By Dave Senf

August 2021

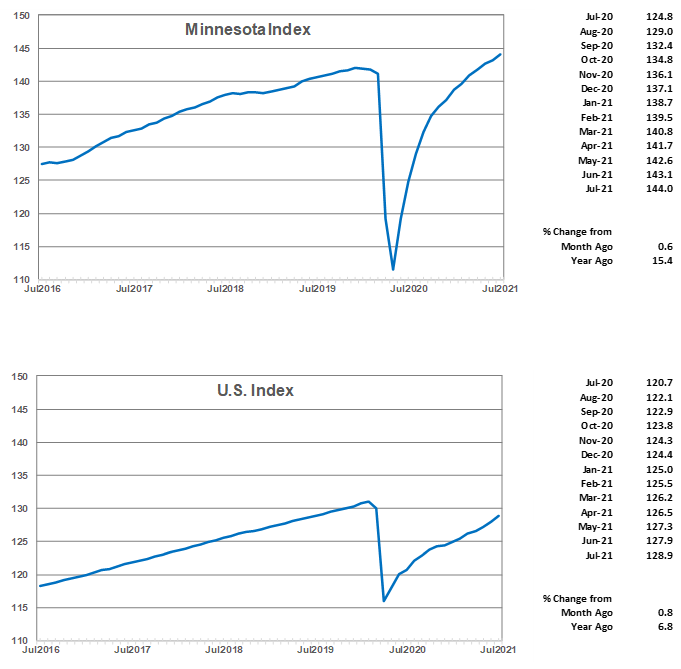

The Minnesota Index climbed for the 14th straight month in July advancing 0.6% to 144.0, as the state's economy continued to expand following the deep pandemic drop off. The index is a proxy for monthly GDP or economic activity, and July's reading is 1.4% higher than the pre-pandemic peak reached in December 2019. The BEA's (Bureau of Economic Analysis) estimate of Minnesota real GDP during the first quarter of 2021 was $342.3 billion, just 0.5% below the all-time real GDP of $343.4 billion recorded during the fourth quarter of 2019. The U.S. Index increased 0.8% in July topping Minnesota's increase by an inch or two. July was the second month in which the U.S. index advanced faster than the Minnesota index over the last 12 months.

The Minnesota Index, a coincident index, combines four state-level indicators to summarize current economic conditions in a single statistic which provides a proxy for monthly GDP. The four state-level variables in the coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index. The Minnesota Index, along with similar indices for all 50 states, is produced by the Philadelphia Federal Reserve Bank.

Minnesota was one of 24 states where the July 2021 index was above the February 2020 reading. Minnesota ranked 10th among the 24 states with higher GDP in July 2021 than in February 2020. Utah (5.1%) and Idaho (3.9) had the highest GDP growth over the period. Hawaii (-7.9%) and Connecticut (-7.8%) had the largest GDP drop off compared to last February. July's readings for neighboring states were higher in South Dakota (2.9%) and Wisconsin (0.5%) than last February but lower in Iowa (-1.5%) and North Dakota (-3.5%).

The Minnesota Index increased 0.6% compared to June's 0.3%, indicating that the pace of economic growth picked up in the state in July. The acceleration was fueled by increasing wage and salary employment and rising real wage and salary disbursements as well as the state's unemployment rate inching down to 3.9% from 4.0%. Employers continue to experience difficulties in finding workers to fill their vast number of job openings as the state's labor force remains significantly below the pre-pandemic level (2.9% below February 2020). It has, however, been gradually expanding. The spike in COVID-19 cases related to the Delta variant may slow the labor force recovery over the next few months.

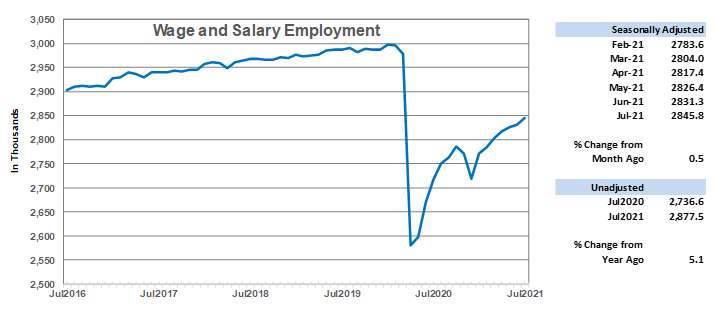

Adjusted Wage and Salary Employment increased 0.5% in July following a revised 0.2% gain in June. The state has added jobs in every month this year with the average monthly increase being 0.7%. U.S. job growth was just a tad faster than Minnesota's growth in July, climbing 0.6%. Minnesota seasonally adjusted employment has grown 4.6% since December 2020 compared to the 3.0% gain nationwide. Minnesota's employers have added 126,200 jobs during the first seven months of 2021 despite struggling to fill their growing number of job openings. As of July, the state has recovered roughly 64% of the 416,000 jobs lost during the pandemic. Nationally 75% of the 22.4 million jobs lost across the nation last March and April have been recovered as of July.

