by Dave Senf

December 2020

Every two years the Labor Market Office of the Department of Employment and Economic Development produces long-term (10 years) industry and occupational employment projections for the state. Once the statewide projections are released, work starts on allocating the projected growth across the six planning regions. Presented below is a summary of regional employment projections for 2018 to 2028.

Possible long-term pandemic effects were not incorporated into either the 2018 - 2028 statewide projections or regional projections because of the high degree of uncertainty surrounding how the ongoing pandemic will ultimately alter employment opportunities in Minnesota over the next 10 years. A clearer picture of how the pandemic will shift industry and occupational employment in Minnesota over the next decade is likely to develop over the next year or so and will be included in the next round (2020 - 2030) of long-term projections.

Prior to the onset of the pandemic recession in April, Minnesota, along with the rest of the nation, was experiencing the longest economic expansion on record. The state added roughly 340,000 wage and salary jobs between 2010 and 2019 for an annual average of 37,750. The increase in wage and salary employment is based on Current Employment Statistics (CES) data which counts wage and salary jobs in the state. Local Area Unemployment Statistics (LAUS) numbers, which count Minnesotans either self-employed or in wage and salary jobs, climbed 288,000 over the same period for an annual average increase of 32,000. CES counts employment by place of work and allows for multiple job-holders and interstate commuting. LAUS counts employment by place of residence (only Minnesota residents) and only primary jobs. Job growth since 2010 averaged 32,000 to 37,750 annually when measured by LAUS and CES numbers.

Average annual job growth over the next 10 years will be far slower than over the last decade. The slowing of job growth in Minnesota in 2018 and 2019, despite solid national economic growth, was a harbinger of the slow job growth expected in Minnesota over the next decade. Minnesota's waning job growth in recent years was a result of the state's labor force growth's slowing. Job growth was limited by tight labor markets as employers struggled to find qualified employees as the unemployment rate hovered around 3.0%. The same forces are expected to restrain job growth over the next decade with labor markets remaining tight as labor force growth slows even more.

Projection employment, unlike the better known CES, QCEW, or LAUS employment numbers, combines wage and salary employment in Minnesota with self-employed Minnesotans, producing a more compressive measure of the number jobs in the state. Minnesota's projection employment declined 5.1% between 2007 and 2010 before increasing 12.3% between 2010 and 2019. The net result is that Minnesota's projection employment in 2018 was 5.7% higher than the 2007 pre-recession peak.

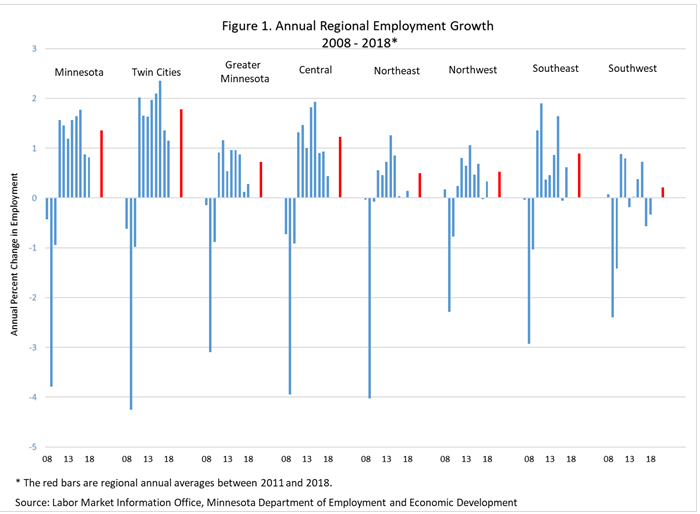

Minnesota's economy is projected to add 149,250 jobs, or roughly 14,900 jobs per year between 2018 and 2028, pushing total jobs in Minnesota to nearly 3.3 million by 2028. Job growth is expected to be uneven across the state much like the uneven regional job growth since the Great Recession (see Figure 1). Greater Minnesota's job growth rate topped job growth in the Twin Cities Metro area half of the time during 1991 – 2001 economic expansion. In contrast, job growth in the Twin Cities has been higher than Greater Minnesota job growth in every year since 2010 until 2020.

