Home to the state's second-largest metro, the Northeast Region has a strong industrial sector, tied largely to the area's abundant natural resources.

Home to the state's second-largest metro, the Northeast Region has a strong industrial sector, tied largely to the area's abundant natural resources.

Most of the manufacturing base centers on mining and forest products industries. More than half of the sector's employment is in paper and machinery manufacturing.

Want the freshest data delivered by email? Subscribe to our regional newsletters.

7/28/2022 9:00:00 AM

Carson Gorecki

Despite rising concerns over high inflation and lingering supply-chain woes, demand for workers remains near record high levels. The latest numbers from DEED's Job Vacancy Survey estimated a total of 11,742 job vacancies in Northeast Minnesota in fourth quarter 2021. This was only down slightly from the record high of 12,886 estimated in the previous survey period of second quarter 2021, and up more than 4,600 from fourth quarter 2020.

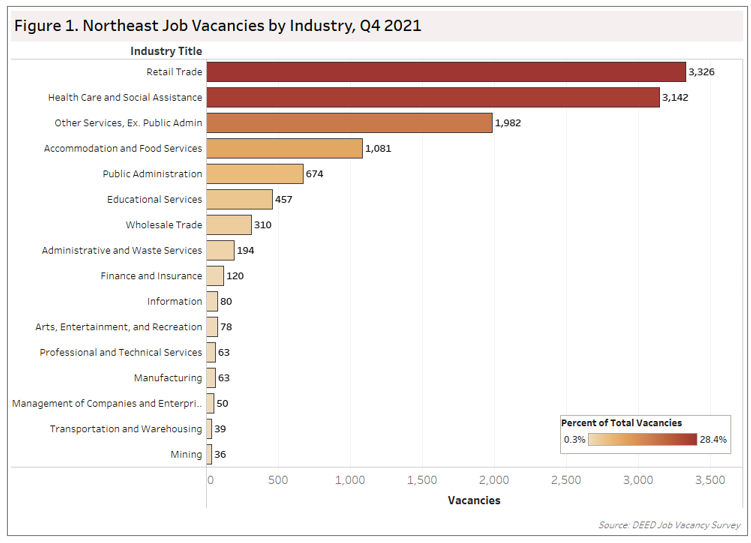

The majority of openings typically fall into the three sectors of Retail Trade, Accommodation & Food Services, and Health Care & Social Assistance. These three sectors combined account for 66% of vacancies in second quarter 2021 and 64% of vacancies in fourth quarter 2021. One notable change from the second quarter to the fourth quarter is the rise in Retail Trade openings. In addition during the fourth quarter, Other Services, a smaller sector including hair and nail salons and auto repair and maintenance, saw a rise in vacancies that brought it in the top three, bumping Accommodation & Food Services (see Figure 1).

Some seasonal trends mean that Retail openings have been more likely to be higher at the end of the year, while Accommodation & Food Services openings tend to be higher in the second quarter as we head into the busy summer tourism season. Health Care openings have not varied as much by quarter. The 3,326 Retail Trade openings in fourth quarter 2021 is an all-time high for the 20-year survey, and represents resurgent demand in a sector that did not see as much employment loss under pandemic pressures as Accommodation & Food Services or Other Services, for example.

The Other Services sector also saw a sizable increase in vacancies in fourth quarter 2021, almost doubling from the second quarter, which at 988, was the previous high mark. The sector remains about 900 jobs (-15.5%) below where it was in 2019, but the recent increase in vacancies likely reflects a recovery in this sector that has taken a little longer getting up to speed relative to some other areas of the economy.

Other indicators of a heating-up labor market are the increasing wage offers across many industries. The hourly median wage offer for all openings rose from $14.46 in fourth quarter 2020 to $15.72 in fourth quarter 2021, an annual increase of $1.26 (8.7%). That increase followed an over-the-year decrease of $0.18 into the second quarter of 2021.

From fourth quarter 2019, the median wage offer increased 11.4%, outpacing the Consumer Price Index (+8%) – a popular measure of inflation. The largest increases in wage offers from 2019 occurred in Wholesale Trade (+78%), Administrative Support & Waste Management (+46%), Health Care & Social Assistance (+45%), and Professional & Technical Services (+36%). Public Administration (-38%), Finance & Insurance (-48%), and Information (-22%) saw a decreases in wage offers. Only two sectors (Health Care & Social Assistance and Wholesale Trade) have seen sustained wage offer growth more than the all-industry average both from 2019 to 2020 and 2020 to 2021.

| Table 1. Median Wage Offer by Sector in Northeast Minnesota, Q4 2019 - Q4 2021 | ||||

|---|---|---|---|---|

| Sector | 2019 Median Wage Offer | 2020 Median Wage Offer | 2021 Median Wage Offer | 2019-2021 Percent Change |

| Wholesale Trade | $12.47 | $19.41 | $22.23 | +78.3% |

| Administrative & Waste Services | $14.56 | $13.96 | $21.30 | +46.3% |

| Health Care & Social Assistance | $15.29 | $15.98 | $22.09 | +44.5% |

| Professional & Technical Services | $20.27 | $18.63 | $27.55 | +35.9% |

| Educational Services | $15.74 | $15.97 | $19.96 | +26.8% |

| Arts, Entertainment, & Recreation | $11.80 | $12.02 | $14.76 | +25.1% |

| Transportation & Warehousing | $16.76 | $14.61 | $19.74 | +17.8% |

| Retail Trade | $12.35 | $13.26 | $14.14 | +14.5% |

| Manufacturing | $19.25 | $26.98 | $21.89 | +13.7% |

| Total, All Industries | $14.11 | $14.46 | $15.72 | +11.4% |

| Mining | $24.81 | $28.14 | $27.42 | +10.5% |

| Other Services, Ex. Public Admin | $13.39 | $16.84 | $14.56 | +8.7% |

| Accommodation & Food Services | $11.18 | $12.00 | $12.13 | +8.5% |

| Information | $14.88 | $17.01 | $11.54 | -22.4% |

| Public Administration | $20.61 | $15.10 | $12.78 | -38.0% |

| Finance and Insurance | $26.77 | $30.72 | $13.80 | -48.4% |

| Source: DEED Job Vacancy Survey | ||||

There are only three sectors that saw growth in both vacancies and wage offers at faster rates than all industries combined: the Health Care & Social Assistance, Retail Trade, and Wholesale Trade sectors all responded to demand with increased openings and higher wages. Despite strong growth, the Retail Trade median wage offer ($14.14) remained below the all-industry median by more than a $1.50. Health Care & Social Assistance ($22.09) and Wholesale Trade ($22.23) by comparison, offered wages much higher than the all-industry median. These three sectors all also saw increased shares of vacancies that were for part-time or temporary and seasonal positions compared to 2019.

These changes could reflect the types of jobs available in the three sectors at the time or represent a shift in employers' approach to hiring. Increased part-time positions may be one strategy by employers to attract more applicants via a wider array of schedule options. Whatever approaches employers turn to, wage offers will likely remain an integral component and the Job Vacancy Survey is a great way to track evolving trends in hiring.

Contact Northeast Minnesota Labor Market Analyst Carson Gorecki at 218-302-8413.