by Dave Senf

February 2019

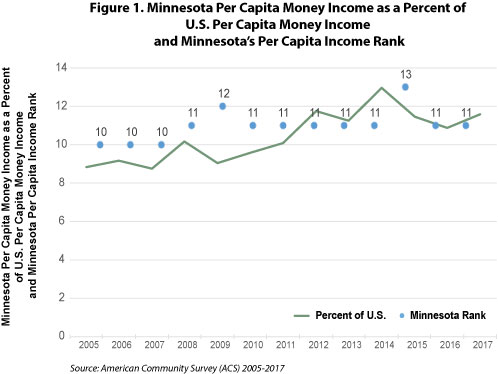

Minnesota's share of U.S. money income, as measured by the American Community Survey (ACS), increased for the first time in three years in 2017. The increase was small but kept Minnesota ranked 11th in per capita money income and lifted Minnesota's per capita money income to 11.6 percent higher than the U.S. average (see Figure 1). Money income data, available since 2005, is one of two measures of income that are commonly used in tracking the relative economic performance among states (see Measures of Income).

Two of the most widely used measures of household income are U.S. Census Bureau's money income and Bureau of Economic Analysis's (BEA) personal income. Money income estimates published by the Census Bureau are compiled from surveying households via the Current Population Survey and the American Community Survey. Money income estimates are available for the U.S., states, metropolitan areas, counties, and sub-county areas and across demographic characteristics such as age and ethnicity. Personal income estimates are compiled largely from administrative data sources, such as tax returns and unemployment tax records, by the BEA and are available only for the U.S., states, metropolitan areas, and counties.

Personal income has its roots in the National Income and Product Accounting (NIPA) system designed to produce Gross Domestic Product (GDP) estimates. The NIPA system uses a double-entry accounting systems to estimate the value of output and the income received in the production of the output. The level of aggregation is high since the main goal is to produce statistics summarizing a limited number of national economic statistics. Money income has its roots in tracking income distribution which means that data are less aggregated since the overall purpose is to compare income levels across households. The two measures also differ in individuals covered and income items included. The net result is that the two widely used income measures give substantially different estimates.

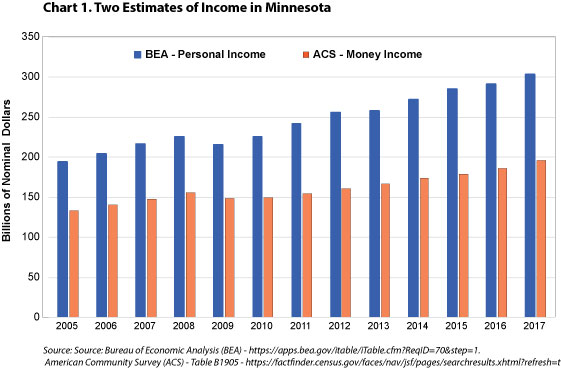

Personal income in 2017 in Minnesota was estimated at $301.1 billion or roughly 54 percent higher than the money income estimate of $196.6 billion (see Chart 1). The difference between the two estimates has fluctuated with Minnesota personal income being 45 percent higher in 2005 to 59 percent higher in 2015. Personal income is higher than money income in part because personal income includes property income (dividends, interests, and rents) received by pensions and non-profit institutions serving households. Employer contributions for employee pensions and insurance funds (including health insurance) are included in personal income but not counted in money income. Another large source of the difference is that most non-cash transfer payments, such as Medicare, Medicaid, and SNAP, are part of personal income but excluded from money income.

Another difference is that the BEA adjusts self-employment income upwards to account for underreporting of income in proprietors' tax returns. Thus proprietors' income total in personal income is significantly higher than self-employed income reported in money income. Personal income also includes net rental income of owner-occupied dwellings. In other words, personal income includes an estimate of the rent that would be collected if owners were renting out the house they lived in. Some types of income that are excluded from personal income are included in money income with the biggest type being individuals' contributions to social insurance (FICA taxes).

