by Cameron Macht

June 2022

Of the six regions in the state, Northwest Minnesota is the closest to being back to their pre-pandemic normal. Through the fourth quarter of 2021, total employment in the region was back to over 98% of the fourth quarter 2019 level, and Northwest's total labor force in the first quarter of 2022 was actually just above the level in first quarter of 2020, right before the recession started. Beneath those macro trends, though, employers and jobseekers are adjusting to a very new normal.

There were about 302,000 workers in the 26-county region through the first three months of 2022, which was up by 9,500 workers compared to the first quarter of 2021. More notably, that was even up by about 2,500 workers from the first quarter of 2020, indicating a significant return to work over the past year as employers filled open jobs.

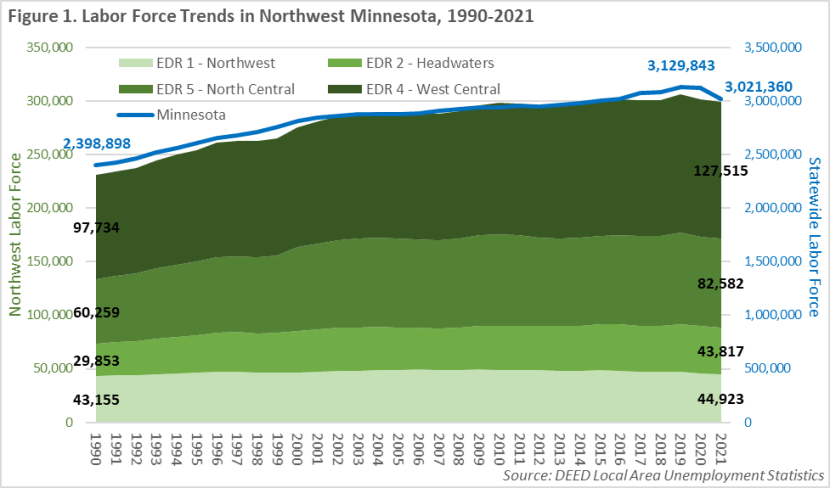

But the region is still below the labor force peak hit in 2019, and labor force growth has noticeably slowed in recent years. After 25 years of rapid labor force growth, Northwest had added almost 70,000 new workers between 1990 and 2015, a 30% increase. That outpaced statewide labor force growth, which expanded 25.5% from 1990 to 2015. At that rate, Northwest averaged about 2,750 additional workers each year during that period, but from 2016 to 2021, save for the spike in 2019, the region's labor force has plateaued at just over 300,000 workers (See Figure 1).

Over time, labor force growth was fastest in Economic Development Region (EDR) 2 – Headwaters, which grew nearly 47% since 1990, and is down less than 1.0% compared to 2019 levels. Likewise, EDR 5 – North Central also saw significant growth from 1990, expanding 37% despite a -3.4% decline from 2019 due to the pandemic. With an older population and a higher reliance on hard hit industries like Leisure & Hospitality, EDR 5 suffered the biggest drop in labor force since the pandemic recession.

After adding almost 30,000 workers from 1990 to 2021, the 9-county EDR 4 – West Central accounted for almost 45% of total labor force growth in Northwest, and is down just -1.4% compared to 2019. In contrast, the smallest and slowest growing labor force in the Northwest planning region is in EDR 1 – Northwest, which added less than 1,800 compared to 1990, mostly due to losing more than 2,500 workers from 2019 to 2021. With just 44,923 available workers in 2021, that was the smallest annual average in EDR 1 since 1993, and down from a peak of 49,558 workers in 2009, during the Great Recession.

Looking at annual averages, employers in Northwest Minnesota cut just over 12,000 jobs from 2019 to 2020 following the pandemic recession, a -5.4% decline. That was less severe than the drop experienced statewide, where total employment fell by -6.7%. However, that masks the severity of the initial decline in the region – Northwest has a very seasonal economy, so the region was actually down a maximum of 25,000 jobs over the year comparing the second quarter of 2020 to the second quarter of 2019.

However, Northwest bounced back much more quickly than the rest of the state, growing 6.4% from second to third quarter of 2020, compared to 4.8% statewide. Northwest also saw stronger quarterly gains in 2021 compared to the state – expanding 5.8% from the first to the second quarter and 1.7% from the second to the third quarter of 2021, ahead of 3.6% and 0.5% gains in the state, respectively. However, seasonal impacts came into play in the winter, with Northwest seeing a -2.1% decline into the fourth quarter while the state increased 1.2%.

