by Luke Greiner

March 2023

Leisure & Hospitality is an important sector of Minnesota's economy, providing about 8.6% of, or one in every 12, jobs in the state. However, it has been challenged in the past few years by a global pandemic and related policies, supply chain issues, a tightening labor force, and more recently, the highest inflation in decades. The hurdles that business owners in the Leisure & Hospitality sector have faced are substantial, leaving some to make the hard choice to close their doors and shutter their business venture. For Leisure & Hospitality businesses still operating, many have reduced hours due to shifting demand or because they can't find enough help to keep their doors open as many days or hours as they would like.

Restrictions during the initial months of the pandemic that were implemented to slow the spread of the virus, led to staggering employment losses during much of 2020, but demand for services rebounded quickly in 2021. The industry posted nearly 39,000 vacant job openings that year, a 20-year high. Employment increases were also impressive in 2021, but not nearly enough openings were filled to bring the Leisure & Hospitality sector back to pre-pandemic employment levels.

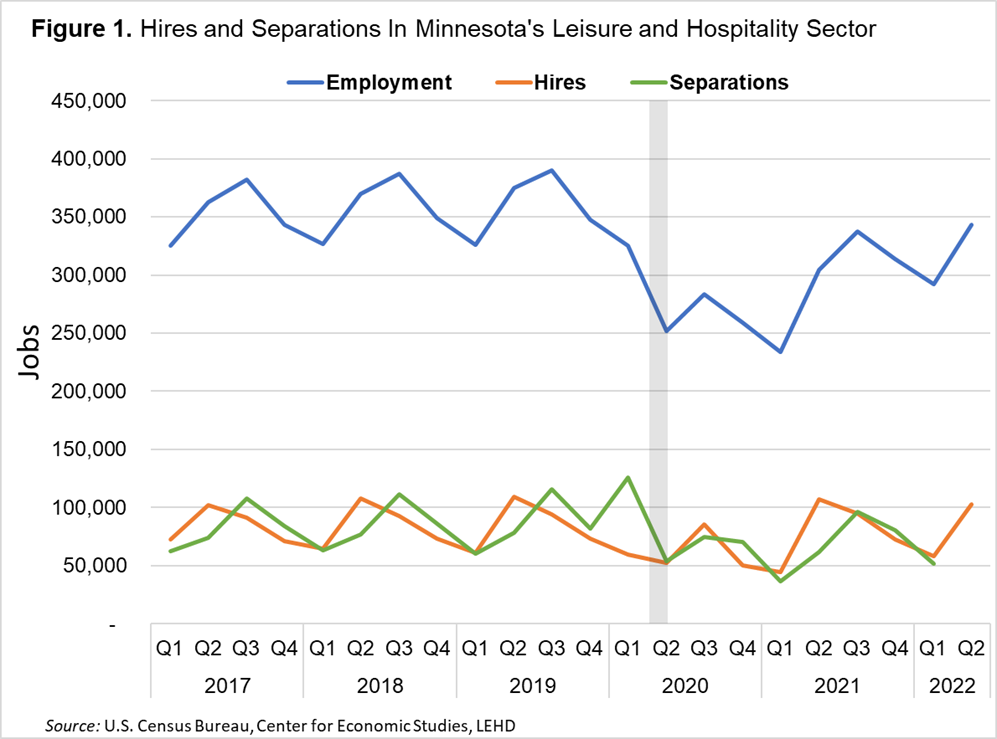

Figure 1 illustrates the changes in hires, separations, and total employment since the beginning of 2020. The Leisure & Hospitality sector typically shows large seasonal employment variations, with hiring ramping up for summer followed by separations as summer turns to fall and young workers go back to school and tourism-related demand wanes. This pattern was consistent in the years before the pandemic(see Figure 1).

The large secondary peak of separations in the beginning of 2020, followed by subdued hiring that summer, both contributed to substantial employment declines. Interestingly, the employment rebound in 2021 is mainly attributed to a decrease in separations, as peak seasonal hiring returned to pre-pandemic levels. This shift likely includes many new hires that are replacing non-seasonal workers who left the industry in 2020.

The recent hiring trends are positive, but also do not appear to be sustainable, partly due to Minnesota's tight labor force. The state still had roughly 50,000 fewer workers overall in 2022 than in 2019. Plus, the competition for labor across the broad economy remains fierce, meaning workers have many options for employment in many different industries and occupations.

