by Tim O'Neill and Dave Senf

February 2020

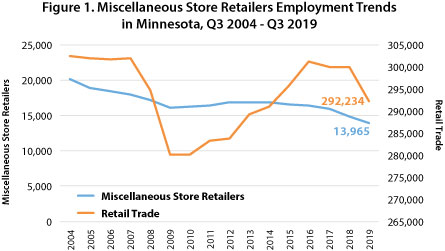

With just under 300,000 jobs, Retail Trade is Minnesota's third largest-employing industry sector. One of every 10 jobs in the state falls in Retail Trade. With 12 in-depth subsectors, however, this broad industry rewards closer looks at any subsector that hooks you. We chose Miscellaneous Store Retailers.

With "miscellaneous" in its title, you can bet on Miscellaneous Store Retailers being a catch-all for retail industries that don't quite fit in with the other 11 subsectors. According to the North American Industrial Classification System (NAICS), this sector includes stores with unique characteristics: florists, art dealers, pet and pet supplies stores, tobacco stores, used book stores, thrift shops, and, among other things, hot tub stores. While certainly unique and varied, Miscellaneous Store Retailers is a relatively small subsector of Retail Trade. As of the third quarter, 2019, there were 2,032 Miscellaneous Store Retailer establishments in the State of Minnesota supplying just under 14,000 jobs. As such, this subsector accounted for under 5 percent of Retail Trade's total employment in the state (see Table 1).

| Industry | Number of Firms | Number of Jobs | Share | Q3 2014 – Q3 2019 Job Change | Average Annual Wage |

|---|---|---|---|---|---|

| Total, All Industries | 180,007 | 2,914,501 | 100.0% | +166,300 (+6.1%) | $57,564 |

| Retail Trade | 13,300 | 292,234 | 10.0% | +1,242 (+0.4%) | $31,148 |

| Miscellaneous Store Retailers | 2,032 | 13,965 | 4.8% | -2,942 (-17.4%) | $26,364 |

| Other Miscellaneous Store Retailers | 1,105 | 6,219 | 44.5% | -840 (-11.9%) | $29,900 |

| Office Supplies, Stationary, and Gift Stores | 392 | 3,749 | 26.8% | -1,642 (-30.5%) | $28,600 |

| Used Merchandise Stores | 287 | 2,849 | 20.4% | -478 (-14.4%) | $20,280 |

| Florists | 248 | 1,147 | 8.2% | +18 (+1.6%) | $15,288 |

| Source: DEED Quarterly Census of Employment and Wages (QCEW) | |||||

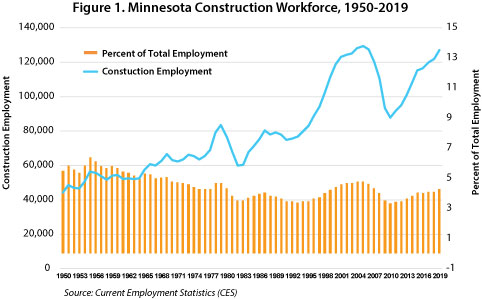

Recent and historical employment trends point to weakness for Miscellaneous Store Retailers in Minnesota. Over the past 15 years, between the third quarters of 2004 and 2019, this subsector lost over 6,200 jobs, contracting by 30.8 percent. For reference, total Retail Trade employment in the state contracted by 3.4 percent between the third quarters of 2004 and 2019 (see Figure 1). Total employment in the state expanded by 11.5 percent during that period of time.

The Great Recession also took place over the span of those 15 years, and Retail Trade employment and Miscellaneous Store Retailers employment contracted by 7.2 percent and 11.1 percent, respectively. More recently, between the third quarters of 2014 and 2019, employment in Miscellaneous Store Retailers has continued to experience some weakness. Office Supplies, Stationary, and Gift Stores has been hit especially hard, losing over 1,600 jobs during these past five years of available employment data. Miscellaneous Stores Retailers, as a whole, lost over 2,900 jobs during this period of time (see Table 1).

