by Dave Senf

May 2013

Note: All data except for Minnesota's PMI have been seasonally adjusted. See the feature article in the Minnesota Employment Review, May 2010, for more information on the Minnesota Index.

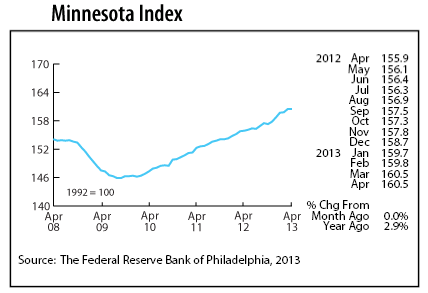

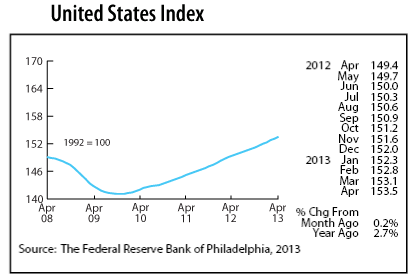

The Minnesota Index was unchanged in April as declining payroll employment last month offset another drop in the unemployment rate and a slight uptick in average manufacturing hours. Minnesota's economy is experiencing more of a spring swoon than the national economy as the U.S. index was up 0.2 percent. The index is a proxy measure of the state's economic activity. The payroll employment component of the index is subject to revisions, so April's reading may eventually report economic growth once employment numbers are revised.

Minnesota's index was racing way ahead of the U.S. index six months ago, suggesting that Minnesota's economy was expanding faster than the U.S. Over the last few months Minnesota's index has slipped behind the U.S. index, indicating that economic growth in Minnesota has slipped below national growth. Economic activity in Minnesota, as measured by the index, is up 2.9 percent from a year ago while the U.S. economy is up 2.7 percent.

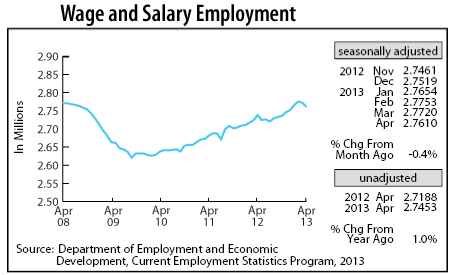

Minnesota's Wage and Salary Employment fell steeply in April with 11,400 jobs lost. April's job cutbacks were the largest since last May and, when combined with March's decline, the first consecutive monthly job declines in three years. Job cutbacks were spread across almost every sector; only Educational and Health Services and Information added positions. Job loss was heaviest in Trade, Transportation, and Utilities, Government, Leisure and Hospitality, and Manufacturing. Manufacturing has recorded job declines for the last three months.

The two-month decline in jobs may be partially related to the late spring with normal spring hiring curtailed by the cold weather. Other labor market indicators are not pointing toward a softening in Minnesota's job growth. Minnesota job growth slipped far behind the U.S. rate on an unadjusted over-the-year basis, 1.0 to 1.6 percent in April. The 1.0 percent over-the-year job growth is the lowest since last September.

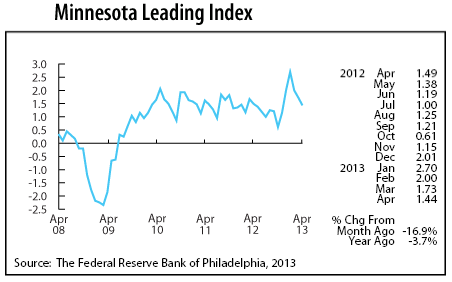

The Minnesota Leading Index slipped for the third consecutive month, dipping to its lowest level since last November. The leading index forecasts the change in the Minnesota Index which is a monthly measure of the state's economic activity. April's 1.44 reading predicts that Minnesota's economy will grow about 1.4 percent over the next six months. That is right in line with the state's economic growth over the last two years. The U.S. leading index was also around 1.4 percent in April.

