by Dave Senf

October 2019

Since 2010 when the state’s job market was just beginning to rebound from the Great Recession, Minnesota has added roughly 317,000 wage and salary jobs through 2018. The increase in wage and salary employment is based on Current Employment Statistics (CES) data which count wage and salary jobs in the state. Local Area Unemployment Statistics (LAUS) numbers, which count Minnesotans either self-employed or in wage and salary jobs, has climbed 259,000 over the same time period. CES counts employment by place of work and allows for multiple job-holders. LAUS counts employment by place of residence and only primary jobs. Job growth since 2010 has averaged 32,700 to 39,600 annually when measured by LAUS and CES numbers.

To clarify – average annual job growth over the next 10 years will be far slower than over last decade. The slowing of job growth in 2018 and the near absence of job growth during the first half of 2019 are harbingers of the slow job growth expected in Minnesota over the next decade. Job growth is expected to be limited to around 18,000 jobs annually over the next 10 years as job expansion will be constrained by very tepid labor force growth.

Projection employment, unlike the better known CES, QCEW, or LAUS employment numbers, combines wage and salary employment in Minnesota with self-employed Minnesotans to produce a more comprehensive measure of the number of jobs in the state.1 Annual average projection employment by industry is estimated by the Minnesota Department of Employment and Economic Development using Quarterly Census of Employment and Wages (QCEW) and Current Employment Statistics (CES) employment data for wage and salary employment estimates. Local Area Unemployment Statistics (LAUS) and American Community Survey (ACS) self-employed data are used to estimate self-employment. Minnesota’s projection employment declined 4.9 percent between 2007 and 2010 before increasing 11.8 percent between 2010 and 2018. The net result is that Minnesota’s projection employment in 2018 was 6.4 percent higher than the 2007 pre-recession peak. 2

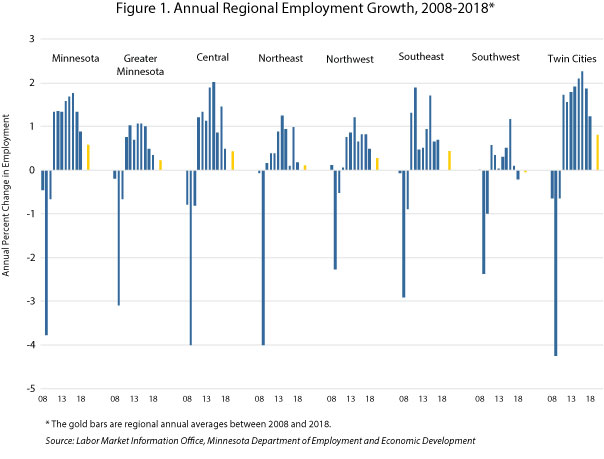

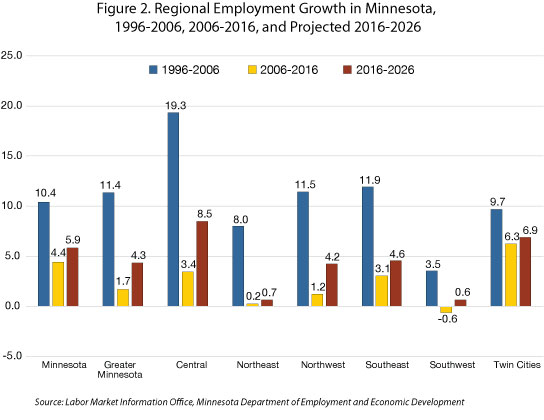

Minnesota’s economy is projected to add 181,600 jobs between 2016 and 2026 3, pushing total jobs in Minnesota to nearly 3.3 million by 2026. Job growth is expected to be uneven across the state much like the uneven regional job growth since the Great Recession (see Figure 1). Greater Minnesota’s job growth rate topped job growth in the Twin Cities Metro area half of the time during the 1991 – 2001 economic expansion. In contrast, job growth in the Twin Cities has been higher than Greater Minnesota’s job growth in every year since 2010.

