-

Overview

Funds are awarded to local units of government who provide loans to assist expanding businesses. Cities, counties, townships, certain development authorities and recognized Indian tribal governments are eligible for this fund.

Project Requirements

All projects must meet minimum criteria for private investment, number of jobs created or retained, and wages paid. At least 50% of total project costs must be privately financed through owner equity and other lending sources (most applications selected for funding have at least 70% private financing).

Prevailing Wage Requirements

Projects that receive $500,000 or more in MIF assistance are subject to prevailing wage requirements. See more about Prevailing Wage Requirements.

Jobs and Wages

All projects must meet minimum job and wage goals. For questions about how to determine wage levels, please refer to the Wage and Benefit Guidelines.

Terms and Interest

Terms are for a maximum of 20 years for real estate and a maximum of 10 years for machinery and equipment. Interest rates are negotiated.

-

Eligibility

The Minnesota Investment Fund (MIF) is a loan program and available to businesses engaged in manufacturing, warehousing, distribution, technology-related industries, and other activities that could be located generally anywhere yet still serve the same market and customers. It is designed to generate new income or wealth to the state that would not be generated by local market demand conditions.

Companies must work with the local government (city, county or township) where a project is located to apply to DEED to receive a MIF award. To receive a MIF loan, a business must, at minimum meet the following requirements:

- Be engaged in an eligible business activity

- Certify that funds will not be used for the operation, construction or expansion of a casino, a sport facility that has a professional sports team as a principal tenant or any firm engaged in retailing merchandise

- Obtain local government support for their project via council resolution

- Match any MIF from private funds or financing

- Be in financial position to repay the loan

- Meet minimum wage requirements for new Twin Cities jobs or for new Greater Minnesota jobs

- Commit to meeting minimum levels of private investment, job creation/retention, and wage benefits within 2 years

- Have other location options outside of Minnesota

- Cause no undue harm to Minnesota business competitors

- Certify that the project would not occur without MIF assistance

- Certify that the project has not yet started (i.e., no building permits, bids, construction, equipment purchases).

The size of an award depends on variety of factors including (but not limited to) Minnesota’s competitiveness, local economic conditions, job creation and wage levels. All expenditures and hiring related to the MIF assistance may not occur until funding has been formally approved.

-

FAQs

When can the business hire employees?

Hiring may begin at any time, but the business will get credit for only those new jobs that are filled after the date of final execution of the Grant Contract (Effective Date). The employment base will be established as of the application completion date.

What certifications do I need to sign as part of my application?

All businesses will sign a Prevailing Wage Certification, a Job Listing Certification and an Unemployment Insurance Consent Form, as applicable.

When can I begin making purchases or begin construction?

MIF funds and the accompanying match dollars may be used only for expenditures occurring after the date of final execution of the Grant Contract (Effective Date). In other words, machinery and equipment funded by MIF funds or matching MIF funds may not be purchased prior to the Effective Date. Likewise, if MIF is funding construction, construction may not begin until after the Effective Date.

What is involved for my organization to administer the MIF Award?

The MIF Program Manual provides an overview of the MIF program requirements and administration.

How long do I have to complete my legal documents and agreements?

Businesses have 120 days from the Award Letter date to compete all legal documents related to the MIF award or the award may be rescinded.

Can I make changes to the Grant Contract and the Loan Agreement?

The template legal documents were created in conjunction with the Minnesota Office of the Attorney General and in accordance with state laws and State Office of Grants Management Guidelines. As a result, only non-substantive changes are allowed.

What are the dates in the Grant Agreement?

The Grant Agreement lays out four dates relevant to the MIF financing. They are:

- Effective Date

- Date of final execution of the Grant Contract

- Benefit Date

- Date equipment operational or building certificate of occupancy issued

- Compliance Date

- 2 years from Benefit Date

- Expiration Date

- 3 months after Compliance Date

Is collateral required?