Even though personal income and money income in Minnesota differs significantly, the state's rank was the same, 18th, for both income measures (see Chart 2). What differs is when per capita income is compared. Per capita personal income in Minnesota in 2017 was $54,360 while per capita money income was $36,400. Per capita income using personal income in Minnesota was only 5.3 percent higher than the U.S. but was 11.6 percent higher using money income. Knowing why personal income and money income estimates differ is key to understanding Minnesota's relative economic position.

| Chart 2. Minnesota Income Rank BEA Personal Income vs. ACS Money Income | |||||

|---|---|---|---|---|---|

| BEA Personal Income | ACS Money Income | Ratio of Personal Income to Money Income | |||

| U.S. | 16,820.3 | U.S. | 10,148.3 | 65.7 | |

| Rank | State | $ Billions | State | $ Billions | |

| 1 | California | 2,364.1 | California | 1,323.4 | 78.6 |

| 2 | Texas | 1,340.6 | Texas | 796.5 | 68.3 |

| 3 | New York | 1,281.1 | New York | 709.4 | 80.6 |

| 4 | Florida | 1,000.6 | Florida | 584.8 | 71.1 |

| 5 | Illinois | 693.9 | Illinois | 423.9 | 63.7 |

| 6 | Pennsylvania | 682.5 | Pennsylvania | 405.7 | 68.2 |

| 7 | New Jersey | 581.2 | New Jersey | 354.5 | 64.0 |

| 8 | Ohio | 544.8 | Ohio | 342.3 | 59.2 |

| 9 | Virginia | 466.7 | Virginia | 304.7 | 53.2 |

| 10 | Massachusetts | 463.9 | Michigan | 296.5 | 56.5 |

| 11 | Georgia | 460.4 | Georgia | 296.5 | 55.3 |

| 12 | Michigan | 460.3 | North Carolina | 293.1 | 57.0 |

| 13 | North Carolina | 454.3 | Massachusetts | 277.8 | 63.5 |

| 14 | West Virginia | 428.8 | Washington | 267.8 | 60.1 |

| 15 | Maryland | 368.3 | Maryland | 234.1 | 57.3 |

| 16 | Colorado | 306.4 | Colorado | 197.8 | 54.9 |

| 17 | Tennessee | 305.7 | Arizona | 197.7 | 54.6 |

| 18 | Minnesota | 303.1 | Minnesota | 196.6 | 54.2 |

| 19 | Indiana | 301.0 | Tennessee | 186.4 | 61.5 |

| 20 | Arizona | 296.6 | Indiana | 182.9 | 62.2 |

| Source: Bureau of Economic Analysis and American Community Survey. | |||||

The ACS money income data are based on household surveys and not administration records, such as income tax and unemployment insurance records. Instead data are collected via the American Community Survey which ask roughly 65,000 Minnesota households each year about their total income over the past 12 months and about the sources of their income.

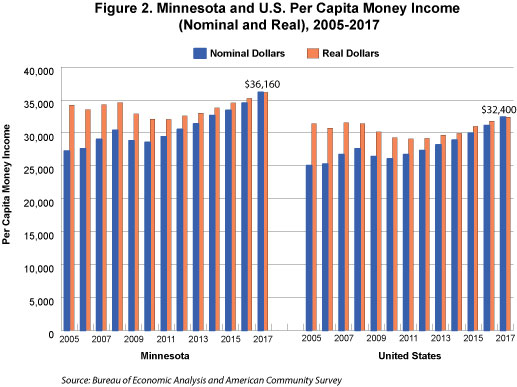

The estimated aggregated money income of Minnesotans in 2017, as estimated by the ACS, was $196.6 billion, putting the state 18th highest among states even though the state ranked only 22nd in population. Minnesota's total money income topped Indiana, Tennessee, Missouri, and Wisconsin, all which have more residents than Minnesota. Minnesota's share of U.S. money income in 2017 remained higher than its share of population, resulting in an estimated per capita money income of $36,160 compared to the U.S. estimate of $32,400.