All regions felt the full effect of the Great Recession in 2009 as job numbers declined across the state, but the Twin Cities, Central, and Northeast regions experienced the steepest declines. Job recovery over the last 10 years has been strongest in the Twin Cities, Central, and Southeast Minnesota. Northwest Minnesota has experienced moderate job growth while Northeast and Southwest Minnesota, the two regions with the oldest and slowest growing labor forces, have lagged behind in job growth.

All regions have more employment in 2018 than in 2007, but the 6.4 percent statewide employment gain from 2007 to 2018 was more than doubled in the Twin Cities where employment was up 15.4 percent. Job growth in the other regions over the same time period were Central (10.9 percent), Southeast (8.4 percent), Northwest (5.8 percent), Northeast (5.4 percent), and Southwest (3.6 percent).4

The seven-county Twin Cities Metro area is projected to add 127,900 jobs, an increase of 6.9 percent over the next decade (2016 – 2026). The metro area is anticipated to generate 70 percent of statewide job growth during the decade which will be slightly lower than the 80 percent of statewide 2006 – 2016 job growth that occurred in the metro area. Unlike other regions in the state the metro area is expected to experience enough labor force growth to support a moderate rate of job growth. Increased commuting from western Wisconsin and from Central and Southeast Minnesota is also expected to support job growth in the metro area. Service-providing industries will create all of the projected job growth as goods-producing employment growth is expected slip despite construction job growth. Job loss in the Manufacturing and Natural Resources and Mining industries will offset climbing Construction employment. Educational and Health Services jobs will account for more than half of the projected job growth followed by jobs in the Professional and Business Services industry.

Central Minnesota, centered by St. Cloud and with five counties adjacent to the Twin Cities Metro area, was the state’s job growth leader from the 1970s to the Great Recession, but its rate of growth has tailed off since then. Central Minnesota had the smallest number of wage and salary jobs at the beginning of the 1970s but passed up every other region except for the Twin Cities seven-county region over the last four decades. Job growth during the last decade was 3.4 percent but is expected to climb to 8.5 percent over the next. Residential development spillover from the Twin Cities along the I-94 corridor between the St. Cloud area and the area up I-35 north of the Twin Cities is expected to pick up but not at the boom pace experienced before the Great Recession. The 26,600 projected jobs will be concentrated in service-providing industries, but almost 6,000 of the projected job gain will be in goods-producing industries with 4,000 Construction jobs added and 2,300 Manufacturing jobs.

Southeast Minnesota employment is projected to grow slightly slower than statewide employment, expanding 4.6 percent by 2026 and adding 12,500 jobs. During the previous decade Southeast Minnesota added 8,200 jobs, an increase of 3.1 percent. Service-providing industries are anticipated to be the source of 87 percent of job growth. Goods-producing job additions will be split between Natural Resources (farming) and Manufacturing industries. Healthcare and Social Assistance industries are expected to add 7,300 positions or roughly 58 percent of all job growth by 2026. Healthcare and Social Assistance employment accounted for 22.7 percent of the total regional employment in 2016. That share is expect to increase to 24.2 percent by 2026. No other regional employment base is as concentrated in Healthcare and Social Assistance as in Southeast Minnesota. By 2026 the statewide share of jobs accounted for by Healthcare and Social Assistance jobs is expected to reach 16.5 percent. Spillover growth from the Twin Cities metro area into Goodhue and Rice counties combined with strong healthcare related job expansion in Rochester will drive the region’s employment growth.