Despite job losses during the pandemic recession, Health Care & Social Assistance is still the largest employing industry in Northwest, with 38,510 jobs at nearly 1,800 establishments. From 2019 to 2020, Health Care dropped by almost 1,000 jobs, but then regained more than 275 jobs in 2021. At a more detailed level, the job losses were concentrated at both Hospitals and Nursing & Residential Care Facilities, with both slicing about 550 jobs since 2019. In contrast, Social Assistance added more than 550 jobs during that period, primarily in Other Individual & Family Services such as Social Service and Community Action Service Agencies, Counseling Services, Crisis Intervention Centers, and Alcoholism & Drug Addiction Self-help Organizations.

With just under 29,000 jobs at more than 800 firms, Manufacturing accounted for 13.2% of total employment in the region, compared to 11.3% of jobs statewide. Northwest manufacturers made smaller job cuts than the state from 2019 to 2020, and saw a faster bounce back in 2021. Manufacturing added more than 900 jobs over the year, with gains seen in almost every subsector including Fabricated Metal Product Manufacturing, Machinery Manufacturing, and Printing.

Likewise, Retail Trade declined less in Northwest than the state from 2019 to 2020, but has not recovered quite as fast as the rest of the state in 2021. Only two Retail subsectors have more jobs now than in 2019 – Building Material & Garden Equipment & Supplies Dealers and Furniture & Home Furnishings Stores; while the other 10 subsectors are still down in employment, though several made strong recoveries in 2021 – most notably General Merchandise Stores and Clothing & Accessories Stores as people returned to more in-person activities.

Another industry that benefited from a return to in-person activities is Educational Services, which regained about 250 jobs in 2021 after losing more than 1,600 jobs in the immediate aftermath of COVID-19 in 2020. Elementary & Secondary Schools cut nearly 1,000 jobs from 2019 to 2020 as schools transitioned to distance learning and transportation needs changed; but those schools added about 350 jobs back in 2021 as schools again filled up with students. In contrast, the region's Colleges & Universities have had a harder time getting students back and cut jobs both years – losing 286 jobs from 2019 to 2020 and another 100 jobs in 2021.

But the sector hit hardest by the pandemic recession was Leisure & Hospitality, which saw more than a fifth of the region's jobs in both Accommodation & Food Services and Arts, Entertainment & Recreation disappear in 2020. Combined, those two industries account for almost 11% of total employment in the region, and are a major part of Northwest's seasonal economy. The good news is that those two industries were in the top three fastest growing industries in the region in 2021, as demand for travel and tourism rebounded.

It is important to note that the fastest growing industry in Northwest was actually Construction, which was the only industry in the region that added jobs in both 2020 and 2021. While the region saw notable gains in both the Construction of Buildings and Specialty Trade Contractors subsectors, the majority of the job growth was concentrated in Heavy & Civil Engineering Construction, and more specifically in Oil & Gas Pipeline Construction.

In sum, 14 of the 20 main industries in the region added jobs in 2021 after 18 of the 20 industries cut jobs from 2019 to 2020. Despite the recent job gains, just five industries reported more jobs in 2021 than in 2019, while the remaining 15 still have work to do to reach pre-pandemic employment levels.

| Table 1. Northwest Minnesota Industry Employment Trends, 2021 Annual Average | Avg. Annual Wages | Job Change, 2020-2021 | Job Change, 2019-2021 | ||||||

|---|---|---|---|---|---|---|---|---|---|

| NAICS Code | NAICS Industry Title | Number of Firms | Number of Jobs | Total Payroll | |||||

| 0 | Total, All Industries | 17,452 | 218,336 | $10,481,183,281 | $47,944 | +7,210 | +3.4% | -4,899 | -2.2% |

| 62 | Health Care & Social Assistance | 1,794 | 38,510 | $1,965,358,480 | $51,012 | +278 | +0.7% | -675 | -1.7% |

| 31 | Manufacturing | 811 | 28,897 | $1,701,314,848 | $58,864 | +929 | +3.3% | -581 | -2.0% |

| 44 | Retail Trade | 2,285 | 27,215 | $864,805,669 | $31,720 | +308 | +1.1% | -629 | -2.3% |