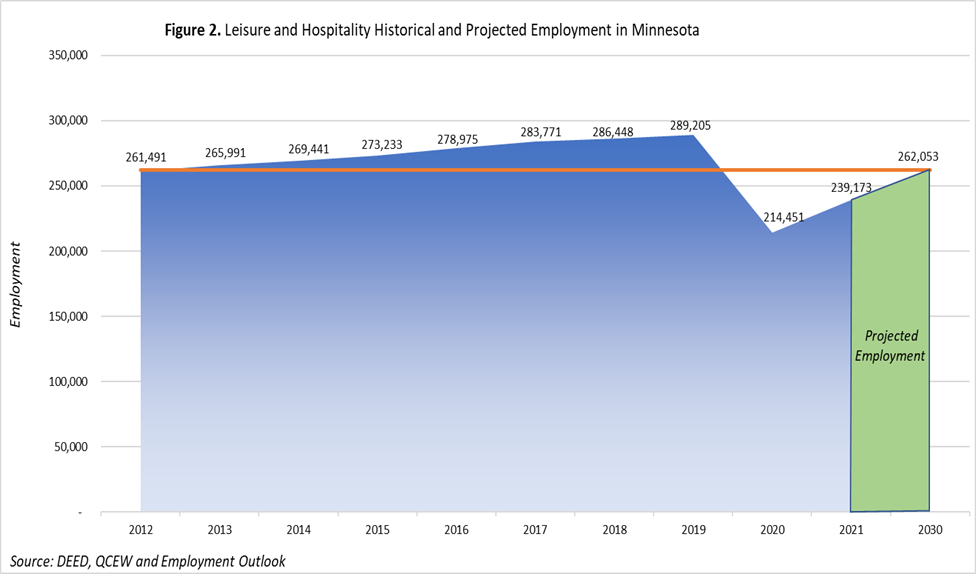

The Leisure & Hospitality sector is projected to continue adding jobs through 2030, but at a much slower pace than the past two years. According to DEED's 2030 employment projections, the Leisure & Hospitality sector is expected to be by far the fastest growing sector (+23%) from 2020 to 2030, yet it still isn't expected to come close to fully recovering from COVID losses. In fact, projected 2030 employment would only get the industry back to 2012 employment levels (see Figure 2).

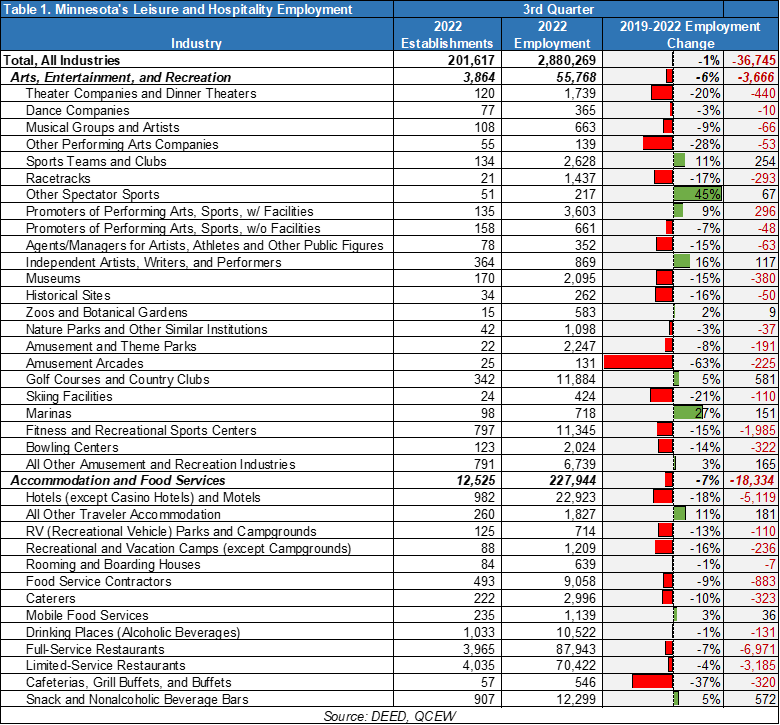

Although the broad Leisure & Hospitality sector has not yet recovered, some components have managed to make gains since 2019 while others saw a disproportionate share of employment loss. From the third quarter of 2019 to 2022, Minnesota's overall employment had nearly recovered from pandemic job losses, down just a single percent, according to Quarterly Census of Employment and Wages (QCEW) third quarter data. However, Arts, Entertainment & Recreation industry employment remained down 6% and Accommodation & Food Services was still off by 7%. The Leisure & Hospitality supersector is made up of the Arts, Entertainment & Recreation and the Accommodation & Food Service industries.