Northwest Minnesota is projected to add 11,000 jobs by 2026, a 4.2 percent gain. During the 1996-2006 decade this region had the third fastest job growth rate but slipped to fourth fastest from 2006 to 2016. During this period the region’s employment expanded by 1.2 percent or 3,300 jobs. Just under 40 percent of projected job growth is expected to be generated by goods-producing industries as the Natural Resource and Mining, Construction, and Manufacturing industries are each projected to add more than 1,000 workers. The gain in Natural Resource and Mining jobs is expected to be generated primarily by expanding large-size farming operations which boost hiring by crop and livestock production industries. Manufacturing jobs will grow faster here than anywhere else in the state, climbing 6.6 percent by 2026 compared to the expected 1.7 percent decline statewide. Educational and Health Services industries will, as is true for all regions, account for the largest percent of projected job gain. The 3,400 Educational and Health Services projected employment expansion over the next 10 years in the region will accounted for 30 percent of all job growth.

Northeast Minnesota has the smallest employment base of all the regions with its regional job total accounting for 8.5 percent of statewide jobs in 2016. The region’s share of statewide employment is projected to decline to 8.2 percent over the next 10 years as job growth in the region is expected to lag significantly behind statewide job growth. In the past this region was heavily dependent on tourism, taconite mining, and timber-related activity for job generation. Tourism is still a leading job generator, but the most important sector these days is the Education and Healthcare sector which accounted for one-third of all employment in 2016. This sector is expected to add 3,600 jobs by 2026, but job reductions in Construction, Manufacturing, Trade, Transportation, and Utilities, Information, and Public Administration will drag the region’s overall employment growth down. Northeast Minnesota along with Southwest Minnesota has the oldest workforce which translates into having the lowest projected regional labor force growth over the next 10 years. The net result is that employment in this region is projected to increase by only 1,700 jobs over the decade.

Southwest Minnesota is projected to have the slowest job growth in the state, growing by 0.6 percent or 1,900 jobs. That will be an increase over 2006 – 2016 when the region lost 0.6 percent of its employment base. Southwest and Northeast Minnesota employment is essentially expected to remain flat over the next 10 year. Southwest Minnesota has three strikes against it when it comes to future job growth. The region’s job rebound since the recession has been the weakest. Regional unemployment has historically been below the statewide rate which reduces potential job growth from falling unemployment. Finally, the region’s workforce is one of the oldest, suggesting that unless immigration picks up sustainably, labor force growth will be more limited than in the other regions. The Educational and Health Services sector will add the most jobs along with Natural Resources and Mining. The uptick in Natural Resources and Mining jobs is mainly increased wage and salary employment hiring on farms as farm consolidation increases farm size. Larger farm size mean fewer self-employed farmers but more wage and salary farm workers.

The distribution of projected regional occupational employment growth across the 10 major occupational groups is shown in Table 1. Unlike in the past, a number of major occupational groups are expected to decrease in employment as tight job markets restrict employment growth especially in lower paying industries. Service occupations, which include about 100 occupations ranging from bailiffs, firefighters, and police officers to janitors, bartenders, child care workers, and nursing assistants, are projected to add the most jobs in all regions except Southeast and Southwest Minnesota.

| Table 1. Projected Regional Employment Growth by Major Occupational Group, 2016-2026 | |||||||

|---|---|---|---|---|---|---|---|

| Occupational Group | Central Minnesota | Northeast Minnesota | Northwest Minnesota | Southeast Minnesota | Southwest Minnesota | Twin Cities Minnesota | Minnesota |

| Total | 26,600 | 1,700 | 11,000 | 12,500 | 1,900 | 127,900 | 181,600 |

| Management, Business and Financial | 1,900 | 400 | 1,400 | 1,200 | 100 | 22,600 | 28,200 |

| Professional and Related | 5,300 | 1,800 | 2,300 | 4,700 | 1,000 | 45,300 | 60,700 |

| Service | 8,400 | 2,000 | 3,300 | 3,100 | 100 | 52,000 | 68,500 |

| Sales and Related | 2,100 | -1,100 | -100 | 200 | -300 | 3,500 | 5,600 |

| Office and Administrative Support | 1,300 | -700 | -300 | -300 | -1,200 | -1,100 | -3,200 |

