by Cameron Macht

June 2018

Southwest Minnesota accounts for nearly one-fourth of the food manufacturing jobs in the state.

Chew on this: Southwest Minnesota is home to 109 food manufacturing establishments providing more than 13,000 jobs and $571.5 million in annual payroll. That is nearly 25 percent of the state’s total employment in food manufacturing, making it one of the region’s most distinguishing industries. In 2017, food manufacturing was nearly four times more concentrated in Southwest Minnesota than the state as a whole.

Not surprisingly, Southwest also has several other agriculture-related industries that are more concentrated in the region than the rest of the state: animal production and aquaculture, crop production, support activities for agriculture, merchant wholesalers of nondurable goods (including grocery, farm products and petroleum), truck transportation and chemical manufacturing.

In sum, these seven heavily agriculture-related industries provide 25,460 jobs, sowing the seeds of economic stability for the region.

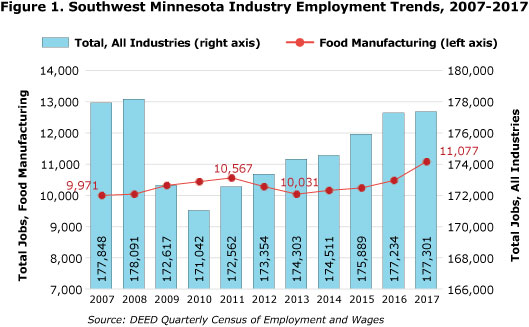

Unlike some other major subsectors in Southwest Minnesota, food manufacturing continued adding jobs during the recession and has expanded even more during the recovery. While the total economy lost just over 6,800 jobs from 2007 to 2010, a 3.8 percent decline, the region’s food manufacturers added 466 jobs, a 4.7 percent increase. Since 2010, employers overall have added 6,259 jobs, a 3.7 percent rise. That included 640 additional jobs in food manufacturing, a 6.1 percent surge (see Figure 1).

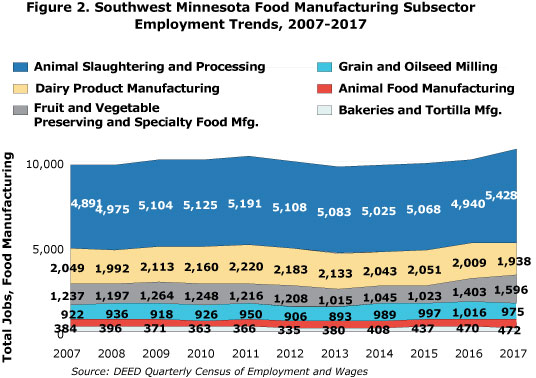

The largest and fastest-growing food manufacturing subsector in the region is animal slaughtering and processing, which had 5,428 jobs after adding nearly 550 jobs in the past decade. Southwest Minnesota has nearly one-third of the state’s total employment in that niche. Most of these processing plants are large employers, averaging 170 employees per site, compared with just 15 employees per site across all industries.

Drilling down further, the largest specialty is animal slaughtering, which includes beef and pork, with 2,507 jobs at 16 firms. Poultry processing is next, with 1,418 jobs at seven plants, after adding 365 jobs since 2010 (up 35 percent). The third-largest specialty is meat processed from carcasses, with six firms providing 1,335 jobs. The smallest subsector is rendering and meat byproduct processing, with 168 jobs at three firms, though that was just over 50 percent of total statewide employment.

Likewise, Southwest also has about one-third of the state’s jobs in grain and oilseed milling (which includes corn milling and soybean processing) and more than one-third of statewide employment in dairy product manufacturing (which includes milk, butter, cheese and ice cream manufacturing). Cheese manufacturing is the largest specialty, with eight firms providing 1,011 jobs.

With the exception of dairy product manufacturing, these food manufacturing specialties were adding jobs over the past decade, with the fastest growth occurring in fruit and vegetable preserving and specialty food manufacturing, which now has 1,596 jobs. That subsector has gained 359 jobs since 2007, a 29 percent increase. Animal food manufacturing, which includes livestock feed as well as food for house pets like cats and dogs, grew 23 percent from 2007 to 2017. That subsector now has 472 jobs in total (see Figure 2).

Despite perceptions that food manufacturing provides only entry-level jobs with low wages, average annual wages are actually over $11,000 higher than the total of all industries. In 2017, average annual wages were $51,688 in food manufacturing, compared with $40,352 across all industries. The highest-paying subsectors were grain and oilseed milling and animal food manufacturing, where workers earned almost $70,000 on average.

Dairy product manufacturing offered annual wages around $55,500, animal slaughtering and processing had average wages of $47,632, and fruit and vegetable preserving and specialty food manufacturing workers earned just under $45,000 in 2017. The only subsector that had lower than average wages were bakeries and tortilla manufacturing, at $28,652.

