by Amanda O'Connell and Luke Greiner

March 2024

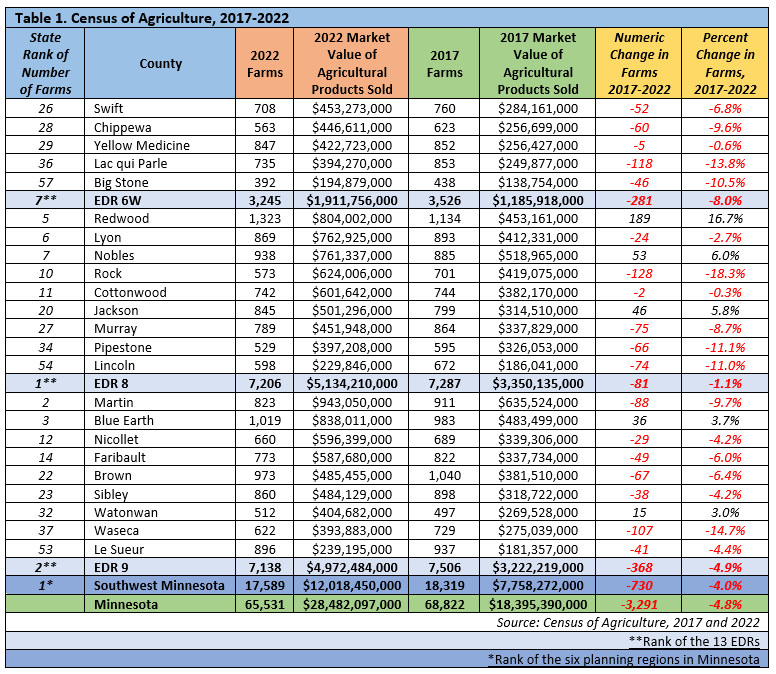

Southwest Minnesota is the state's agricultural hub. With 17,589 farms in 2022, it has the highest number among the six planning regions in the state. Along with more than $12 billion in the market value of agricultural products sold in 2022, Southwest contributes significantly to the state's farming economy. Six counties – Martin (#2), Blue Earth (#3), Redwood (#5), Lyon (#6), Nobles (#7), and Rock County (#10) – are in the top 10 in the state, with four additional counties in the top 20. This distinction highlights Southwest's key role in agriculture and showcases the rich diversity and vitality of its farming (see Table 1).

Despite the high number of farms, the Census of Agriculture data reveal a significant shift within Minnesota's agriculture community, where the state saw a reduction of 3,291 farms, a 4.8% decline from 2017 to 2022. This statewide trend of declining farm numbers is consistent with the decrease observed in Southwest Minnesota as well, which experienced a decline of 730 farms, a 4.0% drop. The counties that had the highest numeric and percent reduction of farms include Rock County (128 farms), Lac qui Parle County (118 farms), and Waseca County (107 farms). Conversely, only a quarter of counties in Minnesota added farms from 2017 to 2022, with four of them in Southwest Minnesota. It's important to note, however, that the average farm size in these counties increased from 2017 to 2022 owing to consolidation of farming operations.

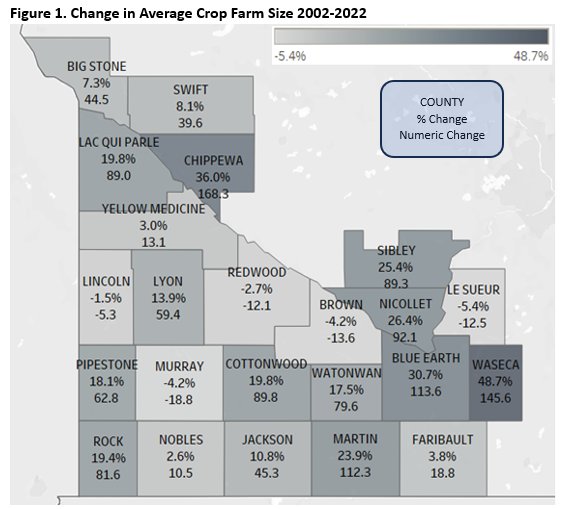

All but five of the 23 counties in the region have seen farm sizes increase over the past 20 years, part of a long-term trend, thanks to larger mechanized equipment, advancing farm practices, and increased government support. The five counties that experienced declines in average farm size were all modest, with Le Sueur having the largest decline at just 5.4%, from 12.5 fewer acres on average. In contrast, the remaining 18 counties that saw average farm sizes increase did so with notable expansions. The largest average gain in acreage was in Chippewa County, with an increase of 168 acres per farm from 2002 to 2022. The largest percent increase was in Waseca County, where average farm acreage grew by almost 50% over the period (see Figure 1).

