by Anthony Schaffhauser

April 2024

Four of the so-called "Drive for 5" grant recipients are in Northwest Minnesota, and one of the five career areas is the trades.

There are 41 trades occupations on DEED's "Occupations in Demand" (OID) list for Northwest Minnesota. Table 1 features the top 15 of these. All but two have a current demand indicator of four or five stars, which indicates the occupations' current demand ranking. Occupations with five stars are ranked in the top quintile (top 20%) in highest current demand, four stars are ranked in the next quintile. The two that feature three-star occupations are the highest ranked trades of the third quintile, meaning they just missed the cut-off for four stars. Cutting the list off at the top 15 is arbitrary, but it provides a nice table size to feature the trades that are currently in the highest demand.

| Table 1: Top 15 Trades Occupations in Demand in Northwest Minnesota | |||||

|---|---|---|---|---|---|

| Job Title | Current Demand Indicator | Employment | Median Hourly Wage | Education Requirements | Training Requirements |

| Maintenance and Repair Workers, General | Five Stars | 2760 | $23.37 | High school diploma or equivalent | Short term on the job training |

| Construction Laborers | Five Stars | 2380 | $22.36 | High school diploma or equivalent | Short term on the job training |

| Carpenters | Five Stars | 1630 | $25.01 | High school diploma or equivalent | Long term on the job training |

| Electricians | Five Stars | 1110 | $30.22 | Postsecondary non-degree award | Long term on the job training |

| First-Line Supervisors of Construction Trades and Extraction Workers | Five Stars | 940 | $37.97 | High school diploma or equivalent | Long term on the job training |

| Operating Engineers and Other Construction Equipment Operators | Five Stars | 840 | $29.65 | High school diploma or equivalent | Short term on the job training |

| First-Line Supervisors of Mechanics, Installers, and Repairers | Five Stars | 790 | $34.31 | High school diploma or equivalent | Long term on the job training |

| Plumbers, Pipefitters, and Steamfitters | Five Stars | 690 | $28.92 | High school diploma or equivalent | Short term on the job training |

| Highway Maintenance Workers | Four Stars | 800 | $27.75 | High school diploma or equivalent | Short term on the job training |

| Cement Masons and Concrete Finishers | Four Stars | 520 | $29.41 | High school diploma or equivalent | Short term on the job training |

| Telecommunications Line Installers and Repairers | Four Stars | 260 | $25.57 | High school diploma or equivalent | Short term on the job training |

| Heating, Air Conditioning, and Refrigeration Mechanics and Installers | Four Stars | 300 | $30.31 | Postsecondary non-degree award | Unavailable |

| Electrical Power-Line Installers and Repairers | Four Stars | 280 | $47.58 | High school diploma or equivalent | Long term on the job training |

| Mobile Heavy Equipment Mechanics, Except Engines | Three Stars | 170 | $30.75 | Postsecondary non-degree award | Short term on the job training |

| Telecommunications Equipment Installers and Repairers, Except Line Installers | Three Stars | 180 | $29.41 | High school diploma or equivalent | Short term on the job training |

| Source: DEED Occupations in Demand Tool | |||||

Note that all occupations that make the OID list can be considered "in demand," but many of those ranked lower include those with a small number of jobs in the region, and thereby have fewer job vacancies. Unemployment Insurance weekly claims for the occupation also pulls down the rank, as does seasonal or temporary vacancies because these indicate passing demand. These factors are important for trades occupations that mostly work in the construction industry, where employment fluctuates seasonally. For example, Paving, Surfacing, and Tamping Equipment Operators is two stars largely because paving can only be done in warmer months, and this is reflected in Unemployment Insurance claims and seasonal job vacancies.

Over half of all 41 Northwest trades occupations in demand pay a median wage higher than $61,000 per year. Compared to a median wage of $45,074 for all occupations in the Northwest, that is at least 35% higher pay than the median for all occupations. Over 75% of trades occupations in demand pay a median wage higher than $53,000 per year. That is at least 18% higher pay than the overall median. There are only three of the 41 trades occupations in demand that pay a lower median wage than all occupations in Northwest Minnesota, and these three are "Helpers" positions for tradespeople that could provide an entry point into the higher-paid trades. These are Helpers for Electricians, Pipelayers, Plumbers, Pipefitters and Steamfitters, and for Installation, Maintenance, and Repair Workers.

