by Luke Greiner

June 2022

More than two years after the pandemic halted the longest economic expansion in our history, Central Minnesota and the entire state have not yet recovered all the jobs lost during the two-month pandemic recession. Covered employment in the region (excluding self-employment) has regained 96% of jobs lost in 2020, but the region still had almost 10,000 fewer jobs in 2021 than it did two years earlier.

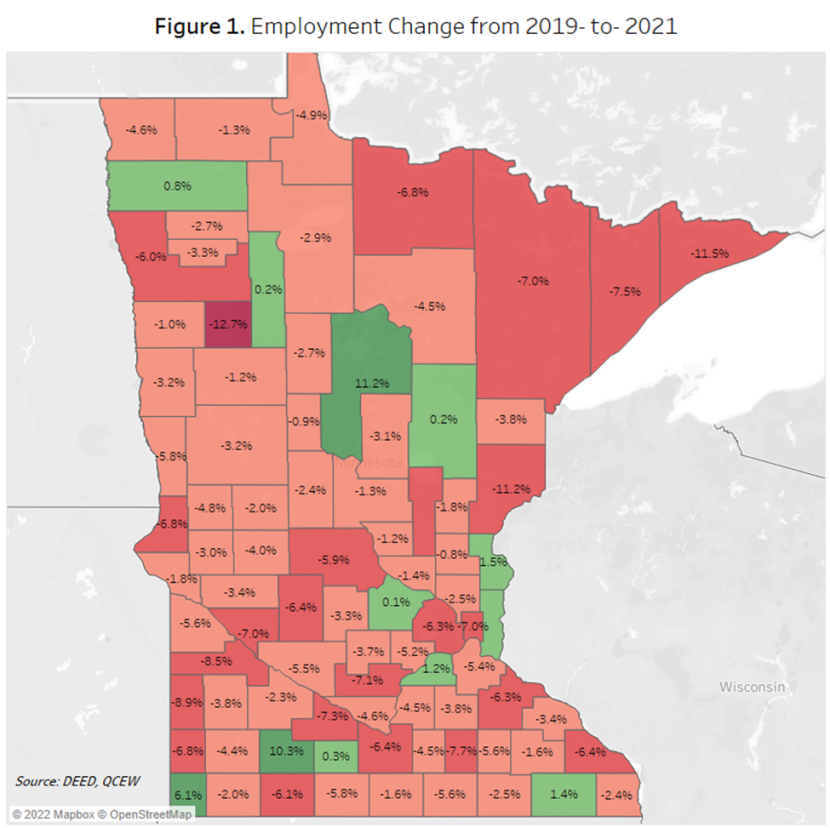

Only 12 counties in the entire state, but two in Central Minnesota - Wright and Chisago - managed to have more employment in 2021 than in 2019. The other 11 counties in the Central region were still down due to the pandemic recession, ranging from Pine County, which is still down -11.2%, to Isanti County, which is down just -0.8% (see Figure 1).