The state's per capita income using ACS money income numbers decline in 2009 and 2010 during the Great Recession even before accounting for inflation (see Figure 2). After adjusting for inflation, real per capita income in Minnesota declined three straight years, 2009 through 2011. Real per capita income in 2011 was 7.4 percent below the 2008 peak or about $2,600 less. Real per capita money income in Minnesota has been gradually recovering since 2011 and in 2017 was 4.5 percent higher than the 2008 pre-recession peak.

Real per capita income for the U.S. peaked in 2007 and fell four straight years, 2008 – 2011, dropping by 7.8 percent or $2,444. The rebound of the real per capita income nationwide after the recession lagged behind Minnesota's rebound as real U.S. per capita money income in 2017 was only 2.7 percent higher than the 2007 pre-recession level. Minnesota's per capita money income in 2005, as reported by the ACS, was 8.8 percent above the U.S. level or $2,780 per person. In 2017 Minnesota's per capita income was 11.6 higher than the nation's or roughly $3,760 per person higher.

So why was the Minnesota 2017 per capita money income $3,760 higher than U.S. per capita money income? Did Minnesotans make more money in the stock market, receive more social security, have higher wages, collect more public assistance, or earn more self-employed income than the average American? Part of the answer is provided in the ACS money income data which break down income sources into eight broad categories.

In Minnesota, as in all states, the most important source of income is paychecks. Wage and salary income accounted for 77.3 percent of Minnesotan money income in 2017 as shown in Table 1 (see the Types of Money Income sidebar for details on what income is include in each category). Social security was the second largest income source for Minnesotans, followed by investment, dividends, and net rental income, self-employment income, and then retirement income. The other three sources of income provide a small proportion of income, accounting for roughly 2 percent of total money income when combined.

| Table 1. 2017 Aggregate Minnesota Money Income in the Past 12 Months (in 2017 billions dollars) | |||

|---|---|---|---|

| Income Source | Minnesota | Minnesota | U.S. |

| Percent of Total | Percent of Total | ||

| Total Money Income | $196.6 | ||

| Wage or Salary Income | 151.9 | 77.3 | 74.8 |

| Social Security Income | 12.7 | 6.5 | 7.0 |

| Interest, Dividends, Net Rental Income | 9.8 | 5.0 | 5.2 |

| Self-Employment Income | 9.2 | 4.7 | 4.8 |

| Retirement Income | 9.1 | 4.6 | 5.9 |

| All Other Types of Income | 2.8 | 1.4 | 1.5 |

| Supplemental Security Income | 0.9 | 0.5 | 0.6 |

| Public Assistance Income | 0.2 | 0.1 | 0.1 |

| Source: American Community Survey, 2017 | |||

The eight types of income reported in ACS are defined as:

Wage or Salary Income: Total money earnings received for work as an employee. Includes wages, salary, commissions, tips, and cash bonuses earned before any deductions.

Self-Employment Income: Net money income (gross receipts minus operation expenses) for individuals operating a farm as an owner, renter, or sharecropper. Net money income (gross receipts minus operation expenses) from one's own business, professional enterprise, or partnership.

Interest, Dividends, Net Rental Income: Interest on savings or bonds, dividends from stockholdings, and net income from rental of property to others. Does not include realized capital gains.

Social Security Income: Social Security pensions and survivor benefits, prior to deductions for medical insurance, and railroad retirement insurance checks from U.S. government. Medical reimbursements are not included.

Public Assistance Income: General Assistance and Temporary Assistance to Needy Families (TANF). Does not include noncash benefits such as SNAP payments, energy assistance, or Medicaid or Medicare reimbursements.

Retirement Income: Retirement income from company pension, union pension, government pension, military pension, and U.S. Railroad pension. Retirement income from KEOGH plan, Simplified Employee Pension (SEP), and any other type of pension, retirement account, or annuity such as IRA, ROTH IRA, 401(k), or 403(b) account.

Supplemental Security Income: Survivor income which is paid to spouses or children of deceased persons or regular income from a disability pension paid to those unable to work due to disability from companies or unions; federal, state, or local governments; and the U.S. military. Does not include Social Security payments.