The largest employing subsector within Leisure & Hospitality is Restaurants, with Full and Limited Service Restaurants accounting for 158,365 jobs, or 56% of employment in the sector. Following that, Hotels had nearly 23,000 jobs, and Snack & Nonalcoholic Beverage Bars, Golf Courses & Country Clubs, and Fitness & Recreational Sports Centers all provided more than 10,000 jobs in Minnesota as of the third quarter of 2022.

Notable employment growth from the third quarter of 2019 to third quarter 2022 within the Leisure & Hospitality sector was found in: Spectator Sports (+45%), Marinas (+27%), Independent Artists, Writers & Performers (+16%), Other Traveler Accommodations (+11%), and Sports Teams & Clubs (+11%), which all managed to add jobs despite the ongoing COVID-19 pandemic. The largest number of jobs were added at Golf Courses & Country Clubs (+581 jobs), Snack & Nonalcoholic Beverage Bars (+572 jobs), and Sports Teams & Clubs (+254 jobs), most of which operate outdoors and didn't have the same restrictions as indoor establishments during 2020.

Of course, those gains were overshadowed by widespread employment losses in the remaining 25 subsectors. The most dramatic employment decline since 2019 was seen at Amusement Arcades (-63%), Cafeterias, Grill Buffets, & Buffets (-37%), and Other Performing Arts Companies (-28%). The largest number of jobs lost was at Full and Limited Service Restaurants (combined -10,156 jobs), Hotels (-5,119), and Fitness & Recreational Sports Centers (-1,985). In summary, 25 of the 36 subsectors in the Leisure & Hospitality sector lost jobs from the third quarter of 2019 to 2022, while only 11 subsectors added jobs (see Table 1).

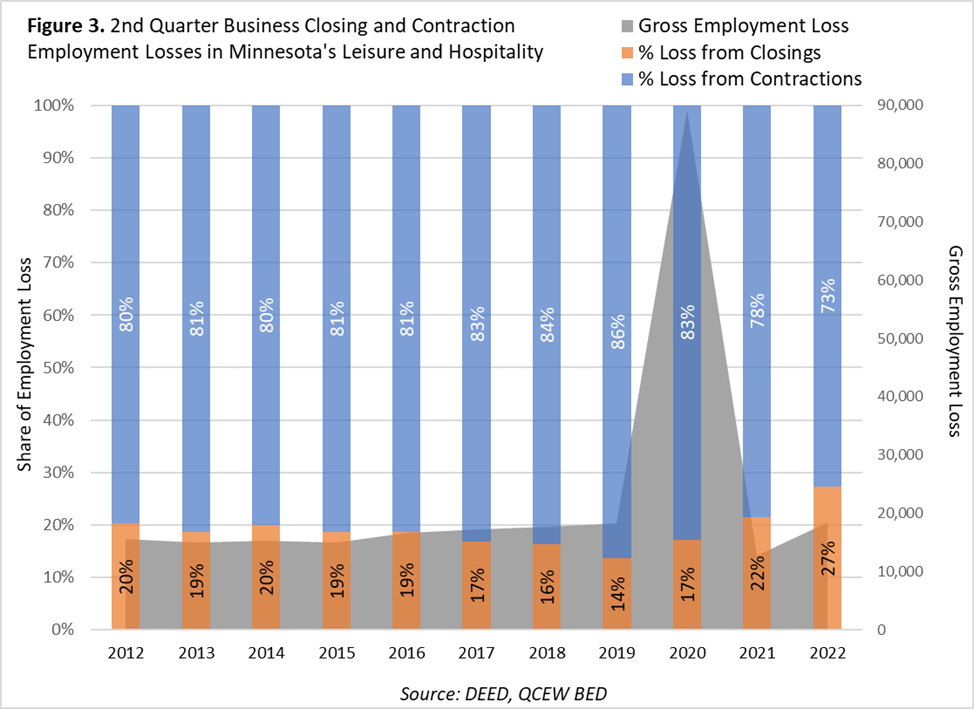

Examining the reasons for job loss in the Leisure & Hospitality sector shows a substantial shift in job losses attributed to establishment closures. In the run up to the Pandemic Recession, the sector typically saw less than 20% of job losses resulting from establishments closing. That ratio dipped in 2019 before climbing to 27% by the second quarter of 2022, showing that closings were more widespread following the Pandemic Recession.