Yes, MIF transactions are loans and security is required as collateral. The security can take many forms – collateral on the equipment being financed, mortgage on a building, a line of credit from another lender or a parent company guarantee are among the possible options.

What documentation will I need to submit for proof of expenditures to receive my disbursement?

Third party verification such as invoices, sworn construction statements, lien waivers, receipts etc. will be required for any eligible costs (costs reimbursed by MIF and accompanying match), be sure to keep copes in the project file. All expenditures representing leverage spending must be documented and presented to DEED in an acceptable format as determined by your loan officer.

What kind of reporting will I need to do?

Once a formal award letter is provided, the business is required to complete and submit an Annual Progress Report detailed job creation and wage levels each January until the Agreement ends. A final report also will be due at the Compliance Date. These reports are required even if the MIF funds have not been disbursed.

-

How to Apply

Applications are accepted on a year-round basis.

Individuals or businesses may not apply for funding on their own.

A local unit of government must contact the DEED Office of Business Finance on behalf of the business to discuss the criteria for making an initial application and to obtain an application form.

If the loan officer agrees that the project appears to meet basic state or federal requirements, the local unit of government will be directed to submit an application on behalf of the business. The application includes sections that both the local government unit and the business must complete.

Contact the Office of Business Finance toll-free at 800-657-3858.

-

Revolving Loan Fund Guides

Federally Funded Revolving Loan Fund

- Guidelines

- When a MIF loan is funded by federal dollars (for example: Community Development Block Grant - Economic Development), any loan repayments to a local revolving loan fund must be administered according to federal guidelines. These guidelines will help local governments use the federal dollars to encourage business development.

- Annual Report Form

- The U.S. Department of Housing and Urban Development requires that all local governments that receive HUD CDBG-ED funds from DEED's MIF report annually on the status of these dollars if placed in a revolving loan fund account. Reporting forms are mailed out in late September and are due by October 25. For an electronic version of the form please contact your DEED Loan Officer.

State-Funded Revolving Loan Fund

- Guidelines

- Although they are not subject to the same restrictions as federal funding, revolving loan funds capitalized with repayments from state-funded loans must adhere to MIF re-use policies, which are guided by state law.

- Annual Report Form

- DEED requires reporting on the status of local revolving loan funds seeded by state-funded MIF. Reporting forms are mailed out in late September and are due by October 25. For an electronic version of the form please contact your DEED Loan Officer.

For More Information

Questions about the use of revolving loan funds? Contact the DEED loan officer in your region (see Contacts tab).

-

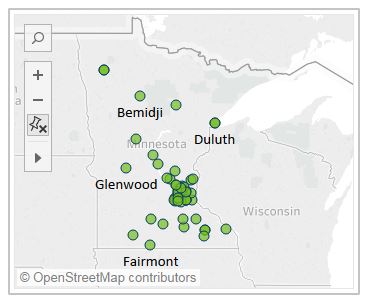

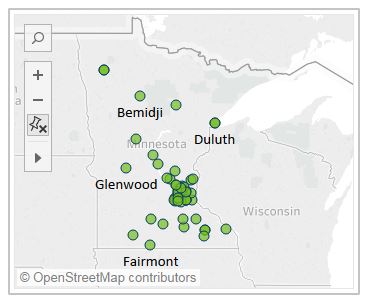

Funding Map

Use this interactive map to see where MIF projects are located throughout Minnesota.

Use this interactive map to see where MIF projects are located throughout Minnesota.

You can see the amount of the awards, project costs, new jobs created, average wages and more for each project and download the data.

View the funding awards map.

The map will open in a new window.

