by Cameron Macht

March 2021

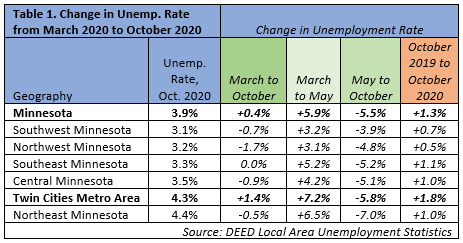

After spiking in April and May due in large part to restrictions on businesses to slow the spread of the coronavirus, unemployment rates across much of the state had ticked back down below 4.0% by October. However, rates below 4.0% suggest a more robust recovery than we’ve seen in job growth, which has been slow to rebound and Unemployment Insurance (UI) claims numbers, which remain high.

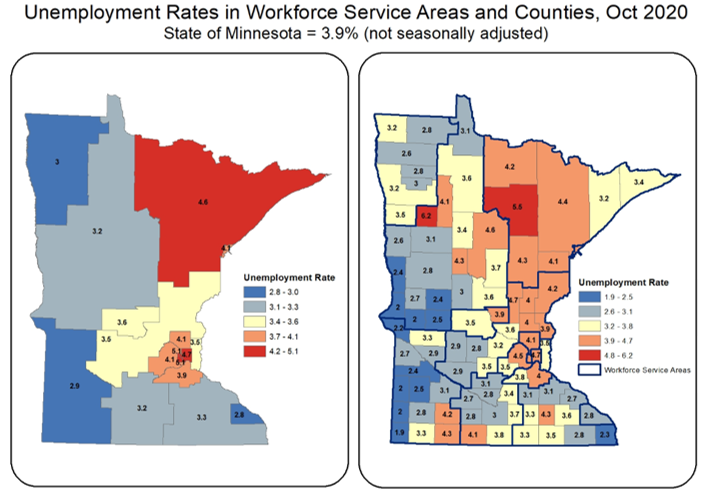

By October, four of the six planning regions and 66 of the 87 counties in the state had unemployment rates below 4.0%. Only two counties were above 5.0%, and none were above the national rate, which sat at 6.9% in October. In Minnesota, October’s regional unemployment rates matched rates last seen in October of 2016, when the state was over six years into the recovery from the Great Recession, and about 3.0% lower than the peaks they reached in 2009 and 2010.

Only one region reported having a higher unemployment rate in October than in March. Likewise, only 18 of 87 counties had a higher rate in the first month of the last quarter compared to the last month of the first quarter of 2020. However, it is important to note that over the past decade, October almost always provides the lowest unemployment rate of the 12 months in the year.

In order to make a direct comparison, it is more helpful to look at the year-over-year changes. While regional unemployment rates still seem low, they are up significantly compared to the historically low levels of the past three years. Northwest and Southwest Minnesota are the closest to pre-pandemic levels; while the Twin Cities is the only region with a higher rate now than in March and is also up the most compared to last October (see Table 1).

A quick look at Minnesota’s map shows that for the most part, smaller rural counties have shown more resistance to recessionary conditions; while metro areas were hit the hardest. In March, prior to the pandemic, the Twin Cities had the lowest unemployment rate of the six regions in the state at 2.9%, and 11 of the 15 lowest county unemployment rates in the state were in metro areas also including Mankato, Rochester, and Moorhead.