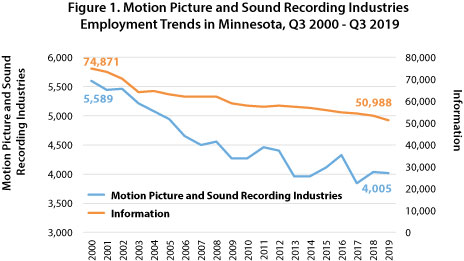

The major industry sector Information is a varied and often misunderstood sector. Essentially this sector comprises establishments engaged in producing and distributing information and cultural products, providing the means to transmit or distribute these products as well as data or communications, and processing data.

Motion Picture and Sound Recording Industries is one of six subsectors in the Information industry. More specifically, establishments in Motion Picture and Sound Recording Industries are involved in the production and distribution of, you guessed it, motion pictures and sound recordings. These processes are typically complex, involving establishments that are tasked with contracting with performers, creating the film or sound content, and providing technical post-production services. Specific in-depth industries in this sector include Motion Picture and Video Production, Motion Picture and Video Distribution, Motion Picture Theaters (except Drive-Ins), Drive-In Motion Picture Theaters, Teleproduction and Other Postproduction Services, Music Publishers, Sound Recording Studios, and Record Production and Distribution. More than 90 percent of Minnesota's employment in Motion Picture and Sound Recording Industries is in Motion Picture and Video Industries (mainly movie theaters) with less than 10 percent in Sound Recording Industries.

In the State of Minnesota there were 362 Motion Picture and Sound Recording Industries establishments supplying just over 4,000 jobs during the third quarter of 2019. As such, this industry is relatively small, accounting for about 8 percent of the state's total Information employment which itself only accounts for about 2 percent of the state's total employment (see Table 1).

| Industry | Number of Firms | Number of Jobs | Share of Total Jobs | Q3 2014 – Q3 2019 Job Change | Average Annual Wage |

|---|---|---|---|---|---|

| Total, All Industries | 180,007 | 2,914,501 | 100.0% | 166,300 (6.1%) | $57,564 |

| Information | 4,261 | 50,988 | 1.7% | -5,781 (-10.2%) | $76,128 |

| Publishing Industries (except Internet) | 1,160 | 19,664 | 38.6% | -1,199 (-5.7%) | $82,784 |

| Telecommunications | 742 | 11,405 | 22.4% | -2,263 (-16.6%) | $78,312 |

| Internet Service Providers, Web Search Portals, and Data Processing Services | 631 | 6,297 | 12.3% | -1,474 (-19.0%) | $104,260 |

| Other Information Services | 1,148 | 5,692 | 11.2% | 739 (14.9%) | $64,220 |

| Motion Picture and Sound Recording Industries | 362 | 4,005 | 7.9% | 57 (1.4%) | $24,388 |

| Broadcasting (except Internet) | 218 | 3,924 | 7.7% | -1,640 (-29.5%) | $61,464 |

| Source: DEED Quarterly Census of Employment and Wages (QCEW) | |||||

Information and those subsectors within it have witnessed steady employment losses in recent history (see Table 1). While Motion Picture and Sound Recording Industries is up 57 jobs (1.4 percent) over the past five years, it has also witnessed steady employment declines. Since 2000 this industry has shed nearly 1,600 jobs in Minnesota, contracting by 28.3 percent (see Figure 1). One reason for these losses may be the introduction and proliferation of video streaming services and its effect on movie theater employment.

If you're looking to purchase a new or used car, there's an excellent chance that you will visit a Motor Vehicle and Parts Dealers establishment. According to the North American Industry Classification System (NAICS), such establishments retail motor vehicle and parts from fixed point-of-sale locations, typically a showroom or an open lot where the vehicles are on display. This industry also includes establishments that retail recreational and all-terrain vehicles, motorcycles, boats, tires, and automotive parts.

Establishments in Motor Vehicle and Parts Dealers generally have a mix of sales and support staff familiar with the requirements for registering and financing a vehicle as well as automotive mechanics and parts experts to provide repair and maintenance services for the vehicles. Retail Salespersons and Automotive Service Technicians and Mechanics alone, account for over one-third (33.5 percent) of the employment in Motor Vehicle and Parts Dealers. Other occupations common to this industry include Parts Salespersons, Light Truck or Delivery Services Drivers, Cleaners of Vehicles and Equipment, First-Line Supervisors of Retail Salespersons, and Tire Repairers and Changers.

