Southwest Minnesota is a national leader in agricultural production, and renewable energy.

Southwest Minnesota is a national leader in agricultural production, and renewable energy.

The region's thriving manufacturing sector includes food processing, machinery, printing, metal products, and computers and electronic products.

Want the freshest data delivered by email? Subscribe to our regional newsletters.

7/7/2021 9:00:00 AM

Luke Greiner

As the pandemic spread through the region last spring and summer, Retail Trade was one of the industries hardest hit, losing 1,765 jobs from the first quarter of 2020 to the second quarter, a -9.3% decline. That was worse than the total of all industries, which cut -6.8% of total employment from spring to summer 2020. But since then, Retail Trade has been one of the strongest industries in the region, actually showing a slight increase in jobs over the year from fourth quarter of 2019 to the fourth quarter of 2020.

Between the second quarter and the fourth quarter of 2020, Retail Trade added 2,410 jobs, more than what was lost in the first quarter. Retail Trade was actually up 366 jobs over the year from the fourth quarter of 2019 to the fourth quarter of 2020, a 1.9% increase, compared to a -4.0% year-over-year decline across all industries. Retail Trade was one of only six industries that added jobs from 2019 to 2020, including Finance & Insurance, Agriculture, and Transportation & Warehousing, which all added at least 150 jobs over the year.

The biggest beneficiary of the pandemic recession was Nonstore Retailers, which includes Electronic Shopping and Home Delivery Sales, but General Merchandise Stores and Food & Beverage Stores also fared well as consumers shifted their purchasing habits. Interestingly, Building Material & Supply Stores saw an immediate bounce as people worked on their homes and gardens, making it the only subsector that added jobs from the first to the second quarter of 2020; but then it was the only retail subsector to see a decline in employment from the second to the fourth quarter of 2020, as demand for products outstripped supply and prices climbed. In contrast, several subsectors actually had more jobs in the fourth quarter of 2020 compared to 2019, including Electronics & Appliance Stores and Motor Vehicle & Parts Dealers.

Over the year, the subsectors that have struggled most to fully bounce back include Clothing & Clothing Accessories Stores, Miscellaneous Store Retailers (which includes Florists, Office Supplies, Used Merchandise, and more); Sporting Goods, Hobby, Book & Music Stores; Health & Personal Care Stores, and Furniture & Home Furnishings Stores (see Table 1).

| NAICS Code | Industry | Qtr. 1 2020 Jobs | Qtr. 2 2020 Jobs | Qtr. 3 2020 Jobs | Qtr. 4 2020 Jobs | Change in Jobs Qtr. 1 2020-Qtr. 2 2020 | Change in Jobs Qtr. 2 2020-Qtr. 4 2020 | ||

|---|---|---|---|---|---|---|---|---|---|

| 44 | Retail Trade | 18,892 | 17,127 | 18,390 | 19,537 | -1,765 | -9.3% | +2,410 | +14.1% |

| 441 | Motor Vehicle & Parts Dealers | 2,636 | 2,332 | 2,518 | 2,574 | -304 | -11.5% | +242 | +10.4% |

| 442 | Furniture & Home Furnishing Stores | 376 | 299 | 341 | 366 | -77 | -20.5% | +67 | +22.4% |

| 443 | Electronics & Appliance Stores | 355 | 332 | 317 | 340 | -23 | -6.5% | +8 | +2.4% |

| 444 | Building Material & Supply Stores | 1,687 | 1,790 | 1,857 | 1,736 | +103 | +6.1% | -54 | -3.0% |

| 445 | Food & Beverage Stores | 4,396 | 4,236 | 4,363 | 4,470 | -160 | -3.6% | +234 | +5.5% |

| 446 | Health & Personal Care Stores | 922 | 807 | 874 | 890 | -115 | -12.5% | +83 | +10.3% |

| 447 | Gasoline Stations | 2,949 | 2,722 | 2,861 | 2,899 | -227 | -7.7% | +177 | +6.5% |

| 448 | Clothing & Accessories Stores | 666 | 313 | 563 | 608 | -353 | -53.0% | +295 | +94.2% |

| 451 | Sporting Good, Book & Music Stores | 714 | 443 | 625 | 664 | -271 | -38.0% | +221 | +49.9% |

| 452 | General Merchandise Stores | 3,126 | 2,979 | 3,130 | 3,402 | -147 | -4.7% | +423 | +14.2% |

| 453 | Miscellaneous Store Retailers | 580 | 418 | 509 | 529 | -162 | -27.9% | +111 | +26.6% |

| 454 | Nonstore Retailers | 483 | 453 | 429 | 1,057 | -30 | -6.2% | +604 | +133% |

| Source: DEED Quarterly Census of Employment & Wages | |||||||||

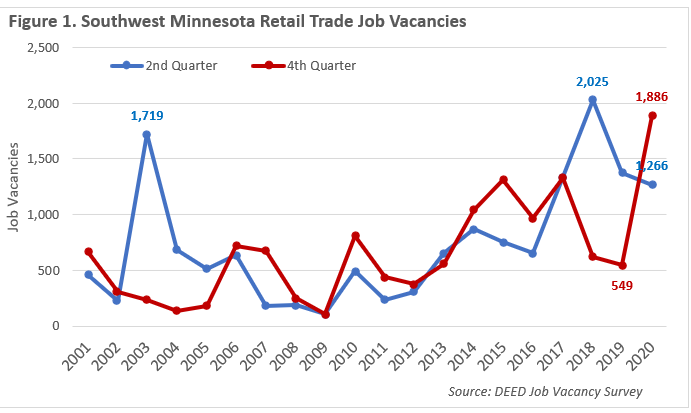

The increased job demand was demonstrated in the most recent Job Vacancy Survey as well, where Retail Trade employers posted the second highest number of job openings in the history of the program in the fourth quarter of 2020. This was after a marked decline in retail openings during the second quarter of 2020, showing that employment bounced back quickly (see Figure 1).

Fourth quarter 2020 vacancies included more than 900 openings for retail sales workers such as:

And nearly 600 openings for supervisors of sales workers:

With flexible schedules and increasing wages and a growing number of positions offering healthcare benefits corresponding to shift to more fulltime positions in retail, job seekers looking for a quick return to the job market should explore what retail has to offer.

Contact Labor Market Analysts Luke Greiner at 320-308-5378 or Mark Schultz or reach out to your local CareerForce location.