by Cameron Macht and Luke Greiner

June 2021

Like the rest of Minnesota, the labor force in the Southwest planning region has been shrinking throughout the past year, making it harder for employers to find workers to fill their open positions. Even before the pandemic recession, the region was experiencing an extremely tight labor market, and those conditions have returned in 2021.

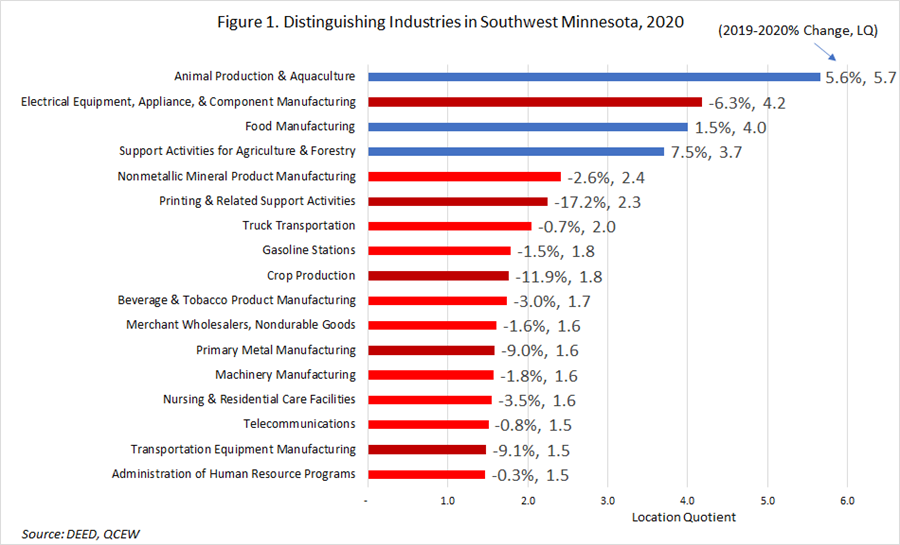

However, after a difficult year in 2020, the region has rebounded due to strength in areas like Agriculture, Manufacturing, and Health Care & Social Assistance. In fact, a number of the region's most distinguishing industries gained market share in 2020, a remarkable feat that highlights the area's resiliency amidst the pandemic. An region's distinguishing industries are identified by high location quotients. A location quotient (LQ) for a particular industry is a ratio that compares the percentage of employment in that industry in a local economy to the percentage that same industry constitutes in a reference economy, in this case Minnesota's economy.

Seventeen industry subsectors have employment concentrations in Southwest that are at least 1.5 times higher than statewide, with Animal Production & Aquaculture topping the list at 6.7 times more concentrated than the state. In sum, eight of the 17 most distinguishing industries are in the Manufacturing industry and four are directly tied to food production and processing, a nod to the importance of Agriculture in the region.

Despite various amounts of job loss, only three distinguishing industries experienced a decline in their LQ over the year. On the other hand, Animal Production & Aquaculture raised their LQ by 0.2, and the following industries all grew by 0.1; Electrical Equipment, Appliance, & Component Manufacturing, Food Manufacturing, Beverage & Tobacco Manufacturing, and Telecommunications (see Figure 1).

Despite retaining market share in the majority of the region's distinguishing industries, all but three lost employment in 2020. Only Animal Production & Aquaculture, Food Manufacturing, and Support Activities for Agriculture managed to add more jobs during the pandemic recession. Animal Production grew the fastest, rising 5.6% from 2019 to 2020, while Printing & Related Activities declined the fastest (-17.2%), followed by Crop Production (-11.9%).