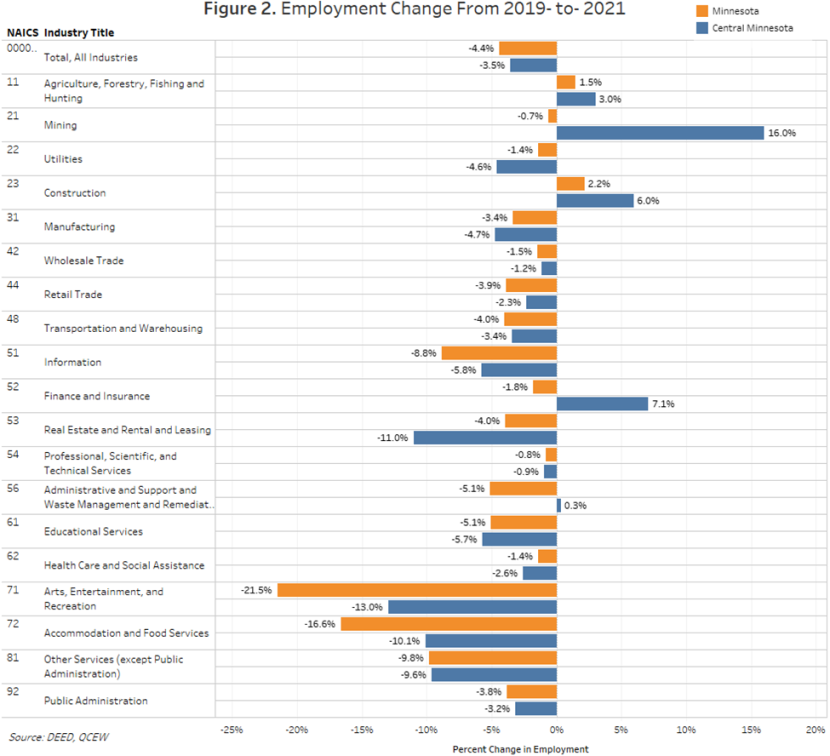

In sum, overall job losses are -3.5% below 2019 levels in Central Minnesota, compared to -4.4% statewide. In terms of percentage change, the Arts, Entertainment & Recreation industry fared the worst with 13% fewer jobs in 2021 than in 2019, yet the sector showed resiliency compared to Minnesota where the industry shed more than 21% of its jobs. It's a similar story in the related Accommodation & Food Services industry, where the region lost a smaller share of jobs in 2020 and has since grown jobs faster compared to Minnesota.

In contrast, the Mining, Agriculture, Construction, Finance & Insurance, and Administrative Support & Waste Management sectors have all managed to expand employment to levels that exceeded 2019 numbers (See Figure 2).

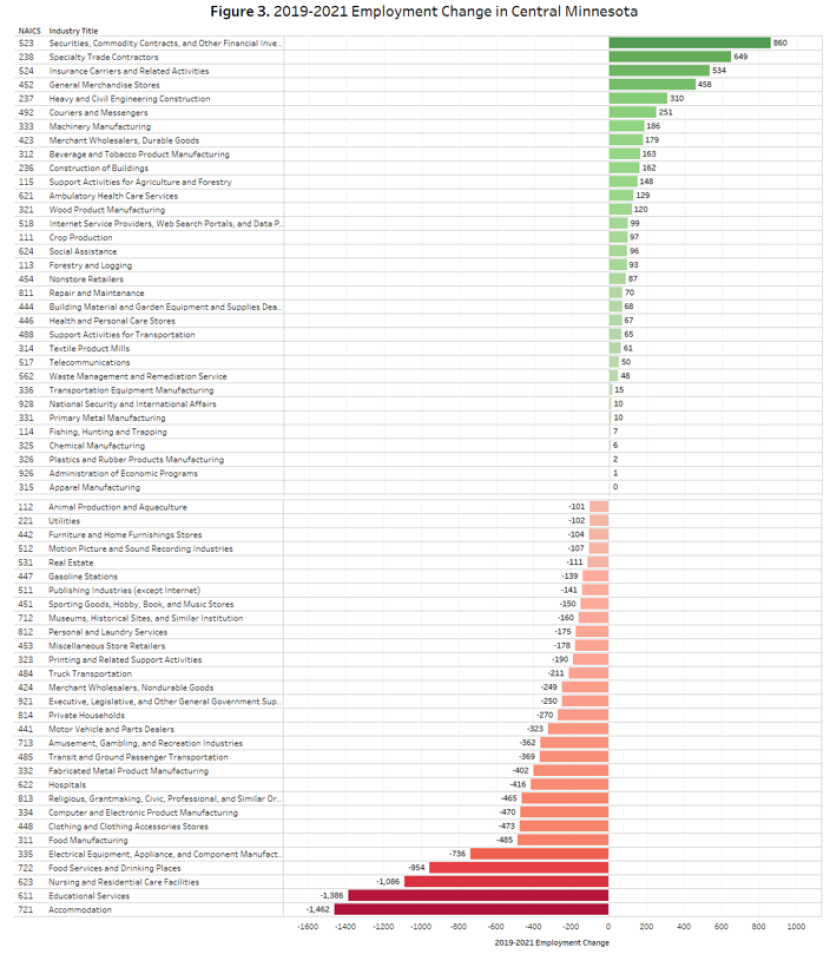

In raw numbers, the region lost substantial numbers of jobs in Accommodation & Food Services (-2,416), Manufacturing (-1,982), Educational Services (-1,386), Health Care & Social Assistance (-1,277), Retail Trade (-841), and Other Services (-841).