All regions felt the full effect of the Great Recession in 2009 as job numbers declined across the state, but the Twin Cities, Central, and Northeast regions experienced the steepest declines. Job recovery over the last 10 years has been strongest in the Twin Cities, Central, and Southeast Minnesota. Northwest Minnesota and Northeast Minnesota have experienced moderate job growth while Southwest Minnesota, the region with the oldest and slowest growing labor force, has lagged behind in job growth.

Four of the regions have higher employment in 2018 than in 2007 with the Twin Cities region leading the way with 8.5% employment expansion. The Central and Southeast regions recorded job growth of 4.2% and 3.1% respectively over the same period. Job expansion in Northwest Minnesota was 1.3% while employment in Northeast Minnesota declined by 0.2% and by 2.0% in Southwest Minnesota.

The seven-county Twin Cities Metro area is projected to add 101,400 jobs, an increase of 5.3% over the next decade (2018 - 2028). The metro area is anticipated to generate 68% of statewide job growth during the decade which will be lower than the 88% of statewide job growth captured by the Twin Cities area between 2008 and 2018. Unlike other regions in the state, the metro area is expected to experience enough labor force growth to support a moderate rate of job growth. Increased commuting from western Wisconsin and from Central and Southeast Minnesota will also support job growth in the metro area. Service-providing industries will create all of the projected job growth as goods-producing employment growth is expected to slip slightly, shrinking by 0.4% despite 10.4% Construction job growth. Job loss in Manufacturing will offset climbing Construction employment. Educational and Health Services jobs will grow the fastest and account roughly 56% of projected job growth. Professional and Business Services jobs will add the second most new positions. Two other sectors – Trade, Transportation, and Utilities and Information – are expected to experience small workforce reductions by 2028.

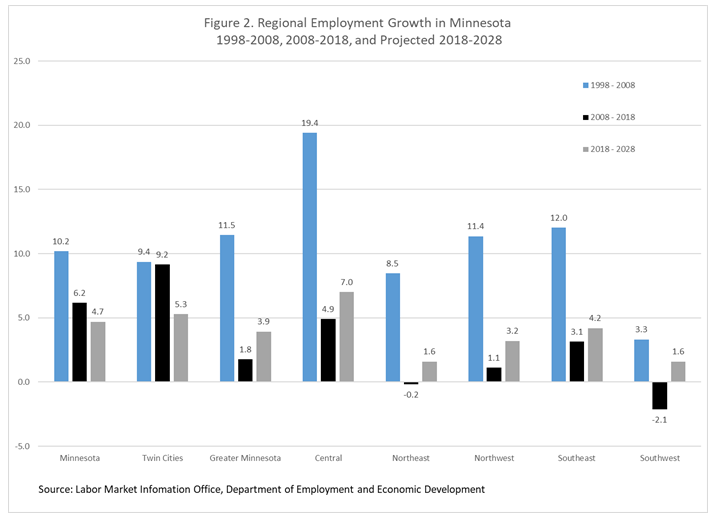

Central Minnesota, centered by St. Cloud and with five counties adjacent to the Twin Cities Metro area, was the state's job growth leader from the 1970s to the Great Recession, but its rate of growth has tailed off in recent years. Central Minnesota had the smallest number of wage and salary jobs at the beginning of the 1970s but passed up every other region except for the Twin Cities seven-county region over the last four decades. Job growth during the decade from 1998 – 2008 was 19.4% but then tailed off to 4.9% from 2008 – 2018 (see Figure 2). The region's employment is expected to climb 7.0% over the next decade, leading all regions in the rate of employment expansion. Residential development spillover from the Twin Cities along the I-94 corridor and up Intestate I-35 north of the Twin Cities is expected to pick up, but not at the boom pace experienced before the Great Recession, helping to spur service related industries. The 22,100 projected jobs will be concentrated in service-providing industries but goods-providing industries are expected to add 4,100 with most of the jobs added in Construction. All sectors in the region are expected to add jobs over the next 10 years.

