by Dave Senf

September 2017

Minnesotans enjoy per capita income that is 13.3 percent higher than the national average. This article breaks down the sources of that income.

Minnesota's share of U.S. income, as measured by the American Community Survey (ACS), reached its highest level in 2014 before slipping slightly in 2015. The 2016 income numbers are due out in September, so stay tuned to see how the state fared in 2016.

The ACS income data, available since 2005, is one of three aggregated measures of income that are useful in tracking relative economic progress across states.1

The ACS income data are based on household surveys and not administration records, such as income tax and unemployment insurance records used by the two other income estimates. Responses to two questions in the American Community Survey are added up to produce income estimates across various geographic areas. The first question asks about total income over the last 12 months, while the other question asks about the sources of the income.

According to the ACS, the estimated aggregated income of Minnesotans in 2015 was $179.3 billion, putting the state 16th among states even though Minnesota ranked 21st in population.

Minnesota's total income topped Arizona, Indiana, Tennessee, Missouri and Wisconsin, which each have more residents than Minnesota. Minnesota's share of U.S. income was 1.94 percent in 2015, while the state's population share was 1.71 percent. That translates into Minnesota having 13.3 percent more income per person than the average U.S. person.

Another way of looking at the income data without thinking about Minnesota's share of national income and population is to directly compare per capita incomes. The 2015 ACS estimates of per capita income in Minnesota and the U.S. were $32,699 and $28,872, respectively.2 As with the share approach, Minnesota's per capita income in 2015 was 13.3 percent higher than the nationwide per capita income. Minnesota's per capita income was 11 percent higher than the national average in 2005 and rose to 14.8 percent higher in 2014, before backing off to 13.3 percent higher in 2015, according to the ACS figures.

Types of Income Included in ACS Income EstimatesWage or Salary Income: Total money earnings received for work as an employee. Includes wages, salary, commissions, tips and cash bonuses earned before any deductions. Self-Employment Income: Net money income (gross receipts minus operation expenses) for individuals operating a farm as an owner, renter or sharecropper. Also includes net money income (gross receipts minus operation expenses) from one's own business, professional enterprise or partnership. Interest, Dividends, Net Rental Income: Interest on savings or bonds, dividends from stockholdings, net income from rental of property to others. Does not include realized capital gains. Social Security Income: Social Security pensions and survivor benefits, prior to deductions for medical insurance and railroad retirement insurance checks from the U.S. government. Medical reimbursements are not included. Public Assistance Income: General assistance and Temporary Assistance to Needy Families. Does not include noncash benefits such as Supplemental Nutrition Assistance Program payments, energy assistance or Medicaid or Medicare reimbursements. Retirement Income: Retirement income from company pension, union pension, government pension, military pension and U.S. Railroad pension. Retirement income from Keogh Plan, Simplified Employee Pension and any other type of pension, retirement account or annuity such as IRA, Roth IRA, 401(k), 403(b) account. Supplemental Security Income: Survivor income that is paid to spouses or children of a deceased person or regular income from a disability pension paid to those unable to work due to disability, from companies or unions, federal, state or local governments, and the U.S. military. Does not include Social Security payments. All Other Types of Income: Includes unemployment compensation, workers' compensation, Veterans Affairs payment, alimony and child support. Source: American Community Survey and Puerto Rico Community Survey 2015 |

The state's per capita income using ACS income numbers declined during the recession in 2009 and 2010, before accounting for inflation. After adjusting for inflation, real per capita income in Minnesota declined for three straight years, 2009 through 2011. Real per capita income in 2011 was 7.3 percent below the 2008 peak, or about $2,400 less.

Real per capita income in Minnesota has been gradually recovering since 2011. As of 2015, however, it was still 0.3 percent short of the peak in 2008, or about $90 less. The best guess is that when 2016 data are available, real per capita income will finally have moved higher than the 2008 peak.

Real per capita income for the U.S. peaked in 2007 and fell through 2012, dropping by 7.8 percent. U.S. real per capita income in 2015 was still 2.4 percent below the 2007 peak level, or about $630 lower.

So why was Minnesota 2015 per capita income $3,826 higher than U.S. per capita income? Did Minnesotans make more money in the stock market, receive more Social Security, have higher wages, or collect more public assistance than the average American?

