by Katie McClelland, Governor's Workforce Development Board Director and Cameron Macht, Regional Analysis & Outreach Manager

September 2023

In the summer of 2023, the number of jobs in Minnesota surpassed 2019 levels as the state's employers continued to hire and expand. Although Minnesota's economy added about 50,000 jobs over the past year and has regained more than 275,000 jobs over the past three years – following the short but severe Pandemic Recession in 2020 – nearly 200,000 jobs remain open in Minnesota as employers struggle to find enough workers to fill these vacancies. Job demand over the past two years was at or near record highs in every region of the state and in most industries, with many openings providing opportunities for career growth and family-sustaining wages.

To help meet the moment of this unique challenge, Governor Walz and Lieutenant Governor Flanagan created the Drive for 5 initiative to create sector partnerships across the state and help fill in-demand positions in technology, the trades, caring professions, manufacturing, and education. This initiative is focused on those five occupational groupings because they are in high demand, are projected to be high-growth, and provide family-sustaining wages. Drive for 5 focuses on moving Minnesotans into high-growth employment opportunities with family sustainable wages and prioritizes training for populations that face some of the most significant barriers to employment: people of color, people with disabilities, and those that face other systemic barriers.

The Department of Employment and Economic Development (DEED) is overseeing the rollout of this initiative and will prioritize funding for partnerships that provide employment and training opportunities to prepare people for the occupations detailed below. Sector partnerships made up of employers, education and training providers, local workforce boards, unions (where applicable), and community-based organizations are the most effective at meeting the moment for the workforce challenges Minnesota is facing. Through Drive for 5, DEED will fund partnerships that provide training that leads to job placements in in-demand occupations, while ensuring job quality for those placements, and recruiting a diverse and representative workforce. These sector partnerships are crucial for ensuring that education and training programs are reflective of employers' needs in their local labor markets, making job placement for students going through the program smoother, decreasing time to hire for employers, and creating a steady talent pipeline in communities across the state.

Programs funded under Drive for 5 will be providing a direct path to job opportunities with family-sustaining wages, using DEED's Cost of Living tool and Occupational Employment & Wage Statistics (OEWS) data as a guideline for wage quality. The Cost of Living tool provides a yearly estimate of the cost of basic needs for individuals and families, by county, region, and statewide. The tool uses federal and state data to examine monthly living costs in seven categories: food, housing, health care, transportation, child care, other necessities, and net taxes. The Cost of Living results represent neither a poverty-level living nor a middle-class living, but rather the income needed to meet basic needs for health and safety.

The average family size in Minnesota is three persons including two partnered adults, with one adult working full time and one adult working part time, as well as one child. This household scenario provides a standard yearly cost and hourly wage need for a typical family, regardless of how the weekly work hours are distributed between the two adults. In 2022, the basic needs Cost of Living in Minnesota was $60,720, which would require an average hourly wage of $19.46 for each worker, combining for around 60 hours of work per week. However, it varied from a low of $47,448 in Southwest Minnesota, which would require an hourly wage of $15.21, to a high of $67,716 in the Twin Cities metro area, which would require an hourly wage of $21.70.

Another measure of wage quality is the median hourly wage for all occupations from OEWS, which reached $24.25 in the first quarter of 2023. OEWS is a federal-state cooperative program between the U.S. Bureau of Labor Statistics and DEED's Labor Market Information office. Surveyed employers are asked about the number of wage and salary workers in detailed occupations and about the wage distribution for those workers, providing wage and employment estimates for around 800 occupations in the state. Like cost of living, median hourly wages varied by region, ranging from a high of $25.67 in the Twin Cities to $21.67 in Northwest Minnesota.

While there are well over 325 occupations in high demand in Minnesota, Drive for 5 will specifically support selected occupations that provide family-sustaining wages to ensure that Minnesota taxpayer dollars are going to programs that will help Minnesotans take care of their families and contribute to their communities. To that end, occupations that were selected must have a median hourly wage above $19.46, and preferably, above $24.25.

