

| Support Activities for Animal Production | 103 | 3.3% | 29 | $2,851,807 | $27,612 |

| *A hog is a pig that weighs over 120 pounds

Source: DEED Quarterly Census of Employment and Wages |

|||||

According to DEED's Occupational Employment Statistics data, employment in Farming, Fishing, and Forestry rests at 280. This does not agree with the total in Table 2 which is QCEW data. QCEW counts each person working at an agricultural business as being in Agriculture. The OES program counts only those who have actual agricultural occupation titles and therefore leaves out occupations like truck drivers and bookkeepers. Half of the OES employment is agricultural equipment operators while another quarter of the employment is farmworkers and laborers for crops or in nurseries and greenhouses. Median hourly wages range from $14.58 for those working as crop, nursery, and greenhouse farmworkers and laborers to $33.13 for supervisors, while 90th percentile wages range from $21.34 to $40.56 for these same two occupations. Among these occupations, all but one require only a high school diploma or equivalent; agricultural inspectors require an associate's degree. It appears that short-term on-the-job training is most relevant for these occupations rather than formal education according to DEED's Occupations in Demand data.

| Table 2. Southeast Minnesota Agriculture Occupations and Wages, 1st Quarter 2019 | |||||||

|---|---|---|---|---|---|---|---|

| Occupation | Employment | Wage Percentiles | Typical Education Requirement in MN | ||||

| 10th | 25th | Median | 75th | 90th | |||

| Total, All Occupations | 241,540 | $10.93 | $13.54 | $19.28 | $30.26 | $43.76 | N/A |

| Farming, Fishing, and Forestry Occupations | 280 | $12.54 | $14.35 | $17.70 | $23.29 | $30.02 | N/A |

| Supervisors/Managers of Farming, Fishing, and Forestry Workers | 20 | $22.93 | $27.08 | $33.13 | $37.78 | $40.56 | High School/Equivalent |

| Agricultural Inspectors | 10 | $21.63 | $21.64 | $26.61 | $31.67 | $38.42 | Associate's |

| Graders and Sorters, Agricultural Products | N/A | $12.90 | $14.32 | $19.13 | $25.23 | $28.56 | High School/Equivalent |

| Agricultural Equipment Operators | 140 | $13.49 | $14.86 | $18.18 | $23.50 | $29.38 | High School/Equivalent |

| Farmworkers and Laborers, Crop, Nursery, and Greenhouse | 70 | $10.10 | $11.58 | $14.58 | $18.46 | $21.34 | High School/Equivalent |

| Source: DEED Occupational Employment Statistics and Educational Requirements for Occupations | |||||||

Data from the United States Department of Agriculture's (USDA) Census of Agriculture are a better fit than data from the Quarterly Census of Employment and Wages when analyzing number of farms in Southeast Minnesota because QCEW data omit family farms since they are usually not covered by unemployment insurance. According to the USDA a farm is defined as "any place from which $1,000 or more of agricultural products were produced and sold, or normally would have been sold, during the year." According to the USDA's National Agricultural Statistics Service (NASS) 2017 Census of Agriculture, there were 11,478 farms in Southeast Minnesota. The largest number of farms were located in Goodhue County (1,461) followed by Fillmore (1,401), Rice (1,242), and Olmsted (1,139) counties, while Freeborn, Mower, and Winona Counties all had over 1,000 farms (see Table 3).

