Home to the state's second-largest metro, the Northeast Region has a strong industrial sector, tied largely to the area's abundant natural resources.

Home to the state's second-largest metro, the Northeast Region has a strong industrial sector, tied largely to the area's abundant natural resources.

Most of the manufacturing base centers on mining and forest products industries. More than half of the sector's employment is in paper and machinery manufacturing.

Want the freshest data delivered by email? Subscribe to our regional newsletters.

7/7/2022 9:00:00 AM

Carson Gorecki

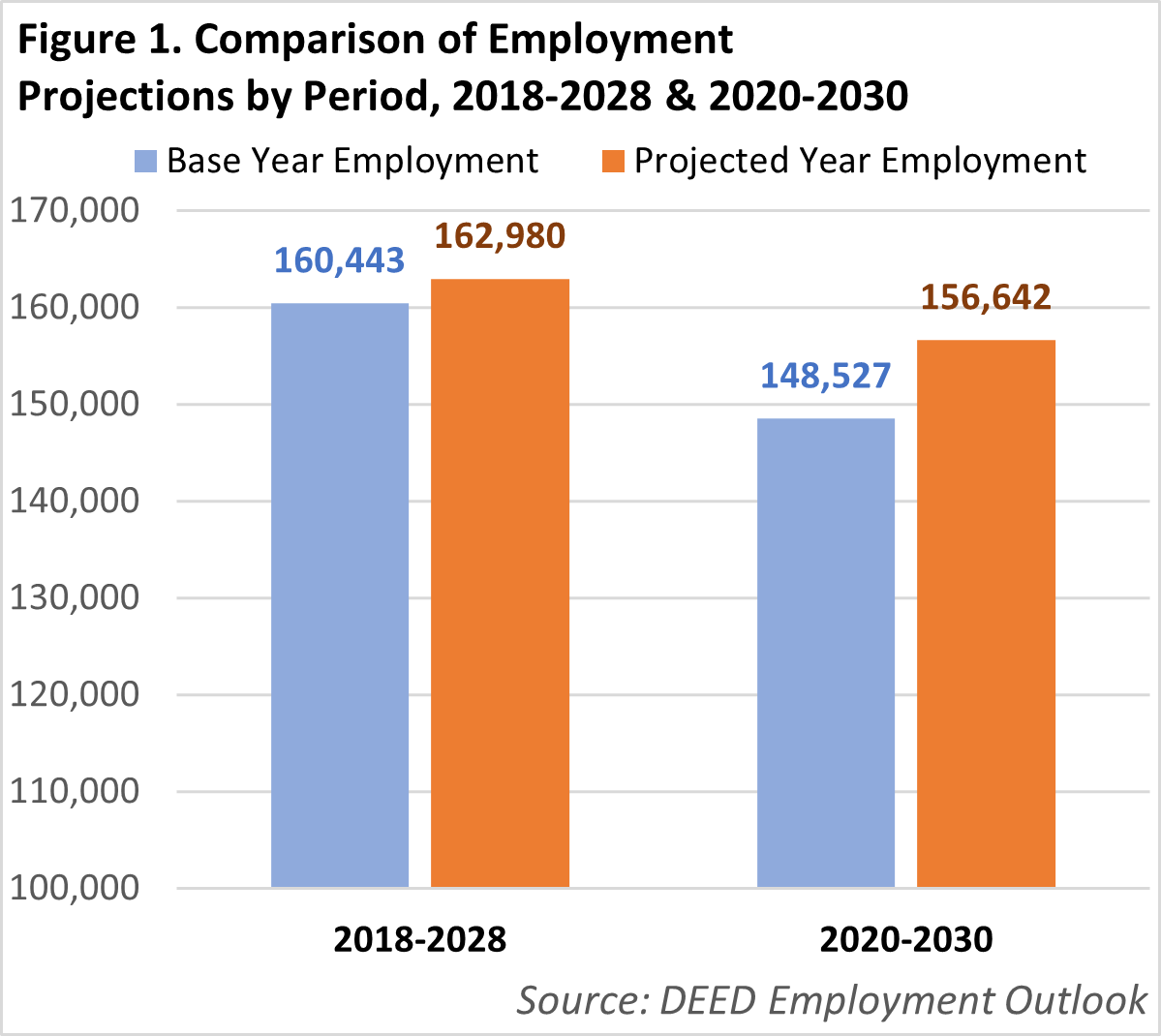

Published every two years, long term employment projections provide an estimate of how industries and occupations are expected to grow or shrink over a ten-year period. The most recent projections period was 2020 to 2030. As a result, it begins to capture the initial impacts that the pandemic had on the workforce. Having the base year of projections coincide with the most acute employment decline in decades, however, had some additional, perhaps less intuitive effects. The largest of these is that the 2020-2030 projected employment growth rate (+5.5%) was more than triple the projected growth rate of the 2018-2028 period (+1.6%). However, what appears at first to be much stronger growth, requires another look.

Some crucial additional context is that in 2018 there were about 11,900 more jobs in Northeast Minnesota than two years later. A 7.4% employment loss is a deficit that even a robust 5.5% growth rate – as is projected for the region in 2020-2030 – cannot overcome. The previous round of projections predicted that there would be about 163,000 jobs in 2028. By comparison, the 2030 projection is 156,600 – about 6,300 fewer – despite the two additional years (see Figure 1). Compared to the other regions, Northeast Minnesota had the 2nd fastest projected 2020-2030 growth rate, but also experienced the largest relative employment decline from 2019 to 2020.

Some crucial additional context is that in 2018 there were about 11,900 more jobs in Northeast Minnesota than two years later. A 7.4% employment loss is a deficit that even a robust 5.5% growth rate – as is projected for the region in 2020-2030 – cannot overcome. The previous round of projections predicted that there would be about 163,000 jobs in 2028. By comparison, the 2030 projection is 156,600 – about 6,300 fewer – despite the two additional years (see Figure 1). Compared to the other regions, Northeast Minnesota had the 2nd fastest projected 2020-2030 growth rate, but also experienced the largest relative employment decline from 2019 to 2020.