The Drive for 5 initiative also focuses on ensuring that these programs are recruiting from and providing opportunities for underserved and underrepresented populations and provide the wraparound services to support these populations through training and placement. DEED is leading a Job Quality initiative in the state, and will be prioritizing jobs that align with the Good Jobs Principles developed by the U.S. Department of Labor and U.S. Department of Commerce.

Drive for 5 is specifically focused on helping people get training and support for placement in the near-term to meet the moment of our current high job vacancy rate in Minnesota. DEED will prioritize providing funding to organizations that have created innovative partnerships to help Minnesotans find the fastest pathway to socio-economic mobility through training programs leading to good jobs.

This may include providing registered apprenticeship program opportunities for occupations that have traditionally required a four-year degree, expanding supportive services and counseling support for students to support job placement and retention, or creating or expanding training for employers on providing good jobs and hiring a diverse and representative workforce to better address immediate hiring needs. To address more immediate hiring needs, local chambers or trade associations may partner with education institutions to support the placement of individuals that will soon be graduating, especially if those education or training programs are serving a high number or percentage of individuals underrepresented in the sector or occupations of focus.

The Legislature provided $20 million over two years for Drive for 5, divided amongst three required components:

DEED has launched the Request for Proposal (RFP) for Drive for 5 – this RFP has an extended open period for proposal development. The extended timeline helps ensure strong partnerships can be created or documented to place individuals in the most in-demand, high growth, high wage jobs.

DEED anticipates that as a result of Drive for 5, the state will see a major improvement in alignment with statewide and regionally-specific labor market needs for these in-demand career fields, increased collaboration with local workforce boards to understand demands in each local area, and the creation or expansion of long-lasting sector partnerships and responsive education and training programs.

The brief profiles below provide more details on the five fields of focus and occupations that meet the Drive for 5 requirements. Each of these profiles show current and expected demand and median wages, as well as provide some insight into workforce demographics for the sectors. A major feature of the Drive for 5 initiative is to support the expansion of opportunities in each of these in-demand occupations for under-represented populations in each of the sectors, which should be considered when creating programs for Drive for 5. The lists below are not exhaustive of occupations eligible for Drive for 5, but provide an overview of the most in-demand roles that meet the Drive for 5 requirements.

With just under 500,000 jobs, Health Care & Social Assistance is easily the largest employing industry in the state, accounting for 17.3% of total jobs in 2022. Some subsectors have high average annual wages, including Ambulatory Health Care Services ($85,609) and Hospitals ($79,802); while others are low wage, including Nursing & Residential Care Facilities ($39,999) and Social Assistance ($32,564). The Health Care & Social Assistance industry has the largest payroll of all industries in the state.

As has been extensively reported, the industry was one of the most impacted during the Pandemic Recession, and has had difficulty filling openings for several years leading to record numbers of vacancies. In fact, the Health Care & Social Assistance industry has accounted for 20% or more of total vacancies in the state since 2013. Demand is so high and the industry so vital, that DEED, the Minnesota Department of Human Services, along with many other state, local and industry organizations launched the CareerForce Follow Your Heart to a Caring Career campaign to encourage people to join the field.

Over the past 10 years, Health Care & Social Assistance was the largest growing industry and is projected to be the largest and among the fastest growing over the next 10 years as well – even if not all industry subsectors are back to normal yet. While most specialties are again seeing growth coming out of the pandemic, a few were lagging behind pre-pandemic jobs numbers, largely because they are struggling to hire more workers. Health Care & Social Assistance subsectors where jobs have not rebounded or where many openings remain unfilled include Nursing Care Facilities; Residential Development Disability, Mental Health & Substance Abuse Facilities; and Home Health Care Services.

The 45,230 job vacancies reported by Health Care & Social Assistance employers in the second quarter of 2022 was far and away the most of any industry in the state, and was the second highest number ever recorded following the record set in the fourth quarter of 2021. This shows the tremendous levels of demand for health care workers following the pandemic, with the number of vacancies in 2022 reaching 7.5 times higher than the low point in 2009 during the Great Recession.