| Table 3. 2007-2017 Change in Number of Farms by County, Southeast MN | ||||

|---|---|---|---|---|

| County | 2007 | 2017 | Numeric Change | Percent Change |

| Fillmore | 1,667 | 1,401 | -266 | -16.0% |

| Rice | 1,494 | 1,242 | -252 | -16.9% |

| Olmsted | 1,384 | 1,139 | -245 | -17.7% |

| Steele | 934 | 746 | -188 | -20.1% |

| Goodhue | 1,644 | 1,461 | -183 | -11.1% |

| Freeborn | 1,257 | 1,076 | -181 | -14.4% |

| Winona | 1,203 | 1,034 | -169 | -14.0% |

| Wabasha | 976 | 809 | -167 | -17.1% |

| Houston | 1,041 | 891 | -150 | -14.4% |

| Dodge | 723 | 611 | -112 | -15.5% |

| Mower | 1,088 | 1,068 | -20 | -1.8% |

| Southeast MN | 13,411 | 11,478 | -1,933 | -14.4% |

| Source: USDA 2007 and 2017 Census of Agriculture | ||||

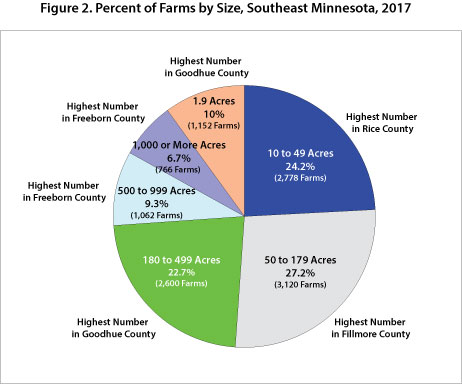

Overall, the Southeast Region saw about 10 percent of its farms having 1 to 9 acres while almost one-quarter ranged from 10 to 49 acres. The largest percentage of the region's farms were those between 50 to 179 acres, and an additional 22.7 were between 180 and 499 acres. The remaining 15 percent of the region's farms were larger farms of 500 acres or more, including 6.7 percent that were 1,000 acres or more (see Figure 2).

Each individual county experienced a loss of farms from 2007 to 2017, for an overall loss of over 1,930 farms in the region, a loss of 14.4 percent. The largest county-level numeric losses were seen in Fillmore (266), Rice (252), and Olmsted (245) Counties, while Mower County saw the smallest decrease in the number of farms with a loss of 20. However, the highest farm loss percentages were seen in Steele (20.1 percent), Olmsted (17.7 percent), and Wabasha (17.1 percent) (see Table 3).

| Table 4. Changes in Farm Numbers by Acreage, Southeast MN, 2007-2017 | ||||

|---|---|---|---|---|

| 2007 Estimate | 2017 Estimate | Numeric Change | Percent Change | |

| 1 to 9 Acres | 879 | 1,152 | 273 | 31.1% |

| 10 to 49 Acres | 3,315 | 2,778 | -537 | -16.2% |

| 50 to 179 Acres | 4,134 | 3,120 | -1,014 | -24.5% |

| 180 to 499 Acres | 3,253 | 2,600 | -653 | -20.1% |

| 500 to 999 Acres | 1,163 | 1,062 | -101 | -8.7% |

| 1,000 Acres or More | 667 | 766 | 99 | 14.8% |

| Source: USDA 2007 and 2017 Census of Agriculture | ||||

Based on acreage, the largest loss was of farms between 50 and 179 acres, which dropped by over 1,000 farms (24.5 percent) from 2007 to 2017, followed by a loss of 653 farms (20.1 percent) between 180 and 499 acres and 537 fewer farms (16.2 percent) between 10 and 49 acres and just over 100 fewer farms from 500 to 999 acres. Overall, farm losses totaled 2,305 while smaller gains were seen in farms 1 to 9 acres and 1,000 acres or more equaled only 372, leaving a net loss of 1,933 farms (see Table 4). This increase in small and large farms appears to be a national trend 1, and the increase in smaller farms may be the result of "more small fruit and vegetable operations"2 while the increase in large farms may be attributed to "inflation of farm product prices over time".2

Despite the drop in the number of farms there are still current job openings in the region. According to DEED's Job Vacancy Survey there are currently 718 job openings for agricultural workers, which is by far the highest the region has seen. Previous highs have been 131 during the fourth quarter of 2001 and 114 in the fourth quarter of 2017, so demand is at an all-time high. These current openings have a median wage of $18.71 per hour. Unfortunately, two-thirds of these openings are part-time while one-third are temporary or seasonal, which may not be ideal for jobseekers looking for full-time and/or year-round employment. In addition, one-third of the job vacancies require post-secondary education while only 1 percent require one or more years' experience (see Table 5).

| Table 5. Job Vacancies in Agriculture, 4th Qtr. 2018 | ||||||

|---|---|---|---|---|---|---|

| Occupation | Vacancies | Percent Part-Time | Percent Temporary

or Seasonal |

Percent Requires

Post-Secondary Education |

Percent Requires

1+ Years Experience |

Median Wage Offer |

| Agricultural Workers | 718 | 66% | 33% | 33% | 1% | $18.72 |

| Source: DEED Job Vacancy Survey | ||||||

This change in the agriculture industry appears to be the result of several factors such as an aging of farmworkers3, the use of more and/or better technology1, and changes in market prices1, just to name a few. Nonetheless, agriculture will continue to play its part in the Southeast Region's economy with a projected need to fill 44 new jobs and 178 job openings caused by labor force exits from 2016 to 2026.

1Guta, Michael (2019, May 3). Small Farms on the Rise in the U.S., But It's Not All Good News.

2McDonald, James M. and Robert A. Hope (2017, March 6). Large Family Farms Continue to Dominate U.S. Agricultural Production.

3Farm News Media; USDA (2019, April 11). Ag Census Confirms Farmers are Getting Older, Bigger or Smaller.