by Nick Dobbins

April 2019

Monthly analysis is based on seasonally adjusted employment data. Yearly analysis is based on unadjusted employment data.*

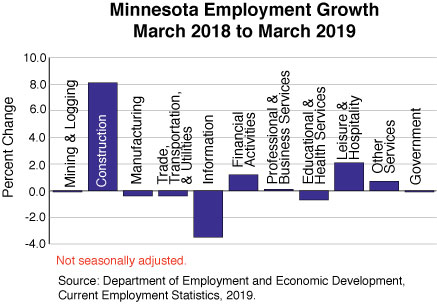

Employment in Minnesota was up by 1,500 (0.1 percent) in March which made up for only part of February’s sharp drop of 7,800 jobs. March’s moderate growth was mainly from a 3,200 job gain in Construction. Goods producers added 2,400 jobs (0.5 percent) while service providers cut 900 (0.0 percent). The private sector added 1,400 jobs (0.1 percent), and the public sector added 100 (0.0 percent). Annually the state added 7,282 jobs (0.3 percent) which is an improvement from the first month of negative over-the-year growth since 2010 recorded in February. Annual growth was concentrated among goods producers (up 7,698 or 1.8 percent) as the much larger service providing industry group reduced jobs by 416 (0.0 percent).

Mining and Logging employment was up a tad in March with 100 jobs added. On the year the supersector lost seven jobs (0.1 percent), so employment in the supersector was virtually unchanged from a year ago.

Employment in the Construction supersector jump 3,100 jobs in March (2.5.1 percent) as February’s record snowfall melted away and construction activity picked up. On an annual basis the supersector added 8,748 jobs (8.4 percent). March marked the 11th consecutive month of over-the-year job growth in Construction. Through the first three months of the year Construction employment has averaged 7.9 percent higher than a year ago. Most of the job gain from a year ago came in Specialty Trade Contractors (up 7,648, 11.2 percent).

Employment in Minnesota’s Manufacturing supersector was down 800 jobs (0.2 percent) in March. Durable Goods Manufacturing cut 600 jobs (0.3 percent) while Non-Durable Goods Manufacturing employment declined by 200 (0.2 percent). On the year the supersector’s employment was down slightly with 1,042 fewer jobs (0.3 percent) than a year ago. Manufacturing employment picked up last year after two years of almost no growth but, much like national activity, manufacturing activity has slowed in 2019 in Minnesota as global growth slows and tariffs activity disrupts trade. March’s negative over-the-year growth was all in Durable Goods Manufacturing, which cut 1,141 jobs (0.6 percent), while Non-Durable Goods Manufacturing added 98 jobs (0.1 percent).

Employment in Trade, Transportation, and Utilities was flat in March with only 100 jobs added (0.0 percent). Wholesale Trade added 400 jobs (0.3 percent), Retail Trade was unchanged from February, and Transportation, Warehousing, and Utilities lost 300 (0.3 percent). Over the year the supersector lost 2,815 jobs (0.5 percent). The supersector has shown over-the-year declines in every month since December. The annual job losses, much like the monthly losses, were driven by Transportation, Warehousing, and Utilities, where employment was down by 3,849 (3.6 percent) from a year ago. Retail Trade was roughly than same as last year while Wholesale Trade employers ramped up employment by 1,166 jobs (0.9 percent) from last March.

The Information supersector lost 300 jobs (0.6 percent) in March. Information employers have lost jobs in every month since December 2018 and on an annual basis since 2002. On an over-the-year basis the Information supersector lost 1,722 jobs (3.5 percent). Telecommunications employers cut 854 jobs (6.8 percent), and non-internet Publishing Industries lost 390 (2.1 percent).

The Financial Activities supersector lost 700 jobs (0.4 percent) in March with job declines in both Finance and Insurance (500, 0.3 percent) and Real Estate and Rental and Leasing (200, 0.6 percent). Annually the supersector added 2,194 (1.2 percent). Finance and Insurance accounted for all the job gains with Depository Credit Intermediation firms adding 977 jobs (1.9 percent) and Insurance Carriers and Related Activities companies ramping up employment by 1,549 (2.4 percent). Real Estate and Rental and Leasing was off by 139 jobs (0.4 percent).