The Caring Professions selected are perhaps the best suited to the training opportunities and career pathways proposed in the Drive for 5 initiative: being in high demand, having fast projected future growth, and offering high wages; and with vacancies existing at every education level. It is important to note there are also thousands of vacancies available in health care support jobs such as Personal Care Aides and Home Health Aides, but median hourly wages are below the family-sustaining wage level so they don't make the list.

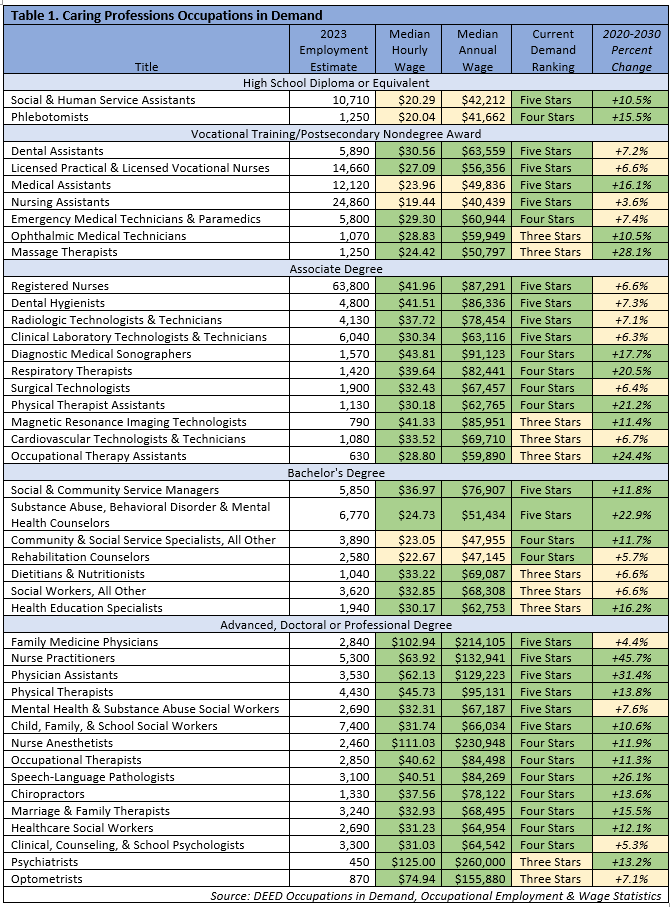

Still, there are more than 40 occupations representing almost 10% of total employment in the state that make the Caring Professions list of occupations in demand. Demonstrating the range in educational requirements, these jobs can be started with a high school diploma and some on-the-job training, as is the case for Phlebotomists; or may require eight or more years of preparation, such as Family Medicine Physicians. All are in high demand and most pay wages well above the guideline for a basic needs cost of living (see Table 1).

|

The cell colors in the table represent the relative ranking for each occupation on the three criteria used for the Drive for 5: family sustaining wages, high current demand, and high projected growth. Cells in green represent occupations with wages above $24.25 per hour, with either four or five stars in demand, and growth above 10%. Cells in yellow represent occupations with wages between $19.46 and $24.25, three stars in demand, and between 0 and 10% projected growth rates. |

New graduates and other job seekers will be important in filling the workforce pipeline. The Health Care & Social Assistance industry relies more heavily on workers between 25 and 54 years of age, with nearly two-thirds (64.9%) of workers in that age group, compared to 62.5% across all industries. However, because of the educational and training requirements, just 2.0% of all workers in Health Care are under 20 years of age, compared to 3.9% across all industries.