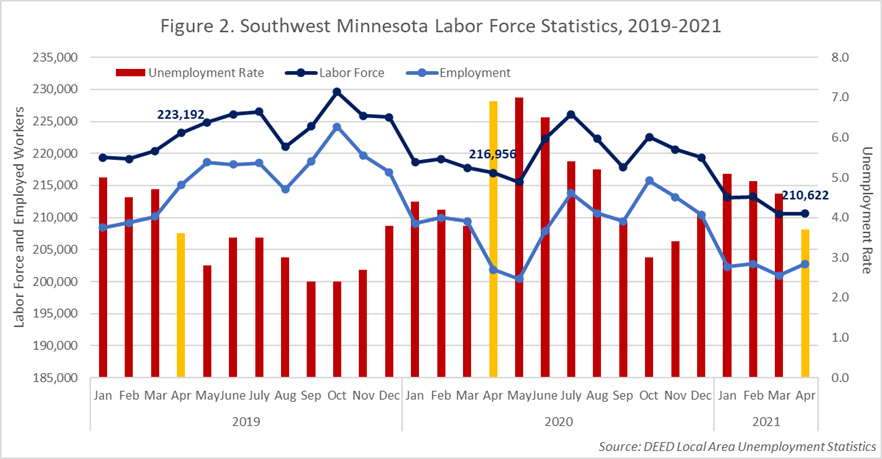

The labor force in Southwest Minnesota had been contracting over time, but has seen a big decline over the past year. There were 210,622 available workers in April of 2021, which was up less than 100 workers compared to March, but down more than 6,300 workers over the past year. And it is down more than 12,500 workers since April of 2019 prior to the pandemic. Though most of the state is dealing with the same declines, the region's 5.6% decline was a much more severe drop than the rest of the state, which was down only 1.7% over the past 2 years.

Part of it is due to the region's aging population, with more and more workers reaching retirement age each year. But in the past year, workers are also reporting other reasons for not engaging in the labor force, including waiting to go back to their last employer, day care or school-aged child care needs, and on-going fear of the coronavirus.

Southwest Minnesota's unemployment rate dropped to 3.7% in April, which was down nearly one point from March, and down over 3% compared to last April, the first month affected by the pandemic recession of 2020. Most counties in the region are experiencing declines and relatively low rates again, including Rock County, which was the lowest in the state at 1.9%. As the region's economy continued to recover, 15 of the 23 counties in the region reported unemployment rates below 4.0%.

The good news is that the drop in the unemployment rate in April was due to people moving from unemployment into employment, instead of workers leaving the labor force. This month's increase is not yet a trend, but is at least a correction in the right direction (see Figure 2).

At 3.7% in April of 2021, that means the region had just 7,823 unemployed workers, which was nearly half as many as it had in April of 2020 at the start of the pandemic recession; and also down by about 300 workers from April of 2019, a year before the pandemic. This is due to shrinking labor force in the region.

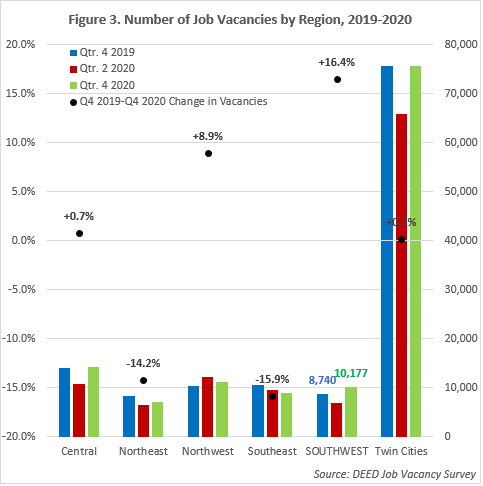

After seeing the most severe year-over-year decline in job vacancies during the second quarter of 2020, in the midst of the pandemic recession, Southwest Minnesota reported the fastest year-over-year increase in job postings in the fourth quarter of 2020. Released last month, data from DEED's Job Vacancy Survey shows that Southwest enjoyed the strongest bounce back of the six planning regions in the state, with employers reporting more than 10,000 vacancies as hiring activity picked up.

With just over 7,700 unemployed workers in the fourth quarter of 2020, Southwest's job seeker per vacancy ratio immediately dropped back below 1-to-1, making it the tightest regional labor market in the state. Statewide, there were about 1.1 jobseekers for every opening.

What caused the rapid rebound? Nearly 40% of the vacancies in the region were in the Health Care & Social Assistance industry, which was just more than double the number reported in the fourth quarter of 2019. This includes a sharp increase in demand for Healthcare Practitioners and Healthcare Support Workers. Most notably, postings for Registered Nurses (RNs) tripled from 211 in the fourth quarter of 2019 to 633 in the fourth quarter of 2020.

