Home to the state's second-largest metro, the Northeast Region has a strong industrial sector, tied largely to the area's abundant natural resources.

Home to the state's second-largest metro, the Northeast Region has a strong industrial sector, tied largely to the area's abundant natural resources.

Most of the manufacturing base centers on mining and forest products industries. More than half of the sector's employment is in paper and machinery manufacturing.

Want the freshest data delivered by email? Subscribe to our regional newsletters.

7/7/2021 9:00:00 AM

Carson Gorecki

While many labor market indicators in Northeast Minnesota are pointing in the right direction for people who are looking for work now, there is one factor that is important to keep an eye on. High numbers of people who are experiencing long-term unemployment can signal long-term challenges for those workers and an underutilized labor pool for employers.

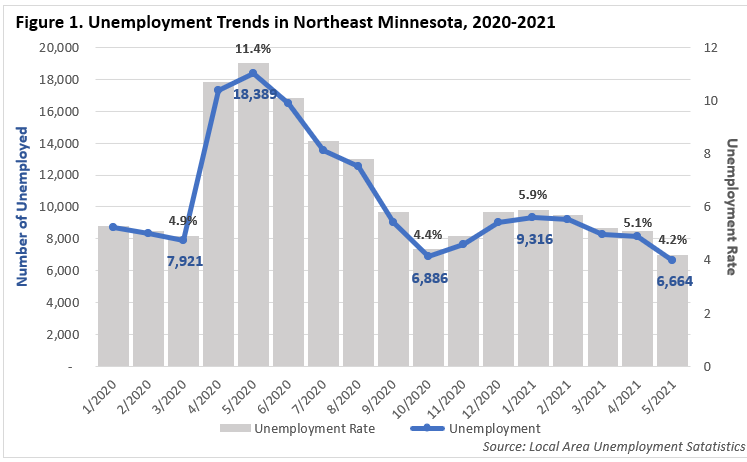

The economic roller coaster that was the last 15 months included a drastic spike in unemployment both nationally as well as here in Northeast Minnesota. The regional unemployment rate reached as high as 11.4% and the number of unemployed peaked at 18,389 in May of 2020. Since that point, the unemployment rate fell somewhat rapidly to a rate of 4.4% in October, before rising again in correspondence with the rising number of COVID-19 cases in the winter months. In recent months, the unemployment rate declined again from 5.9% in January to 4.2% in May (see Figure 1).

Those look like encouraging trends for the labor market, yet the general decline in unemployment masks the relative rise of the long-term unemployed. Both the unemployment rate and the number of unemployed in May were the lowest they have been in over a year, but that does not tell the entire story. In previous blogs I discussed how the decline in the labor force since the pandemic began is cause for concern. The tight labor market conditions that existed prior to the onset of COVID-19 are returning, and now the pool of workers employers must hire from is about 4,700 smaller than it was just over a year ago.

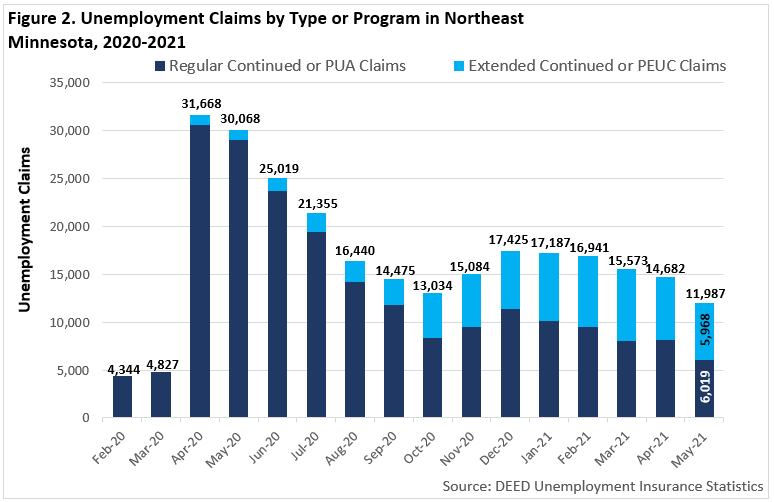

The unemployment story itself is also more nuanced than the simple trend of falling numbers and rates. DEED's Unemployment Insurance (UI) statistics allow a more detailed look at labor market dynamics as the economy strives to recover. In addition to the regular continued and extended continued programs that the state typically provides, the federal response to the pandemic provided the Pandemic Unemployment Assistance (PUA) and Pandemic Emergency Unemployment Compensation (PEUC) programs. The PUA program made UI benefits available to workers that were not typically eligible, including the self employed and independent contractors. The PEUC program provided an extension to those who exhausted regular state benefits, typically after 26 weeks.

Total UI claims1 have declined considerably since April and May of last year, as reflected by the falling unemployment rate and number of unemployed workers. After reaching a high of nearly 32,000 claims in April 2020, total continued claims sat at just under 12,000 in May 2021. This is where additional nuance is available. While both regular continued or PUA claims have declined since December 2020, and extended continued or PEUC claims have declined since March 2021, the share of extended or PEUC claims has increased all but one month since March 2020. As of May 2021, claims were split evenly between regular/PUA and extended/PEUC for the first time, indicating a relative rise in longer-term unemployment as more claimants exhaust their regular benefits and transition to extended benefits programs (see Figure 2).

This transition from regular to extended unemployment benefits is important. The long-term unemployed are less likely to easily re-enter the workforce due to stigma, which in turn can feed a cycle of anxiety and a decline of confidence. This can be particularly true for older workers and workers who had achieved senior positions or have highly specialized skills or qualifications in areas where there aren't a large number of open positions. As a result, the long-term unemployed have been a traditionally underutilized resource, one that is extremely valuable in a tight labor market such as the one we currently find ourselves in. In the recovery from the pandemic recession, efforts to reach the long-term unemployed and welcome them back into the workforce should be one of many strategies utilized by employers and workforce development organizations.

1 Unemployment claims differ from the number of unemployed. Those filing claims may still be considered employed if they continue to work a second job or work reduced hours while still being eligible for unemployment benefits. Additionally, those considered to be unemployed may not be filing or receiving unemployment claims for a variety of reasons.

Contact Northeast Minnesota Labor Market Analyst Carson Gorecki at 218-302-8413.