-

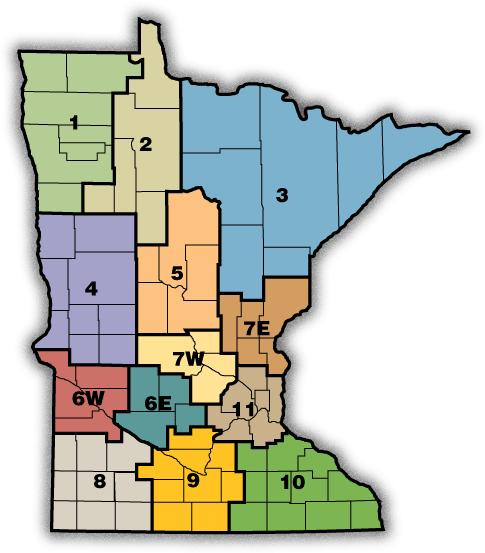

Contacts

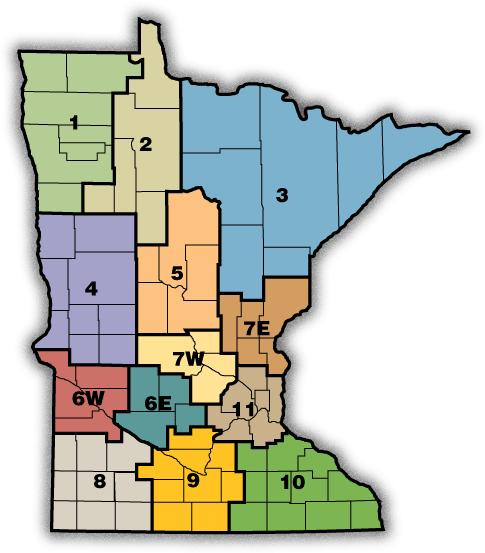

Contact a Regional Representative

Contact a Regional Representative

Each region of the state has an assigned senior loan officer who can answer questions about MIF. Check the map to identify your region and then scroll down the page to find your contact.

Contact Our Business Finance Office

Reach us toll-free at 800-657-3858.

For More Information

For personalized assistance on expanding your business in Minnesota, contact one of our business development managers.

Senior Loan Officers by Region

Region 1

Kittson, Marshall, Norman, Pennington, Polk, Red Lake, Roseau counties

Donna Corbo

651-259-7692

Region 2

Beltrami, Clearwater, Hubbard, Lake of the Woods, Mahnomen counties

Donna Corbo

651-259-7692

Region 3

Aitkin, Carlton, Cook, Itasca, Koochiching, Lake, St. Louis counties

Muhubo Malin

651-259-7426

Region 4

Becker, Clay, Douglas, Grant, Otter Tail, Pope, Stevens, Traverse, Wilkin counties

Donna Corbo

651-259-7692

Region 5

Cass, Crow Wing, Morrison, Todd, Wadena counties

Muhubo Malin

651-259-7426

Region 6E

Kandiyohi, McLeod, Meeker, Renville counties

Kipp Woxland

651-259-7690

Region 6W

Big Stone, Chippewa, Lac Qui Parle, Swift, Yellow Medicine counties

Kipp Woxland

651-259-7690

Region 7E

Chisago, Isanti, Kanabec, Mille Lacs, Pine counties

Muhubo Malin

651-259-7426

Region 7W

Benton, Sherburne, Stearns, Wright counties

David Leslie

651-259-7092

Region 8

Cottonwood, Jackson, Lincoln, Lyon, Murray, Nobles, Pipestone, Redwood, Rock counties

Kipp Woxland

651-259-7690

Region 9

Blue Earth, Brown, Faribault, Le Sueur, Martin, Nicollet, Sibley, Waseca, Watonwan counties

David Leslie

651-259-7092

Region 10

Dodge, Fillmore, Freeborn, Goodhue, Houston, Mower, Olmsted, Rice, Steele, Wabasha, Winona counties

David Leslie

651-259-7092

Region 11

Anoka, Carver, Dakota, Hennepin, Ramsey, Scott, Washington counties

Chinwe Ngwu

651-259-7427

Use this interactive map to see where MIF projects are located throughout Minnesota.

Use this interactive map to see where MIF projects are located throughout Minnesota. Contact a Regional Representative

Contact a Regional Representative