Southeast Minnesota employment is projected to grow slightly slower than statewide employment, 4.2% Southeast to 4.7% statewide, as the region adds an expected 11,600 jobs by 2028. During the previous decade, Southeast Minnesota added 8,300 jobs, an increase of 3.1%. Service-providing industries are anticipated to be the source of 92% of job growth. Almost all goods-producing job expansion will be generated in the Construction industry with minimal job additions in Natural Resources and Mining and job loss in Manufacturing. Educational and Health Services will add the most jobs with 8,500 new jobs expected as the region's Health Care cluster continues to grow. Employment growth in Educational and Health Services is expected to account for just over 70% of the region's employment expansion. In addition to a small decline in Manufacturing jobs, Information jobs will also shrink slightly.

Northwest Minnesota's is projected to add 8,300 jobs by 2028, a 3.2% gain. During the 2008 -2018 decade this region had the fourth fastest job growth rate and is again expected to rank fourth in job growth over the next decade. Northwest Minnesota employment increased by only 1.2% or 2,900 jobs during the last decade. Job growth in the region, as in all regions, was disrupted by the Great Recession from 2008 to 2010. As in the other regions, most job growth, is expected to be in service-providing industries. Just 13% of projected job growth is expected to occur in goods-producing industries with most of that job growth occurring in the Construction sector. A small increase in Natural Resource and Mining jobs is also expected. Manufacturing jobs will dip by 0.5% during the decade. Job decline is also expected in the Information sector. Educational and Health Services industries will, as is true for all regions, account for the largest percent of projected job gain. The 4,700 Educational and Health Services projected employment expansion over the next 10 years in the region will account for more than half of all new positions expected to be created by 2028.

Northeast Minnesota has the smallest employment base of all regions with its regional job total accounting for 5.1% of statewide jobs in 2018. The region's share of statewide employment is projected to decline to 4.9% over the next 10 years as job growth in the region is expected to lag significantly behind statewide job growth, 1.6% to 4.7%. In the past this region was heavily dependent on tourism, taconite mining, and timber-related activity for job generation. Tourism is still a leading job generator but the most important sector these days is the Educational and Health Services sector which accounted for 29% of all employment in 2018. This sector is expected to add 3,700 jobs by 2028. Seven sectors are expected to see declining employment over the next 10 year: Manufacturing; Trade, Transportation, and Utilities; Information; Financial Activities; Leisure and Hospitality; Other Services; and Public Administration. Job decline in most of these sectors will be small but Information and Manufacturing jobs are expected to drop by 11.8% and 8.3%. The declining sectors combined are projected to reduce employment by 2,300. Northeast Minnesota along with Southwest Minnesota has the oldest workforce which translates into having the lowest projected regional labor force growth over the next 10 years. The net result is that employment in this region is projected to increase by only 2,500 jobs over the decade.

Southwest Minnesota is projected to match Northeast Minnesota with 1.6% job expansion over the next decade. This area lost 2% of its employment base during the previous decade (Figure 2). The 1.6% projected job growth translated into 3,400 new jobs for the region. Southwest Minnesota has three interrelated strikes against it when it comes to future job growth. The region's job rebound since the recession has been the weakest. Regional unemployment has historically been below the statewide rate indicating that companies in the region constantly face a harder time finding workers to expand their business when compared to other regions. Finally, the region's workforce is one of the oldest, suggesting that unless immigration picks up sustainably, labor force growth will be more limited than in the other regions. The Educational and Health Services sector will add the most jobs, 2,300, followed by the Professional and Business sector, 1,300 jobs. Six sectors are expected to shed jobs with Trade, Transportation, and Utilities and Other Services cutting the most jobs.

