By Cameron Macht

October 2021

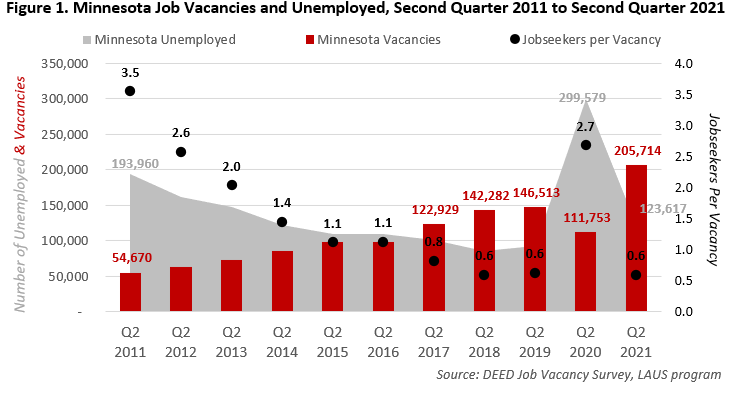

The tight labor market that Minnesota employers had been experiencing up until the pandemic recession returned to a much greater extent in the second quarter of 2021, with the state setting a record for the number of job vacancies while the number of unemployed jobseekers dropped back to pre-pandemic levels. Employers reported 205,714 job vacancies, which was an 84% increase from the second quarter of 2020 at the outset of the coronavirus pandemic and up 40% compared to the second quarter of 2019, which was the previous record high.

With more than 205,000 vacancies and less than 125,000 unemployed workers, the state's jobseeker-per-vacancy ratio dropped back to 0.6-to-1, meaning there were again more jobs available than workers available to fill them. That has been the case in Minnesota in four of the past five years, with vacancies steadily increasing without enough workers to fill the open jobs (see Figure 1).

These 205,714 vacancies translate into a job vacancy rate of 8.0% or 8 job openings per 100 filled jobs. This is the highest rate on record and is double from 4.0% one year ago. It is also unique in comparison to past recessions, when unemployed job seekers typically outnumbered job openings as the economy recovered more slowly and hiring demand took longer to recover. For example, the job vacancy rate hovered between 1.0% and 2.5% from the fourth quarter of 2006 until the fourth quarter of 2012.

Vacancies were up statewide as many employers were poised to grow but struggled to find workers. Compared to one year ago, the number of job vacancies surged 87.9% in Greater Minnesota and climbed by 81.4% in the seven-county Twin Cities metro area. Regionally, 58.1% of all job vacancies were in the Twin Cities, while the remaining 86,209 vacancies or 41.9% were in Greater Minnesota. During second quarter 2021 both the Twin Cities and Greater Minnesota had 0.6 unemployed persons for each vacancy. While all six planning regions were in a similar situation in terms of a tight labor market, Southeast Minnesota had the most severe shortage with more than two jobs for every unemployed worker who was actively seeking work (Table 1).

| - | Central | Northeast | Northwest | Southeast | Southwest | Twin Cities |

|---|---|---|---|---|---|---|

| Unemployed Workers | 15,991 | 7,480 | 11,835 | 9,842 | 7,720 | 70,747 |

| Job Vacancies | 21,935 | 12,886 | 17,762 | 21,510 | 12,116 | 119,505 |

| Job Seekers per Vacancy | 0.7 | 0.6 | 0.7 | 0.5 | 0.6 | 0.6 |

| Source: DEED Job Vacancy Survey, LAUS | ||||||

Vacancies more than doubled in three of the six regions in the state compared to the second quarter of 2020, led by a 123.5% increase in Southeast Minnesota, a 104.5% jump in Central Minnesota, and a 101.8% rise in Northeast Minnesota. Both Southwest (74.1%) and Northwest (45.8%) lagged the state's growth rate, but still saw significant growth in job demand over the year.

Every region except Southwest set a record high number of vacancies in the second quarter of 2021. Both the Twin Cities and Central Minnesota were about 40% above their previous peaks, while Northeast was up 32%, Northwest was up 26%, and Southeast surpassed its record from the fourth quarter of 2018 by more than 16%. Southwest nearly matched its previous peak from the second quarter of 2019, down less than 3%, a difference of fewer than 350 openings.