As commonly understood, trades occupations do not require a college degree. However, four of the 41 Northwest Minnesota trades occupations in demand require a postsecondary non-degree award (certificate or diploma). The remaining 37 require no more than a high school education. This means that many working in these occupations have not completed a college trades program. However, new entrants into the trades may complete a college program in order to get hired. Skill is certainly required for these occupations, and it is rewarded. Note that all the occupations featured in Table 1 that pay over $30 per hour require long term on-the-job training or a postsecondary non-degree award.

To provide more context on pay, consider that all Northwest Minnesota jobs requiring no more than a high school diploma pay a median hourly wage of $20.09. All jobs requiring a postsecondary vocational award pay a median wage of $23.59. Jobs requiring a bachelor's degree pay a median wage of $31.91, which is higher than most trades, but not all, and not by a huge margin considering the time and cost to get a bachelor's degree (see "The Path to Career Success" for Northwest wages by education level).

As mentioned, most trades employment is in the Construction industry sector. However, it is worth noting that there are significant numbers of trades workers in other industries. Maintenance & Repair Workers, General are in every sector that has buildings. Even specialized trades work in other industries. For example, nearly 6% of Minnesota electricians work in Manufacturing to maintain, repair, and upgrade plant and equipment. Also 5.5% of Minnesota carpenters work in manufacturing, for example, making cabinets, manufactured homes, and windows and doors.

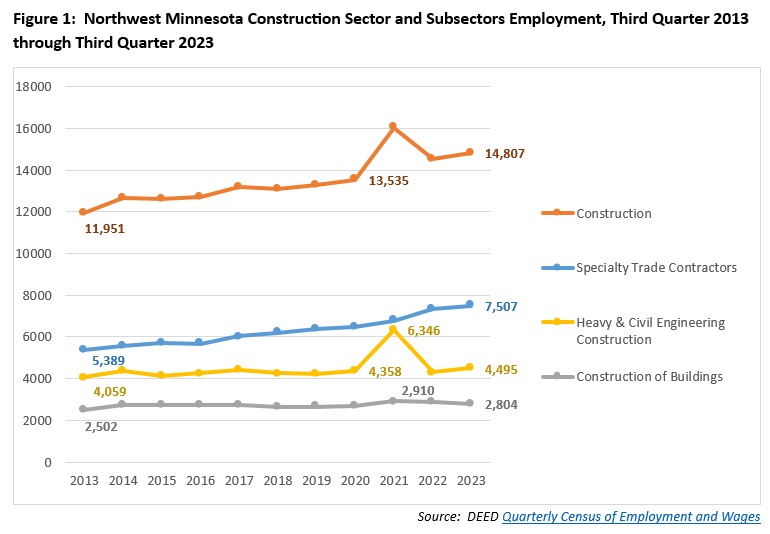

That said, overall demand for trades workers is driven by the construction industry, and construction in the Northwest has been booming (Figure 1). Employment in the entire construction sector grew nearly 24% over the decade from 2013 to 2023, adding 2,856 jobs. By comparison, total Northwest Minnesota Employment grew 4.9% over this time. More recently, construction employment grew 11.3% from third quarter 2019 to third quarter 2023 – much faster than total job growth of just 0.6% over this time.

Construction employment spiked in 2021 when the industry Utility System Construction added 2,028 jobs, going from 1,419 jobs in third quarter 2020 to 3,447 in third quarter 2021, and back to 1,435 jobs in 2023. This Utility System Construction is shown in the Heavy and Civil Engineering subsector and Construction sector in Figure 1. The employment spike mostly represents a temporary influx of workers for a project that had only a slight lasting impact on employment and regional demand for trades workers. However, skipping over 2021, Utility System Construction employment increased 34.9% over the decade from third quarter 2013 to third quarter 2023, adding 371 jobs. The industry growth described above also excludes the 2021 employment spike. Utility System Construction contributed the majority of the Heavy and Civil Engineering Construction subsector's 463 job increase or 10.7% growth over the decade. Since 2019, however, Utility System Construction added a lesser 110 jobs of the 268 job increase in the entire Heavy and Civil Engineering Construction subsector. Thus, Highway, Street, and Bridge Construction and Other Heavy and Civil Engineering Construction have played a larger role in job growth since 2019.

