The state of Minnesota is projected to add more than 100,000 jobs from the second quarter of 2021 to the second quarter of 2022, a strong 3.5% increase. This predicted job growth rate surpasses the 1.0% job growth experienced between 2017 and 2019, prior to the pandemic. However, job growth will continue to be limited by workforce shortages in Minnesota, similar to the shortages faced in many parts of the country. In addition, job growth will likely continue to reflect the course of the coronavirus. Based on this forecasted employment expansion, the state will have recovered 85% of jobs lost during the pandemic by the end of June 2022, leaving total employment about 65,000 below the January 2020 pre-pandemic level. Minnesota wage and salary employment is expected to exceed its pre-pandemic peak by late 2022 or early 2023.

Minnesota's job rebound from the pandemic has averaged 17,000 jobs per month from May 2020 to August 2021. That job growth has recovered 66% of the jobs lost in March and April 2020. Roughly 76% of U.S. pandemic related job loss has been recovered over the same period. Minnesota has regained the same percent of goods-producing jobs (76%) as nationwide but lags in regaining services providing jobs: Only 65% of service jobs have been recovered in Minnesota compared to 76% nationally.

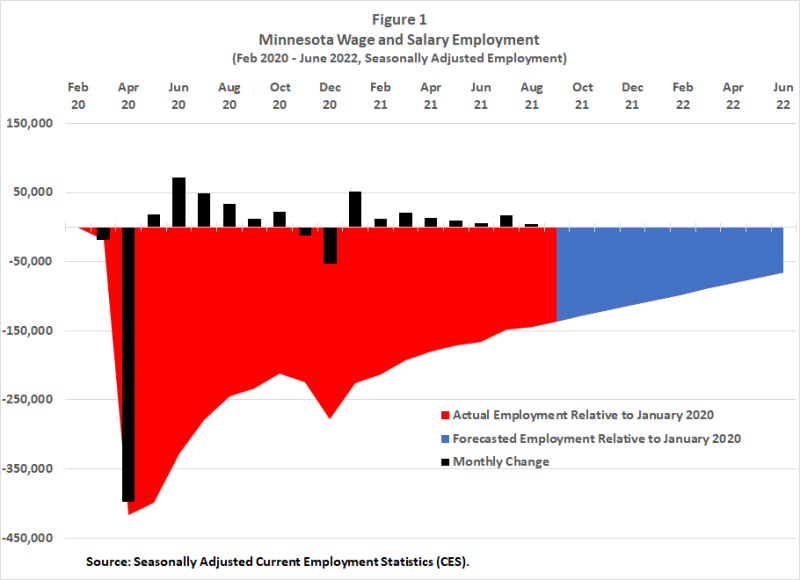

Job growth has been bumpy over the last 16 months (see Figure 1) as spikes in COVID cases spurred business restrictions and changes in individual behavior. The ongoing response to the pandemic has created numerous roadblocks hindering a swifter and more robust rebound. While unprecedented federal pandemic relief spending, such as extended unemployment insurance (UI) benefits, Paycheck Protection Program (PPP) loans, and three rounds of household stimulus checks, has helped moderate the bumps, but job growth ebbs and flows have mostly tracked the coronavirus trajectory. The recent surge in delta variant cases, despite nearly 70% of Minnesota's 18-and-older population being fully vaccinated by the end of summer, is the latest job growth hurdle.

The steep drop-off in State Fair attendance this summer indicates that many individuals continue to alter behavior, including spending habits and household activities, due to virus concerns. A key behavior change for some Minnesotans is their willingness to participate in the workforce. The state's labor force participation rate was 67.8% in August 2021 or 2.4 percentage points below the 70.2% recorded in January 2020. There were roughly 85,000 fewer individuals in the labor force in August 2021 compared to January 2020 on a seasonally adjusted basis. Nationwide labor force participation in August 2021 was down 1.7 percentage points from January 2020.

The decline in labor force participation is a major factor holding back Minnesota's job rebound pace over the last 16 months. Demand for workers has never been higher as indicated by sky-high job vacancy numbers. There are a variety of reasons contributing to Minnesota's labor force drop during the pandemic. Fear of contracting COVID-19, persistent child care challenges, uncertainty of in-person schooling, extended UI benefits, skills mismatch between workers seeking employment and the jobs with vacancies, and an uptick in retirement rates have all been cited as reasons why the state's labor force remains below its pre pandemic level.1

U.S. GDP growth was on track during the first half of the year to exceed 6% for 2021, but growth in the third quarter eased as the rapid spread of the delta strain slowed the rebound in demand for services such as restaurants and air travel and delayed a broad return to the office. Continued supply-chain problems in manufacturing and transportation have also contributed to the more moderate pace of growth. GDP growth in the third quarter is now expected to decelerate to half the rate seen during the previous six months, before regaining some momentum in the fourth quarter and into the first six months of 2022. That renewed momentum is anticipated because the delta strain surge is expected to retreat over the next few months and supply-chain problems will gradually be resolved.