| Farming, Fishing, and Forestry | -200 | -100 | 600 | 500 | 800 | -200 | 1,400 |

| Construction and Extraction | 3,000 | 0 | 1,100 | 200 | 600 | 5,400 | 10,000 |

| Installation, Maintenance, and Repair | 1,300 | 300 | 900 | 500 | 500 | 2,600 | 6,700 |

| Production | 1,400 | -600 | 1,300 | 1,000 | -500 | -6,000 | -4,500 |

| Transportation and Material Moving | 2100 | -300 | 600 | 1400 | 700 | 3800 | 8200 |

| Source: Labor Market Information Office, Department of Employment and Economic Development | |||||||

Professional and related occupations will add the most jobs in Southeast Minnesota from robust health-care related job growth in Rochester. The tight job market over the next 10 years in Southwest Minnesota is expected to limit job growth in lower-paid services job occupations. Professional and related occupations will also add the most jobs in Southwest Minnesota as a result. Higher spending on personal care, restaurants, casinos, and healthcare, especially by Minnesota's expanding senior citizen population, translates into higher demand for personal care aides, home health aides, food preparation workers, hairdressers, gaming supervisors, and amusement attendants.

Professional and related jobs are expected to add the second-largest block of new jobs in the other four regions. The percent of job growth accounted for by professional and related jobs, second in pay rate to management, business, and financial jobs, will be highest in Northeast and Southwest Minnesota. Professional occupations include mostly information technology jobs, educational occupations, and healthcare practitioner and technical jobs. Professional and related occupations are spread across 250 occupations.

Roughly 70 percent of projected job growth statewide is expected to be in either service or professional occupations with the percent varying across regions. Occupations in these two major occupational groups currently account for 38 to 47 percent of total regional employment, with the Southwest and Central regions on the low end and the Northeast and Southeast regions on the high end. Service and professional jobs accounted for 47 percent of all jobs statewide in 2016 and are projected to account for 49 percent in 10 years. The share of jobs in service and professional jobs is expected to increase the fastest in the Twin Cities and Northeast regions during the next decade.

All but two major occupational groups will experience growing job numbers statewide over the next 10 years. The two occupational groups expected to experience declining employment statewide are production and office and administrative support. Jobs in manufacturing are expected to decline in half of the regions with most of the decline in the Twin Cities area. Office and administrative jobs are projected to decrease in all regions except Central Minnesota. The fastest growing occupational group varies across the regions with farming, fishing, and forestry jobs projected to be the fastest growing in the Northwest, Southeast, and Southwest regions. Self-employed farmers are included in the management, business, and financial occupational group whereas wage and salary farm workers are tallied up in the farm, fishing, and forestry occupational group. The number of self-employed farmers are projected to decline across regions but wage and salary farm workers are expected to increase. The net result is employment in the farming, fishing, and forestry occupational group, which is relatively small in numbers in all regions, is projected to be the fastest growing group in the regions mentioned above.

Personal care and service occupations will be the fastest growing jobs in the Central and Twin Cities regions. Both of these regions are expected to have high population growth relative to the other regions, leading to higher demand for a variety of personal care and service workers. Healthcare support occupations are anticipated to be the fastest growing occupational group in Northeast Minnesota.

Production occupations, such as machinists, team assemblers, welders, or job printer, accounted for 7.3 percent of all employment in Minnesota in 2016 with Central Minnesota having the highest manufacturing share, 9.9 percent, and Northeast Minnesota having the lowest, 4.9 percent. The statewide manufacturing share of employment is projected to fall to 6.7 percent by 2026 from 7.3 percent in 2016. Manufacturing's share of employment is also expected to decline in all regions except in Northwest Minnesota where the percent of jobs in manufacturing are projected to inch up to 8.4 percent in 2026 from 8.2 percent in 2016.