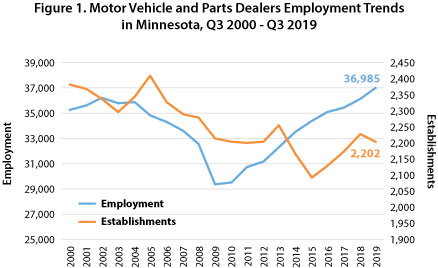

Minnesota had 2,202 Motor Vehicle and Parts Dealers establishments during the third quarter, 2019, supplying nearly 37,000 jobs. While the Seven-County Metro Area accounted for just over half of these jobs, it actually had the smallest concentration of such jobs. The highest concentration of Motor Vehicle and Parts Dealers jobs are found in Central Minnesota, Northwest Minnesota, and Northeast Minnesota.

| Area | Number of Firms | Number of Jobs | Share of MN Motor Vehicle and Parts Dealers Jobs | Q3 2009 – Q3 2019 Job Change | Average Annual Wage |

|---|---|---|---|---|---|

| Minnesota | 2,202 | 36,985 | 100.0% | 7,636 (26.0%) | $49,660 |

| Metro Area | 830 | 19,063 | 51.5% | 3,981 (26.4%) | $55,276 |

| Central MN | 387 | 5,718 | 15.5% | 1,568 (37.8%) | $45,032 |

| Northwest MN | 333 | 3,914 | 10.6% | 657 (20.2%) | $42,536 |

| Southeast MN | 244 | 3,347 | 9.0% | 454 (15.7%) | $45,084 |

| Southwest MN | 157 | 2,595 | 7.0% | 524 (25.3%) | $40,976 |

| Northeast MN | 224 | 2,302 | 6.2% | 486 (26.8%) | $42,484 |

| Source: DEED Quarterly Census of Employment and Wages (QCEW) | |||||

Employment in Motor Vehicle and Parts Dealers has experienced significant whiplash since the turn of the century. Statewide, this industry lost 6,232 jobs between the third quarters of 2001 and 2009, contracting by 17.5 percent. For reference, total employment in the labor market contracted by 1.9 percent during this period of time. Between the third quarters of 2009 and 2019, however, this industry regained 7,636 jobs (see Figure 1). This overall growth rate of 26.0 percent was just about twice the growth rate for the total of all industries (13.7 percent). Every planning region of Minnesota experienced this employment whiplash for Motor Vehicle and Parts Dealers, although growth has been especially robust in Central Minnesota over the past decade (see Table 1).

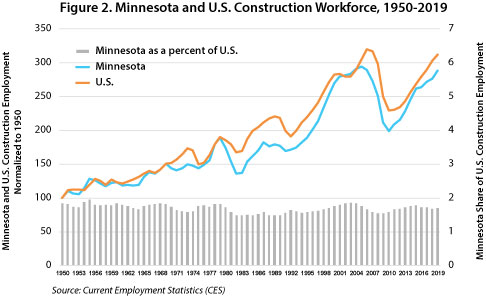

Minnesota's construction industry reached its fourth highest annual average total in 2019, employing an average 127,100 during the year, falling slightly short of the home-building boom years of 2005 – 2007. The industry's rebound in Minnesota was initially ahead of the U.S. rebound but has slowed relative to the rest of the nation over the last few years. Construction employment in the state last year was 1.8 percent lower than the 2005 peak. Nationally, employment was 2.6 percent lower than the 2006 peak.

Ten states reached record-high construction employment in 2019 including Nebraska and South Dakota. Rapid population growth explains record construction employment in Colorado, Oregon, Texas, Utah, and Washington. The factors behind record level construction employment in New York, Oklahoma, and West Virginia are less obvious. Twenty-one states had construction employment last year that was more than 10 percent lower than their peak construction year. Construction jobs in Nevada and Arizona were 30 and 27 percent below their 2006 peak year level.

Construction employment in Minnesota accounted for 4.3 percent of nonfarm wage and salary employment last year, which is slightly below the 70-year average of 4.5 percent. The long-term trend shows construction employment dipping as a percent of employment in Minnesota during the 1950s through the 1970s but since then rising slightly during expansions and declining slightly during recessions (see Figure 1).