Likewise, the median wage offer in Health Care jumped to $18.50 per hour, up more than $4.00 over the previous year. This demonstrates that employers are willing to pay more for talent, but also a shift in the number of openings for workers like Home Health and Personal Care Aides (HHAs and PCAs), Licensed Practical Nurses (LPNs), and RNs. Median wage offers for HHAs jumped from $12.80 per hour in the fourth quarter of 2019 to $14.14 per hour in 2020, and wage offers for Certified Nursing Assistants (CNAs) climbed to more than $15 per hour as health care providers scrambled to fill positions.

The region also saw return in demand for workers in Retail Trade, but did not see a rebound in Accommodation & Food Services. These two industries experienced a significant divergence during the pandemic recession, with sales increasing at Retail Trade – especially at Food & Beverage Stores, Building Material & Supply Stores, and General Merchandise Stores – but revenues plummeting in Accommodation & Food Services as restaurants and hotels adapted to less travel and various restrictions.

Manufacturing and Educational Services both enjoyed increases in job postings over the year as well. The region's highly concentrated Food Manufacturing subsector led the way due to strong demand for food products as more people ate at home, but Southwest also held its own in Machinery Manufacturing and Fabricated Metal Products. Educational Services still has less employment in the region than prior to the pandemic, but demand is rising as local schools adapt and change staffing patterns.

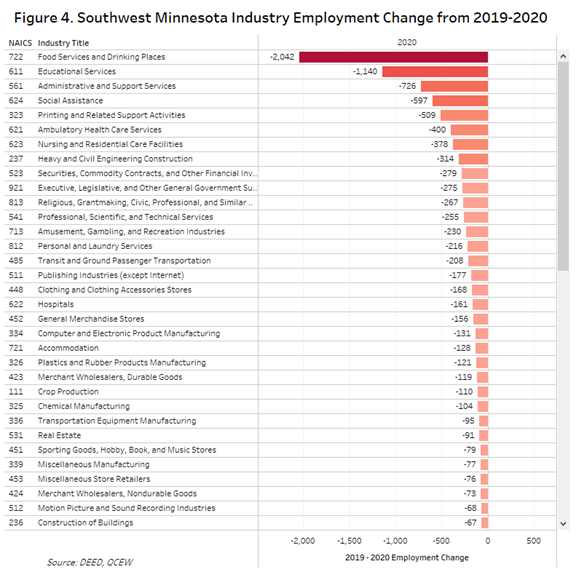

These increasing job vacancies are a great sign that employers are ready to regain the jobs lost in 2020; however a job vacancy only leads to rising employment counts if it is filled by a worker. This means employers in industries that lost large numbers of jobs in 2020 now have to compete against many other opportunities for workers just to get back to their 2019 employment levels. Of course the Food Services & Drinking Places industry tops the list of job losses, with 2,042 fewer jobs (-18.2%) in 2020 compared to 2019. The significant job loss coupled with a decline in job vacancies is concerning, possibly a signal that some of these establishments aren't coming back, or will come back with different employment needs.

Educational Services also averaged far fewer jobs in 2020 than the prior year (-1,140 jobs) as did Administrative Support Services (-726 jobs) and Social Assistance (-597 jobs). Thankfully Child Day Care Services employers were only down 48 jobs (-6.1%) in the region. These day care services are especially important since many workers rely on child care providers while they pursue employment.

Customer-facing industries weren't the only casualties of 2020, Manufacturing in the region ended 2020 with 1,283 fewer jobs (-17.2%) than 2019. The Printing & Related Support Activities subsector suffered the biggest losses, adding to a downward employment trend that started back in 2007. Computer & Electronic Product Manufacturing was off by 131 jobs, Plastics & Rubber Manufacturing was down 121 jobs and Chemical Manufacturing shed 104 jobs. Manufacturing is still highly concentrated in Southwest Minnesota and will be vital to the region moving forward.

Losses were marginally offset by gains in 11 industries, with the biggest gains occurring in Insurance Carriers & Related Activities (+296), Animal Production & Aquaculture (+214), and Food Manufacturing (+165). Gains from industries that expanded in 2020 amounted to 905 jobs, less than half of what was lost in the Food Services & Drinking Places sector alone.

The road to recovery for Southwest Minnesota will be challenging, due to the need to gain back the 9,600 jobs that were lost in 2020 amidst the tightest labor market in the state. In order to regain pre-pandemic employment levels, Southwest Minnesota employers will need to lure workers who left the labor force in the past year back to work. The complex reasons people have left the labor force will likely require creative solutions to draw them back in.