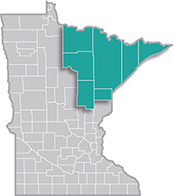

Home to the state's second-largest metro, the Northeast Region has a strong industrial sector, tied largely to the area's abundant natural resources.

Home to the state's second-largest metro, the Northeast Region has a strong industrial sector, tied largely to the area's abundant natural resources.

Most of the manufacturing base centers on mining and forest products industries. More than half of the sector's employment is in paper and machinery manufacturing.

Want the freshest data delivered by email? Subscribe to our regional newsletters.

12/6/2021 9:00:00 AM

Carson Gorecki

By many accounts, Retail Trade has fared better than most other sectors since the onset of the pandemic. This was definitely true as measured by sales, which increased consistently since last year. By common labor market metrics, such as those tracked by DEED's Quarterly Census of Employment and Wages (QCEW), the Retail picture also looked relatively positive. While total employment in Northeast Minnesota fell 7.3% from the second quarter of 2019 to the second quarter of 2021, Retail Trade saw a relatively smaller -4.1% decline.

In between, Retail Trade employment also saw a smaller decline under the initial shock of the pandemic, falling -13% compared to the -15.2% of all industries from 2019 to 2020. Since the second quarter of 2020, Retail employment has also rebounded faster, growing 10.2% over the past year compared to a 9.3% gain across all industries (see Table 1).

| Industry | Q2 2021 Employment | Q2 2019 to Q2 2020 Percent Employment Change | Q2 2019 to Q2 2021 Percent Employment Change | Q2 2021 Average Annual Wage | Q2 2019 to Q2 2021 Percent Wage Change |

|---|---|---|---|---|---|

| Total, All Industries | 135,008 | -15.2% | -7.3% | $50,700 | +10.9% |

| Retail Trade | 16,471 | -13.0% | -4.1% | $30,836 | +13.6% |

| General Merchandise Stores | 3,262 | -9.0% | -1.2% | $28,236 | +12.7% |

| Food and Beverage Stores | 3,013 | -4.3% | -1.2% | $24,180 | +7.1% |

| Gasoline Stations | 2,107 | -8.0% | -4.2% | $22,620 | +11.3% |

| Motor Vehicle and Parts Dealers | 2,098 | -11.6% | -9.1% | $53,664 | +26.9% |

| Bldg. Material & Garden Eqpt. & Supplies Dealers | 1,842 | -2.0% | +4.4% | $29,900 | +15.2% |

| Health and Personal Care Stores | 888 | -18.2% | -7.0% | $40,612 | +11.4% |

| Miscellaneous Store Retailers | 879 | -34.6% | -4.9% | $22,204 | +18.3% |

| Sporting Goods, Hobby, Book, & Music Stores | 683 | -32.5% | +3.2% | $21,268 | +14.6% |

| Clothing and Clothing Accessories Stores | 679 | -58.5% | -19.6% | $20,332 | +16.4% |

| Nonstore Retailers | 412 | -9.6% | -3.5% | $49,920 | +4.5% |

| Furniture and Home Furnishings Stores | 375 | -9.3% | +5.9% | $33,956 | +0.3% |

| Electronics and Appliance Stores | 229 | -11.8% | -39.9% | $45,760 | +14.0% |

| Source: DEED Quarterly Census of Employment and Wages | |||||

It becomes obvious how some of the pandemic's effects on behaviors, activities, and consumption played out. For example, as many workers were sent to work from home, spending (and employment) patterns followed accordingly. Furniture & Home Furnishings Stores (+5.9%), Building Material & Garden Equipment & Supplies Dealers (+4.4%), and Sporting Goods, Hobby, Book, & Music Stores (3.2%) were the three Retail industries that bucked the dominant trend of employment loss and reflected changing consumer preferences.

General Merchandise Stores and Food & Beverage Stores showed employment declines, but within each of those industries there were pockets of success. Grocery Stores benefited from more households cooking and eating more meals at home and Warehouse Clubs & Supercenters likewise benefited from more domestic spending habits. Combined, the latter two sub-industries accounted for nearly 29% of all Retail employment in the region as of the second quarter of 2021, making their growth crucial to the health of the sector. In contrast, with people not going to work in the office and going out less often, the largest employment losses occurred in Clothing & Clothing Accessories Stores (-19.6%) and strangely, Electronics & Appliance Stores (-39.9%), with the latter seeing job losses accelerate over the past year.

Retail Trade wages, on average, also outperformed those of other industries in the region, with annual wages growing $3,700 (+13.6%) over two years (see Table 1). Within Retail, the wage trends were more mixed. While Building Material & Garden Equipment & Supplies Dealers and Sporting Goods, Hobby, Book, & Music Stores saw above average employment and wage growth, the industry with the largest employment growth – Furniture & Home Furnishing Stores – experienced the smallest wage growth (+0.3%) in the sector. Four out of the 25 four-digit Retail sub-industries saw their wages decline over the past two years.

Motor Vehicle and Parts Dealers, specifically Automobile Dealers, saw wages expand the most, ticking up 32.7% since the second quarter of 2019. That wage growth occurred in what was already the highest-paying sub-industry in Retail at an average of nearly $66,000 a year. Wage growth in the Other Motor Vehicle Dealers industry followed closely with an increase of 26.1%. Surging demand for motor vehicles, both automobiles and recreational vehicles, appears to have manifested more in wage growth than in additional employment.

Retail wage and employment trends seem to point toward the retention of more senior employees over the past year and a half, while lower wage employees were more likely to be laid off. This possible trend is also supported by the newest Job Vacancy Survey (JVS) numbers. Demand in Sales occupations was highest for Cashiers, First-Line Supervisors of Retail Sales Workers, and Retail Salespersons. The 628 vacancies in the region for Cashiers is an all-time high, as is the 389 for Supervisors. Despite this high demand, growth in wage offers in Retail openings lagged other industries. The relatively low median wage offer of $12.58 per hour for Retail openings is up 5.7% from the second quarter of 2019, compared to an 8.1% increase for all vacancies ($14.20). This relatively small increase could again point toward the sector's retention of its higher wage employees. Current demand is centered around the lower-wage positions that were more likely to be lost since March 2020.

The Retail sector has largely weathered the storm that ravaged so many service-oriented industries. Yet even within the sector, success or failure was largely determined by where the winds of consumer preferences blew. Home goods, food, hobbies, and recreation-related retailers fared relatively well. Conversely, department stores, automobile Dealers, clothing, and electronics retailers saw larger employment declines at the same time their wages largely grew faster than average. Some Retail industries were able to maintain or even add to sales in the face of adverse labor force trends. The creativity and flexibility that sustained many Retail businesses over the past year and a half is likely to be just as important in the current busy holiday months.

Contact Northeast Minnesota Labor Market Analyst Carson Gorecki at 218-302-8413.