Central Minnesota is a manufacturing stronghold, with several global manufacturing firms operating there.

Central Minnesota is a manufacturing stronghold, with several global manufacturing firms operating there.

The region is especially well known for its expertise in food processing, printing, furniture manufacturing, appliances, machinery and heavy equipment manufacturing.

View our latest blogs on CareerForce. Want the freshest data delivered by email? Subscribe to our regional newsletters.

12/14/2022 9:00:00 AM

Luke Greiner

Home ownership has long been held in high regard in America. Owning a home can provide housing stability, mitigate risks of rent increases, and build and transfer wealth. However, home ownership is not without downsides, such as maintenance, large down payments, geographic immobility, and interest costs, all of which can easily create problems for homeowners. Despite the risks, owning a home is an important part of the American Dream and has been a terrific investment for most who have taken the leap.

According to the National Association of Realtors, the median age of first-time home buyers in the U.S. was 36 years in 2022, up from 33 just a year ago, and is now the oldest age recorded. With more intentional mortgage lending practices put in place after the financial crisis and Great Recession in 2008, an applicant would be hard pressed to be approved for any type of mortgage without being gainfully employed or having already accumulated enough wealth. In Central Minnesota, just over two-thirds of owner-occupied housing units have a mortgage, which equals nearly 140,000 homes.

Thanks to the tightest labor market in most workers' lifetimes, finding employment shouldn't be a barrier to home ownership, but as the battle to pull down inflation continues, housing affordability has become more challenging. This is especially problematic for people in the bottom half of the wealth distribution. This group saw their already disproportionately high share of wealth held in real estate grow by 16%, by the 2nd quarter of 2022 from 2019. Roughly 59% of wealth held by the bottom half of the wealth distribution is in real estate.

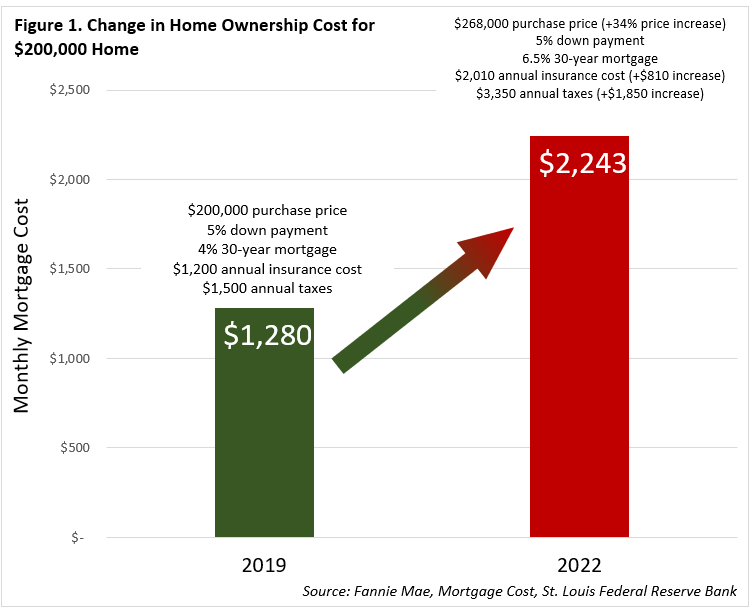

While people who owned homes prior to the pandemic have benefited from valuation increases due to the frenzied buying atmosphere since 2020, the fast price increases can push many would-be homebuyers out of the market. In addition to inflated home prices, there are substantially higher mortgage rates, which effectively decrease the purchasing power of workers. Homes prices are higher while workers can buy less for their money. From the second quarter of 2019 to the second quarter of 2022, home values (based on sale prices and appraisals) increased by 34% and 30-year fixed mortgage rates ranged from between 3.5% and 4.5% to topping 7% in the past month, nearly doubling.

To demonstrate the challenge facing many workers looking to purchase a home, a typical 4% interest rate on a $200,000 home in 2019 would require a monthly payment of roughly $1,300 with taxes and insurance after a 5% down payment. The same home and down payment in 2022 would require over $300 more per month to purchase.

But home prices have also ballooned over this period, accounting for inflated home prices (+34%), which means that $200,000 home in 2019 is likely worth close to $270,000 in 2022. Adjusting for home price increases means the same home would require home buyers to dedicate well over $2,200 per month to pay for increases in the cost of their mortgage, interest rate, insurance, and taxes. To buy the same house in 2022, homebuyers would need to spend 75% more! Meanwhile, median wages for workers in Minnesota increased less than 8% from 2019 to 2021.

For context, the median mortgage cost in 2020 for Central Minnesota was $1,511, and only 22% of houses with a mortgage had monthly payments over $2,000 just two years ago. Wages have a lot of catching up to do before workers of Central Minnesota regain pre-pandemic housing affordability. Because of that, workforce housing, both rental and owner-occupied, remains a struggle in many communities in Central Minnesota.

Contact Luke Greiner at 320-223-6992.