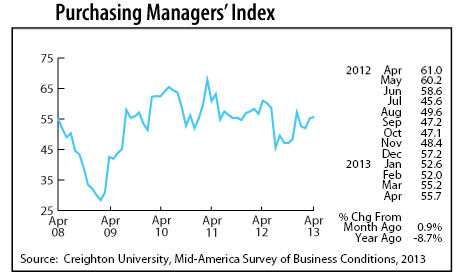

Minnesota's Purchasing Managers' Index (PMI) ticked up for the second consecutive month, inching up to 55.7. The upswing in the survey points toward an expanding state economy in the months ahead. If the index is right, job growth should resume over the next few months. The employment component of the index, however, has been above growth neutral for all four months this year, but manufacturing jobs have increased only in January. Other manufacturing indicators suggest that manufacturing activity may be gaining some speed after slipping over the last few months.

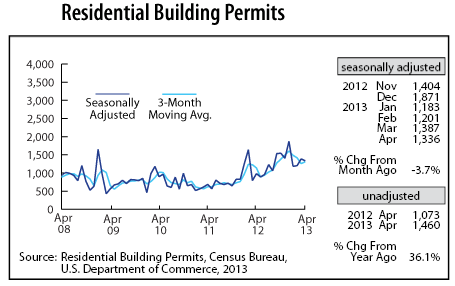

Adjusted Residential Building Permits slipped slightly in April. The housing comeback is going to be a bumpy ride. Home building is likely to pick up in the coming months: home prices are up, homes are selling fast, and the inventory of homes for sale is at the lowest in 10 years.

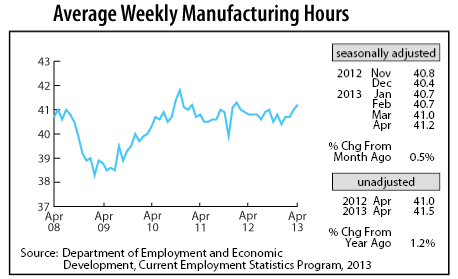

Adjusted Manufacturing Hours rose for the fourth straight month, pushing the factory workweek to its highest level in over a year. An uptick in manufacturing hours usually signals that manufacturing activity is accelerating. Hiring should pick up if this trend continues.

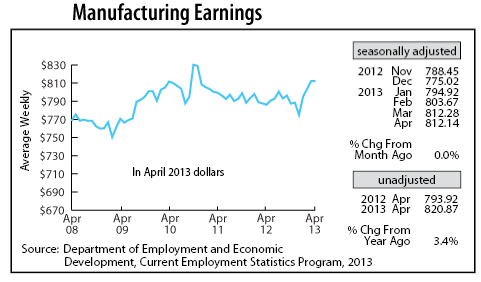

Adjusted Manufacturing Earnings were down slightly in April but remain elevated, near a two and a half year high. Average manufacturing earnings after adjusting for inflation were 3.3 percent higher than a year ago which is good for boosting household spending.

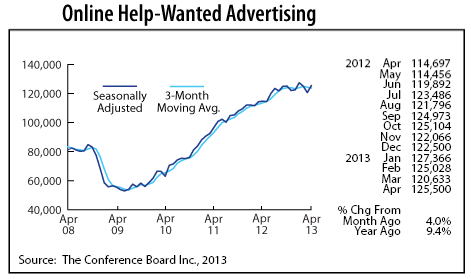

Minnesota's adjusted online Help-Wanted Ads snapped back from a two-month slide, jumping 4.0 percent in April. Online advertising also rose nationwide, climbing 4.2 percent. Minnesota's share of online help-wanted advertising continues to look strong, standing at 2.5 percent of the national total. The 2.5 percent is higher than the Minnesota's 2.0 percent of jobs suggesting that the demand for labor in Minnesota remains stronger than nationwide.

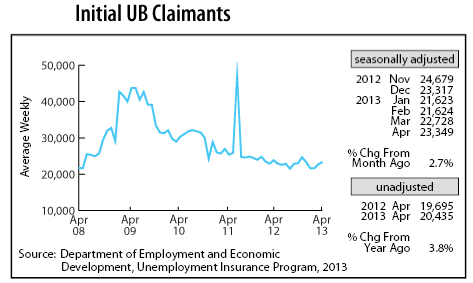

Adjusted Initial Claims for Unemployment Benefits (UB) rose for the second month in a row, advancing to a five-month high. Unadjusted initial claims were 3.8 percent higher than a year ago, making April one of the few months over the last three years with a higher level than 12 months earlier.