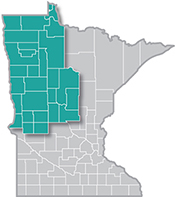

The presence of such industry powerhouses as Polaris, Arctic Cat and New Flyer make Northwest Minnesota a hub of transportation equipment manufacturing.

The presence of such industry powerhouses as Polaris, Arctic Cat and New Flyer make Northwest Minnesota a hub of transportation equipment manufacturing.

From wheat and potatoes to soybeans and sugar beets, the region is a major producer and processor of food staples and specialty agricultural products.

Want the freshest data delivered by email? Subscribe to our regional newsletters.

6/15/2023 9:00:00 AM

Anthony Schaffhauser

With the Governor's proclamation on June 1 to Follow your Heart to a Caring Career, many of my dedicated colleagues are working diligently to raise awareness of the career opportunities in the Health Care & Social Assistance sector. My focus in this blog is on the industry sector itself, and it's written for those potential industry, agency, and non-profit collaborators who, like me, have a deep passion for ensuring Minnesota's most vulnerable citizens are well cared for.

Employment in Health Care & Social Assistance remains below pre-pandemic levels in Northwest Minnesota and statewide. However, in the Twin Cities Metro and Southeast Minnesota, this sector's employment is higher, and the large number of jobs in both pulls up Health Care & Social Assistance employment statewide. With the exception of the Twin Cities and Southeast, every other region has a larger percentage decline in Health Care & Social Assistance employment than the total for all industries, yet the statewide decline is much less: -0.9% compared to -2.0% (see Table 1).

| Table 1: Change in Health Care & Social Assistance and Total Employment by Planning Area | ||||||||

|---|---|---|---|---|---|---|---|---|

| Area | Health Care & Social Assistance Employment (Number of Jobs) | 2018-2022 Health Care Jobs | Total, All Industries, Percent Change | |||||

| 2018 Ann. Avg. | 2019 Ann. Avg. | 2020 Ann. Avg. | 2021 Ann. Avg. | 2022 Ann. Avg. | Numeric Change | Percent Change | ||

| Central | 50,158 | 49,165 | 48,460 | 47,913 | 47,389 | -2,769 | -5.5% | -0.9% |

| Northeast | 34,459 | 34,588 | 33,094 | 32,675 | 32,249 | -2,210 | -6.4% | -5.0% |

| Northwest | 39,362 | 39,185 | 38,228 | 38,496 | 38,260 | -1,102 | -2.8% | -0.5% |

| Twin Cities | 275,363 | 278,947 | 270,271 | 277,062 | 278,895 | +3,532 | +1.3% | -2.0% |

| Southeast | 65,247 | 66,258 | 65,123 | 66,097 | 65,463 | +216 | +0.3% | -1.9% |

| Southwest | 31,341 | 31,569 | 30,045 | 29,337 | 29,207 | -2,134 | -6.8% | -3.1% |

| Minnesota (sum) | 495,930 | 499,712 | 485,221 | 491,580 | 491,463 | -4,467 | -0.9% | -2.0% |

| Source: DEED Quarterly Census of Employment & Wages | ||||||||

This is a stark contrast in pandemic employment rebound: Greater Minnesota experienced faster recovery for all industries, yet slower recovery for Health Care & Social Assistance, while the Metro area experienced the opposite. Despite this contrast, rest assured that Health Care jobs are not being systematically relocated to the Twin Cities Metro while jobs in other sectors are being relocated to Greater Minnesota.

The good news is that Northwest Minnesota is closer to pre-pandemic employment levels than any other region. However, while Health Care & Social Assistance sector employment is closer to 2018 levels in the Northwest than any Greater Minnesota region other than Southeast, it is still well below pre-pandemic levels. This is not due to a lack of job openings; job vacancies in the Health Care sector are up nearly 19% from 2021, and part-time vacancies are down 15%.

Greater Minnesota's older population underlies this apparent paradox of Health Care employment. Like all of Greater Minnesota, Northwest's older population demands a greater share of employment in the Nursing & Residential Care subsector: 28.4% in the Northwest compared to 20.8% statewide. This subsector's employment remains extraordinarily less than its pre-pandemic level. Average employment in 2022 is down -12.2% in the region from 2018, whereas the other subsectors including Ambulatory Health Care, Hospitals, and Social Assistance are down -2.6%, down -3.1%, and up +16.1%, respectively.

While the demand for Nursing & Residential Care Facilities drives the larger share of employment, it is not leading to a faster employment recovery. This is because the lack of workers, not a lack of available jobs, is causing the employment decline. The subsector's employment is countercyclical with the economy; that is, it increases when total employment declines and decreases when total employment goes up.