All Other Types of Income: Includes unemployment compensation, worker's compensation, Veterans Affairs (VA) payment, alimony, and child support. Includes total money earnings received for work as an employee. Includes wages, salary, commissions, tips, and cash bonuses earned before any deductions.

Source: American Community Survey and Puerto Rico Community Survey 2015 Subject Definitions, page 80.

The sources of household money income in Minnesota don't differ all that much from where households across the U.S. earn their income. The one noticeable difference is that Minnesota households receive more of their income via wage and salary income than U.S. households. Wage and salary income accounted for 77.3 percent of Minnesota money income in 2017 compared to the U.S. 74.8 percent.

Minnesota's percent of money income from other major sources a slightly less than nationwide. Minnesota ranked seventh highest in the share of state total income accounted for by wage and salary income in 2017. The average wage and salary employee in Minnesota made roughly 3 percent more than the national average wage and salary employee in 2017 (see Measures of Wages sidebar). The higher wages would account for most of the higher share of wage and salary money income in Minnesota if a number of factors were constant across states.

Three of the main programs for tracking employment numbers in Minnesota also provide wage estimates in various forms and using differing sources. Each wage estimate has its own strengths and limitations.1 In addition to the wage data from the three main programs (Quarterly Census of Employment and Wages (QCEW), Current Employment Statistics (CES), and Occupational Employment Statistics (OES), earnings data from the American Community Survey (ACS) and wage and salary data from the Bureau of Economic Analysis (BEA) are also available. Average and median wage data for the U.S. and Minnesota from the above sources are listed in Table 1 for 2017.

| Table 1. Relative 2017 Wage and Salary, Minnesota and U.S. | |||

|---|---|---|---|

| United States | Minnesota | Minnesota Relative to U.S. | |

| 2017 ACS Wage and Salary Worker Average Annual Earnings | 52,209 | 54,148 | 3.7 |

| 2017 ACS Full-time Year Workers Average Earnings | 64,010 | 67,778 | 5.9 |

| 2017 ACS Full-time Year Workers Median Earnings | 46,881 | 51,221 | 9.3 |

| 2017 ACS Median All Workers Median Earnings | 33,646 | 37,397 | 11.1 |

| 2017 BEA Average Annual Wage and Salary | 55,643 | 55,310 | -0.6 |

| 2017 CES Average Weekly Earnings | 906 | 969 | 6.9 |

| 2017 OES Average Annual Wage and Salary | 50,620 | 52,730 | 4.2 |

| 2017 OES Median Annual Wage and Salary | 37,690 | 41,260 | 9.5 |

| 2017 QCEW Average Annual Wage and Salary | 55,390 | 56,140 | 1.4 |

| Source:

U.S. Census ACS CES - Current Employment Statistics BEA - BEA Regional Data OES -Occupational Employment and Wage Statistics QCEW -Quarterly Census of Employment and Wages |

|||

Minnesota's median wage and salary in 2017 ranges from 9.3 to 11.1 percent higher than the U.S. median wage while the state's average wage and salary ranges from 0.6 percent lower to 6.9 percent higher in Table 1.

1For more information on the various wage estimates see Reviewing the Data, From A to Z, Minnesota Economic Trends, September 2016.

But factors such as age structure, hours worked, labor force participation, and unemployment rates vary across states. Minnesota has roughly the same age structure as the U.S. but has a higher labor force participation and a lower unemployment rate than the nation. That means that a larger share of working-age Minnesotans are working and earning paychecks when compared to the rest of the country. This increases Minnesota's wage and salary money income share. The share is reduced slightly, however, by Minnesota's shorter workweek. Private sector employees in Minnesota worked an average of 34.1 hours each week in 2017 compared to 34.4 percent across the U.S.