Further demographic data from Quarterly Workforce Indicators shows that the Health Care & Social Assistance industry has become much more racially diverse over time, with the number of workers identifying as white alone increasing by 5.1% from 2012 to 2022, compared to an 80.2% increase in the number of jobholders of other races or ethnic groups. It is now one of the more racially diverse industries in the state, with 76.4% of jobholders reporting white as their race compared to 84.2% across all industries. Health Care & Social Assistance has higher concentrations of workers who are Black or African American and Asian or Pacific Islander, but smaller concentrations of workers of Hispanic or Latino origin.

Females hold 76% of total jobs in the industry overall, and the selected Caring Professions are even more female-dominated, representing 80% of people who reported working in these occupations in Minnesota according to data from the Census Bureau's 2021 American Community Survey. Health Care has a range of nontraditional occupations for both genders and provides many opportunities for growth.

Despite losing jobs during the Pandemic Recession, Educational Services provides around 225,000 jobs at 5,000 establishments in Minnesota, making it the fourth largest employing industry in the state. On an annual average basis, Educational Services accounts for about 8% of total employment in the state, or about 1 in every 12.5 jobs. The largest subsector is Elementary & Secondary Schools, with just under 150,500 jobs at more than 2,100 establishments both public and private. Minnesota also has nearly 56,000 jobs at the hundreds of Colleges, Universities & Professional Schools and Junior College campuses across the state, as well as about 18,760 jobs at other schools and educational support services.

The more than 13,000 job vacancies reported by Educational Services employers in the second quarter of 2022 was the highest number ever recorded, with the previous record set in the second quarter of 2021. This shows the tremendous levels of demand for Educational Services workers following the pandemic, with the number of vacancies in 2022 nearly doubling since 2019, prior to the pandemic. However, the median wage offered for these vacancies declined to $19.23 per hour in the second quarter of 2022, down slightly compared to the same survey in the second quarter of 2021, and down nearly $0.50 from the second quarter of 2019. This reflects a shift toward more support occupations, but also the inflexibility of wages in the industry overall.

Despite the constrained wages, about two-thirds (65%) of the Educational Services vacancies required postsecondary education and 60% required a certificate or license, compared to 32% and 38% of all vacancies, respectively. Educational Services employers also continue to place a high premium on related work experience, especially in comparison to other industries, with three-quarters (75%) of openings requiring at least one year of work experience. With flexible schedules and seasonality, 42% of the postings were part-time and 33% were temporary or seasonal, as compared to 37% and 10% of vacancies across all industries.

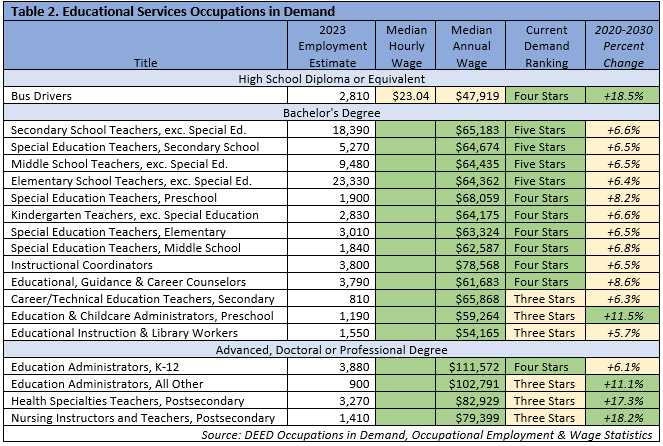

Demand is high for jobs like Teaching Assistants/Paraprofessionals and Substitute Teachers, but their wages do not meet basic needs cost of living requirements. Instead, most Drive for 5 occupations in demand in Educational Services require a bachelor's degree, including Elementary, Middle School, and High School Teachers, as well as Special Education Teachers.

As noted, the Educational Services industry relies more heavily on workers aged 45 years and older, with nearly half (49.8%) of workers in the oldest age groups, compared to 42.9% across all industries. Because of the educational and work experience requirements, just 7.3% of all workers in Educational Services are under 25 years of age, compared to 13.8% across all industries; but it is clear that a new generation of workers will be needed to fill these positions for the long-term.