For example, the subsector's employment in Northwest Minnesota reached an initial high point of 11,219 jobs in fourth quarter 2001, at the economic low point of the 2001 recession. Then, it reached its all-time high (so far) of 12,483 jobs in third quarter 2009, just one quarter after the economic low point of the Great Recession. This suggest that bad economic times boost Nursing & Residential Care Facilities staffing because vulnerable people need care regardless of the economic backdrop.

The implication is that in our current tightest labor market of all time, this subsector is extremely challenged. Furthermore, increased hiring will not address the root cause because turnover is a significant issue for Nursing & Residential Care Facilities.

Unlike Manufacturing, Wholesale Trade, and Transportation & Warehousing, the key functions of Health Care are not as easily automated. The "human touch" is a key ingredient! This is exemplified by Nursing & Residential Care Facilities, where direct care for tenants and residents, culinary, environmental services, maintenance, and regulatory compliance are all key functions that are not very amenable to automation.

So, the solution for this industry, in my mind, is to make these jobs more desirable. Wages have been increased substantially, and unlike most jobs in the region, wages in Northwest Minnesota are comparable with statewide wages (see Table 10 on Page 10). These gaps are typically greatly influenced by the high wages in the Twin Cities, where real estate and other costs can be much higher. There is also growing evidence that flexibility is key to becoming an employer of choice. For example, this recent survey by the Federal Reserve Bank of Minneapolis suggests that workers consider a wide range of factors when choosing a job.

Another interesting quote from a recent StarTribune article says "It just feels like post-pandemic people have a different outlook on work and life," said Paula Montgomery, Gillette's executive vice president of administrative affairs. "Whereas compensation may have previously been the most important component of a benefits package, I'm not sure that's true anymore."

However, my contacts in Health Care inform me that flexibility has decreased since pre-pandemic times, as workers are induced to work longer hours to provide the needed care when hiring goals fall short. And recall from above, part-time vacancies are down 15% according to Job Vacancy Survey results.

The employment decline in the Health Care sector since 2018 is due to a lack of workers, not a lack of jobs. In other words, there is no doubt that the industry could have returned to pre-pandemic employment if the vacant jobs were filled. The weak link is the Nursing & Residential Care subsector, and by "weak link," I am not just referring to the outsized decline in employment. The Health Care system operates with each subsector playing a key part. A lack of staffing in Nursing & Residential Care puts pressure on the other subsectors of Health Care & Social Assistance. For example, Hospitals cannot discharge patients that need rehabilitation care unless there is a nursing home that has the staff to take them.

Also, new healthcare workers often get their start in Nursing & Residential Care Facilities and base their future decision to stay and/or advance in a healthcare field based on their first experiences. This could be a major contributor to the decline in nursing program spots offered in Minnesota (as presented by Dr. Jennifer Eccles, Senior System Director of Nursing Excellence, at the June 8 Healthcare Education Industry Partnership Council quarterly meeting). What's more, even with shrinking nursing programs, many spots are unfilled.

A thriving Nursing & Residential Care subsector is critical for the entire Health Care system, and like any system it is only as strong as its weakest link. I maintain that it is well past time for innovative strategies to make these jobs more desirable. There are good reasons for hope. The Nursing & Residential Care industry has a very generous scholarship program administered through the Minnesota Department of Human Services. Also, the student organization Minnesota HOSA, Future Health Professionals increased membership to 1,206 members in the 2022 to 2023 school year from 462 members in 2020-2021 pandemic emergency, and is now more than 20% higher than the 1,003 memberships in 2019-2020 achieved prior to the pandemic. Northwest Minnesota has a prime opportunity to increase the sparse number of HOSA Chapters in the region.

Contact Anthony Schaffhauser at anthony.schaffhauser@state.mn.us.

June is the kick off for the Follow Your Heart to a Caring Career campaign, including a proclamation from the Governor explaining the benefits of working in Health Care & Social Assistance. DEED's Regional Analysts put together a series of blogs focused on Health Care employment and opportunities in all 6 planning regions:

Central | Northeast | Southeast | Southwest | Twin Cities

As detailed in previous articles, the Health Care & Social Assistance industry has been under stress since the pandemic, but remains a great long-term career opportunity as it is projected to be the largest growing industry over the next decade. The goal of the Caring Careers campaign is to help jobseekers find their fit in health care employment that makes a real difference in the lives of others. Jobseekers that are interested can begin an in-demand career path with great growth potential and no training beyond high school required to start in many positions. Employers even pay for initial training in many cases – and they may also pay for future training to help workers grow their career and earn more money. Many employers also welcome employees who are learning English.