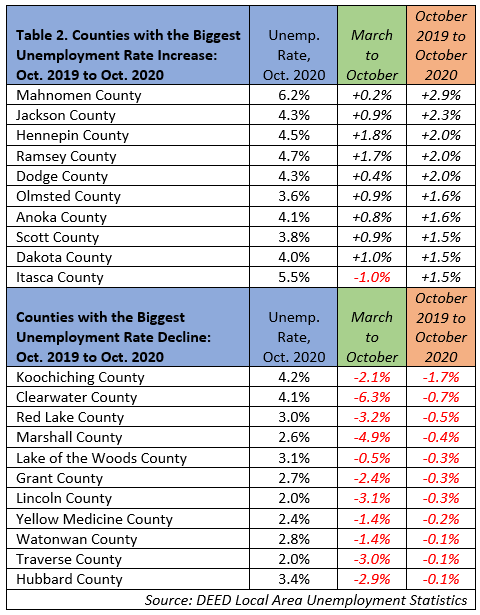

By October, many of these metro counties had flipped from the bottom to the top. Hennepin County went from the third lowest in March to the sixth highest in October; Ramsey jumped from ninth lowest to the third highest; and Anoka went from 13th lowest to 15th highest over the course of the summer and fall. Ranked by percent change from March to October, the top five increases were all metro counties; led by Hennepin and Ramsey, the two largest counties by population in the state; and further joined by three other metro counties in the top 10. Geographically, the highest unemployment rates are concentrated in the Twin Cities metro and Northeast; while the lowest rates are in Northwest and Southwest (see Map 1).

The same trends appear in the year-over-year comparisons – six of the top 10 increases in county unemployment rates from October 2019 to October 2020 were in metro counties; while all 11 counties that actually reported a lower rate this year than last were among the smallest by population and most rural in the state (see Table 2).

None of the 11 counties that saw unemployment declines over the year had more than 10,000 workers; and six had fewer than 5,000 people in the labor force. In sum, those 11 counties had just over 50,000 workers total, which is over 5,000 fewer than Carver County has on its own, even though it is easily the smallest county by population in the Twin Cities metro.

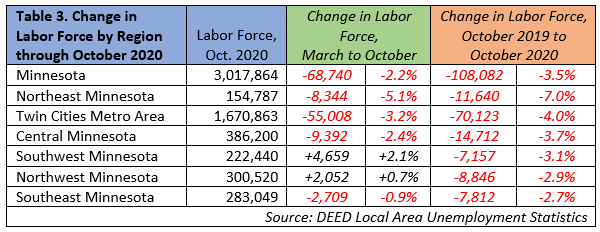

Due to uncertainty in the economy, concerns about exposure to the coronavirus on the job, and the need to care for children, the unemployment rate declines described above were also accompanied by labor force declines. In fact, in both September and October the rate reduction was due almost entirely to people dropping out of the labor force rather than people going back to work. Between March and October, Minnesota’s labor force fell by 68,740 workers, a 2.2% decline.

Over the year, Minnesota had 108,000 fewer workers by October, a 3.5% drop, which has created challenges for employers who are looking for workers and expecting to find them in the midst of a recession. The vast majority of labor force losses occurred in the Twin Cities metro area; but the fastest exodus impacted the Arrowhead region. Despite having the smallest labor force, Northeast saw the second biggest decline among regions in Greater Minnesota, losing 11,640 workers since October of 2019 (see Table 3).

In contrast, Northwest and Southern Minnesota have again been more insulated from the ravages of the recession. In fact, both Southwest and Northwest have added workers since March; and are both down only about 3.0% over the year. Southeast has seen the smallest slice since October 2019, losing just 7,800 workers, a 2.7% cut.

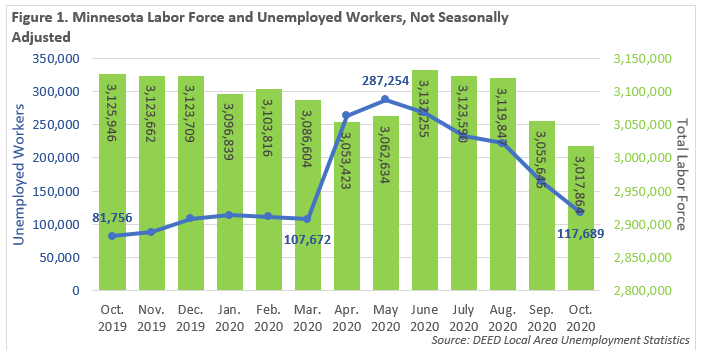

As both the unemployment rate and the size of the labor force have come down, the number of people looking for work has also dropped rapidly. In October 2020, Minnesota had under 120,000 unemployed workers, which is only about 10,000 more than in March. The surge above 287,250 unemployed workers in May was unprecedented, but many have either returned to work or dropped out of the labor force (see Figure 1) since then.