Like Caring Professions, Educational Services is also a female-dominated field, especially in the Preschool, Kindergarten, and Elementary grade levels and Special Education, as well as Counselors and Education Administrators. High School and Postsecondary Teachers are more evenly split between males and females, but overall, about 70% of workers in the selected Educational Services occupations are female.

With more than 36% of public school students reporting a race other than white in 2022, student populations are rapidly becoming more racially and ethnically diverse over time according to data from the Minnesota Department of Education. While workforce demographics are changing as well, they have not kept pace. About 85% of teachers reported being white, compared to Black or African American workers representing just 5.3% of jobholders, followed by 4.0% Asian or Pacific Islander, 3.7% of Two or More Races, and 2.4% Hispanic or Latino in 2021.

The 2023 legislature created several funded opportunities to address teacher shortages, including state investments of more than $150,000,000 over the biennium. The Minnesota Department of Education (MDE), Minnesota Office of Higher Education (OHE), and the Professional Educator Licensing and Standards Board (PELSB) are the main state agencies charged with implementing these programs. More information about state efforts to address teacher workforce shortages are available at the Educator Workforce and Development Center webpage on MDE's website.

The Construction industry surpassed 150,000 jobs for the first time in the summer of 2023, and is up more than 17,000 jobs compared to 2020 employment levels, ranking as one of the best performing industries in Minnesota following the Pandemic Recession. Construction provides about 5% of total employment in the state, or one in every 20 jobs. Construction also has about 18,000 employer establishments, which is the fourth largest number of establishments among all industries, as well as nearly 40,000 self-employed firms. With average annual wages of just under $80,000, wages are about $10,000 above the average for all industries, and are highest in subsectors like Heavy & Civil Engineering Construction and Nonresidential Building Construction.

The recent rise in the number of Construction jobs has led to an increased number of job vacancies across the state. The 9,000 job vacancies reported by Construction employers in the second quarter of 2021 were the highest number ever recorded. Total vacancies dropped to about 5,150 in 2022, but remain near historic highs. The median wage offered for these vacancies increased to $23.50 per hour in the second quarter of 2022, up nearly $2 per hour compared to the same survey in the second quarter of 2019, and up nearly $3.50 from the second quarter of 2021 when vacancies peaked.

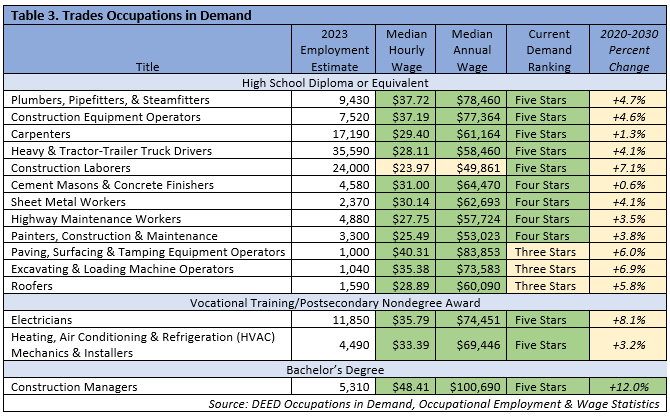

Most construction occupations can be started with a high school diploma and on-the-job training, though many also benefit from registered apprenticeships or vocational training even if not specifically required. In general, the more defined and technical the skills in the job, the higher the wage, though rising demand has also helped push wages higher across the board (see Table 3).

Not surprisingly, the Construction industry relies more heavily on younger workers, with nearly 80% (79.2%) of workers between 19 and 54 years of age, compared to 72.4% across all industries. Because of work experience and safety requirements, just 1.5% of all workers in Construction are under 18 years of age, compared to 3.9% across all industries; and because of physical requirements, just 19.3% of jobs are held by workers aged 55 years and over, compared to 23.7% across all industries.