Diving into a higher level of detail shows just how concentrated by sector losses were. Accommodation, Educational Services and Nursing & Residential Care Facilities have all lost more than 1,000 jobs since 2019. Food & Drinking places also have nearly 1,000 fewer jobs in the region than just a few years prior. Widespread losses in 2020 have carried forward through 2021 in many sectors, with 30 industry subsectors down at least 100 jobs from 2019 to 2021 (see Figure 3). The loss of jobs can be from workers moving out of one industry into another or workers simply leaving the labor force altogether.

At the top of Figure 3 in green are the industry subsectors that have managed to grow during this period. The region added 860 jobs in the Securities, Commodities, and other Financial Investors industry, and more than 500 jobs at Specialty Trade Contractors and Insurance Carriers. General Merchandise stores also finished 2021 in a strong way, adding onto years of job growth.

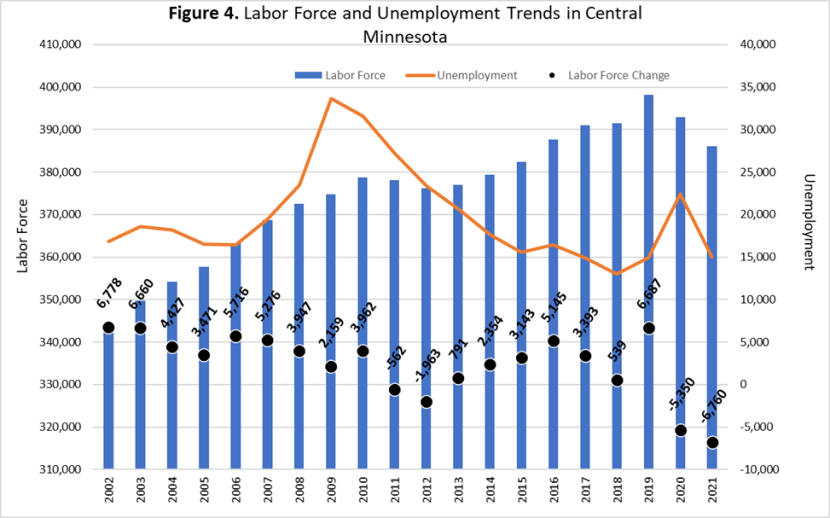

Labor force losses have been especially troublesome and problematic for the economic recovery. Central Minnesota had 12,000 fewer workers in 2021 compared to 2019, a 3% decline. Minnesota as a whole suffered even larger losses, amounting to 108,483 fewer workers (-3.5%) in 2021 than 2019. Regional losses in 2020 continued in 2021, wiping out more than 3 years of previous labor force growth. National data point to older workers aged 55 years and over as the main cohort leading the exodus of workers and it's reasonable to assume the same is true in Central Minnesota.

Meanwhile, the number of workers who were unemployed and looking for work has remained somewhat stable and was roughly the same in 2021 as 2019. With only 15,000 unemployed workers there are more job openings than unemployed workers, making economic recovery a serious challenge (Figure 4).

Employment has not recovered, but it's not from a lack of job openings. Employers in Central Minnesota reported more than 21,000 openings in the fourth quarter of 2021. If all of these openings could be filled, the recovery would be complete and the region would actually be up about 4% in employment over the pre-pandemic peak. But the large number of workers who left the labor force have shifted job vacancy rates to record highs, nearly double the previous high; there are simply not enough available workers to fill the many available jobs.

