By Tim O'Neill

June 2013

The manufacturing sector in northwestern Minnesota has made impressive gains since the end of the Great Recession.

The Great Recession had a significant impact on manufacturing in Minnesota. Between the third quarters of 2006 and 2009, Minnesota manufacturing employment plummeted by 15 percent, losing 52,437 jobs statewide. That compares with a 4.6 percent employment decline across all industries in the state during the same period.

The 26 counties of northwestern Minnesota were especially hard hit by the recession, with manufacturing employment falling 16.5 percent during the three-year period. Similar to Minnesota as a whole, this decline was much steeper than all industries in the region, which saw a 2.9 percent decline.

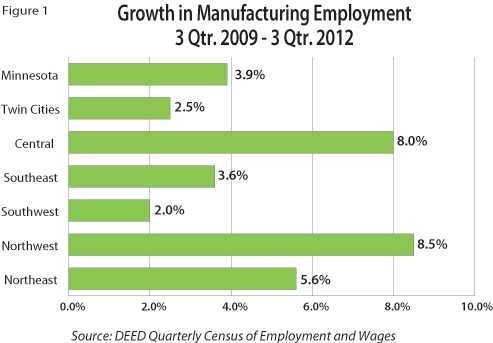

With the end of the recession, however, manufacturing has seen a significant recovery in Minnesota and especially in the northwestern region. Between the third quarters of 2009 and 2012, statewide manufacturing employment grew by 3.9 percent. Northwestern Minnesota, however, saw an increase of 8.5 percent, leading all regions of the state (see Figure 1).

In the third quarter of 2012, northwestern Minnesota had 871 manufacturing establishments supplying 27,808 jobs. In terms of total jobs, the manufacturing sector is behind only health care and social assistance and retail trade in northwestern Minnesota, accounting for about 13 percent of the region's total employment. Manufacturing makes up about 11.7 percent of Minnesota's total employment, so the importance of the industry is more pronounced in the northwest.

Another way to gauge the importance of manufacturing within the state and region is to analyze location quotients (LQ). An LQ is simply a measure of how concentrated a particular industry is within a local economy compared with the national economy. For example, an LQ of 1.0 indicates that a local economy has the same percentage of employment for a particular industry as the nation. An LQ of 2.0 indicates that a local economy has twice the percentage of employment for a particular industry as the nation.

In northwestern Minnesota, the LQ of 1.5 for manufacturing indicates a high concentration of jobs in that sector. Focusing on particular subsectors reveals even higher concentrations. For example, wood product manufacturing has an LQ of 6.2, food manufacturing has an LQ of 2.5, and both transportation equipment manufacturing and machinery manufacturing have LQs of 1.9. With such high concentrations of employment, the growth of manufacturing within northwestern Minnesota will greatly benefit the region's economy and population.

Of the 17 manufacturing subsectors in the northwestern region, the largest is food manufacturing, with 98 firms supplying 5,879 jobs. The next four largest subsectors are transportation equipment manufacturing (36 firms, 4,455 jobs), fabricated metal product manufacturing (160 firms, 4,018 jobs), wood product manufacturing (80 firms, 3,345 jobs), and machinery manufacturing (85 firms, 3,289 jobs). More than three-fourths of the region's manufacturing employment is concentrated in these five sectors (see Table 1).

| Northwest Minnesota Manufacturing Employment | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| NAICS Code | NAICS Industry Title | 3Q 2012 Data | 3Q 2009 - 3Q 2012 Employment | ||||||

| Number of Firms | Number of Jobs | Percent of Jobs | Average Annual Wage | Numeric Change | Percent Change | ||||

| 0 | Total, All Industries | 17,366 | 214,471 | 100.0% | $33,124 | 3,702 | 1.8% | ||

| 31 | Manufacturing | 871 | 27,808 | 13.0% | $42,016 | 2,187 | 8.5% | ||

| 311 | Food | 98 | 5,879 | 21.1% | $41,236 | 692 | 13.3% | ||

| 312 | Beverage and Tobacco Product | 10 | 72 | 0.3% | $21,268 | -2 | -2.7% | ||

| 314 | Textile Product Mills | 18 | 378 | 1.4% | $24,960 | 75 | 24.8% | ||

| 315 | Apparel | 6 | 43 | 0.2% | $15,600 | -4 | -8.5% | ||

| 321 | Wood Product | 80 | 3,345 | 12.0% | $40,612 | -597 | -15.1% | ||

| 323 | Printing and Related Support Activities | 60 | 1,404 | 5.0% | $37,024 | 32 | 2.3% | ||

| 325 | Chemical | 16 | 206 | 0.7% | $47,060 | -17 | -7.6% | ||

| 326 | Plastics and Rubber Products | 38 | 805 | 2.9% | $35,984 | 140 | 21.1% | ||

| 327 | Nonmetallic Mineral Product | 53 | 944 | 3.4% | $53,144 | 149 | 18.7% | ||

| 331 | Primary Metal | 13 | 624 | 2.2% | $45,240 | 123 | 24.6% | ||

| 332 | Fabricated Metal Product | 160 | 4,018 | 14.4% | $42,952 | 799 | 24.8% | ||

| 333 | Machinery | 85 | 3,289 | 11.8% | $48,204 | 561 | 20.6% | ||

| 334 | Computer and Electronic Product | 20 | 811 | 2.9% | $48,828 | 126 | 18.4% | ||

| 335 | Electrical Equipment, Appliance and Component | 4 | 45 | 0.2% | $39,260 | 6 | 15.4% | ||

| 336 | Transportation Equipment | 36 | 4,455 | 16.0% | $41,704 | 538 | 13.7% | ||

| 337 | Furniture and Related Product | 73 | 571 | 2.1% | $30,264 | -358 | -38.5% | ||

| 339 | Miscellaneous | 90 | 553 | 2.0% | $28,600 | -50 | -8.3% | ||

| Source: DEED Quarterly Census of Employment and Wages | |||||||||

Except for wood product manufacturing, the top five subsectors in the region witnessed significant growth between 2009 and 2012. Other subsectors showing strong growth include textile product mills (24.8 percent growth), primary metal manufacturing (24.6 percent growth), and plastics and rubber products manufacturing (21.1 percent growth).

In a year-end survey conducted by DEED, 85 percent of Minnesota manufacturers said they expect production levels to increase or stay the same in 2013.1 Long-term industry projections support these findings, with the sector projected to grow 5 percent or 14,198 jobs in Minnesota by 2020. In northwestern Minnesota, the outlook is even stronger. Between 2010 and 2020, industry projections show the manufacturing sector adding 4,238 jobs for a 17 percent increase.

With the resurgence of manufacturing in northwestern Minnesota and optimism for continued growth, demand for workers will only increase. To meet this demand, a number of steps can be implemented, including exposing high school students to careers in manufacturing, increasing collaboration between employers and educational institutions, and expanding on-the-job training.2 These efforts will help students and job seekers find opportunities in manufacturing in northwestern Minnesota and ensure continued regional growth in the sector.

1"Minnesota Manufacturing Business Conditions Survey," Minnesota Department of Employment and Economic Development, 2012.

2Leibert, Alessia. "Hiring Difficulties in Minnesota's Manufacturing Sector: Are There Skills Gaps in Manufacturing?" Minnesota Department of Employment and Economic Development, February 2013.