GDP growth over the next year will however continue to be more than robust enough to keep labor demand and job vacancies elevated in the state. Labor force growth will continue to be sluggish even as extended UI benefits end, the delta variant retreats, vaccination rates inch up, childcare availability improves, and schools settle into in-school teaching. Job growth will continue to be limited as labor supply continues to run far short of labor demand over the next year.

Minnesota's short-term jobs forecast for the one-year period from the second quarter 2021 to second quarter 2022 expects 100,600 jobs to be added, a 3.5% increase over the year. The forecasted job expansion averages out to roughly 8,400 jobs a month, a slowdown compared to previous monthly gains. Job growth was more rapid last year when the state's labor market was bouncing back from the first wave of the pandemic and many workers were recalled to jobs they lost in March and April 2000. The predicted 3.5% job growth rate surpasses the 1.0% job growth experienced between 2017 and 2019, as the state job market continues to dig its way out of the steep job pandemic decline.

Under the forecasted job growth, the state will have recovered 85% of jobs lost during the pandemic by June 2022, leaving total employment about 65,000 below the January 2020 level. Not all industries are expected to reach their pre-pandemic employment levels during 2022. But other industries have or will be expanding their workforces above pre-pandemic levels, pushing Minnesota wage and salary employment past its pre-pandemic peak by late 2022 or early 2023. The three-year peak-to-bottom-to peak job recovery of the pandemic Recession will be shorter than the four years needed to fully recovery jobs from the 2001 Recession and the five and a half years required to recover all jobs lost during the Great Recession.

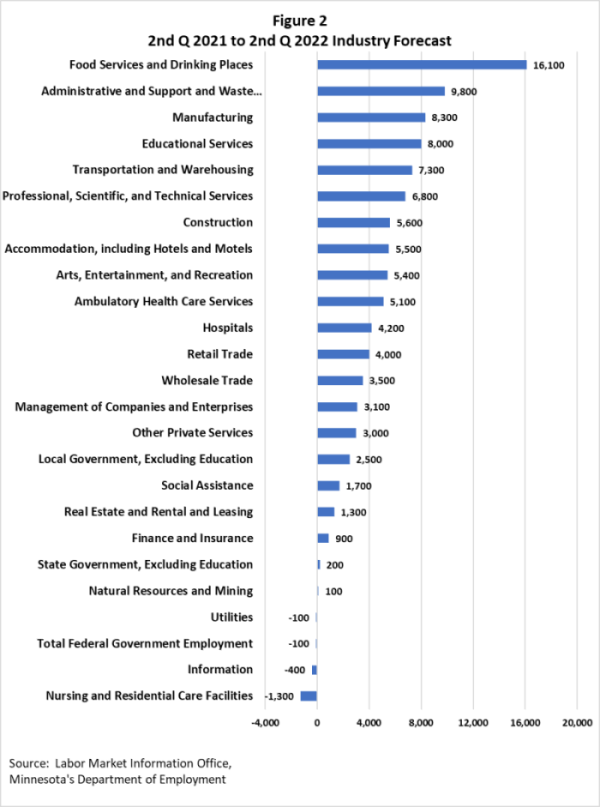

Job growth will be widespread but will be faster in industries that lost the most jobs during the early months of the pandemic (see Figure 2). Industries expected to add the most jobs over the next 12 months are: Food Services & Drinking Places (16,100); Administrative & Support Services (9,800); Manufacturing (8,300); Educational Services (8,000) and Transportation & Warehousing (7,300). Some of the industries adding the most jobs over the next year, such as Food Services & Drinking Places and Educational Services, are face-to-face service-based industries and were the most disrupted by the pandemic. However, employment in most in-person interaction service industries will still be short of their pre-pandemic level by June 2022. Other industries such as Manufacturing and Transportation & Warehousing are expected to increase their workforces as business conditions improve and demand for their products or services increase.