Occupational job openings generated by employment growth have always been only one minor piece of the future job openings puzzle. Many more occupational openings are generated each year by workers either exiting the labor force (retiring, for example) or transferring to another job that involves a different occupation. These openings, also known as separations, are the primary driver of future occupational job openings and give a broader measure of the future job availability by occupation.5

Roughly 4.8 percent of Minnesota workers are expected to exit the labor force on average each year between 2016 and 2026. Another 6.3 percent of workers will transfer occupations each year. Together, openings from labor force exits and occupational transfers are projected to average 343,000 each year or 20 times the annual average of openings projected from employment growth.

Table 2 displays the regional distribution of projected labor market exit and occupational transfer (separation) openings across major occupational groups from 2016 through 2026. The distribution of projected separation openings is more evenly spread across all occupations when compared to the distribution of employment growth openings, since separation openings are based on each region's 2026 employment base rather than projected employment growth. Job growth is projected to be concentrated in a select number of industries that have particular occupational needs, whereas labor market exits and occupational transfer openings will be happening across all industries and occupations.

| Table 2. Projected Replacement Openings by Major Occupational Group, 2016-2026 | |||||||

|---|---|---|---|---|---|---|---|

| Occupational Group | Central Minnesota | Northeast Minnesota | Northwest Minnesota | Southeast Minnesota | Southwest Minnesota | Twin Cities Minnesota | Minnesota |

| Labor Force Exit Openings | |||||||

| Total | 157,500 | 78,200 | 130,800 | 131,000 | 103,600 | 882,000 | 1,480,000 |

| Management, Business and Financial | 11,800 | 4,500 | 13,400 | 12,000 | 12,900 | 76,400 | 130,500 |

| Professional and Related | 19,900 | 11,700 | 17,600 | 20,800 | 12,700 | 138,700 | 223,000 |

| Service | 49,600 | 28,800 | 39,700 | 38,900 | 29,500 | 279,200 | 463,900 |

| Sales and Related | 20,300 | 9,200 | 16,000 | 14,800 | 12,200 | 99,700 | 171,500 |

| Office and Administrative Support | 20,100 | 11,000 | 17,100 | 17,600 | 13,000 | 138,100 | 215,600 |

| Farming, Fishing, and Forestry | 1,000 | 400 | 1,400 | 900 | 1,600 | 1,100 | 6,300 |

| Construction and Extraction | 6,400 | 2,600 | 4,600 | 3,300 | 3,600 | 23,100 | 43,800 |

| Installation, Maintenance, and Repair | 4,400 | 2,600 | 3,600 | 3,200 | 2,700 | 20,300 | 37,000 |

| Production | 12,600 | 3,100 | 8,900 | 10,800 | 7,800 | 49,600 | 92,700 |

| Transportation and Material Moving | 11,300 | 4,300 | 8,400 | 8,800 | 7,500 | 55,800 | 95,800 |

| Occupational Transfer Openings | |||||||

| Total | 201,000 | 99,200 | 163,900 | 166,600 | 128,500 | 1,193,200 | 1,950,300 |

| Management, Business and Financial | 14,800 | 7,600 | 13,600 | 15,000 | 11,100 | 155,200 | 216,400 |

| Professional and Related | 24,300 | 14,800 | 22,000 | 25,700 | 15,700 | 196,500 | 300,800 |

| Service | 52,400 | 31,000 | 43,000 | 42,300 | 32,000 | 298,100 | 497,700 |

| Sales and Related | 25,700 | 11,300 | 19,900 | 18,700 | 15,400 | 138,700 | 228,900 |

| Office and Administrative Support | 23,500 | 12,900 | 19,500 | 20,500 | 14,700 | 165,100 | 254,800 |

| Farming, Fishing, and Forestry | 3,100 | 1,000 | 4,200 | 2,700 | 4,700 | 3,100 | 18,700 |

| Construction and Extraction | 11,700 | 4,800 | 8,300 | 6,000 | 6,400 | 42,300 | 79,900 |

| Installation, Maintenance, and Repair | 7,600 | 4,500 | 6,200 | 5,400 | 4,700 | 34,300 | 62,800 |

| Production | 22,400 | 5,300 | 15,900 | 18,400 | 13,700 | 82,300 | 158,300 |

| Transportation and Material Moving | 15,400 | 6,000 | 11,400 | 11,900 | 10,200 | 77,600 | 132,100 |

| Source: Labor Market Information Office, Department of Employment and Economic Development | |||||||