The distribution of projected regional occupational employment growth across the 10 major occupational groups is shown in Table 1. Unlike in the past a number of regional major occupational groups are expected to decrease in employment as tight job markets restrict employment growth especially in lower paying industries. Service occupations, which include about 100 occupations ranging from bailiffs, firefighters, and police officers to janitors, bartenders, child care workers, and nursing assistants, are projected to add the most jobs in all regions except in Southeast Minnesota. Professional and related occupations will expand the most in Southeast Minnesota as robust health-care related job growth is expected in Rochester.

| Table 1. Projected Regional Employment Growth by Major Occupational Group, 2018 - 2028 | |||||||

|---|---|---|---|---|---|---|---|

| - | Central Minnesota | Northeast Minnesota | Northwest Minnesota | Southeast Minnesota | Southwest Minnesota | Twin Cities Minnesota | Minnesota |

| Total | 22,100 | 2,500 | 8,300 | 11,600 | 3,400 | 101,400 | 149,300 |

| Management, business and financial | 2,200 | 400 | 900 | 800 | 200 | 19,900 | 24,300 |

| Professional and related | 6,700 | 1,600 | 3,200 | 5,100 | 1,400 | 39,100 | 57,700 |

| Service | 7,700 | 2,000 | 3,200 | 4,200 | 1,800 | 44,700 | 63,200 |

| Sales and Related | 600 | -700 | 200 | 200 | -400 | -2,000 | -1,700 |

| Office and Administrative Support | 0 | -1,200 | -900 | -800 | -1,300 | -6,700 | -11,400 |

| Farming, Fishing, and Forestry | 100 | -100 | 0 | 100 | 200 | 100 | 400 |

| Construction and Extraction | 2,400 | 600 | 900 | 1,000 | 700 | 5,600 | 11,300 |

| Installation, Maintenance, and Repair | 900 | 200 | 400 | 500 | 500 | 1,800 | 4,300 |

| Production | 0 | -500 | -300 | -300 | -400 | -5,400 | -7,100 |

| Transportation and Material Moving | 1,500 | 100 | 700 | 800 | 600 | 4,300 | 8,300 |

| Source: Labor Market Information Office, Department of Employment and Economic Development | |||||||

Service occupations are expected to add the most in the other regions as higher spending on personal care, restaurants, casinos, and healthcare, especially by Minnesota's expanding senior citizen population, translates into higher demand for personal care aides, home health aides, food preparation workers, hairdressers, gaming supervisors, and amusement attendants.

Professional and related jobs are expected to add the second-largest block of new jobs in all regions except Southeast Minnesota. The percent of job growth accounted for professional and related jobs, second in pay rate to management, business, and financial jobs, will be highest in Northeast and Southeast Minnesota. Professional occupations include most information technology jobs, educational occupations, and healthcare practitioner and technical jobs and are spread across 250 occupations.

Roughly 80% of projected job growth statewide is expected to be in either service or professional occupations with the percent being highest in Northeast Minnesota and the lowest in Central Minnesota. Occupations in these two major occupational groups accounted for 38 to 48% of total regional employment in 2018, with the Southwest and Central regions on the low end and the Northeast and Southeast regions on the high end. Service and professional jobs accounted for 43.4% of all jobs statewide in 2018 and are projected to account for 45.1% in 10 years. The share of jobs in service and professional jobs is expected to jump the most in the Twin Cities, Central, and Northeast regions over the next decade.

All but three major occupational groups will experience growing job numbers statewide over the next 10 years. The three occupational groups expected to experience declining employment statewide are office and administrative support, production, and sales. Jobs in office and administrative support positions are expected to decline all regions except Central Minnesota. Production occupations are also expected to decline in all regions except Central Minnesota. Sales and related occupation positions will fall in Northeast, Southwest, and the Twin Cities regions. The fastest growing occupational group will be construction and extraction jobs in all regions except for the Twin Cities. Service occupations will be the fastest growing occupational group in the Twin Cities.

Production occupations, such as machinists, team assemblers, welders, or job printers, accounted for 7.0% of all employment in Minnesota in 2018 with Central Minnesota having the highest production job share, 9.9%, and Northeast Minnesota having the lowest, 5.0%. These occupations are concentrated in the state's manufacturing companies and are expected to shrink in numbers relative to overall employment as manufacturing employment declines. Production occupations are expected to slip to 6.4% of all employment statewide by 2028. The shares of employment accounted for by production occupations in Central and Northeast Minnesota are predicted to fall to 9.3% and 4.6% by 2028.