Professional and Business Services employment was down by 700 (0.2 percent) in March. The decline came in Professional, Scientific, and Technical Services (400, 0.2 percent) and Administrative and Support and Waste Management and Remediation Services (900, 0.7 percent). Management of Companies and Enterprises added 600 jobs (0.7 percent) in March. Annually the supersector was basically unchanged from last year as employment increased by only 41 jobs. Professional, Scientific, and Technical Services added 1,365, (0.8 percent), and Management of Companies and Enterprises added 1,185 jobs (1.5 percent). But Administrative and Support and Waste Management and Remediation Services reduced employment by 2,509 jobs (2.0 percent). The component’s decline was caused by the loss of 7,129 jobs (12.5 percent) in the Employment Services sector.

The Educational and Health Services supersector cut 300 jobs (0.1 percent) in March. Health Care and Social Assistance added 200 jobs (0.0 percent), but Educational Services reduced jobs by 500 (0.8 percent). Over the year Educational and Health Services employment was off by 3,532 (0.7 percent), with declines in both of its component sectors. Educational Services lost 1,242 jobs (1.8 percent), mostly in Colleges, Universities, and Professional Schools, while Health Care and Social Assistance lost 2,290 jobs (0.5 percent).

Leisure and Hospitality employment was up by 200 (0.1 percent) in March with the loss of 500 jobs (0.2 percent) in Accommodation and Food Services sector offset by 700 jobs (1.4 percent) added in Arts, Entertainment, and Recreation. Annually the supersector added 5,333 jobs (2.1 percent). Arts, Entertainment, and Recreation added 3,983 (9.7 percent) and has had over-the-year job growth of greater than 5 percent in every month since October. Accommodation and Food Services added 1,440 (0.7 percent) jobs, with job growth in both Accommodations (340, 1.3 percent) and Food Services and Drinking Places (1,110, 1.6 percent).

Leisure and Hospitality employment was up by 200 (0.1 percent) in March with the loss of 500 jobs (0.2 percent) in Accommodation and Food Services sector offset by 700 jobs (1.4 percent) added in Arts, Entertainment, and Recreation. Annually the supersector added 5,333 jobs (2.1 percent). Arts, Entertainment, and Recreation added 3,983 (9.7 percent) and has had over-the-year jobs growth of greater than 5 percent in every month since October. Accommodation and Food Services added 1,440 (0.7 percent) jobs, with job growth in both Accommodations (340, 1.3 percent) and Food Services and Drinking Places (1,110, 1.6 percent).

Leisure and Hospitality employment was up by 200 (0.1 percent) in March with the loss of 500 jobs (0.2 percent) in Accommodation and Food Services sector offset by 700 jobs (1.4 percent) added in Arts, Entertainment, and Recreation. Annually the supersector added 5,333 jobs (2.1 percent). Arts, Entertainment, and Recreation added 3,983 (9.7 percent) and has had over-the-year jobs growth of greater than 5 percent in every month since October. Accommodation and Food Services added 1,440 (0.7 percent) jobs, with job growth in both Accommodations (340, 1.3 percent) and Food Services and Drinking Places (1,110, 1.6 percent).

| Seasonally Adjusted Nonfarm Employment (in thousands) | |||

|---|---|---|---|

| Industry | Mar-19 | Feb-19 | Jan-19 |

| Total Nonfarm | 2,958.0 | 2,956.7 | 2,964.5 |

| Goods-Producing | 454.3 | 452.5 | 457.1 |

| Mining and Logging | 6.8 | 6.7 | 6.8 |

| Construction | 128.0 | 125.2 | 128.6 |

| Manufacturing | 319.5 | 320.6 | 321.7 |

| Service-Providing | 2,503.7 | 2,504.2 | 2,507.4 |

| Trade, Transportation, and Utilities | 535.5 | 535.2 | 538.1 |

| Information | 47.5 | 47.9 | 48.0 |

| Financial Activities | 185.4 | 186.0 | 185.0 |

| Professional and Business Services | 377.4 | 377.8 | 375.8 |

| Educational and Health Services | 538.4 | 539.0 | 541.9 |

| Leisure and Hospitality | 280.8 | 280.2 | 281.2 |

| Other Services | 113.5 | 112.8 | 112.5 |

| Government | 425.2 | 425.3 | 424.9 |

| Source: Department of Employment and Economic Development, Current Employment Statistics, 2019. | |||

*Over-the-year data are not seasonally adjusted because of small changes in seasonal adjustment factors from year to year. Also, there is no seasonality in over-the-year changes.