The fastest growing subsector is Specialty Trade Contractors with a whopping 39.3% growth over the decade and 17.2% since 2019. The Construction of Buildings subsector added 302 jobs or 12.1% growth over the decade. While this is faster than Heavy and Civil Engineering Construction over the decade, since 2019 Heavy and Civil Engineering Construction grew 6.3%, outpacing Construction of Buildings' 5.2% growth.

Every construction subsector grew over the decade, and each subsector's growth accelerated since 2019. Furthermore, this growth is much faster than total job growth in the Northwest. Thus, the Northwest Minnesota Construction sector is booming, and the growth is throughout the construction subsectors.

DEED's Employment Outlook projects the construction industry to grow 4.3% from 2020 to 2030. It has already grown over 9% from third quarter 2020 to third quarter 2023. "Construction has far exceeded its pre-pandemic trend..." Projections are based on prior trends, so we will have to await the 2022 to 2032 projections to begin to incorporate the trend since 2020. In the meantime, the occupational projections are still enlightening because they include not only the openings from growth, but also the openings from the need to backfill for labor force exits, mostly retirements, as well as for occupational transfers from those switching occupations, for example being promoted to a supervisor occupation. Table 2 includes all the trades with projected 2030 employment of at least 150 in Northwest Minnesota, as well as the total for all occupations in Northwest Minnesota.

| Table 2: Northwest Minnesota 2020 to 2030 Employment Projections for Selected Trades Occupations | |||||||

|---|---|---|---|---|---|---|---|

| Occupation Title | Estimated 2020 Employment | Projected 2023 Employment | Percent Change | Total Change | Labor Force Exit Openings | Occupational Transfer Openings | Total Hires |

| Total, All Occupations | 250,722 | 263,441 | 5.1 | 12,719 | 115,886 | 168,024 | 296,629 |

| Carpenters | 2,261 | 2,338 | 3.4 | 77 | 671 | 1,434 | 2,182 |

| Maintenance and Repair Workers, General | 2,022 | 2,163 | 7.0 | 141 | 737 | 1,221 | 2,099 |

| Construction Laborers | 1,795 | 1,968 | 9.6 | 173 | 556 | 1,271 | 2,000 |

| Electricians | 1,225 | 1,294 | 5.6 | 69 | 366 | 925 | 1,360 |

| Operating Engineers and Other Construction Equipment Operators | 969 | 1,030 | 6.3 | 61 | 327 | 717 | 1,105 |

| Highway Maintenance Workers | 858 | 875 | 2.0 | 17 | 340 | 544 | 901 |

| Plumbers, Pipefitters, and Steamfitters | 831 | 860 | 3.5 | 29 | 247 | 608 | 884 |

| First-Line Supervisors of Construction Trades | 675 | 713 | 5.6 | 38 | 196 | 449 | 683 |

| First-Line Supervisors of Mechanics, Installers, and Repairers | 591 | 605 | 2.4 | 14 | 173 | 356 | 543 |

| Painters, Construction and Maintenance | 554 | 588 | 6.1 | 34 | 173 | 317 | 524 |

| Electrical Power-Line Installers and Repairers | 468 | 469 | 0.2 | 1 | 88 | 315 | 404 |

| Heating, Air Conditioning, and Refrigeration Mechanics and Installers | 425 | 431 | 1.4 | 6 | 110 | 292 | 408 |

| Cement Masons and Concrete Finishers | 424 | 427 | 0.7 | 3 | 103 | 280 | 386 |

| Mobile Heavy Equip. Mechanics, Except. Engines | 363 | 396 | 9.1 | 33 | 113 | 256 | 402 |

| Telecommunications Equip. Installers and Repair | 386 | 369 | -4.4 | -17 | 131 | 289 | 403 |

| Other Installation, Maintenance and Repair Work | 339 | 346 | 2.1 | 7 | 121 | 229 | 357 |

| Telecommunications Line Installers and Repairers | 232 | 260 | 12.1 | 28 | 55 | 208 | 291 |