These changes impact the landscape of Southwest Minnesota's economy, as there are fewer farm operations. Only Redwood County has been able to grow the number of farm operations since the late 1990's, whereas all other counties in Southwest Minnesota have far fewer farm operations now than 20 years ago. In fact, Southwest Minnesota had 2,270 fewer crop farm operations in 2022 compared to 2002, an overall decline of 12.4%. By 2022 there were 16,103 operations left in the area.

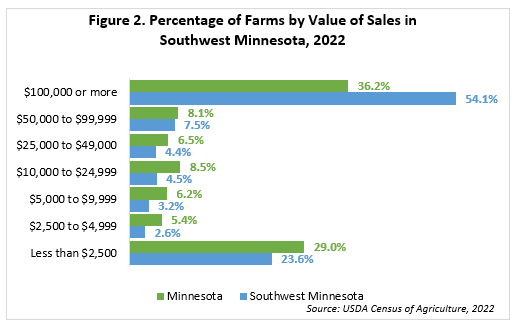

The Census of Agriculture data reflect the patterns in value of sales for farms in Minnesota. In Southwest Minnesota just over half (54.1%) of farms generate $100,000 or more, significantly higher than the state at 36.2%. This indicates a strong presence of high-earning farms in the region. In contrast, a larger proportion of Minnesota's farms fall into the lowest income category, with 29.0% earning less than $2,500 compared to Southwest Minnesota's 23.6%. The disparities continue across the income brackets, with Minnesota exhibiting a higher percentage of farms than Southwest in the intermediate income ranges from $2,500 to $99,999. These variations suggest that Southwest Minnesota has a higher concentration of larger or more commercially successful farms. In contrast, Minnesota has a more significant number of smaller or hobby farms that produce smaller sales (see Figure 2).

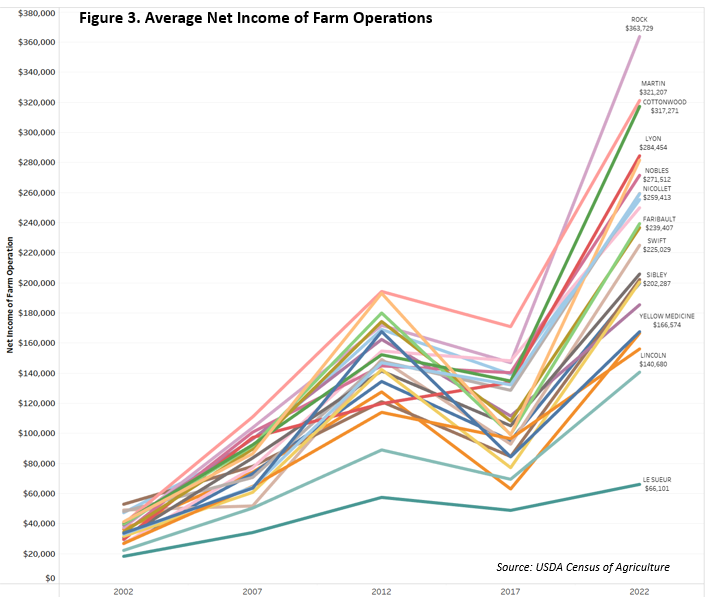

In line with the large share of farms with high sales receipts, net income from farm operations has ballooned according to the recent USDA Census of Agriculture. Figure 3 illustrates how the average net income has fluctuated over the past two decades. Excellent commodity prices bolstered local communities and their economies during the Great Recession from 2008 to 2010, allowing the region to sidestep somewhat an otherwise deep and widespread economic downturn.

However, the boom-and-bust nature of agricultural economics prevailed and by the mid 2010s, net income fell substantially in every county. By 2022 the tide had turned once again, and net farm operation income climbed to the highest levels on record. Rock County recorded the highest at $363,729 net farm income per operation on average. Le Sueur County famers remained the most stable, but also recorded the lowest net farm income at just $66,101 per operation on average.