The statewide manufacturing share of industry employment is projected to fall to 9.5% in 2028 from 10.2% in 2018 as manufacturing employment decreases by 2.8% over the next 10 years. Manufacturing's share of employment is expected to decline in all regions except in Central Minnesota where manufacturing jobs are projected to grow by 2.1%. The manufacturing workforce in Northeast Minnesota and in the Twin Cities is expected to tail off the fastest, declining by 8.3% and 4.9% over the next decades.

Occupational job openings generated by employment growth have always been only one minor piece of the future job openings puzzle. Many more occupational openings are generated each year by workers either exiting the labor force (retiring, for example) or transferring to another job that involves a different occupation. These openings, also known as separations, are the primary driver of future occupational job openings and give a broader measure of the future job availability by occupation.

Roughly 4.5% of Minnesota workers are expected to exit the labor force on average each year between 2018 and 2028. Another 7.1% of workers will transfer to some other occupation during an average year. Together openings from labor exits and occupational transfer are projected to average roughly 364,300 each year or 24 times the expected annual average of 14,900 job openings created by employment growth.

Table 2 displays the regional distribution of projected labor market exit and occupational transfer (separation) openings across major occupational groups from 2018 through 2028. The distribution of projected separation openings is more evenly spread across all occupations when compared to the distribution of employment growth openings, since separation openings are based on each region's 2018 employment base rather than projected employment growth. Job growth is projected to be concentrated in a select number of industries that have particular occupational needs, whereas labor market exits and occupational transfer openings will be happening across all industries and occupations.

| Table 2. Projected Replacement Openings by Major Occupational Group, 2018 - 2028 | |||||||

|---|---|---|---|---|---|---|---|

| - | Central Minnesota | Northeast Minnesota | Northwest Minnesota | Southeast Minnesota | Southwest Minnesota | Twin Cities Minnesota | Minnesota |

| Labor Force Exit Openings | |||||||

| Total | 148,800 | 72,700 | 123,200 | 122,800 | 94,200 | 841,800 | 1,405,500 |

| Management, business and financial | 11,400 | 4,300 | 12,800 | 9,600 | 10,600 | 71,900 | 120,300 |

| Professional and related | 20,000 | 11,500 | 17,700 | 20,800 | 13,000 | 137,900 | 219,800 |

| Service | 46,500 | 25,900 | 37,900 | 37,700 | 25,600 | 268,000 | 445,400 |

| Sales and Related | 17,700 | 8,300 | 13,900 | 13,200 | 10,400 | 93,600 | 157,600 |

| Office and Administrative Support | 19,200 | 10,600 | 16,200 | 16,100 | 12,400 | 129,900 | 204,000 |

| Farming, Fishing, and Forestry | 1,200 | 300 | 1,500 | 800 | 1,600 | 1,300 | 6,600 |

| Construction and Extraction | 5,800 | 2,600 | 4,100 | 3,400 | 2,900 | 21,800 | 40,700 |

| Installation, Maintenance, and Repair | 4,200 | 2,400 | 3,200 | 3,200 | 2,900 | 18,500 | 34,600 |

| Production | 12,200 | 3,000 | 8,300 | 10,100 | 7,500 | 45,900 | 86,600 |

| Transportation and Material Moving | 10,500 | 3,900 | 7,700 | 7,700 | 7,200 | 52,900 | 89,800 |

| - | Occupational Transfer Openings | ||||||

| Total | 229,900 | 112,900 | 186,200 | 187,600 | 145,100 | 1,374,900 | 2,237,600 |

| Management, business and financial | 18,500 | 9,200 | 17,600 | 16,100 | 13,700 | 180,000 | 254,400 |

| Professional and related | 30,100 | 18,300 | 27,500 | 30,000 | 20,000 | 241,500 | 365,000 |