Part of the answer is provided in the ACS income data, which break down income sources into eight broad categories. In Minnesota, as in all states, the most important source of income is paychecks. Wage and salary income accounted for 77 percent of Minnesotans' income in 2015 as shown in Table 1. Social Security was the second-largest income source for Minnesotans, followed by investment, dividends and net rental income, self-employment income and retirement income. The other three sources provide a small proportion of income, accounting for just over 2 percent when combined.

| Income Source | Minnesota 2015 Income (Billions of 2015 Dollars) | Minnesota Percent of State Income | U.S. Percent of National Income |

|---|---|---|---|

| Total Household Income | $179.27 | ||

| Wage or Salary | $138.10 | 77.0 | 74.3 |

| Social Security | $11.72 | 6.5 | 7.2 |

| Interest, Dividends or Net Rental | $8.98 | 5.0 | 5.5 |

| Self-Employment | $8.47 | 4.7 | 4.8 |

| Retirement | $8.26 | 4.6 | 5.9 |

| Other Types of Income | $2.65 | 1.5 | 1.6 |

| Supplemental Security | $0.87 | 0.5 | 0.7 |

| Public Assistance | $0.21 | 0.1 | 0.1 |

| Source: American Community Survey, 2015. | |||

The sources of household income in Minnesota aren't all that different from U.S. households. The one noticeable difference is that Minnesota households receive more of their income from wage and salary income than U.S. households. Wage and salary income accounted for 77 percent of Minnesota income in 2015 compared with 74.3 percent in the U.S. Social Security income, interest, dividend or net rental income, and retirement income account for a larger share of income nationally than in Minnesota.

Minnesota ranked seventh in the share of state total income generated by wage and salary income in 2015. Minnesota's average wage is slightly higher than the average U.S. wage. But more important in explaining Minnesota's higher share of income from wage and salary income is that a larger share of working-age Minnesotans earns paychecks compared with the rest of the country. A lower unemployment rate and significantly higher labor force participation rate boost wage and salary income share in the state above the national norm.

Table 2 lists Minnesota's ranking, in terms of each income category's share of state income, for the six highest income sources. Minnesota's rank is listed along with the top and bottom three states and the U.S. average share.3

| Rank | Wage and Salary Share | Percent | Rank | Social Security | Percent |

|---|---|---|---|---|---|

| 1 | NJ | 78.4 | 1 | WV | 13.0 |

| 2 | UT | 77.8 | 2 | AR | 10.5 |

| 3 | MD | 77.8 | 3 | MS | 10.3 |

| 7 | MN | 77.0 | U.S. Average | 7.2 | |

| U.S. Average | 74.3 | 35 | MN | 6.5 | |

| 49 | WV | 68.3 | 49 | MD | 5.2 |

| 50 | FL | 67.8 | 50 | AK | 3.6 |

| 51 | MT | 66.9 | 51 | DC | 2.5 |

| Rank | Interest, Dividends, or Net Rental | Percent | Rank | Self-Employment | Percent |

| 1 | ND | 8.7 | 1 | SD | 9.9 |

| 2 | FL | 8.0 | 2 | ND | 9.6 |

| 3 | DC | 7.8 | 3 | MT | 7.0 |

| U.S. Average | 5.5 | U.S. Average | 4.8 | ||

| 32 | MN | 5.0 | 24 | MN | 4.7 |

| 49 | OH | 4.0 | 49 | AL | 3.5 |

| 50 | WV | 3.5 | 50 | WV | 3.4 |

| 51 | MS | 3.3 | 51 | DE | 3.3 |

| Rank | Retirement | Percent | Rank | Other Types of Income | Percent |

| 1 | NM | 8.8 | 1 | AK | 3.0 |

| 2 | AL | 8.0 | 2 | WV | 2.7 |

| 3 | DE | 8.0 | 3 | NM | 2.4 |

| U.S. Average | 5.9 | U.S. Average | 1.6 | ||

| 48 | MN | 4.6 | 38 | MN | 1.5 |

| 49 | TX | 4.5 | 49 | NJ | 1.3 |

| 50 | NE | 4.5 | 50 | NY | 1.2 |

| 51 | ND | 3.4 | 51 | DC | 0.8 |

| Source: American Community Survey, 2015. | |||||

The state rankings when examined closely reveal a lot about the economic structure of states. For instance West Virginia, Florida and Montana are ranked at the bottom when it comes to wage and salary income as a percent of total state income. West Virginia and Florida are near the top when in it comes to reliance on Social Security. These states have relatively older populations. Thus a higher percentage of their populations is composed of senior citizens collecting Social Security and not active in the workforce.