| Fence Erectors | 246 | 248 | 0.8 | 2 | 59 | 187 | 248 |

| Brickmasons and Blockmasons | 190 | 184 | -3.2 | -6 | 60 | 115 | 169 |

| Source: DEED Employment Outlook Tool | |||||||

Taking into account all trades occupations for which projections are available, Northwest Minnesota employers will need to hire 16,078 trades workers from 2020 to 2030, which is 5.4% of the 296,629 total hires in all occupations. Table 2 clearly shows that the replacement hires - labor force exit openings and occupational transfer openings - far exceed the net growth - total change - in the occupations. Thus, even if the construction boom were to end tomorrow, and there is no sign that it will, the demand for trades workers is expected to be strong into the future.

Workers tend to leave the trades for jobs in other occupations as they age. Northwest Minnesota's construction industry is staffed with 65% workers under age 45, compared to 57% under age 45 in all industries (DEED Quarterly Employment Demographics). This will drive demand for replacement trades workers.

Furthermore, both growth and new skills for trades workers will be driven by Energy Efficiency and Green Construction. Energy Efficiency and Green Construction will boost and modify HVAC and Refrigeration, Insulation, and Weatherization, and Maintenance and Repair trades. Additionally, Green Construction will boost and modify Cement Masons and Concrete Finishers, Carpenters, Electricians, Hazardous Materials Removal, Equipment Operators, Pipefitters and Steam Fitters, Plumbers, Roofers, Sheet Metal, and Structural Metal trades.

The younger construction workforce is testament to the physical demands of the work. Trades workers are paid so well not only for their skills, but also for their vigor. Another challenge is that much of the work is seasonal. Construction employment peaks in the third quarter because of its seasonality, so Figure 1 above represents the highest quarterly employment of the year. The Northwest's first quarter 2023 construction employment was 29% lower than third quarter. In addition to strength and skill, trades workers need to be good money managers to put away the funds to get through the off season.

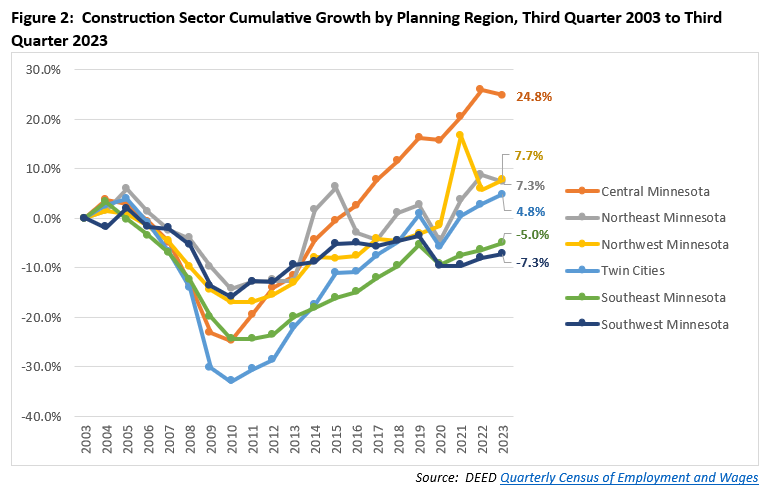

Construction can also be economically cyclical. Construction employment can turn down sharply with a recession. While this was not the case in 2020 and 2021, construction was the epicenter of the Great Recession that began in December 2007. The Northwest Minnesota region, however, did not take as big a hit as Central Minnesota, Southeast Minnesota, or the Twin Cities Region. Figure 2 displays construction employment over the past 20 years, starting with 2003 at zero and tracking cumulative growth, that is, the change from 2003 over time.

While Northwest Minnesota had the third smallest construction employment drop in the aftermath of the Great Recession, note that Northwest construction employment did not get back to the 2003 level until 2011. Also, the maximum drop in construction employment in the Northwest was 17% below 2003 level, while the maximum employment drop for all industries was 0.1% below the 2003 level. While neither the Great Recession nor the pandemic recession are considered typical, construction is known as a cyclical industry. Construction spending drops when business activity contracts, more so than spending on healthcare, education, utilities, and food. Those hardy enough to choose a career in the trades may also need the resiliency to retrain for another career either in response to the physical demands as they age or in response to a recession.