Although an unprecedented amount of job loss occurred in 2020, government intervention by way of large stimulus and business relief packages kept many businesses that ceased or significantly cut back operations solvent. By 2022, government-provided pandemic stimulus and relief funds were mostly exhausted and despite high levels of demand for Leisure & Hospitality services, a new level of workforce challenges meant some businesses weren't able to continue operating because they couldn't find workers.

The level of gross job losses in the Leisure & Hospitality sector was in the normal range in 2022, but a much larger share of this job churn was from business establishments shuttering. In contrast, the share of gross employment gains attributed to new establishments opening was similar to pre-pandemic levels after spiking in 2020. It's possible that the large share of job loss from establishment closures in 2022 are the result of businesses closing that opened in a pandemic environment in 2020, and are not well adapted to current consumer preferences (see Figure 3).

Explore Minnesota Tourism partners with the Federal Reserve Bank of Minneapolis and Hospitality Minnesota every quarter to conduct surveys of business conditions for the state's tourism and hospitality industry. The Winter 2023 survey was open from February 21 to March 6 and received 216 responses.

Three years after the COVID-19 pandemic began, quarterly business conditions survey results have become more consistent. Trends indicate that across the state and industry sub-sectors, most of Minnesota's Leisure & Hospitality industry has reached a point of stability with businesses now dealing with evolving challenges but focused on year-over-year growth.

The Winter 2023 survey included a new question which asked business about their two greatest challenges to operating capacity and productivity. Aside from customer demand, the three greatest challenges reported were: price inflation for necessary goods and services (63%), labor availability for open positions (36%), and wage increases (35%). This aligns with findings from another survey question, in which 74% of firms reported wholesale price changes of 5% or more over the last 12 months and 40% reported a "very tight" labor market.

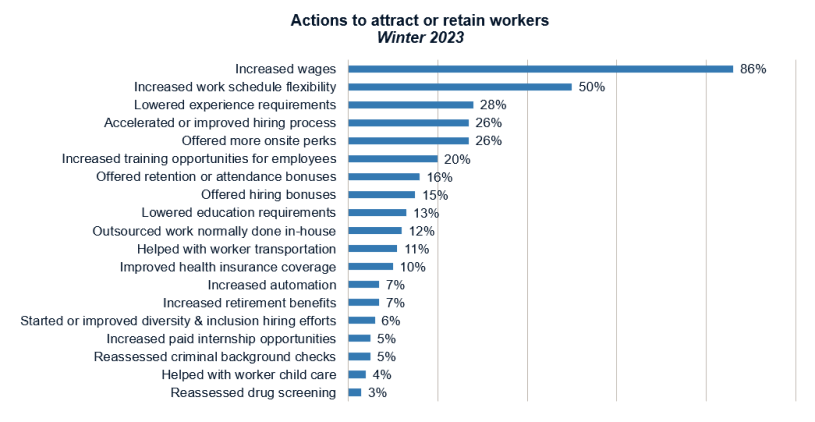

In a separate question, Leisure & Hospitality businesses were asked, "What has your company done in the last six months, if anything, to attract or retain workers?". By far the top response, selected by 86%, was "increased wages." Half of businesses have increased work schedule flexibility, and between 20-28% of industry firms have lowered experience requirements, accelerated or improved hiring processes, offered more onsite perks, and/or increased employee training opportunities (see survey chart 1).

Winter 2023 Survey Chart 1: "What has your company done in the last six months, if anything, to attract or retain workers?"