| Service | 60,000 | 33,800 | 48,300 | 49,500 | 34,100 | 344,000 | 574,100 |

| Sales and Related | 27,000 | 12,300 | 20,800 | 20,000 | 15,800 | 154,800 | 251,200 |

| Office and Administrative Support | 26,500 | 14,800 | 22,200 | 22,400 | 16,900 | 185,700 | 288,200 |

| Farming, Fishing, and Forestry | 3,700 | 1,100 | 4,500 | 2,500 | 4,800 | 3,800 | 20,200 |

| Construction and Extraction | 14,300 | 6,200 | 9,700 | 8,400 | 6,900 | 52,800 | 98,100 |

| Installation, Maintenance, and Repair | 8,900 | 5,000 | 6,800 | 6,800 | 6,300 | 39,600 | 73,800 |

| Production | 23,800 | 5,900 | 15,900 | 19,600 | 14,700 | 85,500 | 164,800 |

| Transportation and Material Moving | 17,000 | 6,500 | 12,900 | 12,500 | 11,800 | 87,100 | 147,800 |

| Source: Labor Market Information Office, Department of Employment and Economic Development | |||||||

Workers will be needed in the future to fill openings in all occupations, even in declining occupations. The 3.1 million jobs in Minnesota in 2018 were spread across 806 occupations of which 218 or 27% are projected to shed jobs over the next 10 years. About 865,000 workers were employed in these shrinking occupations in 2018. Over the next 10 years roughly 44,400 positions in these declining occupations will be cut.

Demand for workers with the right skills for these shrinking occupations will still exist as labor market exit, and occupational transfer openings will average over 106,000 per year across the 218 occupations. For example, assemblers and fabricator jobs are anticipated to decline on average by 430 jobs each year, but each year there will be 1,250 labor force exits and 2,300 occupational transfer openings for assemblers and fabricators. That works out to more than 3,000 assemblers and fabricators openings each year.

Table 3 shows each region's 2018 employment base, 2018 – 2028 projected job growth, and 2018 – 2028 projected separation openings. Job openings in slower growing regions such as Southwest Minnesota are more likely to arise from replacement needs than from employment growth. There will be more than 74 separation openings in Northeast Minnesota for every job opening created by employment growth. That ratio is lowest in Central Minnesota, 17 separation openings per new job opening, since employment growth in that region of the state is expected to be strong.

| Table 3. Minnesota Projected Regional Employment Growth and Replacement Openings, 2018-2028 | ||||||

|---|---|---|---|---|---|---|

| - | 2018 Employment | 2028 Employment | 2018 - 2028 Employment Growth Openings | 2018 - 2028 Labor Force Exit Openings | 2018 - 2028 Occupational Transfer Openings | 2018 - 2028 Total Openings |

| Minnesota | 3,145,800 | 3,295,100 | 149,300 | 1,405,500 | 2,237,600 | 3,792,300 |

| Central Minnesota | 314,700 | 336,800 | 22,100 | 148,800 | 229,900 | 400,800 |

| Northeast Minnesota | 160,400 | 163,000 | 2,500 | 72,700 | 112,900 | 188,200 |

| Northwest Minnesota | 263,100 | 271,400 | 8,300 | 123,200 | 186,200 | 317,700 |

| Southeast Minnesota | 273,500 | 285,000 | 11,600 | 122,800 | 187,600 | 321,900 |

| Southwest Minnesota | 206,400 | 209,800 | 3,400 | 94,200 | 145,100 | 242,600 |

| Twin Cities Metro | 1,927,600 | 2,029,000 | 101,400 | 841,800 | 1,374,900 | 2,318,000 |

| Source: Labor Market Information Office, Department of Employment and Economic Development | ||||||

Long-term projections are updated every two years to keep up with constantly changing economic trends. The need to incorporate pandemic induced long-term impacts on Minnesota's future jobs attests to the need to update projections on a regular basis. Detailed industry and occupational employment projections, along with detailed separation openings projections, for Minnesota and for the state's six planning regions.