Table 2 lists Minnesota's ranking in terms of each income category's share of state income for the six highest income sources. Minnesota's rank is listed along with the top and bottom three states and the U.S. average share2. State rankings when examined closely reveal a lot about the variation of state economies. For instances, Montana, New Mexico, and Florida are ranked at the bottom when it comes to wage and salary income as percent of total state income. New Mexico and Florida are in the top 10 when in it comes to reliance on social security and retirement income. These states have a relatively older population and thus a higher percentage of their population is senior citizens living off social security and retirement income and less active in the workforce.

| Table 2. 2017 State Ranking of Share of Total Income by Income Sources | |||||

|---|---|---|---|---|---|

| Wage and Salary Share | Percent | Social Security | Percent | ||

| 1 | District of Columbia | 80.9 | 1 | West Virginia | 13.1 |

| 2 | Utah | 78.7 | 2 | Arkansas | 10.4 |

| 3 | New Jersey | 78.7 | 3 | Alabama | 10.3 |

| 7 | Minnesota | 77.3 | U.S. Average | 7.0 | |

| U.S. Average | 74.8 | 36 | Minnesota | 6.5 | |

| 49 | Florida | 68.4 | 49 | California | 5.0 |

| 50 | New Mexico | 67.8 | 50 | Alaska | 4.3 |

| 51 | Montana | 67.1 | 51 | District of Columbia | 2.7 |

| Interest, Dividends, or Net Rental | Percent | Self-Employment | Percent | ||

| 1 | Montana | 7.8 | 1 | North Dakota | 9.3 |

| 2 | Florida | 7.6 | 2 | South Dakota | 7.9 |

| 3 | Vermont | 7.4 | 3 | Montana | 7.1 |

| U.S. Average | 5.2 | U.S. Average | 4.8 | ||

| 26 | Minnesota | 5.0 | 27 | Minnesota | 4.7 |

| 49 | Georgia | 3.8 | 49 | Indiana | 3.8 |

| 50 | Louisiana | 3.7 | 50 | Virginia | 3.8 |

| 51 | West Virginia | 3.5 | 51 | West Virginia | 3.3 |

| Retirement | Percent | Other Types of Income | Percent | ||

| 1 | New Mexico | 9.6 | 1 | Oklahoma | 2.4 |

| 2 | Delaware | 8.9 | 2 | New Mexico | 2.3 |

| 3 | West Virginia | 8.0 | 3 | West Virginia | 2.3 |

| U.S. Average | 5.9 | U.S. Average | 1.5 | ||

| 48 | Minnesota | 4.6 | 40 | Minnesota | 1.4 |

| 49 | Texas | 4.5 | 49 | Massachusetts | 1.2 |

| 50 | Nebraska | 4.2 | 50 | New York | 1.1 |

| 51 | North Dakota | 3.0 | 51 | District of Columbia | 0.7 |

| Source: American Community Survey, 2017 | |||||

Montana on the other hand, along with North and South Dakota, is one of the leading states when it comes to self-employment income. Higher self-employment income shares of total state income tend to correlate with states where agriculture is a dominant industry. Alaska ranks near the top most years for share of money income coming from other types of income primarily because of the Alaskan Permanent Fund. If you know any Alaskans, you know how they eagerly await their annual Permanent Fund dividend. The annual Permanent Fund payout however fell to $1,100 in 2017 from $2,000 in 2015, pushing Alaskans' percent of income from other types of income down to sixth highest in 2017.

Tracking different income categories over time is a useful exercise in understanding how state economies are changing especially relative to each other. Eight states (Alabama, Connecticut, Delaware, Florida, Georgia, Michigan, Nevada, and New Mexico) had lower real per capita money income in 2017 than in 2005. North Dakota, thanks to the oil boom, led real per capita income growth, increasing 17.2 percent to $34,040 in 2017 over the 12-year period. D.C. and Washington were next in line increasing 11.3 and 10.4 percent. Real per capita money income increased 5.7 percent in Minnesota during the same period, which was the 15th fastest increase. Real per capita money income climbed 7.5 percent (7th fastest) to $29,610 in South Dakota. Iowa's real per capita money income increased 5.3 percent (16th fastest) to $30,870, while Wisconsin's real per capita money income grew 2.9 percent (28th fastest) to $32,000. U.S. real per capita income rose 3.1 percent to $32,400 over the same period.