Source: Winter 2023 Industry Business Conditions Survey

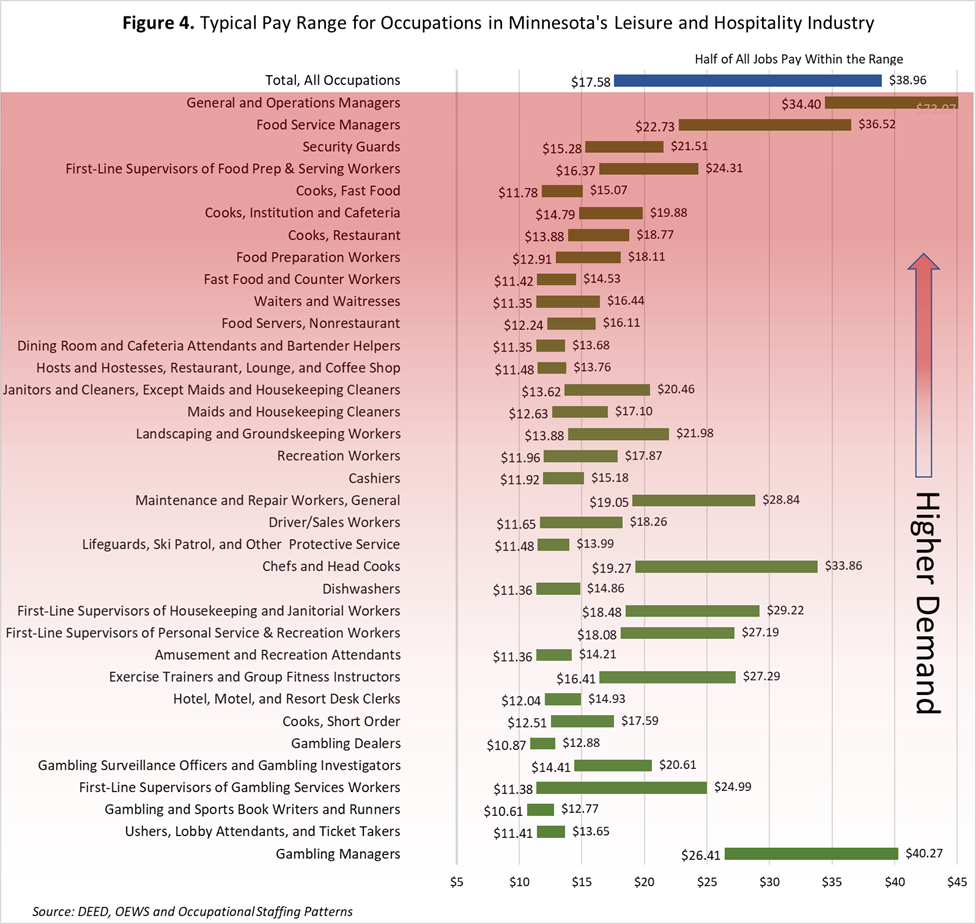

Another challenge facing the Leisure & Hospitality industry is the relatively low wages found in the most common occupations. Although some of the most in-demand occupations commonly found in the sector provide excellent wages (i.e. General Managers, Food Service Managers, Maintenance & Repair Workers, Chefs & Head Cooks, and various First Line Supervisors), starting wages for many of the customer-facing jobs fall short of a livable wage. The Cost of Living for a single person in Minnesota requires full-time employment with an hourly wage of $16.62. The part-time nature of many of the occupations found in Figure 4 means annual hourly earnings need to be supplemented by tips where possible, or by holding multiple jobs in many cases.

However, the relatively lower wages also keep barriers to entry low in the Leisure & Hospitality sector, making it a prime employment opportunity for Minnesota's youngest workers. The sector is incredibly important for young workers to gain work experience and learn about employer expectations and hone soft skills. More so than any other sector, Leisure & Hospitality relies on young workers as a primary source of labor, filling over 27% of jobs with workers from ages 14 to 21 years, according to workforce demographics from the Quarterly Workforce Indicators program.

While young workers helped fill the void left by workers ages 55 years and older who exited the labor force in 2020, many high school and college students are not a suitable replacement for the jobs listed in Figure 4, particularly occupations that require full-time and year-round work schedules.

All of the occupations in Figure 4 are in relatively high demand by employers, giving job seekers a buffet of establishments to choose from. In addition to employers in the Leisure & Hospitality sectors competing for workers, other industry sectors are also struggling with hiring and retention and have attempted to lure workers from lower-paying services sectors, like Leisure & Hospitality, into higher-paying industries. Competition for workers is fierce, but worker quality is also important, and an entry-level position still requires new workers to show up with a certain level of soft and hard skill competency to be successful.

The past few years have caused much strife for business owners, but no other sector carried as much pandemic-related employment burden as the Leisure & Hospitality sector. Employers in the sector who have persevered are faced with a new era of possibilities, both positive and negative, for their future. Recent growth in wages will help attract and retain workers, but increasing demand for positions that allow employees to work from home provides an entirely new challenge that most occupations in Leisure & Hospitality simply cannot accommodate. If food and travel prices continue to increase, consumer behavior will also continue to shift, creating opportunities and challenges for the sector to adapt in the short term, while labor force constraints will most likely be a long-term struggle.