Workers will be needed in the future to fill openings in all occupations, even in declining occupations. The 3.1 million jobs in Minnesota in 2016 were spread across 812 occupations of which 162 or 20 percent are projected to shed jobs over the next 10 years. About 683,000 workers were employed in these shrinking occupations in 2016. Roughly 33,000 positions in these shrinking occupations will disappear by 2026.

Demand for workers with the right skills for these shrinking occupations will still exist as labor market exits and occupational transfer openings will average nearly 74,000 per year across the 162 occupations. For example, team assemblers are anticipated to decline on average by 320 jobs each year, but each year there will be 930 labor force exits and 1,580 occupational transfer openings for team assemblers, creating demand for 2,510 workers.

Table 3 shows each region's 2016 employment base, 2016 – 2026 projected job growth, and 2016 – 2026 projected separation openings. Job openings in slower growing regions such as Southwest Minnesota are more likely to arise from replacement needs than from employment growth. There will be more than 1,000 separation openings in Southwest Minnesota for every job opening created by employment growth. The replacement ratio is lowest in Central Minnesota, 13 separation openings per new job opening, since employment growth in that region of the state is expected to be strong.

| Table 3. Minnesota Projected Regional Employment Growth and Replacement Openings, 2016-2026 | ||||||

|---|---|---|---|---|---|---|

| Location | 2016 Employment | 2026 Employment | 2016 - 2026 | 2016 - 2026 | 2016 - 2026 | 2016 - 2026 |

| Employment Growth Openings | Labor Force Exit Openings | Occupational Transfer Openings | Total Openings | |||

| Minnesota | 3,097,300 | 3,278,900 | 181,600 | 1,480,000 | 1,950,300 | 3,611,900 |

| Central Minnesota | 310,400 | 337,100 | 26,700 | 157,500 | 201,000 | 385,100 |

| Northeast Minnesota | 160,300 | 162,100 | 1,800 | 78,200 | 99,200 | 179,100 |

| Northwest Minnesota | 262,800 | 273,700 | 10,900 | 130,800 | 163,900 | 305,600 |

| Southeast Minnesota | 273,700 | 286,200 | 12,500 | 131,000 | 166,600 | 310,100 |

| Southwest Minnesota | 211,600 | 213,500 | 1,900 | 103,600 | 128,500 | 234,000 |

| Twin Cities Metro | 1,878,400 | 2,006,300 | 127,900 | 882,000 | 1,193,200 | 2,203,100 |

| Source: Labor Market Information Office, Department of Employment and Economic Development | ||||||

Long-term projections are updated every two years to keep up with constantly changing economic trends. Detailed industry and occupational employment projections, along with detailed separation openings projections, for Minnesota and for the state's six planning regions are available.

1Minnesota's 2016 annual average projection employment was estimated at 3,097,300. By comparison, the 2016 annual average job total for QCEW, CES, and LAUS were respectively 2,881,100, 2,893,900, and 2,916,400.

2Unless otherwise stated the employment used in this article refers to projection employment.

310-year projections for the state and the six planning regions are carried out every two years. The current projections are for 2016 – 2026. Updated 2018 – 2028 projections will be published in April 2020. For more information on statewide 2016 – 2026 projections.

42018 employment estimates are preliminary estimates as self-employment estimates are based on ACS data which were released in September 2019.

5A new methodology for projecting future separations openings has been utilized in the 2016-2026 projections. More detailed information on the new methodology is available at New Separations Methodology and Its Impact on Occupational Employment Projections or What’s behind occupational separations?.