-

Job Creation Fund Eligibility

The program is available to businesses engaged in manufacturing, warehousing, distribution, technology-related industries, and other eligible activities. Companies must work with the local government (city, county or township) where a project is located to apply to DEED to receive designation as a Job Creation Fund business.

To be designated as a Job Creation Fund business, a business must, at minimum:

- Be engaged in an eligible business activity

- Obtain local government support for their project via council resolution

- Invest at least $500,000 ($250,000 for Targeted Populations*) in real property improvements within one year of becoming a designated Job Creation Fund business

- Create at least 10 (5 for Targeted Populations*) new permanent full-time equivalent jobs within two years of becoming a Job Creation Fund business while maintaining existing employment numbers

- Pay at least $15.87 in wages and benefits in 2024, adjusted annually based on 110% of federal poverty guidelines. The level will change again on Jan. 1, 2025.

- Have other location options outside of Minnesota

- Cause no undue harm to Minnesota business competitors

- Certify that the project would not occur without Job Creation Fund assistance

Projects that begin prior to becoming designated by DEED are not eligible for the Job Creation Fund.

Prevailing Wage Requirements

Projects that receive $200,000 or more in Job Creation Fund assistance are subject to prevailing wage requirements. Learn more regarding Prevailing Wage Requirements by reviewing the Prevailing Wage Guide or visiting the Department of Labor and Industry website regarding Prevailing Wage Requirements.

Available Benefits

Companies that meet eligibility requirements must sign a business subsidy agreement with DEED to meet job retention, creation, wage, and capital investment requirements. The following benefits may be available once a business meets the conditions of its agreement and provides proof of performance:

- $1000 ($2000 for Targeted Populations*) per year per job created for jobs paying at least $33,150 in cash wages

- $2000 ($3000 for Targeted Populations*) per year per job created for jobs paying at least $44,618 in cash wages

- $3000 ($4000 for Targeted Populations*) per year per job created for jobs paying at least $57,365 in cash wages

- $4000 ($5000 for Targeted Populations*) per year per job created for jobs paying at least $70,113 in cash wages

- Up to a 5% rebate for real property improvements for businesses located in the Twin Cities Metro

- Up to a 7.5% rebate for real property improvements for business located in Greater Minnesota

*A targeted population is defined as if the business is located in Greater Minnesota or if 51% of the business is cumulatively owned by minorities, veterans, women or persons with a disability.

-

How to Apply to the Job Creation Fund

Applications for the Job Creation Fund are accepted year-round. Businesses must apply through the local government unit (city, county or township) where the project will be located.

In consultation with DEED, the local government unit will determine whether the business meets minimum program requirements. To assist with the process, complete this Job Creation Fund Eligibility and Application Checklist. Projects that meet the minimum requirements should contact Tom Washa, Program Manager at 651-259-7483 for an application and complete the following four-step process:

Step One

With assistance from the local government, the business submits the Job Creation Fund Application Form and required supporting documents to DEED. Completed applications may be emailed to jobcreationfund@state.mn.us or mailed to the following address:

Tom Washa

Program Administrator - Principal

Office of Business Finance

180 E 5th St Suite 1200

St. Paul, MN 55101

Step Two

DEED evaluates the application and notifies the local government and business of approval or denial. If approved, DEED will formally designate the business as a Job Creation Fund business and determine an award amount. Awards in excess of $500,000 require DEED to hold a public hearing.

Step Three

After a public hearing (if applicable), DEED drafts a business subsidy agreement specifying project goals and duration for the agreement and sends it to the business for signature. The business then returns the agreement to DEED for final signature by the DEED commissioner.

Step Four

Through the duration of the business subsidy agreement, the local government will continue to provide assistance to the designated JCF business. This includes collecting required reporting information and submitting progress reports, annual reports, requests for payment, and providing updates to the business regarding updates to annually adjusted wages.

Program Materials

Select the links below to view, download or print these forms:

-

Job Creation Fund Frequently Asked Questions

See our list of Frequently Asked Questions.

-

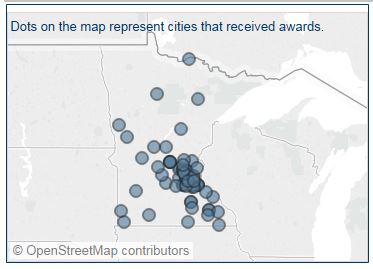

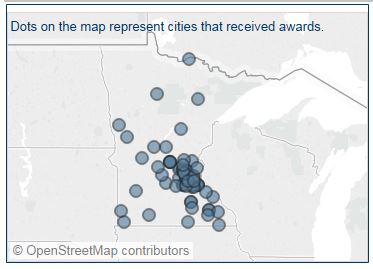

Funding Awards

Use this interactive funding awards map to see where Job Creation Fund projects are located throughout Minnesota.

You can see the amount of the awards, project costs, new jobs created, average wages and more for each project and download the data. (Data for other DEED business finance programs is also available.)

The map will open in a new window.