Unlike the previous two groups, Trades is a male-dominated career field, and is also much less racially diverse. Census data show that about 95% of workers in these specific occupations are male, and 87% are white. About 6.5% of workers were of Two or More Races, and 5.4% were Hispanic or Latino. However, QWI data suggest that the racial diversity of the workforce has changed over time, with the number of Construction workers identifying as white alone increasing by 36% over the past 10 years, compared to a 143% increase in the number of jobholders of other race or ethnic groups. The fastest growth occurred for Hispanic or Latino, Asian, and workers of Two or More Races, which all more than doubled from 2012 to 2022.

Construction is projected to see even more job growth over the next 10 years. However, growth varies by sector, with areas like Heavy & Civil Engineering Construction expected to see the fastest expansion, and Construction of Buildings and Specialty Trade Contractors projected to see more measured growth. With a set of occupations in demand that have low training requirements and plentiful hiring opportunities, Construction employers have a chance to tap into new workforce pools.

Until being passed by the Health Care & Social Assistance industry in the early 2000s, Manufacturing had been the largest employing industry in the state. With nearly 325,000 jobs at more than 8,500 employer establishments, Manufacturing is still second largest, and has the second largest payroll. With average annual wages of $77,000, wages are about $7,000 above the average for all industries and are highest in subsectors like Computer & Electronic Product Manufacturing and Chemical Manufacturing.

Unlike most other industries, Manufacturing fared relatively well during the Pandemic Recession. It has regained jobs slightly faster than the economy overall in the past year and is also projected to see slight growth over the next 10 years. However, growth varies by sector, with areas like Food, Fabricated Metal Product, Chemical, and Machinery Manufacturing expected to add jobs while specialties like Printing, Paper, Textiles, and Apparel Manufacturing are projected to decline.

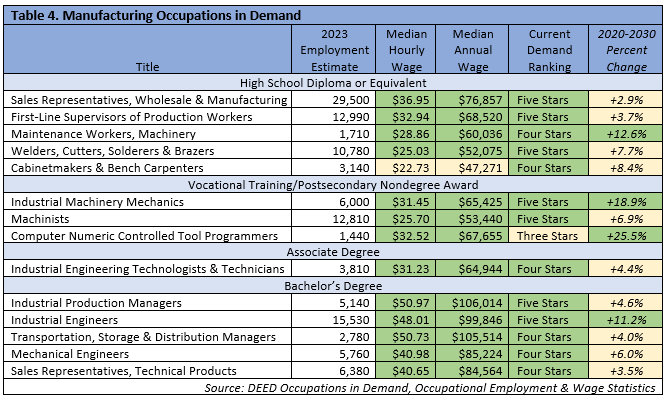

Manufacturing had almost 19,000 job vacancies in 2022, which was easily the highest number on record in the over 20-year history of the Job Vacancy Survey. Many of the occupations in demand in Manufacturing can be started with a high school diploma and some amount of on-the-job training, though employers prefer postsecondary training for some occupations such as Machinists, Welders, Industrial Machinery Mechanics, CNC Machine Tool Programmers, and more. Professional occupations such as Industrial Engineers, Industrial Production Managers, and Mechanical Engineers require a bachelor's degree (see Table 4).

New graduates and other jobseekers will be important in filling the workforce pipeline in the Manufacturing industry. The Manufacturing industry relies more heavily on workers aged 45 years and older, with nearly half (48.8%) of workers in the oldest age groups, compared to 42.9% across all industries. Because of the work experience requirements, just 8.1% of all workers in Manufacturing are under 25 years of age, compared to 13.8% across all industries.

Data from QWI shows that the Manufacturing industry has become much more racially diverse over time, with 82.7% reporting white as their race compared to 84.2% overall. The number of Manufacturing workers identifying as white alone declined by -3.0% from 2012 to 2022, compared to a 48.4% increase in the number of jobholders of other race or other ethnic groups. Manufacturing has higher concentrations of workers who are Asian or Pacific Islanders and of Hispanic or Latino origin, but smaller concentrations of Black or African American and American Indian workers.

