by Luke Greiner

June 2024

With employment finally surpassing pre-pandemic levels, most data point to a strong and growing economy in Central Minnesota, although the shadow of the Pandemic Recession still looms. While inflation has slowed, prices for many consumer goods remain noticeably higher than a few years ago – and the labor market remains tight, mostly unfazed by federal monetary policy. This labor market is good news for job seekers, but the hiring and retention challenges for employers remain, almost becoming an accepted norm.

The past year brought a full recovery of jobs to Central Minnesota, but the number of workers remains below 2019 levels. It might sound conflicting to say the region has more jobs but fewer workers, but there are subtle differences in the datasets that can explain the divergence. DEED's Local Area Unemployment Statistics program counts the number of workers living in the region, regardless of where they are employed; while DEED's Quarterly Census of Employment & Wages counts the number of jobs at covered employer establishments located in the region, regardless of who is working there or where they live.

Thousands of workers in Central Minnesota commute to the Twin Cities and other regions for work, and likewise workers from outside the region also commute in for jobs inside the 13-county region, filling jobs without increasing the labor force. Other nuances include that a worker can be working in multiple jobs, thereby increasing the number of jobs without necessarily increasing the number of workers. Additionally, covered employment data does not include self-employment, but counts of the labor force do. This means a worker who leaves an employer to start their own business would produce a "job loss" but remain counted as a worker.

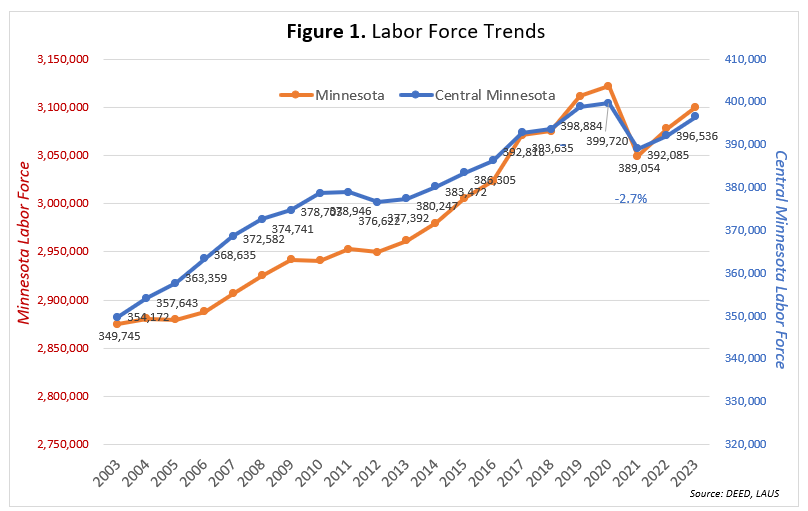

After peaking in 2020 at 399,720 workers, Central Minnesota experienced what played out across the country—an incredible exodus from the labor market. By 2021, nearly 3% of workers had left the region's labor force, slightly worse than the -2.3% decline across Minnesota. But after losing roughly 10,700 workers in 2021, the region's labor force began clawing back some of that deficit. By 2023, net labor force levels were down just -0.8% from the peak in 2020, or 3,184 workers. Minnesota barely bested the region with its recovery, down -0.7% over the same period (see Figure 1).