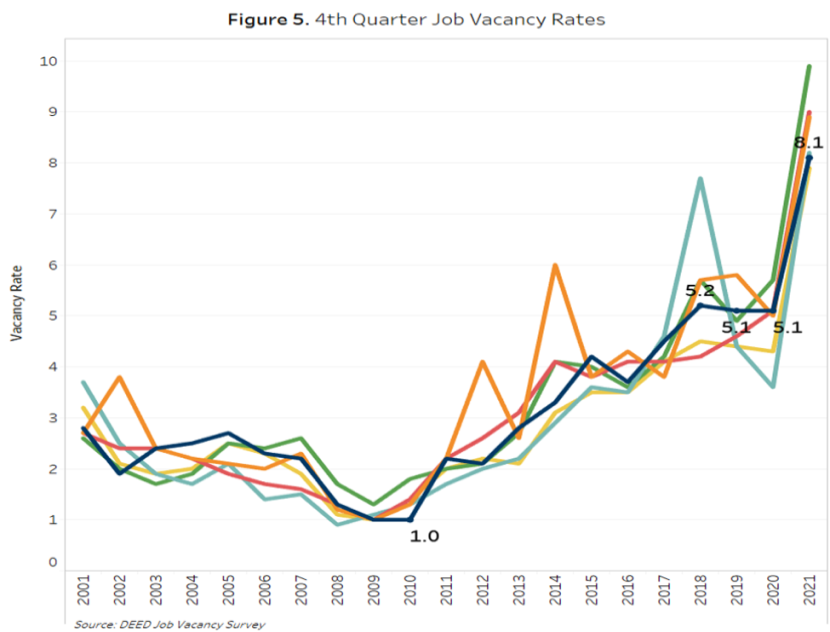

Job vacancy rates are the share of openings relative to employment. Central Minnesota's incredible 8.1% job vacancy rate illustrates the leverage workers have in the current labor market, yet it's even higher in surrounding Northwest, Northeast, and Southwest Minnesota (Figure 5).

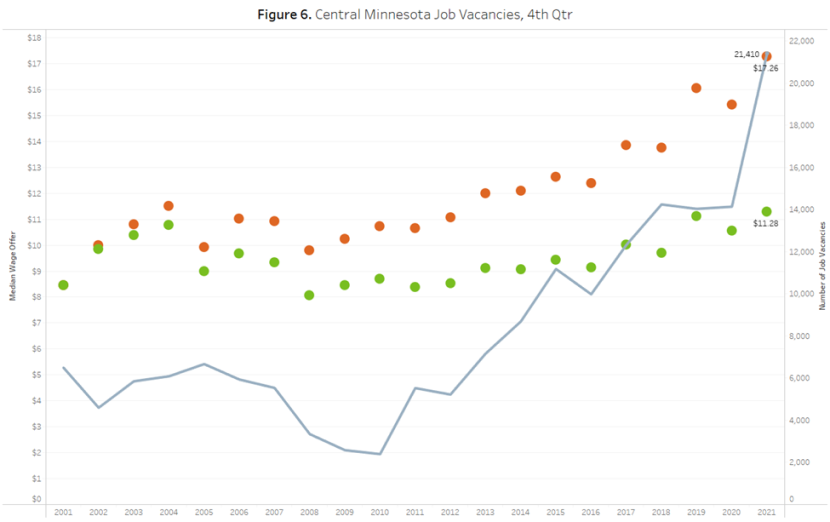

With 21,410 job vacancies in 4th quarter 2021, there were 52% more job vacancies than the previous high recorded in 2019. Job vacancies are usually an indicator of a healthy and growing economy, but that correlation relies on the vacancies getting filled by workers. Large numbers of openings are still great news for job seekers and workers looking to make a change, but the loss of employment and labor force during the same period means economic growth is being held back.

Thanks in part to the tight labor market, wage growth has accelerated recently, but unfortunately inflation is now at 40-year highs which is cutting into wage gains, in some cases completely erasing the raises workers receive. The median wage offer for all job vacancies in 4th quarter 2021 was $17.26, but after adjusting for inflation the real median hourly wage offer was $11.28, just 17 cents higher than it was in 2019 (Figure 6).

