By Oriane Casale

September 2013

DEED's latest Job Vacancy Survey showed job openings in the second quarter climbed to their highest level in 12 years in Minnesota.

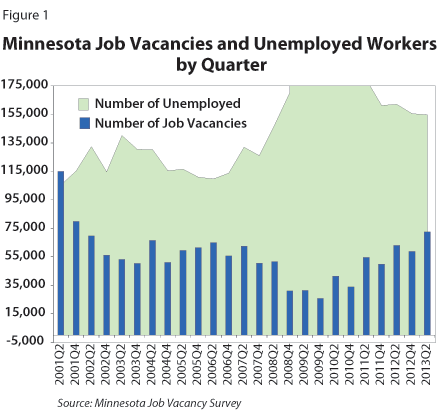

The Minnesota Job Vacancy Survey results for the second quarter of 2013 support other evidence - job growth, falling unemployment and strong gross domestic product growth, for example - that the labor market has finally recovered from the Great Recession. The number of vacancies (72,569) was higher than any time since 2001, and the ratio of unemployed to job openings fell to 2.1. This matches the ratio during second quarter 2007, just before the economy fell into recession and the unemployment rate spiked at the same time that hiring dropped off. This ratio rose to as high as 8.2 unemployed per vacancy during fourth quarter 2009 - the peak of the recession as far as job seekers in Minnesota were concerned.

Figure 1 shows the relationship between vacancies and the number of unemployed over the last 12 years.

With 42,316 vacancies in the second quarter, the Twin Cities has seen a surge in job vacancies over the past year. Greater Minnesota, while seeing a rise of 6.7 percent to 30,253 vacancies, did not capture the same share of the increase over the last year. Over the past three years, however, the vacancy increases are much closer, growing 77 percent in the Twin Cities and 72 percent in Greater Minnesota. The increases in Greater Minnesota came earlier (in 2011) and have slowed since.

Statewide, major industry sectors that have seen the greatest increases in vacancies since second quarter 2010 - when the economy finally began to show signs of life again - are health care (up 5,663), retail trade (up 4,966), accommodations (up 3,961) and construction (up 2,495). Other categories, such as other services and management, have high percentage increases over the period, but the vacancy numbers are smaller.

Over the year, the median wage offer for all job vacancies dropped from $12.99 to $12.50. This is due to a slight shift in the industries that were hiring during the second quarter of 2013 compared with a year earlier. Hiring in both the retail trade and the arts and entertainment industries was up, accounting for 4,100 of the 9,600 additional job vacancies over the year. While good news, this had the effect of lowering the overall median wage offer slightly.

Part-time job offers were at an all-time high. While there is no definitive explanation, it might be seen as good news. Marginally attached workers, people with disabilities who might have a difficult time holding full-time jobs, stay-at-home parents and older workers benefit from access to part-time jobs. Employers might be offering these options as the labor market tightens in an attempt to draw in these workers.

The survey also asked employers to report their future hiring plans over the next six months. The following question was asked: "In the next six months, do you expect your current employment level to rise, remain the same or decrease?" Results were positive during second quarter 2013. Eighteen percent of employers expect to increase employment levels, up 6.6 percent from a year ago, while only 5.6 percent expect to see decreases, down slightly from last year.

These numbers can be translated into a diffusion index where a score over 50 indicates that employers plan to increase employment overall. At 56.2, the second quarter 2013 diffusion index indicates that employers plan to add jobs over the next six months.

Moreover, these positive results are spread across all industries statewide. By region, the Twin Cities has a higher diffusion index than Greater Minnesota, but only one region, the northeast, fell below the threshold for overall expansion. Moreover, all industries fell above the threshold.

This article provides a brief overview of the second quarter 2013 Minnesota Job Vacancy Survey results. Many other important pieces of information on these vacancies, including part-time versus full-time hiring, wages, educational and experience requirements, and benefits offers, are available through our Job Vacancy Survey tool.