The presence of such industry powerhouses as Polaris, Arctic Cat and New Flyer make Northwest Minnesota a hub of transportation equipment manufacturing.

The presence of such industry powerhouses as Polaris, Arctic Cat and New Flyer make Northwest Minnesota a hub of transportation equipment manufacturing.

From wheat and potatoes to soybeans and sugar beets, the region is a major producer and processor of food staples and specialty agricultural products.

Want the freshest data delivered by email? Subscribe to our regional newsletters.

8/3/2020 9:00:00 AM

Erik White

Newly released data show that the Paycheck Protection Program (PPP) helped retain more than 100,000 jobs in Northwest Minnesota, nearly half of total employment in the region. At least in the short-term, PPP kept these workers on the payroll and provided relief to businesses. Long-term effects will have to be measured down the road, but the immediate boost was very apparent.

The PPP was created by the federal government in response to the COVID-19 pandemic to provide loans to help businesses with 500 employees or less keep their workers on the payroll. Enacted under the federal CARES Act and administered through the U.S Small Business Administration (SBA), these loans are eligible for forgiveness if employee retention criteria are met and the funds are used for eligible expenses. Data has been released on nearly five million PPP loans made to businesses and non-profits throughout the United States and this month's Local Look analyzes the loans that went to Northwest Minnesota.

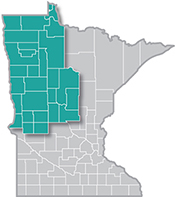

According to SBA data, there were 12,401 PPP loans issued in the 26-county Northwest Minnesota planning region, and these loans helped retain about 103,000 jobs, or just over 46% of total employment in the region. Loan amounts varied greatly, ranging from less than $1,000 to more than $5 million, but the majority of loans issued were for less than $50,000. So far, 76.6% of PPP loans in Northwest Minnesota were for less than $50,000 but there were also nearly 100 loans secured for more than $1 million (see Table 1).

| Table 1. Number of PPP Loans by Loan Amount in Northwest Minnesota | |

|---|---|

| Loan Amount | Number of Loans |

| Up to $10,000 | 3,797 |

| $10,001-$20,000 | 2,566 |

| $20,001-$30,000 | 1,626 |

| $30,001-$40,000 | 868 |

| $40,001-$50,000 | 642 |

| $50,001-$75,000 | 896 |

| $75,001-$100,000 | 503 |

| $100,001-$125,000 | 301 |

| $125,001-$149,999 | 208 |

| $150,000-$350,000 | 610 |

| $350,001-$1 million | 288 |

| $1 million-$2 million | 56 |

| $2 million-$5 million | 30 |

| $5 million-$10 million | 10 |

| Source: US Small Business Administration | |

One concern of the PPP program at the national level is that the BIPOC (Black, Indigenous, and People of Color) community would be left out because the application process relied on banking institution relationships, especially when banks were initially inundated with loan applications. The SBA data does have demographic variables including race, gender, and veteran status and analysis shows the concern may be warranted in Northwest Minnesota. There were only three loans for more than $150,000 that went to self-identified Black or African American, Asian American, or American Indian recipients. Of the loans made for up to $150,000, just seven went to Black or African American-owned businesses, 38 went to Asian American-owned, 13 to American Indian-owned, and 24 went to Hispanic or Latino-owned businesses. While that data is helpful, it should be noted that about two-thirds of the PPP applications in Northwest Minnesota left the race or ethnicity question unanswered; so the exact demographic breakout of loan recipients is unknown.

Funding for the PPP program is still available as of middle July and applications are being accepted until August 8, 2020. For those interested, check here for more information.

Contact Erik White.