Private sector employers added 8,700 positions, and the public sector added 5,800 positions in July for a total gain of 14,500 jobs. That was the largest monthly increase since March and the third largest monthly increase of the year. Most of the job growth in the public sector can be traced to local government education as enrollment in summer school was much higher than in previous years. Private sector job growth was concentrated in Leisure and Manufacturing. Job loss occurred mostly in Trade, Transportation, and Utilities and Educational and Health Services.

June's unadjusted over-the-year change was 5.1% which was slightly below the 5.3% national growth. Seasonally adjusted unemployment dropped to 3.9% while the U.S. rate declined to 5.4% in July.

Minnesota's 5.1% over-the-year increase in unadjusted employment was the 23rd highest among the states. Hawaii (10.3%) and Vermont (9.6%) had the highest annual increases while Oklahoma (2.1%) and Kansas (2.8%) had the lowest annual increases. South Dakota (4.9%), Wisconsin (4.0%), North Dakota (4.0%), and Iowa (3.5%) all experienced slower over-the-year job growth than Minnesota.

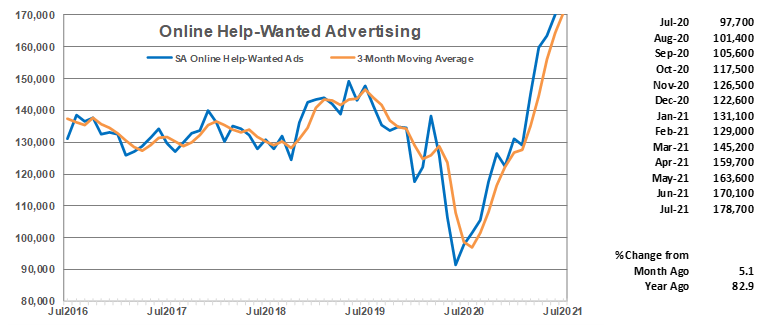

Online Help-Wanted Ads continued to climb in July to another all-time high of 178,100. July's 5.1% jump was slightly higher than the U.S. 3.7% increase. Online Help-wanted ads from Minnesota employers in July were 68% above the 16-year average. Nationally, online help-wanted ads were 81% higher than the historical monthly average. Job listings were up 84% from a year ago nationally and 83% in Minnesota. The state's share of U.S. online job postings has been 2.2% over the last three months, slightly higher than the 2.0% share of U.S. wage and salary employment.

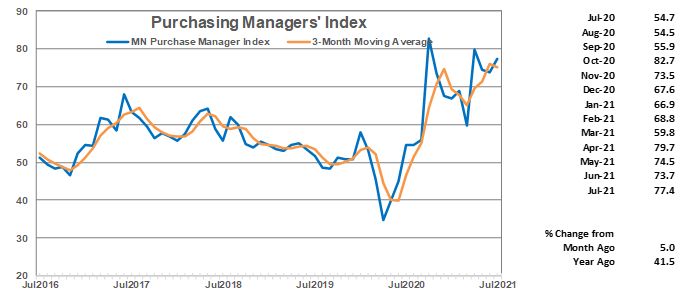

Minnesota's Purchasing Managers' Index (PMI), after tailing off for two consecutive months, jumped in July to 77.4, the third highest monthly read across 27 years of data. The robust reading suggests that Minnesota manufacturers expect factory activity to accelerate over the rest of the year.

The national ISM Manufacturing Index dipped to 59.5 from 60.6 while the Mid-America Business Index (nine states including Minnesota) slipped to 73.1 from 73.5. As has been the case over the last few months, Minnesota manufacturers are more optimistic about manufacturing growth over the rest of the year relative to the current level than their counterparts in most other states.

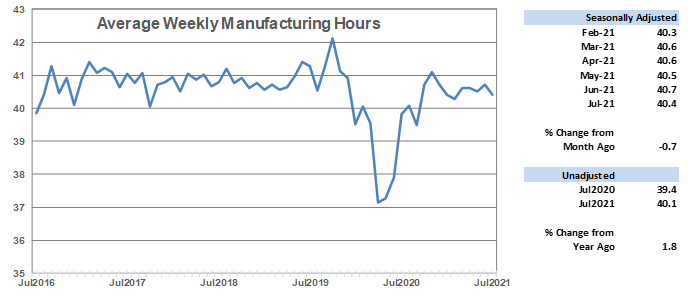

Average weekly Manufacturing Hours inched down in July to 40.4. The slight dip in the factory workweek is inconsistent with the strong PMI reading as expanding manufacturing activity is usually accompanied by an uptick in manufacturing hours. Manufacturers in the state added 2,700 positions in July, the second largest monthly gain going back to 1990. Factory employment in the state has increased 5,700 so far in 2021 but remains roughly 3.4% or 11,100 jobs below February 2020.