| 61 | Educational Services | 395 | 21,294 | $1,020,610,090 | $47,996 | +249 | +1.2% | -1,389 | -6.1% |

| 72 | Accommodation & Food Services | 1,537 | 20,202 | $408,362,536 | $20,020 | +2,385 | +13.4% | -2,092 | -9.4% |

| 92 | Public Administration | 724 | 15,260 | $813,690,207 | $53,300 | -813 | -5.1% | -1,206 | -7.3% |

| 23 | Construction | 2,286 | 13,598 | $966,910,532 | $70,668 | +1,861 | +15.9% | +2,228 | +19.6% |

| 42 | Wholesale Trade | 608 | 11,509 | $729,573,446 | $63,336 | +529 | +4.8% | +359 | +3.2% |

| 81 | Other Services | 1,553 | 6,492 | $178,896,408 | $27,508 | +629 | +10.7% | -239 | -3.6% |

| 48 | Transportation & Warehousing | 874 | 6,161 | $293,065,225 | $47,528 | +106 | +1.8% | +44 | +0.7% |

| 52 | Finance & Insurance | 850 | 5,864 | $397,074,223 | $67,704 | -49 | -0.8% | -97 | -1.6% |

| 11 | Agriculture, Forestry, Fish & Hunting | 904 | 5,225 | $252,312,735 | $47,840 | -55 | -1.0% | -63 | -1.2% |

| 54 | Professional & Technical Services | 845 | 4,689 | $277,767,458 | $59,280 | +67 | +1.4% | -62 | -1.3% |

| 56 | Admin. Support & Waste Mgmt. Svcs. | 684 | 4,115 | $151,430,702 | $36,608 | +296 | +7.8% | +40 | +1.0% |

| 71 | Arts, Entertainment & Recreation | 399 | 3,189 | $71,321,119 | $22,256 | +436 | +15.8% | -350 | -9.9% |

| 51 | Information | 278 | 2,552 | $140,668,048 | $55,120 | +117 | +4.8% | -48 | -1.8% |

| 53 | Real Estate, Rental & Leasing | 462 | 1,527 | $62,629,688 | $41,028 | +26 | +1.7% | +17 | +1.1% |

| 22 | Utilities | 67 | 1,244 | $117,742,504 | $94,692 | -14 | -1.1% | -39 | -3.0% |

| 55 | Management of Companies | 56 | 581 | $54,155,164 | $93,340 | -66 | -10.2% | -114 | -16.4% |

| 21 | Mining | 42 | 208 | $13,494,199 | $60,892 | -8 | -3.7% | -2 | -1.0% |

| Source: DEED Quarterly Census of Employment & Wages | |||||||||

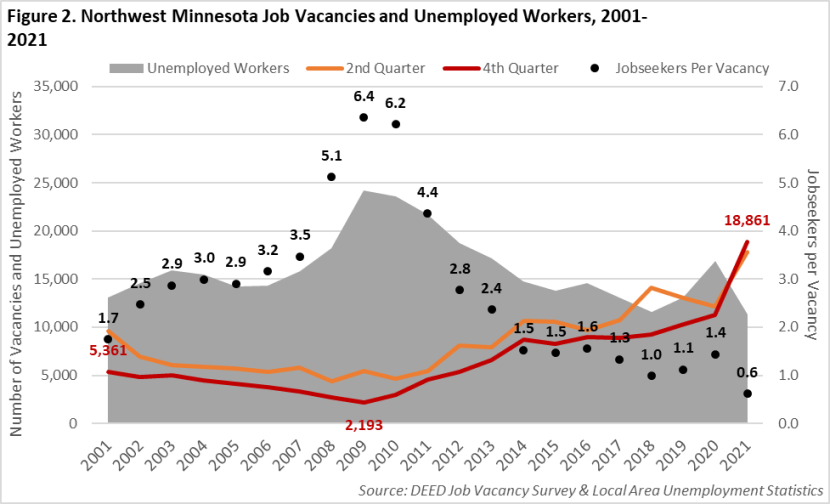

Like the state overall, employers in Northwest Minnesota reported the highest number of job vacancies on record in the fourth quarter of 2021, with nearly 19,000 open positions in the region. That was a 68% increase over the year, and an additional 1,100 vacancies from the previous record set in the second quarter of 2021. While the number of job vacancies in the region stayed depressed for three years following the Great Recession in 2008 before starting to climb again in 2011, there was no reprieve from the tight labor market conditions the region was experiencing prior to the pandemic recession.