Employers hoping to tap into a recessionary spike in unemployed jobseekers have been frustrated at not finding them. Instead, many businesses are expressing confusion about why they aren’t getting applications for the jobs they have available, finding it difficult to locate and hire new workers.

Likewise, CareerForce staff across the state who expected to be overwhelmed with newly laid-off jobseekers have reported relatively low activity levels. Notably, many employment programs, such as Dislocated Worker, have not seen the typical surges in enrollment that come with a recession. This may in part be due to the fact that most layoffs started off as temporary, and haven’t moved to permanent, though staff report that rehire or call back dates are unknown or continue to be pushed back.

“We are not seeing people seek out workforce services at the level you would expect. We anticipated a (virtual) line out the door, but instead we are having to work twice as hard to market our services and bring in new clients for our programs,” said Elena Foshay, the Director of Workforce Development for the City of Duluth, a leading CareerForce partner. “Part of the issue is that our main referral sources - other agencies in the community and UI re-employment sessions - are not serving people at all or in the same way. Also, the digital divide is a factor - we have a large number of people in our community and region without internet or even phone access, so they can’t connect with our virtual services.”

There are many other factors at play as well with one of the primary barriers being lack of child care and challenges supervising school-age children engaged in remote learning. Many regions were facing a child care shortage prior to the pandemic, putting pressure on an industry that was already in crisis. But with many schools switching to distance learning during the fall, many parents who are also labor force participants have found it difficult to both work and care for children and manage at-home schooling. In some cases, someone in the family has had to quit their job to stay home with their younger children.

Skill shortages are another pre-pandemic issue exacerbated in this recession. The industries hit hardest by layoffs are Accommodation and Food Services and Arts, Entertainment and Recreation occupations, which tend to have low educational requirements and rely on short-term on-the-job training. While their skills in customer service, communication, and conflict- resolution are valuable, many of the people who lost their jobs in Leisure and Hospitality industry supersector might not have the specific training or knowledge needed for jobs that are available now. And because of COVID-19 health and safety limitations, it is challenging to scale up quickly, especially in areas like health care and transportation where the need is most acute.

Other workers, especially those in older age groups or in more vulnerable populations, are reluctant to work in jobs they feel might put them at risk of contracting COVID-19. And others are temporarily home sick, suffering from COVID-19, or are quarantining because they’ve been exposed to it. Through the end of October, Minnesota had reported more than 140,000 cumulative positive cases, and the weekly percent of positive tests was rising at the end of the month as a new surge spread across the state. The highest number of positive cases were in working age adults, from 16 to 64.1

Contrary to most recessions, the current booming stock market and healthy 401k balances may also be encouraging workers reaching retirement age to leave the labor force in larger numbers than in the past. For regions with an older population, especially Northeast Minnesota, this may be having a huge but hidden impact on the available workforce. Workers in the oldest age group are also the most susceptible to the most adverse effects of COVID-19, which is likely another factor in their dropping out of the labor force.

And of course many workers are still receiving UI benefits while they are laid off. If they perceive their job loss to be temporary, they may decide to "make do" on the UI payments while they wait to return to their previous employer. However, temporary partial wage replacement is not a great long-term solution. Foshay, the Duluth Workforce Development director, fears that individuals and “more families are sinking into deep poverty, and are struggling with all the barriers to employment that come with that – transportation challenges, mental health and addiction, housing instability, etc.” Similar concerns have been voiced across the state.

Though seemingly short-term, the COVID-19 economic disruption will likely have a long-term impact on the state’s workforce. According to DEED’s 3rd Quarter 2020 forecast, Minnesota’s recovery “is linked to the trajectory of the coronavirus and the size of any future round of federal stimulus. Job growth is expected to slow over the coming months and a recovery of all jobs lost is not projected to be reached until late 2022 or early 2023.”2

1Minnesota Department of Health. Weekly COVID-19 Report. 10/29/2020.

2Senf, Dave. "Minnesota’s 3rd Quarter Jobs Forecast". Minnesota Economic Trends. December 2020.