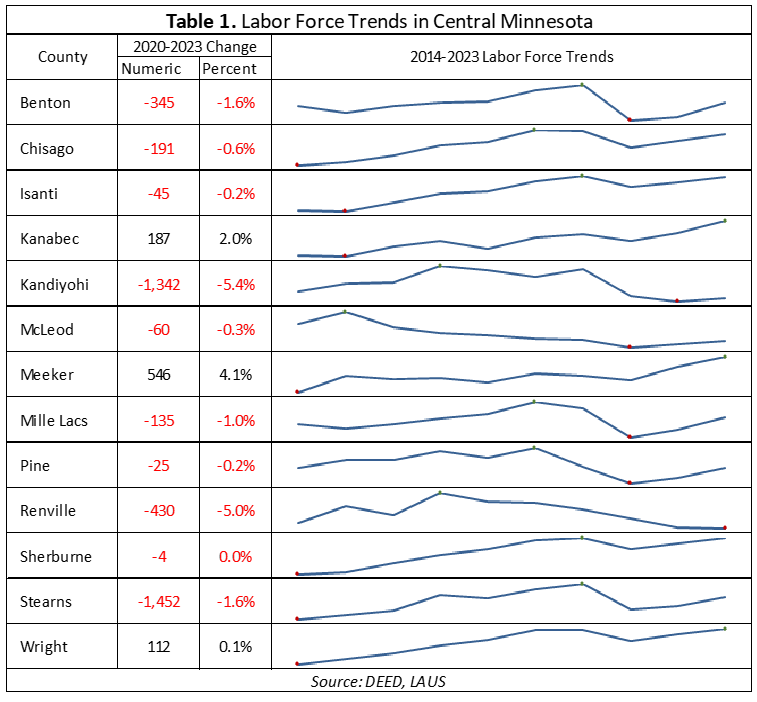

Most counties in Central Minnesota also ended with fewer workers in 2023 than they had in 2020 . Only Kanabec, Meeker, Wright, and Sherburne counties have managed to recover their labor force back to 2020 levels. Table 1 illustrates the variation in long-term labor force trends for counties in Central Minnesota, from long growth trajectories in counties like Sherburne, Wright, and Isanti, to modest growth in Mille Lacs, Meeker, and Pine, to declines in Kandiyohi, McLeod, and Renville counties.

Table 1 also shows how growth has occurred recently for every county except Renville. The upside for Renville County is that it avoided the steep losses found in most other counties. While the largest loss from 2020 to 2021 was in neighboring Kandiyohi, with a -5% loss, Renville managed a decline of just -2.3%.

Labor force numbers tell one aspect of the current labor market; but another important indicator is the utilization of the labor we have, using unemployment rates. The unemployment rate in Central Minnesota averaged 3.3% in 2023, the second lowest regional rate recorded in more than three decades. Rates through the first third of 2024 show no signs of loosening, so experiencing similar hiring challenges to last year is a reasonable expectation for employers. While the rate of unemployment is only a single measure, it says a lot about other aspects of the economy, such as consumer confidence, employment opportunities and bargaining power.

Understanding the economic condition of Central Minnesota requires more than just examining unemployment rates; employment numbers are equally crucial. Employment data differs from labor force data in several ways. Most importantly, it reflects not only employer demand for workers but also the ability of employers to fill job openings. Employment is recorded only when a position is filled, and the net changes represent shifts in the workforce.

Employment in Central Minnesota rebounded in 2023 to pre-pandemic levels, in line with Minnesota, but the rebound took three years and was still just 735 jobs higher than in 2019. This growth, which amounts to 0.3%, is a welcome sign of recovery, indicating a gradual but steady improvement in the region's economic health. However, employment recovery varies by industry domain and sectors within them.

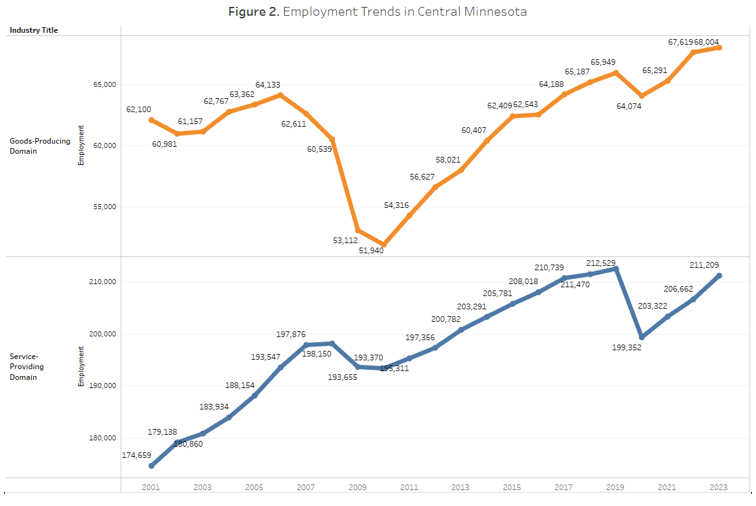

Figure 2 illustrates net employment changes over the past two decades for the Goods-Producing domain and the Service-Providing domain in Central Minnesota. The Goods-Producing domain includes Natural Resources & Mining, Construction, and Manufacturing. All other industry sectors are contained within the Service-Providing domain.

Unlike the Great Recession, the Goods-Producing component of the economy did relatively well in the recent recession and carried forward a 3% gain into 2024 compared to 2019, thanks to just over 2,000 net new jobs. In contrast, the Service-Providing domain still had 1,320 fewer jobs in 2023 compared to 2019, a loss of -0.6%. However, if the average growth from the five years leading up to the pandemic had held, the Service-Providing domain would have had more than 220,000 jobs by 2024. It would take a gain of more than 9,000 jobs to get there in Central Minnesota.