Since 2014, the region was steadily closing in on a 1-to-1 jobseeker per vacancy ration, making it difficult for employers to find workers for open positions. The spike in unemployment in 2020 reversed that trend, but only temporarily, and not even remotely close to the ratios seen during the Great Recession when there were far fewer vacancies. Instead, with the record vacancy levels posted in 2021, the region dropped below a 1-to-1 ratio, with nearly two jobs available for every unemployed worker looking for a job (see Figure 2).

Retail Trade reported the largest number of openings in Northwest, setting a new record with 5,236 vacancies in the fourth quarter of 2021. That was a 70% increase over the year, and nearly 1,250 more vacancies than the previous record set in the second quarter of 2021. Health Care & Social Assistance also posted a new peak with 4,684 vacancies, or about 25% of the total. This was a 65% increase over the year and up 53% compared to the second quarter of 2021, showing the critical level of demand that healthcare providers in the region are facing. Combined, those two industries accounted for over half of the open jobs in the region.

The region also saw large and growing numbers of vacancies in Accommodation & Food Services, where demand doubled over the year; Manufacturing, Other Services, Educational Services, Public Administration, and Finance & Insurance, which also set a new record for vacancy levels.

Across all occupations, the median wage offer rose to $16.85 in fourth quarter 2021, which is also the highest in the history of the Job Vacancy Survey back to 2001. It was more than $2.50 higher than in the fourth quarter 2020, reflecting rising wage offers from employers desperate for workers, as well as a shifting occupational mix. Nineteen of the 21 occupational groups saw an increase in median wage offers over the year, with the biggest gains experienced for Community & Social Service, Business & Financial Operations, Protective Service, Office & Administrative Support, and Installation, Maintenance & Repair. However, even lower-paying jobs like Sales & Related and Food Preparation & Serving occupations saw wages climb more than 10% over the year.

In addition to surging levels of current demand, Northwest is also projected to see strong job growth over the next decade. This round of projections start with the recession-depressed job counts from 2020, and therefore some of the expected growth is actually remaining job recovery. However, even once the region gets back to pre-pandemic employment levels, we forecast additional growth.

This includes faster gains in the industries that were hardest hit, including Arts, Entertainment & Recreation, Accommodation & Food Services and Other Services, which typically are not among the fastest growing industries in our 10-year forecasts. To that end, Health Care & Social Assistance is again expected to be the largest growing and one of the fastest growing industries, potentially accounting for as much as one-third of total projected job gains through 2030.

Other industries that should see substantial growth in the region include Educational Services, Manufacturing, Wholesale Trade, Construction, Professional & Technical Services, and Public Administration. In contrast, only five of the 20 main industries are projected to lose jobs over the decade, with the biggest decline predicted in Retail Trade as consumer behaviors continue to change. Though relatively small, Utilities is expected to see the fastest decline, cutting nearly 15% of employment from 2020 to 2030 (see Table 2).

| Table 2. Northwest Minnesota Industry Employment Projections, 2020-2030 | |||||

|---|---|---|---|---|---|

| NAICS Code | Industry | Estimated Employment 2020 | Projected Employment 2030 | Percent Change 2020-2030 | Numeric Change 2020-2030 |