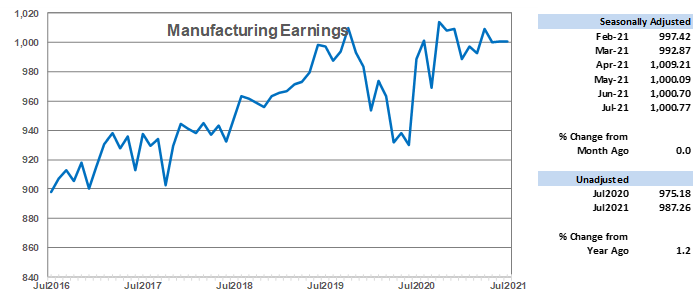

Seasonally adjusted average weekly Manufacturing Earnings, adjusted for inflation, were unchanged in July despite the fall off in hours worked. Factory paychecks have bounced back from the pandemic recession plunge but have been relatively flat over the last few months despite Minnesota manufacturers having a hard time finding workers to fill their vacancies. Seasonally adjusted factory paychecks were up 1.2% from last year in real terms in Minnesota.

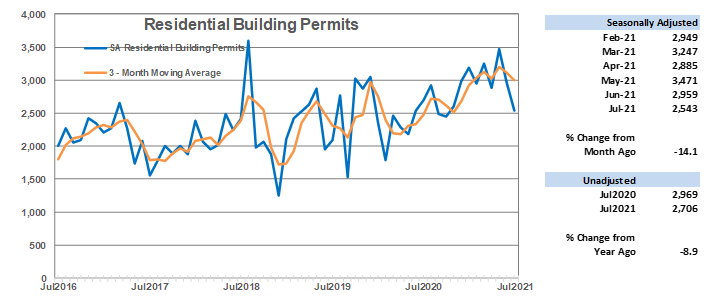

Adjusted Residential Building Permits, an early indicator of future home building activity, declined for the second straight month, slipping 14.15% in July to 2,543. That was the second lowest monthly total since last October. A declining trend in multi-family permits is behind the waning residential building permits. Median home prices continue to set record highs each month as home-builders scramble to meet homebuyers' demand, but labor shortages and supply chain issues have hampered faster homebuilding. There are signs, however, that the home buying market may be down shifting as high home prices drive potential buyers out of the market.

Minnesota accounted for 1.9% of home building permits issued nationwide in July which tops the state's 1.7% share of U.S. population. Minnesota accounted for 1.7% of single-family permits but 2.5% of multiple-unit permits. Home-building permits over the first seven months of 2021 were 31% above the 2020 pace.

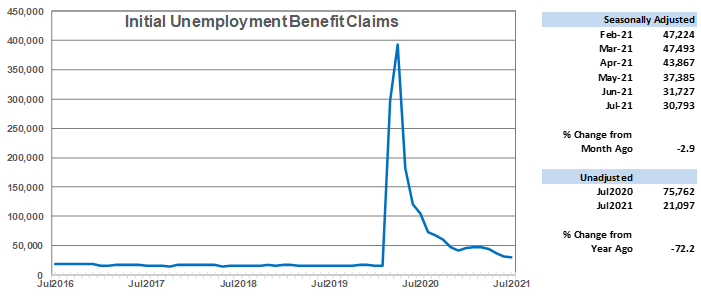

Adjusted Initial Claims for Unemployment Benefits (UB) declined for the fourth month in a row, inching down to 30,793. Unadjusted jobless claims were 72.2% lower than a year ago but remain stubbornly above the pre-pandemic levels. July's claim level was 87% higher than the 2015 – 2019 July seasonally adjusted initial jobless claims of 16,180. Initial claims were highest in Manufacturing, Health Care and Social Assistance, and Construction. Employers continue to lay off an above normal number of workers as they adjust to demand shifts brought on by the pandemic.

Note: All data except for Minnesota's PMI have been seasonally adjusted. See the feature article in the Minnesota Employment Review, June 2010, for more information on the Minnesota Index.

The Philadelphia Federal Reserve Bank, which produces the Minnesota Leading Index, has temporary suspended generation of state leading indices.