The presence of such industry powerhouses as Polaris, Arctic Cat and New Flyer make Northwest Minnesota a hub of transportation equipment manufacturing.

The presence of such industry powerhouses as Polaris, Arctic Cat and New Flyer make Northwest Minnesota a hub of transportation equipment manufacturing.

From wheat and potatoes to soybeans and sugar beets, the region is a major producer and processor of food staples and specialty agricultural products.

Want the freshest data delivered by email? Subscribe to our regional newsletters.

6/17/2024 3:00:38 PM

Anthony Schaffhauser

Employment in the Health Care & Social Assistance sector increased from 2022 to 2023 in the Northwest, and in every other Minnesota Planning Area. However, workforce challenges continue and so does each region's need to address them. In fact, part of what I wrote for this blog a year ago remains true:

Employment in Health Care & Social Assistance remains below pre-pandemic levels in Northwest Minnesota . However, in the Twin Cities Metro and Southeast Minnesota, this sector's employment is higher, and the large number of jobs in both pulls up Health Care & Social Assistance employment statewide.

Health Care & Social Assistance employment in the Twin Cities and Southeast is at an all-time high, while every other region is below pre-pandemic levels. Notably, Northwest had the fastest overall job growth since 2018, but still experienced a decline in Health Care & Social Assistance. This is a stark contrast to the prior five-year period when Health Care & Social Assistance employment handily outpaced total employment growth in every region (see Table 1).

Table 1: Healthcare & Social Assistance and Total Employment by Planning Area

Area |

Health Care & Social Assistance Jobs | 2013 - 2018 Change | 2018 - 2023 Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Health Care &

Social Assistance |

Total, All Industries Percent | Health Care &

Social Assistance |

Total, All Industries Percent | ||||||

| 2013 | 2018 | 2023 | Jobs | Percent | Jobs | Percent | |||

| Central | 46,627 | 50,158 | 48,870 | +3,531 | +7.6% | +6.9% | -1,288 | -2.6% | +0.9% |

| Northeast | 32,767 | 34,459 | 32,638 | +1,692 | +5.2% | +2.4% | -1,821 | -5.3% | -3.7% |

| Northwest | 36,820 | 39,362 | 39,089 | +2,542 | +6.9% | +4.2% | -273 | -0.7% | +1.0% |

| Southeast | 60,127 | 65,247 | 66,409 | +5,120 | +8.5% | +4.0% | +1,162 | +1.8% | -0.4% |

| Southwest | 30,290 | 31,341 | 29,905 | +1,051 | +3.5% | +1.6% | -1,436 | -4.6% | -2.3% |

| Twin Cities | 238,683 | 275,363 | 291,689 | +36,680 | +15.4% | +8.8% | +16,326 | +5.9% | -0.5% |

| Minnesota | 446,773 | 497,257 | 511,376 | +50,484 | +11.3% | +7.1% | +14,119 | +2.8% | +0.7% |

Source: DEED Quarterly Census of Employment & Wages

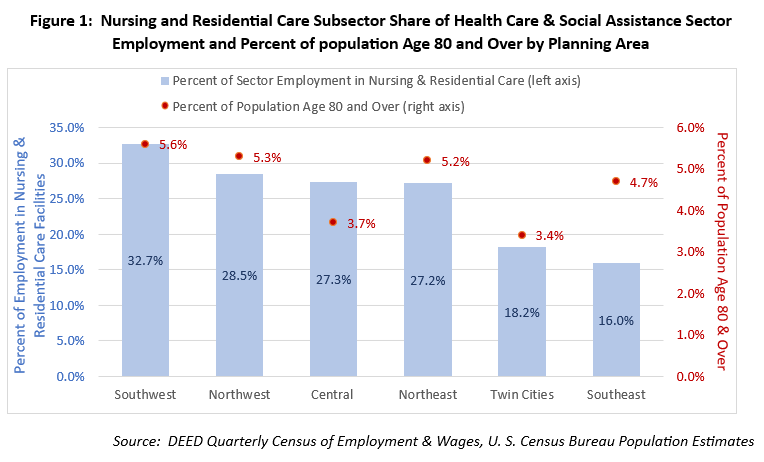

The differentiating factor of the Twin Cities and Southeast is the smaller share of Health Care & Social Assistance employment in the Nursing & Residential Care subsector (Figure 1). The Northwest's older population explains the higher share of employment in the Nursing & Residential Care subsector, as it does Southwest and Northeast. Rochester in the Southeast draws people from all over the world for acute and specialty health care, and Central is likely is a long-term care choice for many families in the West Metro. The difficulty recruiting and retaining Nursing Assistants is a primary factor that is holding back sector employment in these regions. This challenge is imperative to overcome because the Northwest's aged 75 and over population has the fastest growth of any age cohort.