Manufacturing has recovered roughly 13,500 of the 21,500 jobs lost last in March and April 2020 when the pandemic first hit. The 8,300 manufacturing jobs predicted to be added over the next 12 months push manufacturing employment to its January 2020 level by next June. Job growth at Minnesota manufacturers over the next 12 months is expected to be strong, prompting the state's manufacturers to increase hiring as orders climb with strong GDP growth. Administrative & Support Services lost 25,000 jobs during the early months of the pandemic with roughly 17,000 jobs recovered since. The 9,800 jobs anticipated to be added over the next 12 months will drive jobs in the industry well above its pre-pandemic peak. A large share of job growth in this industry will be at Employment Services companies and Services to Building & Dwellings.

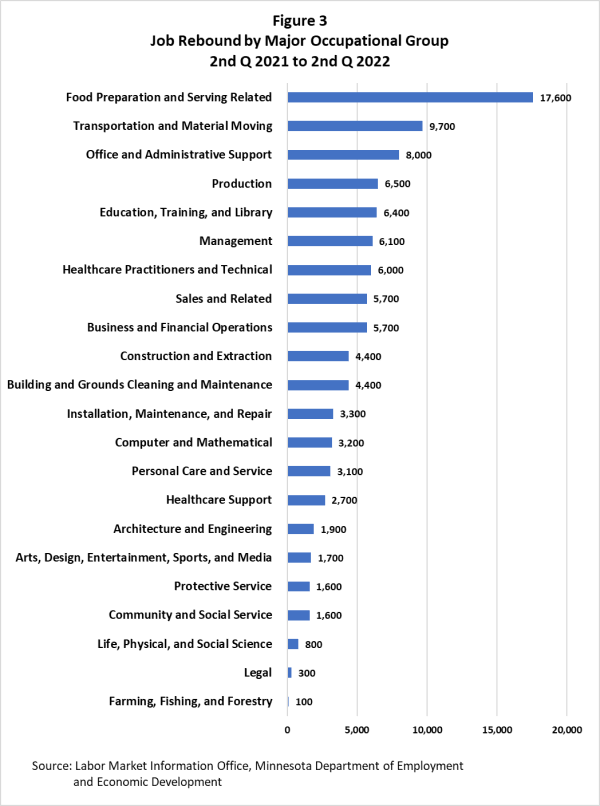

Food Preparation & Serving Related occupations (think fast food and counter workers, waiters and waitresses, and restaurant cooks) are expected to add the most jobs over the next 12 months as dining places and drinking establishments continue to gradually recover from their pandemic cutbacks and closings, despite some temporary pullbacks when virus cases spiked (see Figure 3). Hiring for Transportation & Material Moving jobs (such as laborers and freight, stock, and hand material movers, heavy and tractor-trailer truck drivers, light truck or delivery services drivers and stockers and order fillers) is expected to remain robust over the next 12 months pushing this major occupational group to second on the list of occupational groups adding the most jobs.

The ongoing bounce back in Minnesota's manufacturing sector will boost demand for workers in many production occupations (such as miscellaneous assemblers and fabricators, machinists, first-line production supervisors, welders, and production workers helpers). Many of the projected jobs are in skilled production occupations that manufacturers were having a hard time filing even before the pandemic but others are in less-skilled entry-level occupations that have also been difficult to fill. Average weekly manufacturing earnings topped $1,000 for the first time in August, a clear sign that manufacturing firms are upping their wages in order to attract more job seekers.

Thirty-eight percent (297 occupations) of the 773 occupations covered in the short-term job forecast will grow faster than the predicted 3.5% overall job growth rate. Thirty-four percent (260 occupations) are projected to increase between 3.5% and 2.0% while 26% (199 occupations) are expected to add workers but at a rate below 2.0%. Only 2% of occupations (17 occupations) are expected to shrink over the next year. Shrinking occupations include New Account Clerks, Legal Secretaries, and Telephone Operators. The 17 occupations anticipated to lose positions over the next year have a combined workforce of 35,000 as of second quarter 2021. Roughly 400 positions in these occupations are expected to be cut by June 2022.

Voluntary pullbacks in spending by consumers in August due to the sharp upturn in COVID-19 infections thanks to the delta variant, combined with supply-chain bottlenecks are cooling economic activity but not enough to stop job growth in Minnesota. Job growth will however slow in the state over the next year even though the pool of jobseekers is expect to continue to grow. The growth in the labor force will just not be fast or extensive enough to meet the strong hiring plans of employers. Job vacancies will probably moderate some, but employers will continue to face major difficulties in meeting their labor demands.

1For a deeper discussion of factors shaping Minnesota's labor force supply see the "More than Simple Supply and Demand" article.