The presence of such industry powerhouses as Polaris, Arctic Cat and New Flyer make Northwest Minnesota a hub of transportation equipment manufacturing.

The presence of such industry powerhouses as Polaris, Arctic Cat and New Flyer make Northwest Minnesota a hub of transportation equipment manufacturing.

From wheat and potatoes to soybeans and sugar beets, the region is a major producer and processor of food staples and specialty agricultural products.

Want the freshest data delivered by email? Subscribe to our regional newsletters.

9/8/2022 9:00:00 AM

Anthony Schaffhauser

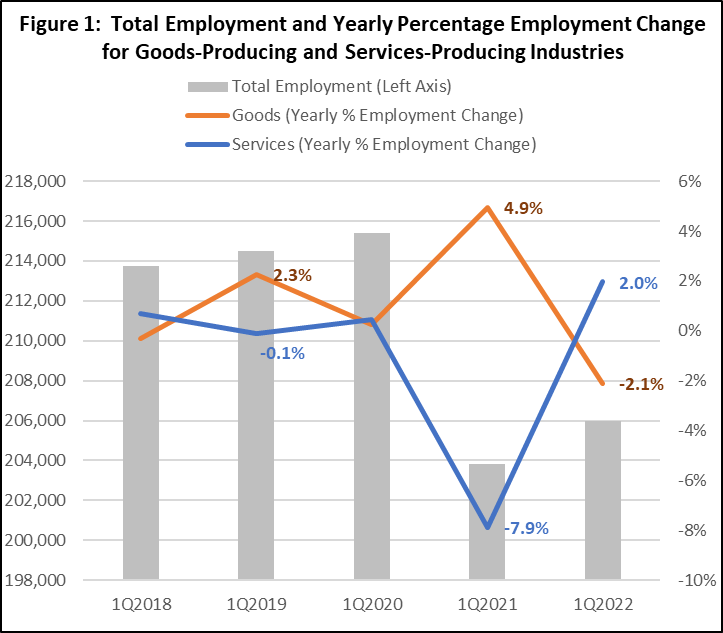

DEED's recent release of the first quarter 2022 Quarterly Census of Employment and Wages (QCEW) provides our first look into how Northwest Minnesota is faring by industry two years after the onset of the COVID-19 pandemic. While the region is still down compared to 2020, total employment gained ground compared to the first quarter of 2021, adding 2,172 jobs over the past year, or 1.1%. However, the yearly percentage change in employment differed over the past two years for goods-producing industries, which includes Natural Resources, Construction, and Manufacturing, versus services-producing industries, which were hit harder initially (see Figure 1).

Faring well despite the pandemic recession, Natural Resources and Manufacturing both saw small employment declines from 2020 to 2021, falling -1.8% and -1.2% respectively. Construction employment grew 5.4% from 2019 to 2020, then surged an additional 27.6% into 2021, making it easily the fastest growing industry in the region. But with the large size of the manufacturing sector, it's decline largely offset Construction gains, leaving a 4.9% employment gain for goods-producing industries.

Severe job declines in Leisure & Hospitality, Health Care & Social Assistance, Educational Services, Public Administration, and Retail Trade dominated the services-providing domain during the pandemic recession in 2020. As we entered 2022, spending shifted back to services, and employment returned with it.