Montana, on the other hand, is one of the leading states when it comes to self-employment income. Higher self-employment income shares of total state income tend to correlate with states where agriculture is a dominant industry. North Dakota is the top state for share of income coming from interest, dividends and net rentals. Included in this category is royalties. Oil royalties combined with farmland rentals probably account for most of North Dakota's lead position in this income category. Alaska ranks near the top most years for other types of income per capita because of the Alaska Permanent Fund. If you know any Alaskans, you know how they eagerly await their annual Permanent Fund dividend that was just over $2,000 per person in 2015.

Tracking different income categories over time is a useful exercise for understanding how state economies are changing, especially relative to each other. Nevada is the only state where the per capita income level (not adjusted for inflation) is still below its pre-recession peak. States that have just barely rebounded above their pre-recession peak per capita income include Arizona, Georgia, Florida and Idaho. North Dakota, on the other hand, barely felt the Great Recession during its oil fracking boom. North Dakota's per capita income dropped only in 2010 and increased by 54 percent between 2005 and 2015, moving the state from 33rd in 2005 to seventh in 2015. Minnesota's per capita income climbed 25.3 percent during the same 10 years, slipping from seventh in 2005 to 11th in 2015.

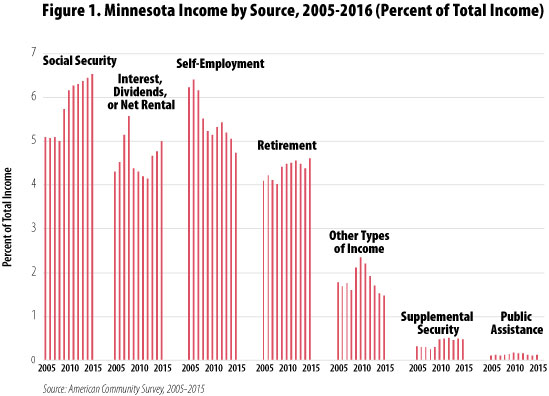

Figure 1 displays how income sources for Minnesota households have ebbed and flowed over the last 10 years using the share of state income measure. The share of wage and salary income isn't shown, but as with the U.S. wage and salary share it has been gradually declining. The 2005 share of income from wages and salaries was 78 percent and 75.6 percent for Minnesota and the U.S., respectively. The 2015 shares were down to 77 percent for Minnesota and 74.3 percent for the U.S. Over the 10 years, Minnesota's share of wage and salary edged down one percentage point, while nationally the share declined 1.3 percentage points. Income from self-employment has also been declining relative to total income over the last decade.

Social Security income and retirement income have been gaining in importance, especially since the Great Recession. It is hard to say how much of that is due to early retirement related to job loss during the recession versus the gradual acceleration in baby boomers retiring.

Social Security income accounted for 9.9 percent of household income in Florida in 2015, due primarily to 19.5 percent of Floridians being older than 64 years. Minnesota's senior citizens accounted for 14.6 percent of the population in 2015 and are projected to reach 19.3 percent by 2025. Minnesota's percent of household income arising from Social Security will likely be approaching Florida's current 9.9 percent by 2025.

The increase and decrease in other types of income as a percent of household income in Minnesota between 2008 and 2013 mainly tracks with changes in unemployment compensation received by Minnesota households. The number of unemployed Minnesotans peaked in 2009 at 229,000, after climbing from 117,000 in 2005. The average annual number of unemployed in 2015 was down to 110,000. Roughly 0.8 percent of Minnesota's income in 2009 and 2010 stemmed from unemployment compensation designed to offset lost wage and salary income during downturns. Public assistance income also rose during the recession but has since reverted to its pre-recession level of 0.1 percent of total household income in Minnesota.

Tracking annual changes in ACS estimates of Minnesota households is another tool in understanding how the Minnesota economy works and how well it is performing, especially compared with the national economy and other states. Minnesota, based on ACS income data as of 2015, took less of a hit from the recession and has put it in the rearview mirror faster than most states.

1The three income datasets are the ACS's money income data, the Bureau of Economic Analysis personal income data, and the IRS adjusted gross income data. Due to different concepts of income, the three income estimates differ significantly.

2Source: Author's calculations using American Community Survey household income estimates. Per capita income estimates presented here differ slightly from ACS per capita income estimates due to use of differing population estimates used in per capita calculations.

3ACS income data for total income and the eight income categories by state for 2005 – 2015 are shown graphically using four views: actual income, percent of state total income, share of U.S. income and per capita at Sources of Household Income by State.