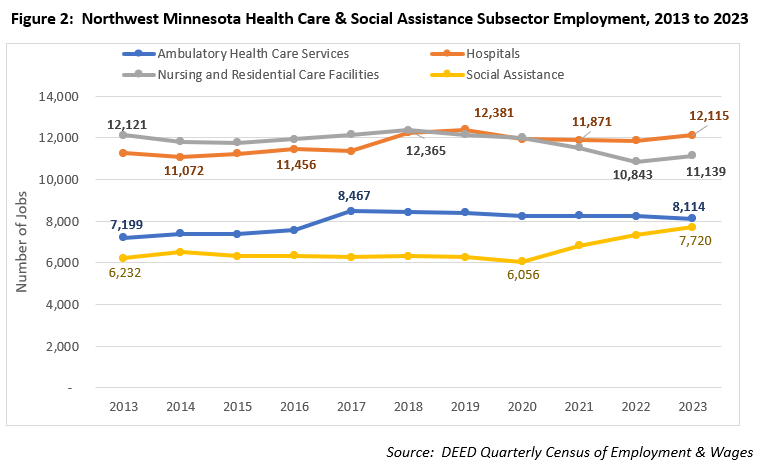

While the Northwest looks to be faring relatively well (with a mere 0.7% employment decline) compared to other regions with large employment shares in the Nursing & Residential Care subsector, it is the Social Assistance subsector that is bolstering the sector's employment. Social Assistance employment grew a whopping 28% from 2020 to 2023, adding 1,664 jobs. Every other subsector is still below its peak employment in 2023, with Ambulatory Care down 353 jobs (-4.2%), Hospitals down 266 jobs (-2.1%), and Nursing & Residential Care Facilities down 1,226 jobs (-9.9%). However, Nursing & Residential Care Facilities did add 296 jobs (2.7%) from 2022 to 2023 (Figure 2).

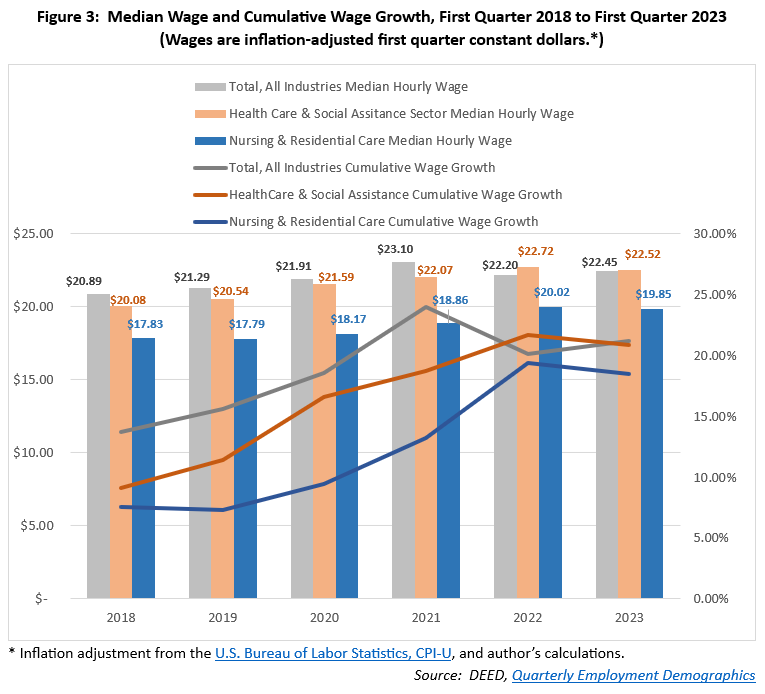

No doubt, the occupational health dangers and stresses of the pandemic have eased, and this has helped increase employment. But that would be true for all of the Health Care & Social Assistance subsectors, and to a lesser extent, the total of all industries. Wages are a key factor in the Nursing & Residential Care Facilities workforce challenge. Given the occupational mix, it is not a surprise that wages are lower than the Health Care & Social Assistance sector as a whole and lower than the total of all industries. But wage growth has also fallen short, compounding the issue (Figure 3). Nursing & Residential Care Facilities wage growth was closing the gap from 2020 to 2022, but pulled back in 2023.

As I wrote a year ago, "So, the solution for this industry, in my mind, is to make these jobs more desirable." In that blog I emphasized other factors besides wages that could bolster worker recruitment and retention, including more flexible and part-time shifts (and certainly avoiding double shifts). I can also point out the U. S. Department of Labor's Good Jobs Principles. Although wage increases were accelerating last year, employers need to find other ways to attract people to these essential positions.

I have previously written about how the Nursing & Residential Care Facilities subsector is vital to the entire health care system, and demonstrated how caregiving demands that are diverted to families affect worker availability for all industries. More recently, the Centers for Medicare and Medicaid promulgated staffing regulations for nursing homes that will add to the staffing challenge. Clearly, both higher wages and non-wage features are needed to meet the needs of our region's aging population.

For more information about Health Care employment in Northwest Minnesota, contact Anthony Schaffhauser at Anthony.schaffhauser@state.mn.us.