Federal programs designed for various policy reasons also contribute to farm incomes. In Southwest Minnesota roughly $150 million flowed through various ag-related programs to farm operations in 2022. The average government program receipt for farm operations that received support ranged from $28,465 in Lyon County to $7,876 in Le Sueur County. While net farm income is inherently volatile, average federal program payments to farms have remained more consistent, but exceptions exist where average government payments doubled or even tripled from 2017 to 2022. For example, Pipestone County farmers received an average government payment of $5,400 in 2017, then increased 323% to nearly $23,000 in 2022. Similarly, average government payments in Lyon increased by 188%, in Rock County by 182%, and by 142% in Redwood County.

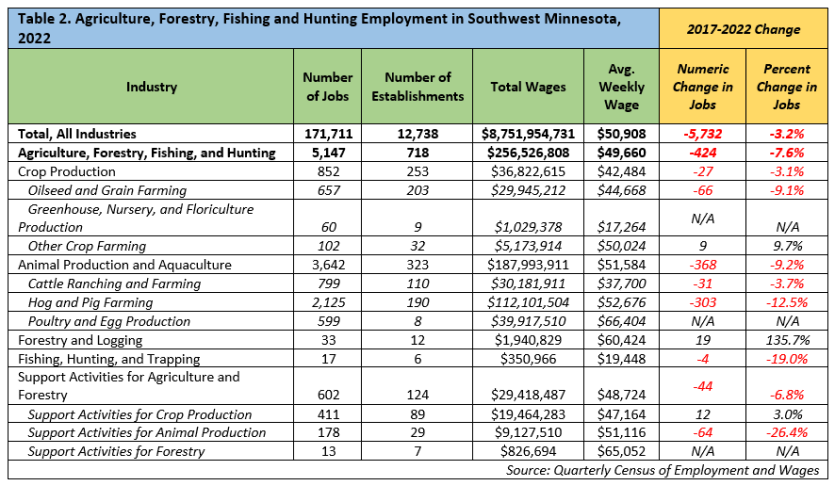

DEED's Quarterly Census of Employment and Wages program offers further insights into employment within the Agricultural sector, providing job counts from farming operations that are covered by the Unemployment Insurance program. Looking at annual averages from 2022, the Agriculture industry had 718 firms, providing a total of 5,147 jobs, which was 3% of the region's overall employment. Since 2017 the sector has declined by 424 jobs, translating to a 7.6% decline in Agriculture employment.

There are five subsectors within the Agriculture industry in Southwest Minnesota: Crop Production, Animal Production, and Aquaculture, Forestry and Logging, Fishing, Hunting and Trapping, and Support Activities for Agriculture and Forestry. Of these five subsectors, four experienced employment declines from 2017 to 2022. The subsector with the largest decline in employment from 2017 to 2022 was Animal Production and Aquaculture, which experienced a decline of 368 jobs, a 9.2% decrease. The only subsector that gained employment was in the Forestry and Logging subsector, which gained 19 jobs, a growth rate of 135.7%.

In Southwest Minnesota the Animal Production and Aquaculture subsector dominates the agricultural employment landscape, accounting for 70.8% of the industry's jobs. Crop Production follows, comprising 16.6% of employment. Meanwhile, the Support Activities for the Agriculture and Forestry subsector adds another 602 positions, representing 11.7% of the industry's payroll. The remaining employment is split between the Forestry and Logging and the Fishing, Hunting, and Trapping subsectors, jointly contributing a smaller share of less than 1.0% to the region's Agricultural employment.

Subsectors can be drilled down further to get greater detail of Agriculture employment in Southwest Minnesota. Within the Animal Production and Aquaculture subsector, Hog and Pig Farming held the majority of jobs, accounting for 58.3% of the subsector's employment, despite shedding 303 positions from 2017 to 2022. The most significant employment category in Crop Production was Oilseed and Grain Farming, which experienced a reduction of 66 jobs over the same period. Support Activities for Crop Production dominated the Support Activities for Agriculture and Forestry subsector, with 411 jobs in 2022.

Despite the inherent volatility in agricultural markets, Southwest Minnesota's farmers remain steadfast as they navigate the complexities of modern agriculture. These stewards of the land continue to uphold the rich tradition of farming in the region while charting a course towards a prosperous future for Southwest Minnesota.