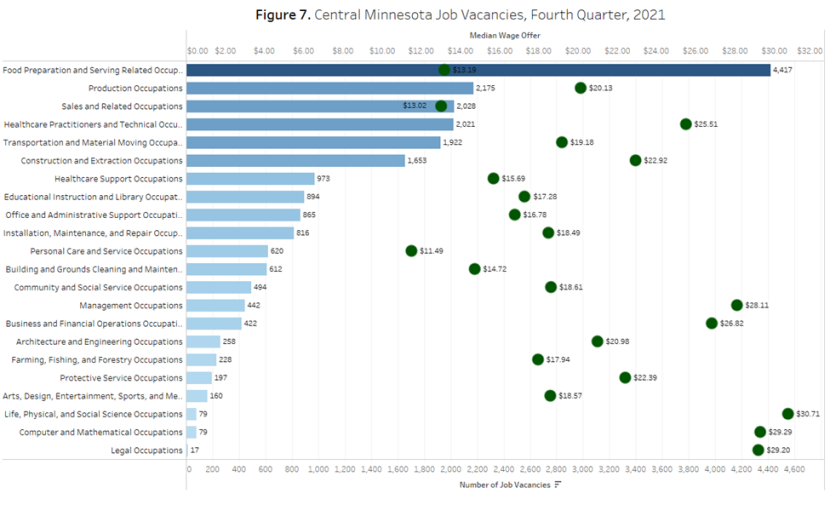

Openings are abundant and at or near record highs for most occupational categories. The largest number of openings are for Food Prep & Serving workers (4,417 openings), followed far behind by Production, Sales, Health Care, Transportation, and Construction Openings. Entry level positions, which typically account for the majority of openings, might not reflect the wages that currently employed and more experienced workers will demand and receive when changing jobs (see Figure 7).

Knowing that job creation is being held back by slow labor force growth in the coming decade on top of substantial labor force losses in 2020 and 2021, it shouldn't come as a surprise that recently released employment projections are lower than previous estimates. Central Minnesota was previously expected to be the fastest growing region in the state but is now projected to grow slower than most other regions.

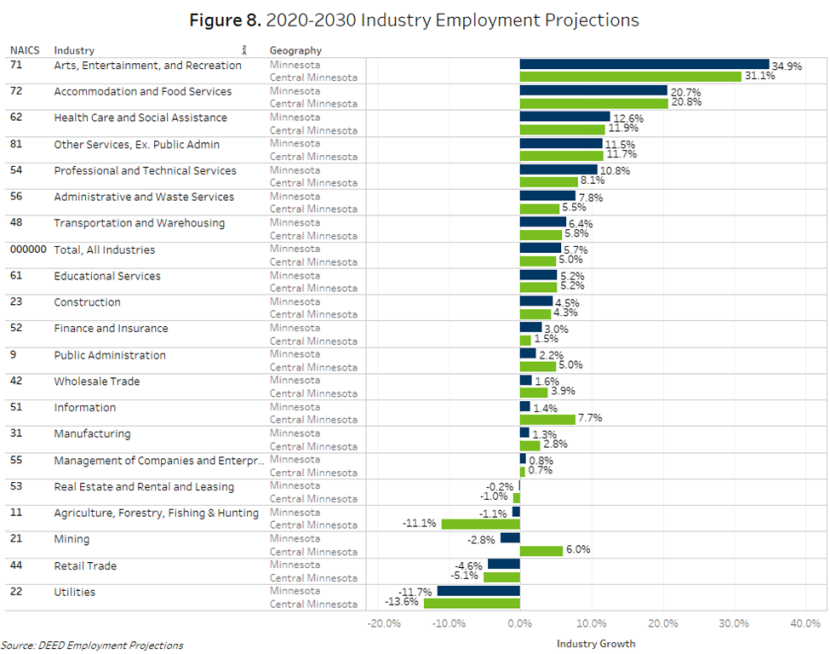

With employment projected to expand by 5% from 2020 to 2030, that would be roughly two-thirds as fast as actual employment growth from 2011 to 2021. A few sectors are likely to show strength in the region and grow faster than statewide including Accommodation & Food Services, Other Services, Public Administration, Wholesale Trade, Information, and Manufacturing. Losses are projected in several subsectors including Utilities, Retail Trade, Mining, Agriculture, and Real Estate.

Continuing recent employment trends, the fastest growth is expected to come in areas of the economy that suffered the largest losses during the pandemic recession. Despite explosive growth projected in Accommodation & Food Services (+20.8%), the sector still wouldn't surpass 2019 employment levels. It's the same story for the Manufacturing and Information sectors, with both not expected to hit 2019 employment levels by 2030, although the Information sector has been in decline for two decades in the region (see Figure 8).

Central Minnesota's economic future will depend on bringing workers back to the labor force that left in the past few years. Projected labor force growth is much slower than in past decades, with only +0.6% growth expected from 2,500 additional workers from 2023 to 2033.

In summary, the labor force has fewer workers, employers have more openings, and the number of unemployed workers isn't large enough to relieve the current labor market friction. Even if every single unemployed worker was hired there would still be unfilled job openings, so trying to tap into underutilized labor pools is a useful strategy. Future labor market conditions could be much different than today: with such a large share of recent labor force exits from workers aged 55 years and over, it's possible that more will return to work and shore up the labor force. Central Minnesota will need all the help it can get to fill the jobs that are currently available, as well as new jobs that will be created in the future.