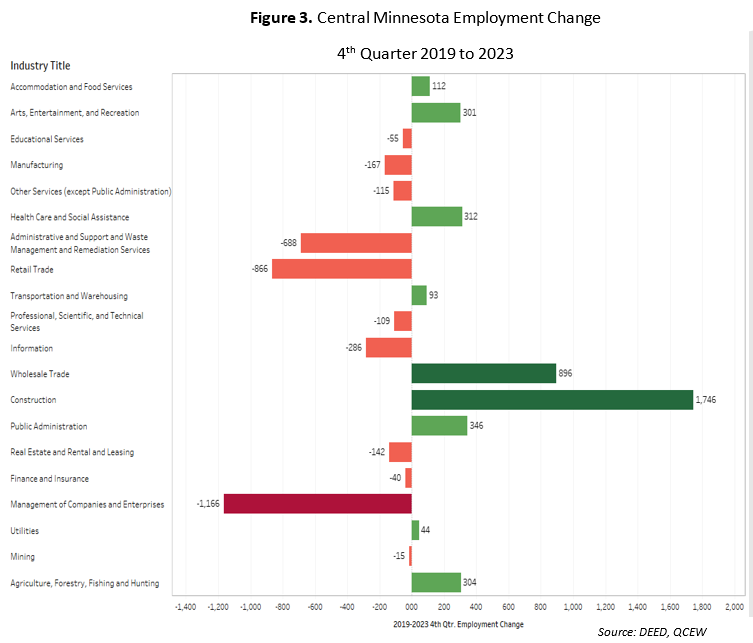

Within the broad domains of the economy are much more divergent trends, even within the Goods-Producing domain. Figure 3 demonstrates how the largest component in Goods-Producing, Manufacturing, did not contribute to employment growth. Manufacturers have added about 2,200 jobs since 2020, but that was after losing about 2,400 jobs from 2019 to 2020. Instead, the domain was held afloat by large gains in Construction and Agriculture. From the fourth quarter of 2019 to 2023, Construction managed to grow employment by 9%, a remarkable feat considering the hiring difficulties. Agriculture added 300 jobs from 2019 to 2023, a 6.25% growth rate.

Meanwhile, nine of the Service-Providing industry sectors were still at a net loss through the end of 2023. It should be noted that the large losses in Management of Companies are not reflective of physical employment change, but rather a classification change that artificially and temporarily boosted employment in 2019.

The Leisure & Hospitality sector, comprised of Accommodation & Food Services and Arts, Entertainment & Recreation, has made a remarkable recovery in the region. Central Minnesota is the only region in the state to have more employment in both sectors by the end of 2023 compared to 2019, with gains of 112 jobs in Accommodation & Food Services and 301 net new jobs in Arts, Entertainment & Recreation.

The related Retail Trade sector has been showing less favorable signs. The industry has been adding jobs since the dramatic losses of 2020 and is on track to recover, but at its current growth rate, it will take another two to three years barring significant shifts in the business cycle.

The last piece of the recovery puzzle is contained in data about job openings, as detailed in the latest Job Vacancy Survey results. Through 2023, Central Minnesota employers posted just over 14,000 openings, a substantial decline from the record levels set in 2021 and 2022, but well above historical norms and matching the numbers posted leading up to 2020. If all 14,320 openings were immediately filled, Central Minnesota's employment would grow by 5%, and nearly every sector would be in the green compared to 2019.

For context, Retail Trade employment was down 866 jobs from the fourth quarter of 2019 to 2023 (see Figure 3), but retailers posted an average of 2,289 openings throughout 2023. With high numbers of job openings simultaneous with employment decline compared to 2019, it's likely that the tight labor market is holding back employers' ability to hire to the level they want to.

Food Prep & Serving-related occupations are the most common openings, with more than 2,300 openings and a median wage offer of $14.84 per hour. Healthcare occupations also posted large numbers of openings and higher-than-typical starting wages. The highest wage offers were for Computer & Mathematical occupations, while Personal Care & Service occupations had the lowest median hourly wage offers at $14.55 (see Figure 4).

Turning job openings into actual employment is crucial for Central Minnesota's economy to reach its pre-pandemic peak across all sectors. For this to happen, the labor force needs to continue growing and employer demand for labor must remain steady. Despite data indicating a robust job market for jobseekers, matching individuals with desirable employment remains a significant challenge. While abundant job openings are encouraging, it still requires candidates with the right skills and interests to fill these positions successfully.