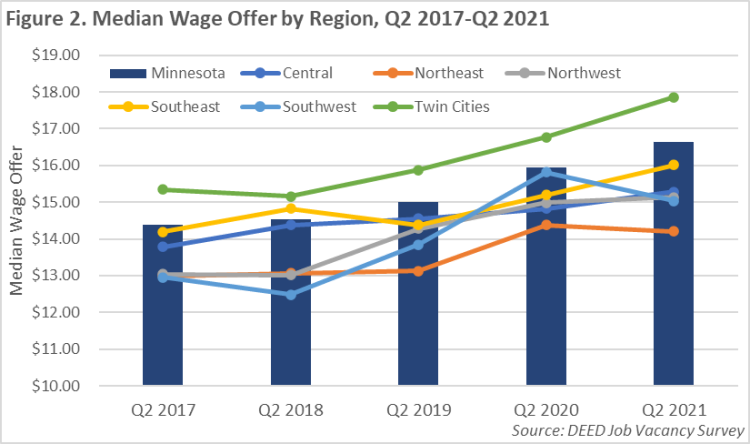

At $16.64 the median hourly wage offer was up 4.3% from one year ago and is the highest ever reported in the history of the survey. Wage offers rose in four of the six regions in comparison to last year, with only Southwest and Northeast seeing a decline. In Northeast vacancies rose fastest in Health Care and Social Assistance, whereas Southwest saw a doubling in openings in both Health Care and Retail Trade. Wage offers increased fastest in the Twin Cities, jumping 6.5% over the year, followed by Southeast, increasing 5.3% (Figure 2).

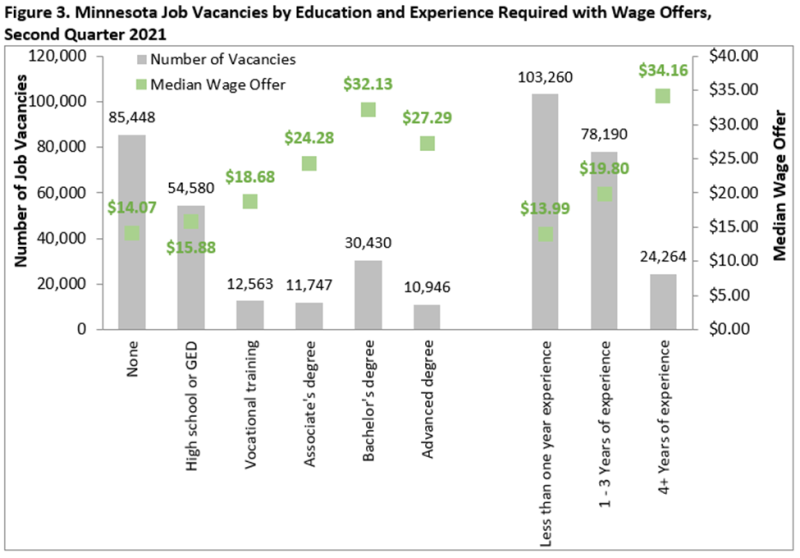

Wage offers are highly correlated with experience and education requirements. In general, wages are much higher for occupations that require additional education, training, or more years of related work experience. The largest number of vacancies require lower levels of education or training – just over two-thirds of current openings could be started with a high school diploma or less, and just over half required less than one year of experience (Figure 3).

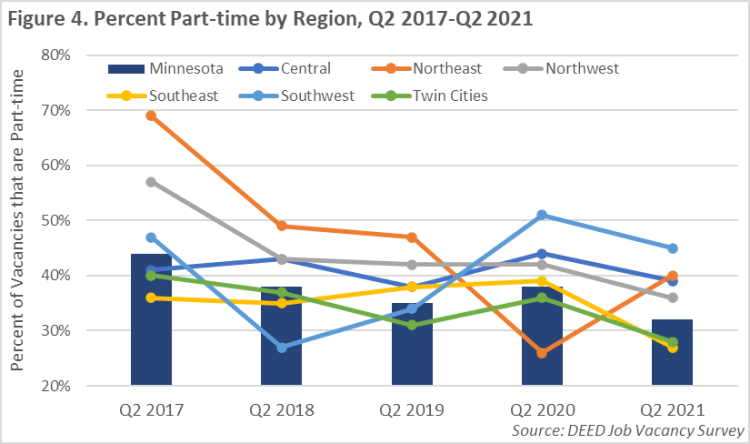

In addition to raising wages and lowering education and experience requirements to attract a wider candidate pool, employers who are struggling to find workers have also started to change hours required. Over the past three years prior to the pandemic recession in 2020, an average of 39% of openings were part-time. In the second quarter of 2021 just 32% were part-time, which is tied with the fourth quarter of 2020 for the lowest ratio of part-time job vacancies in the history of the survey going back to 2001.

This suggests that employers are finding it more beneficial to try to fill one full-time job rather than two part-time jobs or responding to job seeker preferences for more hours and higher wages. Five of the six regions in the state saw a decline in part-time offerings as well, with Northeast being the only exception, mainly from a huge increase in Health Care and Social Assistance vacancies (Figure 4).

With unprecedented demand spread across every region of the state and every industry, the most recent Job Vacancy Survey data show clear signs of a job seeker's market. Wages are rising, education and experience requirements are dropping, and full-time opportunities are increasing. These data provide job seekers and counselors with information on occupations showing hiring demand within their region. The information also helps employment, training, and education providers understand current labor market conditions in their region and tailor services to meet customer and employer needs.