For job seekers looking for new opportunities in a growing, high-paying field, the food manufacturing industry in Southwest Minnesota brings a lot to the table. Some occupations that are in demand offer lower wages – such as packers and packagers, bakers, and production worker helpers, which all reported median hourly wages between $11.50 and $12.50. But there are several occupations that offer higher wages – including first-line supervisors, industrial machinery mechanics, industrial truck and tractor operators, and general maintenance and repair workers, with each earning median wages above $19 per hour (see Table 1). All but one of these occupations could be started with a high school diploma and on-the-job training, with only industrial machinery mechanics requiring a vocational award.

| Table 1. Wage and Employment Estimates for the Top 15 Occupations in Demand in Food Manufacturing in Southwest Minnesota | |||

|---|---|---|---|

| Occupational Title | Estimated Regional Employment | Median Hourly Wage | Percent of Statewide Employment |

| Total, All Occupations | 179,500 | $17.14 | 6.3% |

| Packaging and Filling Machine Operators | 1,060 | $16.34 | 10.6% |

| Meat, Poultry, and Fish Cutters and Trimmers | 700 | $14.29 | 17.1% |

| Food Batchmakers | 200 | $17.77 | 4.6% |

| Slaughterers and Meat Packers | N/A | $14.91* | N/A |

| Packers and Packagers, Hand | 620 | $11.51 | 5.5% |

| Laborers and Freight, Stock and Material Movers | 2,500 | $16.28 | 6.1% |

| Helpers--Production Workers | 660 | $12.54 | 5.8% |

| Bakers | 120 | $12.48 | 5.1% |

| First-Line Supervisors of Production Workers | 1,000 | $27.75 | 8.3% |

| Industrial Truck and Tractor Operators | 650 | $19.98 | 7.5% |

| Industrial Machinery Mechanics | 770 | $22.52 | 11.6% |

| Inspectors, Testers, Sorters, Samplers and Weighers | 720 | $16.91 | 7.5% |

| Maintenance and Repair Workers, General | 1,800 | $19.02 | 7.8% |

| Food Cooking Machine Operators and Tenders | 50 | $15.02 | 10.6% |

| Food Processing Workers, All Other | 70 | $15.07 | 7.2% |

| * - Minnesota wage data; Source: DEED Occupational Employment Statistics | |||

Food manufacturing and other agriculture-related industries have contributed greatly to the health of Southwest Minnesota's economy. But food manufacturing also has been a leader in integrating diversity into the region's workforce.

In 2017, 94 percent of job holders in Southwest Minnesota were White, with just 6 percent of workers being of other races or ethnicities. In comparison, workers of other races held about 20 percent of jobs in food manufacturing. In addition, Hispanic or Latino workers held nearly 30 percent of jobs in food manufacturing while being only 6 percent of the region's workforce (see Figure 3).

Just under 8,450 food manufacturing workers in the region were white in 2017, a decrease of about 3,025 since 2000. The number of Hispanic or Latino workers in the industry increased 20 percent from 2000 to 2017, although all of that growth happened before 2007, with the number peaking at 4,076 in 2006. Since then the number of Hispanic or Latino workers in food manufacturing has dropped by almost 1,000, with many of those workers moving into other industries in the region.

In contrast, the number of workers of who were not white rose rapidly in the region's food manufacturing industry since the turn of the century.

The number of black workers nearly tripled from 2000 to 2017, from 304 to 895 workers. Jobs held by Asian workers increased 50 percent, from 594 to 878 workers. In sum, workers of races other than white alone accounted for 2,075 jobs in 2017, a 94 percent jump since 2000.

It is important to note that nearly one-third of the 10,617 Hispanic or Latino job holders in the region and one in five of the region's 10,676 job holders of races other than white were employed in food manufacturing, by far the highest concentration of any industry subsector. But workforce data also show that the racial and ethnic diversity originally embraced by food manufacturing employers is now spreading to other industries in the region.

Looking back at the racial composition of the workforce in 2000, workers of races other than white held just under 3 percent of all jobs, but they held 8.5 percent of jobs in food manufacturing. Over the past 17 years, the total number of jobs across all industries held by workers of other races more than doubled overall (115 percent), while the number of jobs held by Hispanic or Latino workers jumped 87.5 percent across all industries. In both cases, this outpaced the growth in food manufacturing.

Clearly, agriculture and manufacturing are vital to Southwest Minnesota's economic success, with food production transforming the landscape both literally and figuratively. Food manufacturing employs thousands of workers across the region and has led the way in welcoming and integrating workers of other races and ethnicities, many of whom are now dispersing into the broader economy.

Food manufacturing offers a variety of job and career opportunities that pay relatively high wages for the region without requiring college education. Most jobs in the industry can be started with a high school diploma or less, and can provide a path to success through on-the-job training and hard work. With many agriculture producers and food manufacturers still looking to expand, opportunities in the field abound.