| 0 | Total, All Industries | 250,722 | 263,441 | +5.1% | +12,719 |

| 62 | Health Care & Social Assistance | 36,901 | 41,390 | +12.2% | +4,489 |

| 67 | Self-Employed & Unpaid Family Workers | 29,526 | 29,674 | +0.5% | +148 |

| 31 | Manufacturing | 27,999 | 28,618 | +2.2% | +619 |

| 44 | Retail Trade | 26,846 | 25,467 | -5.1% | -1,379 |

| 9 | Public Administration | 22,824 | 23,240 | +1.8% | +416 |

| 61 | Educational Services | 22,015 | 23,101 | +4.9% | +1,086 |

| 72 | Accommodation & Food Services | 17,040 | 20,515 | +20.4% | +3,475 |

| 42 | Wholesale Trade | 11,829 | 12,347 | +4.4% | +518 |

| 23 | Construction | 10,693 | 11,157 | +4.3% | +464 |

| 81 | Other Services | 9,052 | 10,144 | +12.1% | +1,092 |

| 48 | Transportation & Warehousing | 6,436 | 6,741 | +4.7% | +305 |

| 52 | Finance & Insurance | 6,053 | 6,227 | +2.9% | +174 |

| 11 | Agriculture, Forestry, Fishing & Hunting | 5,574 | 5,505 | -1.2% | -69 |

| 54 | Professional & Technical Services | 4,927 | 5,360 | +8.8% | +433 |

| 71 | Arts, Entertainment, & Recreation | 3,406 | 4,303 | +26.3% | +897 |

| 56 | Administrative Support & Waste Mgmt. Services | 3,889 | 4,139 | +6.4% | +250 |

| 51 | Information | 2,276 | 2,229 | -2.1% | -47 |

| 53 | Real Estate & Rental & Leasing | 1,425 | 1,414 | -0.8% | -11 |

| 22 | Utilities | 1,135 | 970 | -14.5% | -165 |

| 55 | Management of Companies | 660 | 665 | +0.8% | +5 |

| 21 | Mining | 216 | 235 | +8.8% | +19 |

| Source: DEED 2020 to 2030 Employment Outlook | |||||

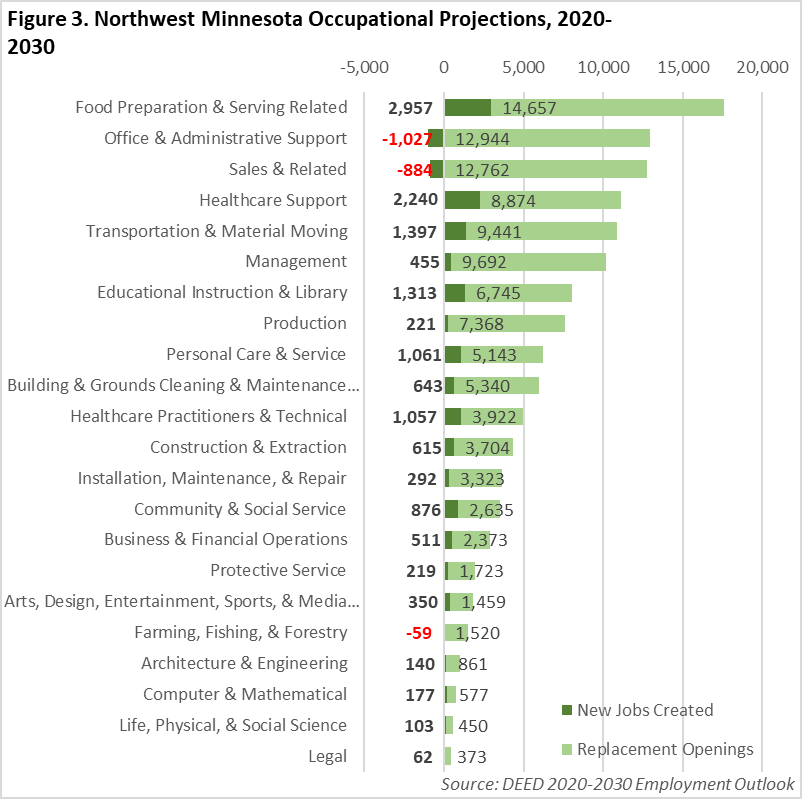

In addition to new job growth, there is also projected to be substantial demand for workers to fill jobs left open from labor force exits. These are jobs that currently exist but will become available as current workers retire, leave the labor force for other reasons, or change careers completely. For every occupational group, there are significantly more labor market exits and replacement openings than new jobs created, so the region will need to tap into every worker group available (see Figure 3).

Northwest Minnesota is poised to pass its pre-pandemic peaks in the next year, provided the labor force returns to normal as well. The region has seen slowing labor force growth in recent years, but is leading the state in recovery through 2021. Employers will need to embrace workers from all demographic groups in order to fill all of the jobs they currently have available, and to fill future demand.

The region's economy has seen a strong bounce back in vital industries including Health Care & Social Assistance, Manufacturing, and Leisure & Hospitality; but those industries are also reporting record levels of job vacancies and are raising wages to attract new workers. The next year and the next decade will require all hands on deck.