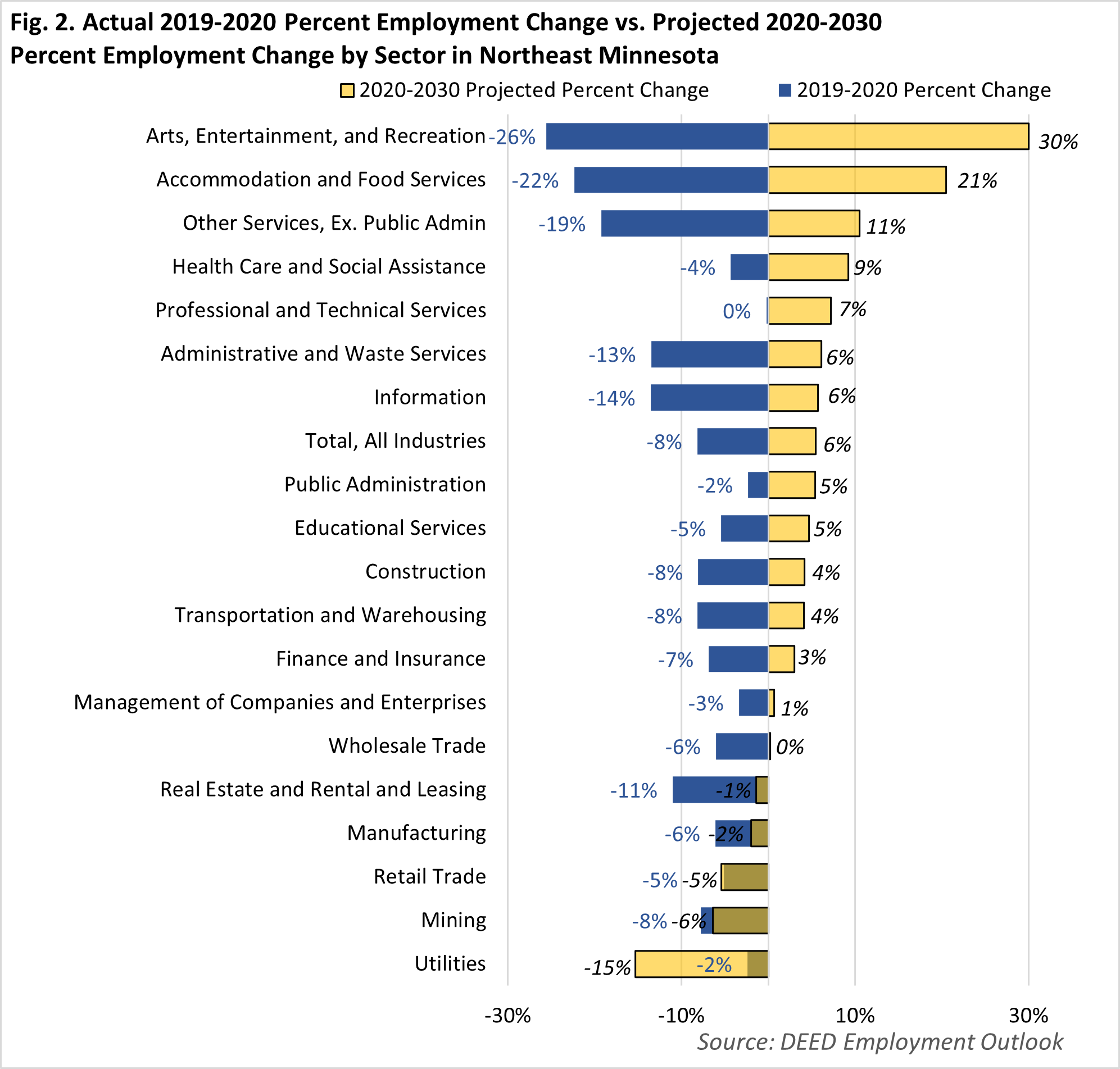

This is not to say that the entire story is one of decreased employment growth. There is also important nuance and variability within the most recent projections. Some of the largest growth was in those industry sectors most impacted by the pandemic, indicating expected recovery in those areas. This includes Arts, Entertainment, & Recreation (+30%), Accommodation & Food Services (+20.5%), Other Services (+10.5%), and Health Care & Social Assistance (+9.2%), with the former three being the sectors that saw the largest initial employment losses in 2020 (see Figure 2). Health Care did not experience the large initial declines seen in Leisure & Hospitality and Other Services, yet neither has it seen any rebound into 2021. This is notable given the consistent, strong growth the sector has seen for decades. One of the bright spots was Professional & Technical Services, which did not lose many jobs in 2020, yet still posted above average projected employment growth (+7.2%).

On the other hand, many of the sectors that fared relatively well through the initial period of the pandemic, were also more likely to see the slowest growth and some cases projected employment decline. Examples of this are Utilities (-15.3%), Mining (-6.4%), Retail Trade (-5.4%), and Manufacturing (-2%). Continued trends such as e-commerce and automation are also likely contributors to declines in some of these sectors. Across the economy the decline of the number of people looking for work was a shared factor in dampening some of the earlier recovery predictions. Northeast Minnesota, as of April 2022, had 6,435 fewer people in the labor force than in February 2020, and only 1,114 had joined or re-joined over the previous year. If this pace were to continue, it would limit the ability of employers to find and hire workers, effectively placing a ceiling on any future job growth.

Contact Northeast Minnesota Labor Market Analyst Carson Gorecki at 218-302-8413.