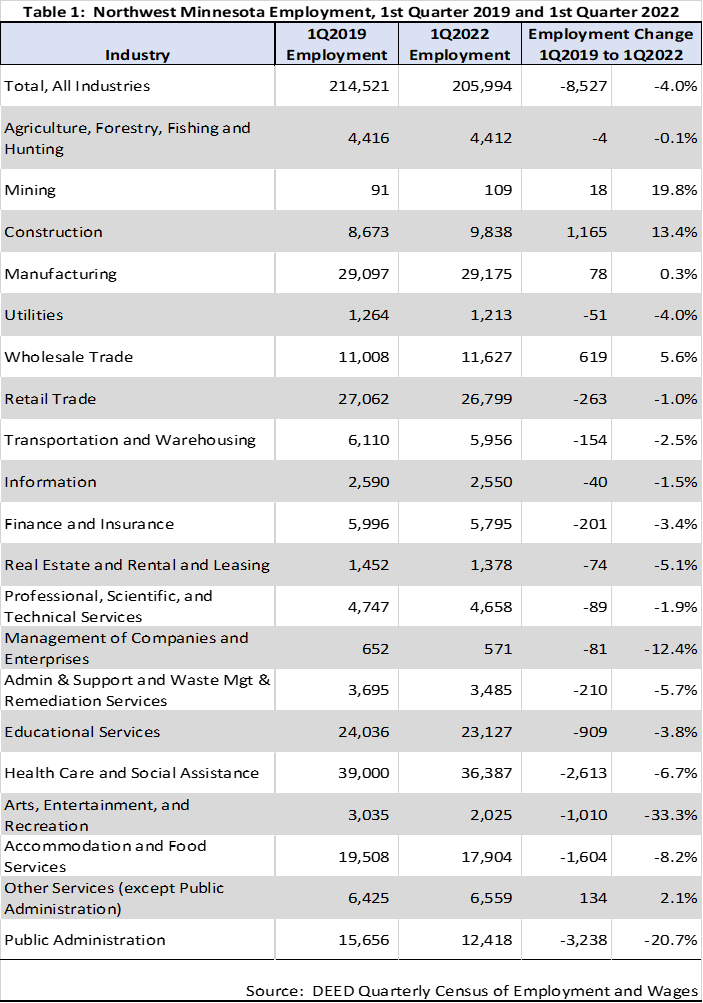

By the first quarter of 2022, total covered employment in Northwest is still 4% below pre-pandemic levels, even with the 2% growth in service-providing sectors from the first quarter of 2021. Wholesale Trade is the standout for job gains and percent growth, while Other Services (a catch-all that includes everything from automotive repair to hair salons to churches) also grew from pre-pandemic levels. Comparing statewide, Minnesota has a 1% job gain for Wholesale Trade, and a 6.1% decline in Other Services from first quarter 2019 to first quarter 2022. So, Wholesale Trade and Other Services bucked the trend in the Northwest (see Table 1).

After years of solid growth, Construction lost 1,834 jobs or -15.7% over the 12 months ending in the first quarter of 2022. Even with this drop, Construction is still the largest job gainer from first quarter 2019 to first quarter 2022. Mining, which in Northwest mainly supplies Construction with sand and gravel, had the largest percentage employment gain at 19.8%. Manufacturing employment is slightly above pre-pandemic level, while Agriculture, Forestry, Fishing & Hunting is essentially unchanged.

It is not surprising that Arts, Entertainment & Recreation and Accommodation & Food Services were down significantly as of last winter. However, that employment decline in Health Care & Social Assistance is roughly equal to the employment decline of these two sectors combined is not so expected. However, Health Care employment has not fully rebounded and the industry is facing some serious hiring and retention challenges.

Public Administration is the sector with the largest job losses. Nearly all these jobs were lost in local government, which shed 3,196 jobs (-25.3%) from first quarter 2019 to first quarter 2022. By comparison, in Minnesota this sector had a decline of -9.4%. From first quarter 2021 to first quarter 2022 there was only a slight rebound for Northwest Minnesota in local government of 111 jobs, or 1.2%.

In summary, most services industries have lower employment since the pandemic, and a few still have a lot of ground to make up. However, goods producing industries have maintained or exceeded levels reached in 2019. More recent Local Area Unemployment Statistics show that continued recovery is occurring, with an estimated 1.8% increase in Northwest Minnesota's employment from March through June 2022, which should be reflected in second quarter 2022 data.

Contact Anthony Schaffhauser at 320-441-6594.