Table 3 compares the Minnesota and U.S. real money income growth changes between 2005 and 2017. Minnesota's slightly higher than U.S. total money income growth combined with its lower than U.S. population growth translates into Minnesota's per capita money income premium relative to the nation, climbing from 8.4 percent above in 2005 to 11.6 percent above in 2017 (see Figure 1). The 11.6 percent higher per capita money income is down from the 13.0 percent peak in 2014. Minnesota and U.S. changes across the eight categories of money income are fairly similar except for supplemental security income and public assistance income. Both of these sources of income have climbed at a faster rate in Minnesota than nationally. This is probably because Minnesota added more aid to these predominantly federally funded programs than most other states.

| Table 3. Percent Change in Real Money Income Sources 2005-2017 | ||

|---|---|---|

| Minnesota | U.S. | |

| Total Money Income | 17.2 | 16.3 |

| Wage or Salary Income | 16.0 | 15.2 |

| Social Security Income | 48.5 | 43.6 |

| Retirement Income | 32.8 | 34.9 |

| Interest, Dividends, Net Rental Income | 35.5 | 25.1 |

| Self-Employment Income | -12.5 | -12.3 |

| All Other Types of Income | -8.1 | -4.6 |

| Supplemental Security Income | 82.0 | 57.0 |

| Public Assistance Income | 5.8 | -22.0 |

| Population | 11.8 | 12.9 |

| Source: American Community Survey, 2005 and 2017 | ||

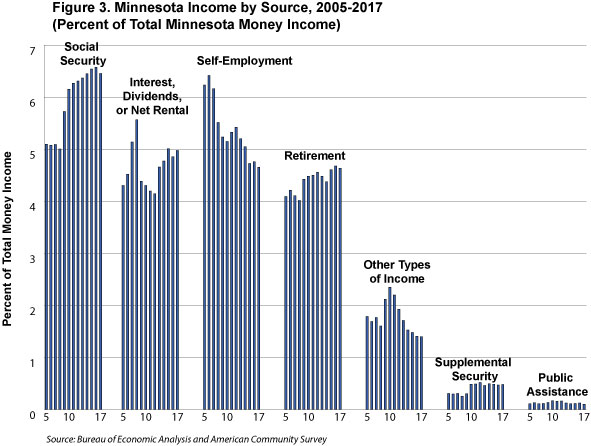

Figure 3 displays how money income sources for Minnesota households have ebbed and flowed over the last 13 years using the share of state income measure. The share of wage and salary income isn't shown, given its overwhelming share of money income, but it has increased over the last two years as unemployment rates have continued to decline. More people working means more income received from wages and salaries. The share of income arising from wage and salary income is expected, however, to tail off gradually over the next two decades as the baby boomers complete their working years and move to depending on Social Security and other retirement money to pay their bills.

Social Security income and retirement income had been gaining in importance in Minnesota especially from the end of the Great Recession until 2017. The dips in 2017 probably reflect the tight labor market. As Minnesota baby boomers continue to retire, Social Security income and retirement income are expected to resume gradually increasing as money income sources. That will happen only if the baby boomers retire in Minnesota rather than Florida or Arizona. Social Security and retirement income accounted for 17 and 16 percent of all money income in Florida and Arizona in 2017 compared to 13 percent for the U.S. and 11 percent in Minnesota. Minnesota's percent of money income generated by Social Security and retirement income is likely to reach the current percentages in Florida and Arizona by 2030.

Tracking annual changes in ACS estimates of Minnesota households, especially relative to other states, is another tool to help in understanding the forces driving the Minnesota economy and the state's economic performance relative to the nation and other states. Minnesota, based on ACS money income data, took a slightly smaller hit from the Great Recession, put the recession in the rearview mirror faster than most states initially, and has been keeping up with national growth rate over the last few years when money income is used as a barometer.

2ACS income data for total income and the eight income categories by state for 2005 – 2017 are shown graphically using four views: actual income, percent of state total income, share of U.S. income, and per capita income at Sources of Household Income by State.