Manufacturing is a male-dominated industry, with males holding more than two-thirds of total jobs. In the face of tight labor markets, Manufacturing employers will need to conduct outreach in additional communities in order to attract the talent they need to grow and replace existing workers in the future.

The Information Technology (IT) field in Minnesota is best classified as a set of occupations rather than an industry, as IT employment is spread across every industry in the state. Minnesota was home to around 110,000 IT workers in 2022, and these occupations provided about 4.0% of total employment in the state compared to about 3.6% in U.S. In addition to high concentrations, wages for these IT occupations were also high, with a median hourly wage of $49.73, which adds up to over $100,000 for a full-time, year-round worker.

It is important to note that about 85% of the Computer & Mathematical jobs in the state, which we use to represent IT positions, are located in the seven-county Twin Cities metro area – this is about 22 percentage points higher than the share of all occupations located in the metro. The other 15% of Computer & Mathematical jobs were spread across Greater Minnesota. Wages are also higher in the Twin Cities than in Greater Minnesota.

According to the Job Vacancy Survey, economic growth has created a steady rise in the number of openings for IT occupations across Minnesota. The almost 7,000 job vacancies reported by employers for computer occupations in the fourth quarter of 2021 was the highest number on record, before falling back to about 4,500 vacancies in 2022. Still, trend lines for IT vacancies have been pointing upward over time, even prior to the onset of the labor market tightness and dependence on technology induced by the pandemic starting in 2020.

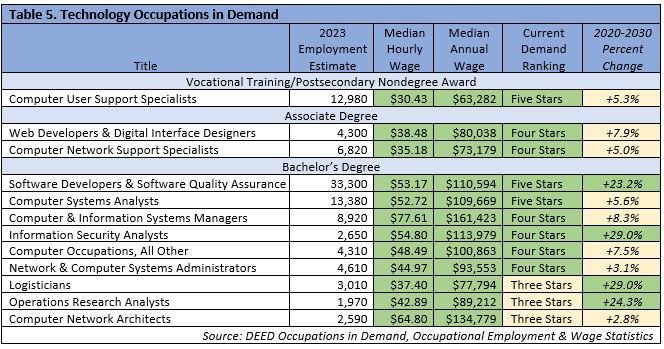

The vast majority of IT occupations require at least some postsecondary education, with most requiring a bachelor's degree. The lowest requirements were for Computer User Support and Computer Network Support Specialists and Web Designers, where about half required vocational training or an associate degree, making that the most typical requirement for entry into the careers. The rest of the selected IT occupations typically required a bachelor's degree or higher (see Table 5). However, these bachelor's degree requirements for IT roles may be changing along with national trends which show that roles like Software Developers and Network Administrators are lowering requirements for 4-year degrees. For example, one study showed that only 40% of Accenture's Software Developer/Engineer roles require a 4-year degree, and only 50% of Network Administrator roles have the requirements. For Microsoft, it's 62% and 21%, respectively, and IBM is at 31% and 34%.

Like Manufacturing and the Trades, IT has traditionally been a male-dominated career field, with males holding about 73% of total jobs according to Census data from 2021. However, the IT field is actually more racially diverse, with just 77% reporting white as their race, compared to 13% Asian or Pacific Islander, 4.2% Black or African American, 4% Hispanic or Latino, and 4% of Two or More Races.

The increased demand for IT jobs in Minnesota will likely continue, with a projected 12.2% job expansion from 2020 to 2030. In sum, there may be as many as 35,000 total openings for IT occupations in the state over the next decade, due to new jobs being created and a large number of replacement openings – jobs that become available as existing workers retire out of the labor force or change careers.

Over the coming months and years, the Drive for 5 initiative will help Minnesota fill some of its most critical workforce needs while supporting more Minnesotans in preparing for and finding family-sustaining employment on an in-demand career path. The first step in this initiative is rolling out now through the request for proposals from education and training organizations, as well as industry and other business associations, to create the structure for preparing more Minnesotans for good jobs in technology, the trades, caring professions, manufacturing, and education.